The traditional image of stock exchanges, with the excited shouts of traders and phones ringing off the hook, is increasingly a thing of the past. Today, a significant portion of financial transactions takes place in almost absolute silence, orchestrated by complex computer systems. This new paradigm is algorithmic trading, an approach that uses computer programs to execute orders on financial markets at a speed and with a precision unthinkable for a human being. In a context like Italy and the Mediterranean, where financial tradition has deep roots, this innovation represents a true revolution, a bridge between a past of personal relationships and a future dominated by data.

Algorithmic trading is not science fiction, but an established reality that moves enormous amounts of capital every day. It is estimated that the global algorithmic trading market will reach $28.44 billion by 2030, with steady annual growth. These systems, also known as trading bots, are nothing more than software programmed to follow a series of precise rules. They analyze market variables such as price, volume, and time to decide when to buy or sell, executing the trades automatically. The goal is simple: to make trading more efficient by eliminating the emotionality that often leads to irrational decisions.

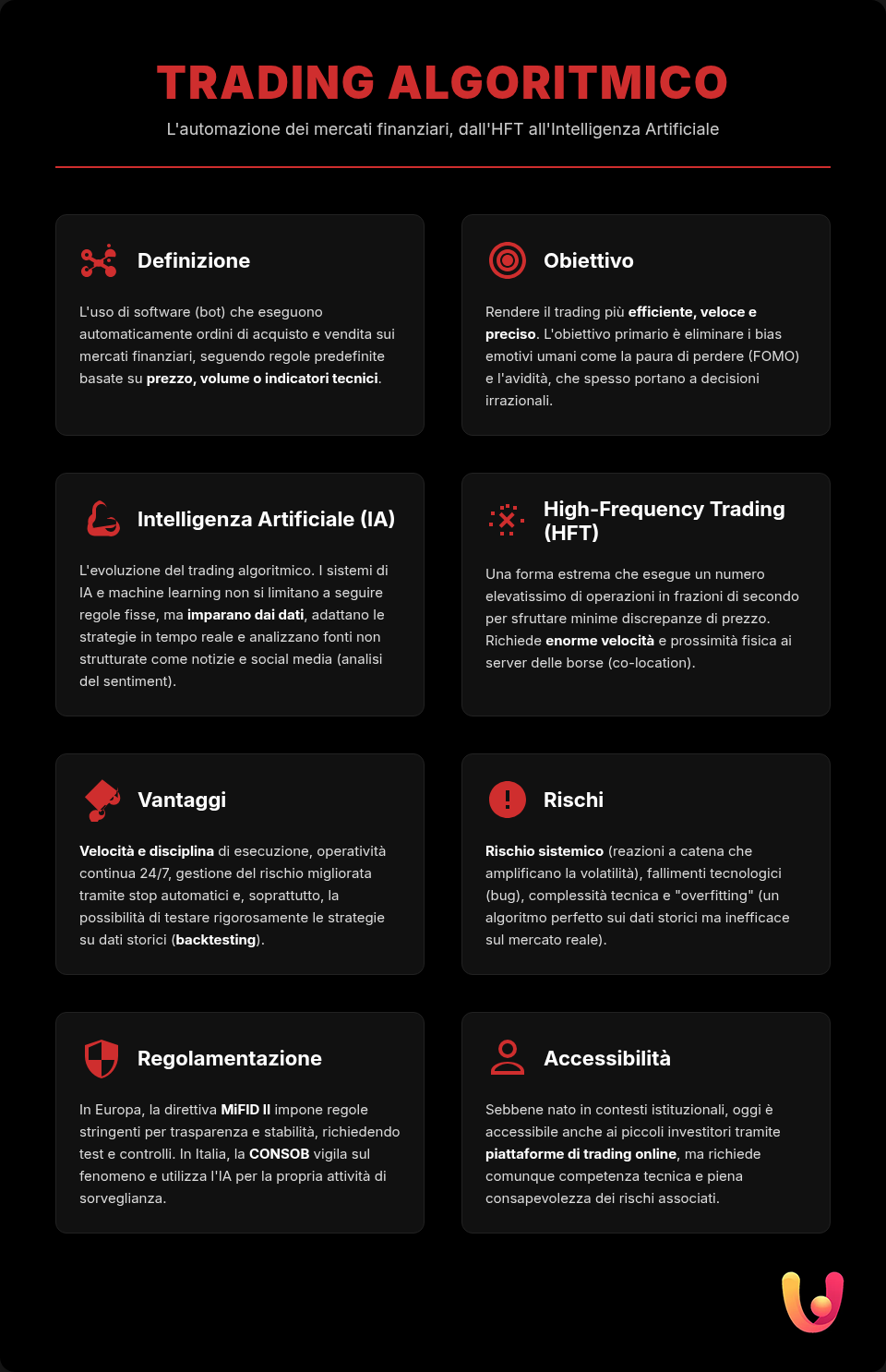

What Is Algorithmic Trading?

Algorithmic trading, in simple terms, is the use of a computer program that follows a defined set of instructions (an algorithm) to place a trade. The algorithm can be based on strategies that consider timing, prices, quantities, or complex mathematical models. When predefined market conditions are met, the system automatically executes a buy or sell order, freeing the trader from continuous manual market monitoring. This scientific approach allows every detail to be planned in advance, ensuring an objective and codifiable execution of the trading plan.

We can imagine a systematic trader as a captain who sets and supervises an airplane on autopilot. The captain’s skills are fundamental to setting the course, just as a trader’s training is crucial for developing and managing their own trading systems.

The underlying strategies can vary. The most common include technical analysis, where the algorithm reacts to signals from chart indicators like moving averages or the Relative Strength Index (RSI), and the strategy based on price action, which focuses on price movements. For example, a bot could be programmed to buy a stock if its price crosses above a certain moving average and, at the same time, the RSI indicates an oversold condition. This approach allows strategies to be tested on historical data (backtesting) before being applied to the real market, a crucial phase for evaluating their effectiveness.

Artificial Intelligence Enters the Game

While traditional algorithmic trading is based on fixed rules, the introduction of Artificial Intelligence (AI) and machine learning has taken these systems to the next level. AI trading is not limited to executing pre-programmed instructions; it uses advanced algorithms to analyze huge amounts of data, learn from it, and adapt strategies in real time to market changes. These systems can identify complex patterns and trends, often imperceptible to the human eye, offering a significant competitive advantage.

The applications of AI in finance are vast and constantly expanding. Supervised machine learning algorithms, for example, are trained on historical data to predict the future performance of a stock. Unsupervised techniques, on the other hand, can discover hidden structures in data, such as grouping customers with similar behaviors. A particularly innovative field is sentiment analysis: thanks to Natural Language Processing (NLP), AI systems can analyze news, financial reports, and even social media posts to measure investor “sentiment” and react instantly to global events.

High-Frequency Trading (HFT): The Formula 1 of the Markets

One of the most extreme and debated applications of algorithmic trading is High-Frequency Trading (HFT). This is a technique that uses powerful algorithms and advanced infrastructure to execute an extremely high number of orders in fractions of a second. The goal of HFT is to exploit tiny, temporary price discrepancies, generating a minimal profit on each trade but repeating it millions of times. To succeed, speed is everything: HFT firms invest huge amounts of capital to place their servers as close as possible to the stock exchanges’ servers (co-location), minimizing latency.

HFT accounts for a significant portion of global trading volumes, estimated to be between 10% and 40% in the stock market. While proponents claim that HFT increases market liquidity and reduces bid-ask spreads, making trading cheaper for everyone, there is no shortage of criticism. Its extreme speed can indeed generate instability and contribute to sudden volatility events, such as the 2010 “Flash Crash,” when U.S. markets plummeted and recovered in minutes, partly due to the massive and simultaneous withdrawal of HFT operators.

Advantages and Opportunities of Automated Trading

The adoption of algorithmic trading offers numerous advantages that are reshaping investment strategies. The first and most obvious is execution speed. Algorithms can analyze markets and execute trades in milliseconds, capitalizing on opportunities that would vanish before a human trader could react. This capability not only maximizes profit potential but also ensures execution at the best possible price. Another key benefit is the elimination of emotional decisions. Fear and greed are often an investor’s worst enemies; bots, operating on predefined rules, are not influenced by these biases, ensuring ironclad discipline.

Furthermore, automated systems can operate 24/7, monitoring global markets nonstop and freeing the trader from the need to constantly be in front of a screen. This allows for better risk management, thanks to the setting of automatic stop-losses and limits, and facilitates diversification by allowing multiple strategies to be applied simultaneously across different markets. The ability to perform accurate quantitative analysis through backtesting, by testing strategies on historical data, offers an additional guarantee, allowing algorithms to be refined before risking real capital.

Risks and Challenges: The Other Side of the Coin

Despite the significant advantages, algorithmic trading also presents risks and complexities that cannot be ignored. One of the biggest dangers is systemic risk. The speed and interconnectedness of algorithms can amplify volatility and, in extreme cases, trigger cascading market crashes if many systems react similarly to a specific event. As engineer and fintech expert Francesco Zinghinì points out, developing robust financial platforms requires a deep understanding of both the mathematical aspects and potential points of failure. A bug in the code or a technological malfunction can cause huge losses in a matter of moments.

Technical complexity is another barrier. Developing, testing, and maintaining effective algorithms requires advanced programming skills and a deep knowledge of financial markets. Additionally, there is the risk of “overfitting,” which is creating an algorithm that performs perfectly on historical data but fails in real, changing market conditions. Finance, after all, is not just about numbers; it is influenced by unpredictable events that no algorithm can fully anticipate. For this reason, even in automated trading, human supervision and proper risk management, like that required to operate with complex instruments such as investment certificates, remain fundamental.

The Italian and European Context: Between Regulation and Innovation

In Europe, the rise of algorithmic trading has prompted authorities to create a regulatory framework to govern its development and mitigate its risks. The MiFID II directive, which came into force in 2018, introduced strict rules for investment firms using these technologies. The goal is to ensure market transparency and stability. The regulations require operators to notify their use of algorithms, to adequately test their systems, and to have control mechanisms in place to prevent anomalous behavior, such as “circuit breakers” that can halt trading in cases of excessive volatility.

In Italy, CONSOB (Commissione Nazionale per le Società e la Borsa) closely monitors the phenomenon. The authority has published an operational guide to support firms in complying with regulatory obligations and constantly warns investors about scams related to promises of easy profits through automated bots. CONSOB itself is exploring the use of AI to improve its surveillance activities, developing algorithms to detect suspected cases of insider trading with a speed and precision unthinkable for a human analyst. This scenario reflects the duality of Mediterranean culture: a strong anchor in tradition and investor protection, combined with a drive for technological innovation to remain competitive in the global market. The European approach, as defined by ESMA (European Securities and Markets Authority), is not to curb innovation but to govern it to ensure that markets remain fair and resilient. This approach could also be useful for those approaching derivative instruments like call and put options.

In Brief (TL;DR)

Discover how algorithmic trading and artificial intelligence are revolutionizing modern finance, from automating investment strategies with bots to managing systemic risks in High-Frequency Trading.

We delve into how these technologies work, from trading bots to artificial intelligence, analyzing their opportunities and systemic risks with insights from expert Francesco Zinghinì.

We will explore the technologies, the use of AI, and the potential systemic risks that arise from them.

Conclusion

Algorithmic trading and artificial intelligence are no longer futuristic concepts but pillars of modern finance. They have transformed markets, making them faster, more efficient, and globally interconnected. The ability to analyze data in real time, execute trades without emotional influence, and operate on a global scale has opened up once-unimaginable opportunities. However, this technological revolution brings new challenges: from the need for careful regulation to prevent systemic risks, to the growing technical complexity required to compete. In a context like Italy and Europe, the key to success will lie in the ability to balance innovation and tradition, embracing new technologies without forgetting the principles of transparency and investor protection. The future of finance will not be a battle between man and machine, but a synergy in which human intelligence will guide and supervise the computing power of algorithms to navigate increasingly complex markets.

Frequently Asked Questions

Imagine giving a computer a set of precise rules on when to buy or sell a financial instrument, like a stock. Algorithmic trading is exactly that: a program, or bot, executes trades automatically following the instructions it has been given. This allows for very fast operation without the influence of emotions like fear or greed, which often affect human decisions.

Yes, the use of trading bots is legal in Italy and Europe, provided they are used on authorized platforms and in compliance with current regulations. The European Union, through the MiFID II directive, has established precise rules to ensure market transparency and stability, requiring algorithms to be tested and monitored. Authorities like Consob in Italy watch over the practice to prevent abuse and manipulation.

It was once an exclusive tool for large banks and investment funds, but today, algorithmic trading is also accessible to small investors. Many online trading platforms offer tools to create simple algorithms or to use pre-programmed bots, often without needing to know programming languages. However, it still requires study, a clear strategy, and an awareness of the risks.

Yes, it is possible to generate profits, but there are no easy or guaranteed earnings. Success depends on the quality of the strategy, market conditions, and proper risk management. The risks are real: a poorly programmed algorithm can cause rapid losses, as can a sudden market change not anticipated by the strategy. ESMA and Consob warn against promises of unrealistic gains and highlight dangers such as misleading advice and privacy risks.

Artificial Intelligence (AI) represents the evolution of algorithmic trading. While a traditional bot only follows fixed rules, a system based on AI and machine learning can learn from historical data, adapt its strategy, and even analyze news or social media sentiment to predict market movements. This offers enormous potential but also increases complexity and introduces new risks, such as the unpredictable behavior of the algorithm itself.

Still have doubts about Algorithmic Trading: Bots and AI Revolutionize Finance?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.