In Brief (TL;DR)

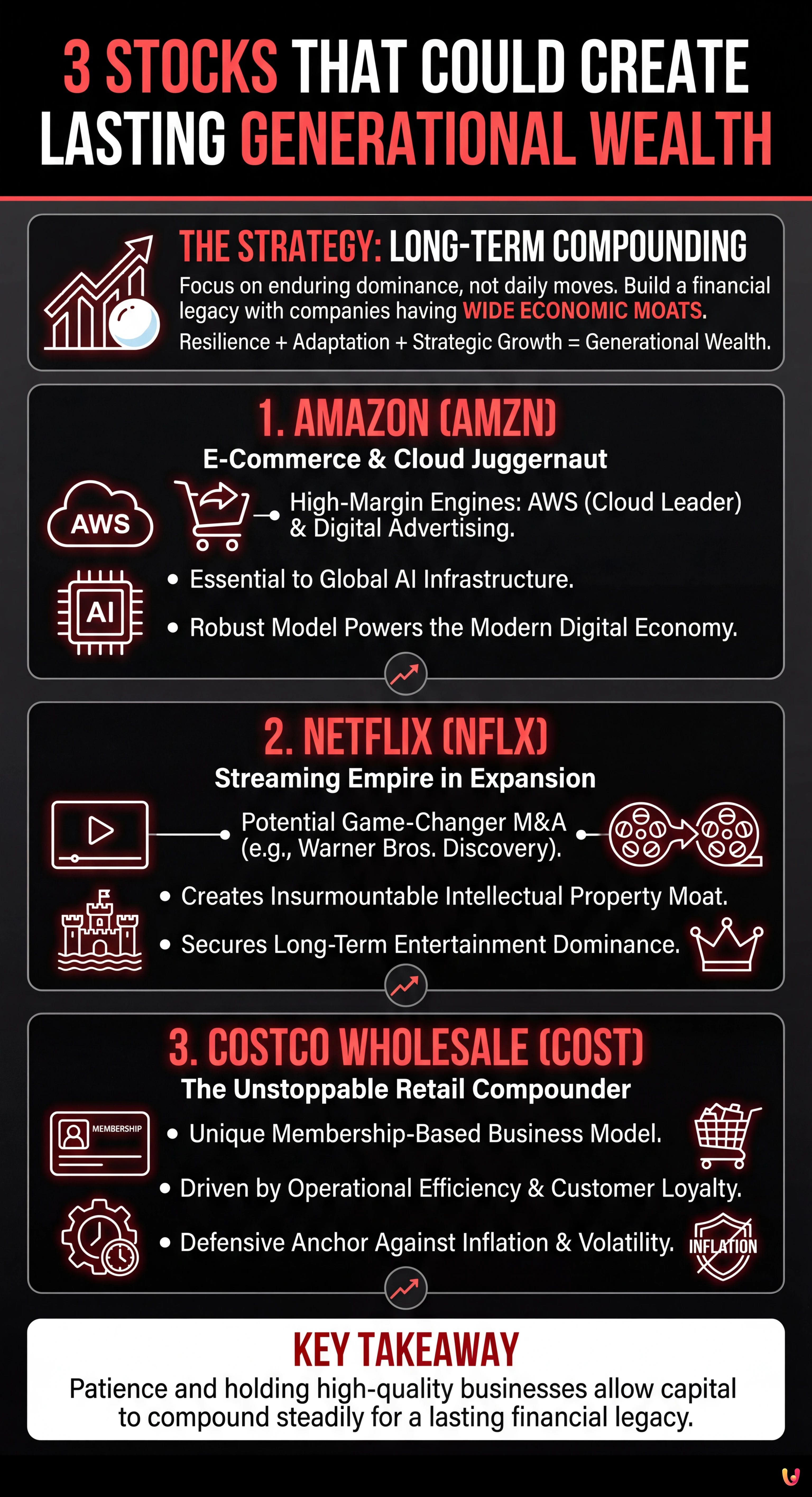

Investors can build generational wealth by prioritizing market-leading companies with wide economic moats over short-term trading strategies.

Amazon continues to dominate cloud and advertising sectors, while Netflix seeks to expand its empire through strategic acquisitions.

Costco offers a reliable defensive anchor for portfolios, delivering consistent returns through its unique membership-based business model.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In the fast-paced world of finance, the allure of quick profits often overshadows the proven strategy of long-term compounding. However, for investors seeking to build a financial legacy that outlasts them, the focus must shift from daily ticker movements to the enduring dominance of market-leading companies. On Tuesday, January 20, 2026, a trending search for "Amazon stock" highlights a renewed interest in these foundational assets. According to financial analysts at The Motley Fool and data from Yahoo Finance, identifying corporations with wide economic moats is the key to creating lasting generational wealth.

Generational wealth is not built overnight; it is the result of holding high-quality businesses that can navigate economic cycles, adapt to technological shifts, and capitalize on strategic opportunities such as mergers and acquisitions. While market volatility remains a constant, certain industry titans continue to demonstrate the resilience and growth potential required for a multi-decade portfolio. Here are three stocks that stand out as prime candidates for long-term investors today.

1. Amazon (AMZN): The E-Commerce and Cloud Juggernaut

It is no surprise that Amazon remains a top contender for generational wealth portfolios. With over 2,000 searches trending today, the tech giant continues to command investor attention. According to recent analysis by The Motley Fool, Amazon’s thesis for the next decade rests not just on its retail dominance, but on its high-margin profit engines: Amazon Web Services (AWS) and digital advertising.

Despite recent headlines about billionaire fund managers reallocating capital, Amazon’s fundamental business model remains robust. AWS continues to lead the cloud computing market, a sector essential to the global AI infrastructure build-out. Furthermore, Amazon’s advertising business has blossomed into a massive revenue stream, leveraging the company’s unparalleled consumer data. For investors looking to anchor their portfolios with a company that powers the modern digital economy, Amazon remains a quintessential "forever" stock.

2. Netflix (NFLX): A Streaming Empire in Expansion Mode

Netflix has long been a staple of growth portfolios, but recent developments have elevated its status to a potential generational compounder. The streaming giant is currently at the center of one of the most significant mergers and acquisitions stories of the year. According to reports from Bloomberg and The Motley Fool, Netflix is actively considering revising its bid for Warner Bros. Discovery (WBD) to an all-cash offer, a strategic move designed to fend off rival bids from Paramount Skydance.

This potential acquisition would be a game-changer, effectively merging Netflix’s massive global subscriber base with Warner Bros.’ prestigious studio assets and deep content library, including HBO. Such a consolidation would not only eliminate a key competitor but also provide Netflix with an insurmountable intellectual property moat. While M&A activity always carries integration risks, a successful deal could secure Netflix’s dominance in the entertainment industry for decades, making it a compelling pick for investors with a long-term horizon.

3. Costco Wholesale (COST): The Unstoppable Retail Compounder

While tech giants often grab the headlines, few companies have created as much steady wealth for their shareholders as Costco Wholesale. The warehouse club operator is a master of consistency, driven by its unique membership-based business model. According to financial data from Finviz, Costco continues to deliver solid returns by focusing on operational efficiency and customer loyalty.

Costco’s "treasure hunt" shopping experience and its ability to offer unbeatable prices create a defensive moat that is difficult for competitors to breach. In an era of fluctuating inflation and changing consumer habits, Costco’s value proposition remains attractive to millions of households worldwide. For investors, the stock represents a lower-volatility anchor that complements high-growth tech holdings, offering a reliable path to compounding wealth over generations.

Conclusion

Building lasting generational wealth requires patience and a commitment to owning the world’s best corporations through thick and thin. Amazon, Netflix, and Costco each offer a unique path to this goal: Amazon through its cloud and logistics infrastructure, Netflix through media dominance and strategic acquisitions, and Costco through unwavering consumer loyalty. By focusing on these enduring businesses, investors can position themselves to benefit from the long-term growth of the global economy, turning today’s capital into a legacy for the future.

Frequently Asked Questions

According to recent financial analysis, companies with wide economic moats like Amazon, Netflix, and Costco are prime candidates for long-term compounding. These corporations demonstrate the resilience required to navigate economic cycles while offering growth potential through diverse revenue streams such as cloud computing, media dominance, and membership-based retail models.

Amazon remains a top choice for investors because its business model extends far beyond simple e-commerce into high-margin engines like Amazon Web Services and digital advertising. As a leader in the cloud computing sector essential for global AI infrastructure, the company possesses a robust foundation that powers the modern digital economy, making it a quintessential forever stock.

Acquiring Warner Bros Discovery would be a game-changer for Netflix by combining its massive subscriber base with a prestigious content library and studio assets. This strategic move would create an insurmountable intellectual property moat and eliminate key competitors, potentially securing the dominance of the streaming giant in the entertainment industry for decades to come.

Costco serves as a lower-volatility anchor in a portfolio due to its unique membership-based business model and operational efficiency. The company fosters intense customer loyalty through its treasure hunt shopping experience and unbeatable prices, creating a defensive moat that protects it against inflation and changing consumer habits.

Building generational wealth requires shifting focus from daily ticker movements to the enduring dominance of market-leading companies. The proven strategy involves patience and a commitment to holding high-quality businesses that can adapt to technological shifts and capitalize on strategic opportunities, allowing capital to compound steadily over many years.

Sources and Further Reading

- U.S. Securities and Exchange Commission (SEC): Basics of Stock Investing

- Wikipedia: Amazon.com Inc. – Corporate Structure and Services

- Wikipedia: Netflix – History and Business Model

- Wikipedia: Costco Wholesale Corporation – Operations and Membership Model

- U.S. Securities and Exchange Commission (SEC): Understanding Compound Interest

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.