In Brief (TL;DR)

The evolution of banking services through technological innovation promises to make operations more effective and efficient, reducing operating costs and improving user experience.

Experience personalization, the use of biometrics for security, and the integration of advanced financial technologies will transform the use of ATMs.

The focus on sustainability with ATMs powered by renewable energy and built with eco-friendly materials reflects a growing commitment towards a more environmentally friendly banking future.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Since the 1960s, ATMs have revolutionized the way we bank. In this article, you will find a complete guide on ATMs: from their history and operation to the new technologies that are revolutionizing them. You will learn how to use an ATM safely and securely and discover the advantages and disadvantages of this technology.

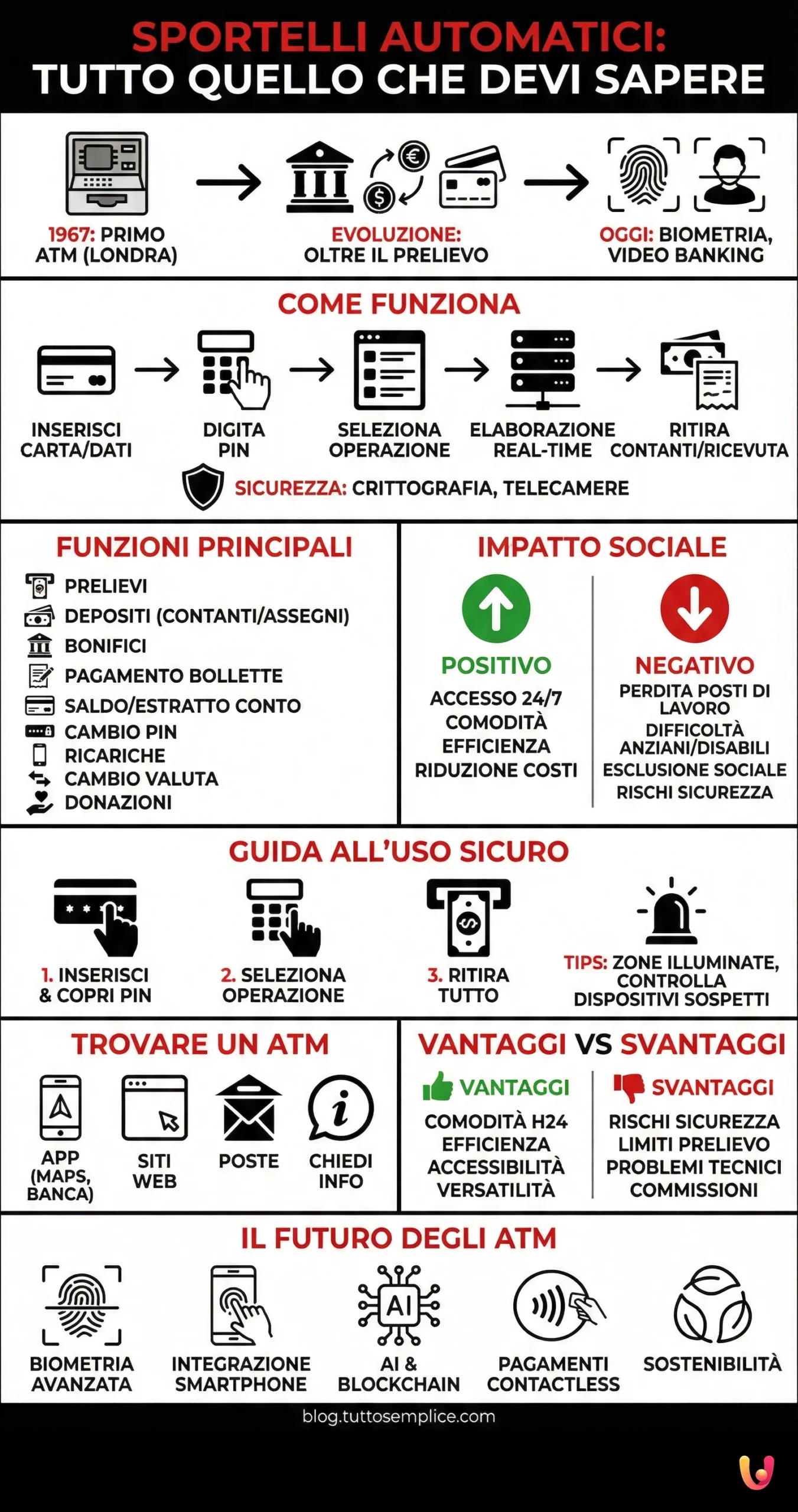

History of the ATM

The history of the ATM (Automated Teller Machine) is fascinating and testifies to the continuous innovation in the field of financial technologies.

The first ATM was introduced in 1967 in London by Barclays Bank. This revolutionary device allowed customers to withdraw cash outside of bank opening hours, marking the beginning of a new era in the banking world.

Since then, ATMs have undergone significant evolution, extending their functions beyond simple cash withdrawals.

Today, users can perform a variety of operations, including deposits, fund transfers, and bill payments, making daily financial management more accessible and convenient.

The evolution of ATMs over the years

The evolution of ATMs over the years has represented a real qualitative leap in the accessibility and security of banking operations.

From the beginnings with simple cash withdrawals, we have moved to machines capable of offering an increasingly vast range of services.

Innovative features, such as check and cash deposits without the use of envelopes, top-ups for prepaid cards and phones, and even the possibility of performing interactive banking operations via video conference with an operator, have transformed ATMs into true autonomous banking service centers.

Security technology has also advanced significantly, with the introduction of biometric recognition systems, such as fingerprint or facial recognition, to guarantee even more secure transactions.

This continuous evolution demonstrates the constant commitment to effectively responding to consumer needs, while offering increasingly higher levels of security and convenience.

Social impact of ATMs

The social impact of ATMs has been significant and complex, with both positive and negative aspects.

Positive effects

- Greater access to banking services: ATMs have allowed people to access banking services 24 hours a day, 7 days a week, even in rural or remote areas where there are no bank branches.

- Convenience and flexibility: ATMs have made it easier and faster for people to perform banking transactions such as cash withdrawals, deposits, bill payments, and phone top-ups.

- Cost reduction: The use of ATMs has led to a reduction in costs for banks, which have been able to reduce the number of branches and staff.

- Efficiency and productivity: ATMs have allowed for the automation of many banking transactions, making them more efficient and faster.

Negative effects

- Job loss: The introduction of ATMs has led to job losses in the banking sector, particularly for branch employees.

- Difficulty for the elderly or people with disabilities: Some people, such as the elderly or those with disabilities, may have difficulty using ATMs.

- Social exclusion: The increased use of ATMs can lead to the social exclusion of people who do not have access to this technology or who do not know how to use it.

- Security issues: ATMs can be vulnerable to theft and fraud.

Ultimately, the social impact of ATMs has been ambivalent. On one hand, they have led to greater convenience, flexibility, and efficiency in banking services. On the other hand, they have caused job losses, social exclusion, and security problems.

How an ATM works

An ATM, also known as an Automated Teller Machine, works through a sophisticated system of hardware and software designed to process banking transactions autonomously.

When a user inserts a bank card into the machine, the system reads the data from the magnetic stripe or the card’s chip. The user then enters their PIN (Personal Identification Number) to authenticate themselves. Once identity is verified, access is granted to the services offered by the machine, which may include cash withdrawals, deposits, money transfers, bill payments, and balance inquiries.

Operations are processed in real-time, communicating with the bank’s database to verify available funds and record transactions.

Transaction security is guaranteed by various levels of protection, including data encryption systems. ATMs are equipped with security cameras and alarm mechanisms to prevent and report attempts at fraud or vandalism.

Thanks to these technologies, ATMs represent an essential tool for modern banking, offering accessible banking services 24 hours a day.

Functions of an ATM

In addition to the functions already mentioned, an ATM offers a variety of services that expand the possibilities for users to manage their finances autonomously. Among these additional functions, we find:

- Request for bank statements: Users can print a summary of recent transactions or view the statement directly on the screen.

- PIN Change: To maintain high levels of security, users can change their PIN directly at the ATM.

- Top-up of prepaid cards and mobile phones: Many ATMs allow users to top up the credit of prepaid cards, including phone cards, providing a convenient and quick additional service.

- Currency exchange operations: In some cases, ATMs allow withdrawals in currencies other than the local one, which is especially useful for travelers.

- Donations to charities: Some ATMs offer the possibility to make donations to selected charities, expanding the social role of the bank.

These additional functions demonstrate how ATMs have become multifunctional tools, essential for meeting the diverse daily financial needs of users in a practical and secure way.

How do you use an ATM?

Using an ATM is an intuitive and secure process, designed to facilitate daily banking operations. Below is a step-by-step guide for beginners:

- Card insertion and identification: Insert your debit or credit card into the ATM and enter your Personal Identification Number (PIN). Make sure to cover the keypad while entering the PIN to protect your security.

- Selection of the operation: After logging in, a main menu with several options will be displayed. Select the operation you wish to perform, such as cash withdrawal, deposit, request for statements, or other available functions.

- Execution of the operation: Follow the on-screen instructions to complete the operation. For example, if you are making a withdrawal, you will need to choose the amount. If you are making a deposit, insert the cash or checks into the appropriate slot.

- Confirmation and receipt: After performing the operation, the machine will ask if you want a receipt. It is advisable to print it as proof of the transaction performed.

- End of session: Retrieve your card when the machine indicates to do so. Ensure you take all your property, including the card, withdrawn cash, and the receipt.

Remember that, for security reasons, it is important to use ATMs in well-lit and monitored areas and to be aware of your surroundings during use.

Finding the nearest ATM

There are several ways to search for the ATM nearest to you:

- Smartphone applications

- Google Maps: is the most used app to search for places of interest, including ATMs. Just open the app, search for “ATM” and the map will show all the automated tellers nearby. You can also filter results by ATM type (for example, those offering cash deposit services) or by bank.

- Your bank’s app: many banks offer apps that allow you to find ATMs within their network.

- Specific apps for ATMs: such as “ATM Locator” or “AroundMe”.

- Websites

- Your bank’s website: most banks have a website that allows you to find ATMs in their network.

- Search engine websites: such as Google or Bing. Just search for “ATM near me” and the search engine will show a list of automated tellers nearby.

- Trade association websites: such as the ABI (Italian Banking Association).

- Postal ATMs

- Postal ATMs are widespread throughout Italy and are easily accessible.

- Asking for information

- At the bank: you can ask your bank advisor or branch staff for information.

- To a passerby: if you are on the street, you can ask a passerby for information.

- Telephone assistance services

- Your bank’s toll-free number: you can call your bank’s toll-free number to ask for information on the nearest ATMs.

When looking for an ATM, it is important to consider

- Distance: choose an ATM that is close to you.

- Fees: some banks charge fees for using ATMs of other banks.

- Services offered: some ATMs offer additional services, such as cash deposits or currency exchange.

- Safety: choose an ATM located in a safe area.

Advantages and disadvantages of using an ATM

Using Automated Teller Machines (ATMs) offers numerous advantages, but also presents some disadvantages that deserve careful consideration.

Advantages

- Convenience: ATMs are available 24 hours a day, allowing banking operations to be carried out outside of branch opening hours. This represents a huge advantage for those with busy work schedules.

- Efficiency: Operations such as withdrawals, deposits, and money transfers can be performed quickly without the need to interact with bank staff.

- Accessibility: With a vast network of machines available in various locations, both in urban and rural areas, users often have easy access to ATMs.

- Versatility: Many ATMs offer a variety of functions beyond simple cash withdrawals, such as bill payments, check deposits, and prepaid card top-ups.

Disadvantages

- Security: Using an ATM, especially at night or in isolated areas, can expose you to security risks, including theft and fraud.

- Limitations: ATMs may have daily withdrawal limits that might not meet a user’s immediate cash needs. Additionally, international transactions may encounter obstacles or additional costs.

- Technical issues: ATMs can suffer malfunctions or run out of cash, causing inconvenience to users.

- Costs: Using ATMs of other banks or in international locations can entail high fees for transactions or withdrawals.

In conclusion, although ATMs offer practicality and efficiency, it is fundamental to use them consciously, keeping in mind both the advantages and disadvantages to best manage one’s daily finances.

How to protect yourself from fraud

To reduce the risk of fraud at ATMs, it is essential to take some precautions. First of all, it is recommended to use ATMs located in well-lit and busy areas.

Avoiding ATMs in isolated or poorly visible locations can reduce the risk of being approached by malicious individuals.

Furthermore, before performing any operation, it is important to check the ATM for any unusual or additional devices that might have been installed to capture credit or debit card information.

Covering the keypad with your hand while typing the PIN can prevent it from being stolen by any hidden cameras.

Finally, it is fundamental to regularly monitor your bank statements to promptly identify any unauthorized transactions, and immediately report any suspicious or unusual operation to your bank.

By adopting these measures, companies and users can protect themselves more effectively from fraud at ATMs.

What to do in case of lost or stolen debit or credit card

In case of loss or theft of your debit or credit card, it is fundamental to act promptly to minimize any risk of fraud. The first step to take is to immediately contact the bank or issuing institution to report the incident. This will allow the card to be blocked and prevent unauthorized use.

Subsequently, it is advisable to file a report with the police authorities, providing all necessary details, such as the approximate place and time where the loss or theft occurred. This document can be useful in case of disputes for fraudulent transactions.

Furthermore, it is useful to carefully monitor bank statements following the event, in order to identify and potentially contest any unauthorized operation that might have been performed before the card was blocked.

Finally, after blocking the lost or stolen card, it will be necessary to request the issuance of a new card. Most banks offer a rapid replacement service to ensure that users can continue to access their funds with minimal inconvenience.

The future of ATMs

The future of ATMs promises to be full of technological innovations aimed at making banking transactions even more secure and convenient for users.

With the advancement of artificial intelligence and blockchain technology, we have started to see smarter ATMs, capable of offering personalized services and recognizing customers through biometric systems, such as facial or fingerprint recognition.

Furthermore, integration with smartphones and other smart devices will allow operations to be performed more quickly and securely, reducing the risk of fraud.

Solutions are also being explored to extend ATM services, including contactless payment functionalities and the possibility of performing more complex banking operations.

This development will not only improve the user experience but will also contribute to reducing operating costs for banks, marking a significant step forward in the evolution of personal finance management.

How will ATMs adapt to new customer needs?

To adapt to new customer needs, ATMs will have to offer an increasingly fluid, secure, and personalized experience.

The personalization of the user experience, supported by artificial intelligence, will allow ATMs to adapt the options and services offered based on the specific habits and needs of each customer.

Furthermore, the adoption of new biometric identification technologies will make transactions faster and more secure, eliminating the need to remember a PIN code or carry a card.

The integration with innovative financial technologies will allow ATMs to offer a wider range of services, such as real-time currency conversion or the purchase of financial products directly from the machine.

Finally, to respond to the growing demand for sustainable banking operations, we will likely see an increase in ATMs powered by renewable energy and made with eco-friendly materials.

Such initiatives not only respond to the needs of customers aware of the importance of environmental issues, but also represent a step forward towards a more sustainable future in the banking sector.

Conclusions

In conclusion, ATMs are experiencing a true revolution, witnessing how technological innovation is profoundly influencing the banking sector.

The adoption of biometric identification systems, integration with the most modern financial technologies, and the use of renewable energies and eco-friendly materials represent not only a response to the needs of an increasingly demanding and aware public, but also a precise direction towards a more sustainable and efficient future.

The predicted evolution of ATMs suggests a transformation that goes well beyond the simple operation of withdrawal or deposit, opening the doors to a wide range of personalized and secure financial services, available 24 hours a day.

This scenario will not only significantly improve the user experience, making banking operations faster, simpler, and more personalized, but will also contribute to reducing environmental impact, aligning the banking sector with growing global expectations of sustainability.

Finally, it is clear that the future of ATMs and, more generally, of banking services, will be characterized by an increasingly strong integration between technology, security, personalization, and sustainability.

This will not only benefit end users, but will also determine significant progress towards a more responsible sector attentive to collective and environmental needs.

Frequently Asked Questions

An electronic device that allows bank customers to perform banking transactions without the assistance of a teller.

Cash withdrawals, deposits, bill payments, phone top-ups, wire transfers, currency exchange.

Insert your debit or credit card, enter your PIN, and follow the instructions on the screen.

Convenience, flexibility, speed, 24/7 accessibility.

Difficulty for some people (elderly, disabled), possible fraud, fees.

Do not use the ATM if it is damaged, do not type the PIN in front of suspicious people, always check the movements on your account.

Artificial intelligence and biometric recognition will revolutionize the use of ATMs.

At bank branches, supermarkets, shopping malls, airports.

Contact your bank immediately.

Costs vary depending on the bank and the type of transaction.

Sources and Further Reading

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.