In Brief (TL;DR)

American Express credit cards offer numerous advantages, including the Membership Rewards program, travel insurance, and access to airport lounges.

However, it is important to carefully evaluate the costs and fees, which can be high for some cards.

The choice of card depends on your needs and spending habits.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Do you want a credit card that offers exclusive benefits and makes you feel part of a prestigious club? The American Express credit card could be the ideal solution, but it is important to understand if it fits your needs. Costs, benefits, and requirements: in this complete guide, we will analyze every aspect of Amex cards, from the Green Card to the Platinum Card, to help you make an informed decision. You will discover how the Membership Rewards program works, what insurance is included, and how to get the most out of your American Express card. Get ready to enter a world of privileges and opportunities!

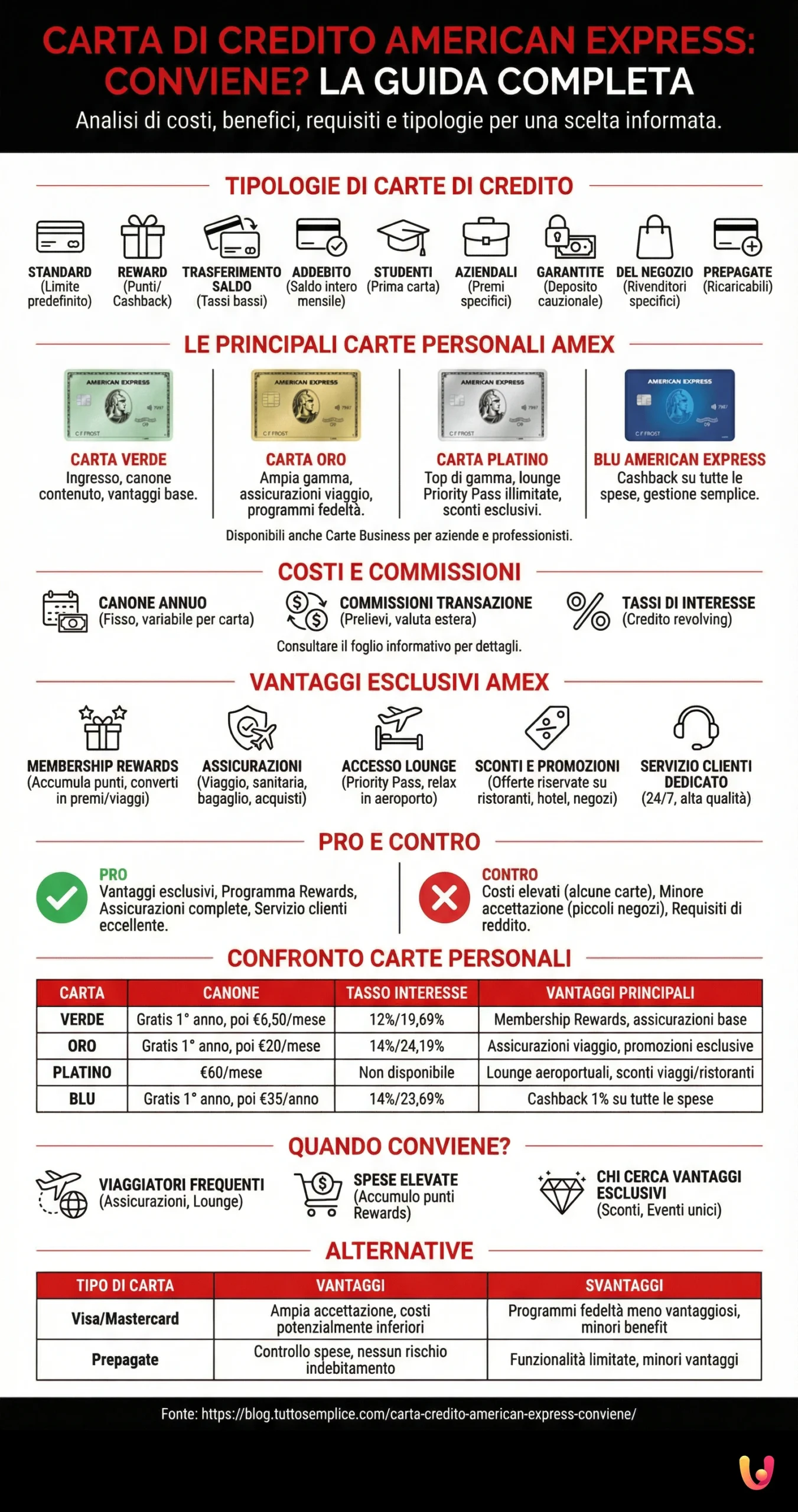

Types of American Express Credit Cards

American Express offers a wide range of credit cards, each with specific features and benefits. Before analyzing the individual cards, it is important to understand the different categories of credit cards available on the market:

- Standard cards: Allow you to make purchases up to a predefined credit limit.

- Reward cards: Offer rewards such as travel points or cashback.

- Balance transfer cards: Allow you to transfer the balance from other credit cards, often with low introductory interest rates.

- Charge cards: Do not have a predefined spending limit, but the balance must be paid in full every month.

- Student cards: Designed for university students applying for their first card.

- Business cards: Can be used by business owners and employees and may offer specific corporate rewards.

- Secured cards: Require a cash security deposit that reduces the risk for the credit card issuing company.

- Store credit cards: Can only be used at specific retailers.

- Prepaid cards: Are not true credit cards; you need to load them with cash before you can use them for purchases.

Among the most popular American Express personal cards, we find:

- American Express Green Card: The entry card to the American Express world, ideal for those looking for a card with a reasonable annual fee and basic benefits.

- American Express Gold Card: Offers a wide range of benefits, including travel insurance and access to loyalty programs, with a higher annual fee compared to the Green Card.

- American Express Platinum Card: American Express’s top-of-the-line card, with a significant annual fee but with exclusive benefits such as unlimited access to Priority Pass airport lounges and discounts on restaurants and travel.

- Blue American Express: A card with cashback on all expenses, ideal for those looking for a simple and advantageous solution for managing daily expenses.

In addition to personal cards, American Express also offers business cards, such as the American Express Business Card and the American Express Platinum Business Card, designed for the needs of companies and freelancers.

Costs and Fees of American Express Cards

Before applying for an American Express credit card, it is essential to carefully evaluate the costs and fees. Here are the main ones:

- Annual fee: The fixed cost for owning the card, which varies depending on the type of card.

- Transaction fees: Possible fees applied to certain operations, such as cash withdrawals or payments in foreign currency.

- Interest rates: Applied in case of using revolving credit, i.e., when you choose to repay the balance in installments.

To get a complete picture of the costs, it is advisable to consult the information sheet for each card on the American Express website.

Exclusive Benefits of American Express Cards

American Express credit cards offer a series of exclusive benefits that distinguish them from traditional cards. Among the main ones:

- Membership Rewards Program: Allows you to accumulate points with expenses made and convert them into rewards such as travel, gift cards, or discounts. Points accumulate with daily spending and with Amex Offers, which provide discounts and bonus points on a variety of products and services. It is also possible to transfer Membership Rewards points to the loyalty programs of partner airlines and hotels, such as Delta SkyMiles, Marriott Bonvoy, and Hilton Honors.

- Travel and purchase insurance: Some cards offer comprehensive insurance coverage for travel and purchases, such as health insurance, luggage insurance, and purchase protection.

- Access to airport lounges: High-end cards, such as the Platinum Card, offer free and unlimited access to Priority Pass airport lounges worldwide.

- Exclusive discounts and promotions: American Express regularly proposes offers and discounts reserved for cardholders, such as discounts on restaurants, hotels, and shops.

- Dedicated customer service: American Express offers high-quality customer service, available 24 hours a day, 7 days a week, with reduced waiting times.

Disadvantages and Limits of American Express Cards

Despite the numerous advantages, American Express cards also present some disadvantages:

- High costs: Some cards, such as the Platinum Card, have high annual fees and commissions.

- Lower acceptance: Not all merchants accept American Express cards, especially small shops.

- Income requirements: For some cards, such as the Gold Card, a minimum annual income is required.

However, for many users, the benefits of an Amex card can outweigh the costs. If you are ready to explore your options, here is how to apply for an American Express credit card…

How to Apply for an American Express Credit Card

Applying for an American Express credit card is simple and fast. It is possible to do it online on the American Express website, following these steps:

- Choose the card best suited to your needs.

- Fill out the online application form with your personal and financial details.

- Submit the request and await the outcome of the evaluation by American Express.

Generally, the response arrives within a few business days. For more information, consult the official American Express website.

Comparison Between Different American Express Cards

To help you choose the American Express card best suited to your needs, here is a comparative table with the main features of personal cards:

| Card | Fee | Interest Rate | Main Benefits |

|---|---|---|---|

| Green Card | Free for the 1st year. From the 2nd, €6.50 per month. | 12%/19.69% | Membership Rewards Program, basic insurance |

| Gold Card | Free for the 1st year. From the 2nd, €20 per month. | 14%/24.19% | Travel insurance, access to exclusive promotions |

| Platinum Card | €60 per month. | Not available | Access to airport lounges, discounts on travel and restaurants |

| Blue American Express | Free for the 1st year. From the 2nd, €35 per year. | 14%/23.69% | 1% Cashback on all expenses |

When Is an American Express Credit Card Worth It?

An American Express credit card can be worthwhile in several situations:

- Frequent travelers: The travel insurance and access to airport lounges offered by some cards are particularly advantageous for those who travel often.

- High spenders: The Membership Rewards program allows you to accumulate valuable points with expenses, especially if you make significant purchases.

- Those seeking exclusive benefits: American Express offers a series of unique benefits, such as discounts at restaurants, hotels, and access to exclusive events.

Alternatives to American Express Credit Cards

If an American Express card does not convince you, there are several alternatives on the market:

| Card Type | Advantages | Disadvantages |

|---|---|---|

| Visa/Mastercard Credit Cards | Wide acceptance, potentially lower costs | Less advantageous loyalty programs, fewer exclusive benefits |

| Prepaid Cards | Expense control, no risk of debt | Limited functionality, fewer benefits |

Conclusions

Ultimately, the value of an American Express credit card depends on a combination of factors, including your spending habits, your lifestyle, and your financial needs. If you are a frequent traveler, an Amex card with airport lounge access and comprehensive travel insurance can be a valuable investment. If, on the other hand, you prefer simplicity and immediate cashback, the Blue American Express might be more suitable for you.

The Membership Rewards program offers great flexibility and the possibility to accumulate valuable points with daily expenses, but it is essential to carefully evaluate the cost-benefit ratio. Amex cards, in fact, tend to have higher annual fees compared to traditional cards.

Before making a decision, carefully analyze the features of each card, the costs, the benefits, and the limits, comparing them with your needs. Do not forget to also consider alternatives, such as Visa and Mastercard cards, which offer greater acceptance at merchants.

Frequently Asked Questions

American Express cards are payment cards that allow you to make purchases and cash withdrawals, with the possibility of repaying the balance in installments or in a single solution. They are distinguished by the exclusive benefits offered, such as the Membership Rewards program and access to airport lounges.

The Membership Rewards program allows you to accumulate points with your expenses and convert them into rewards such as travel, gift cards, or discounts at numerous partners.

The cost varies depending on the card. Some cards have an annual fee, while others are free. It is important to also evaluate transaction fees and interest rates.

American Express cards are accepted at millions of merchants worldwide, but their acceptance may be more limited compared to Visa or Mastercard cards, especially in small shops.

Requirements vary depending on the card. Generally, you must be of legal age, a resident of Italy, and have sufficient income.

You can request a credit limit increase by contacting American Express customer service. The request will be evaluated based on your credit history and financial situation.

In case of theft or loss of the card, it is essential to contact American Express customer service immediately to block it and avoid unauthorized use. American Express will provide you with a replacement card.

Yes, you can withdraw cash from ATMs, but keep in mind that fees may apply.

You can contact American Express customer service by phone, via email, or through the online chat available on the website.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.