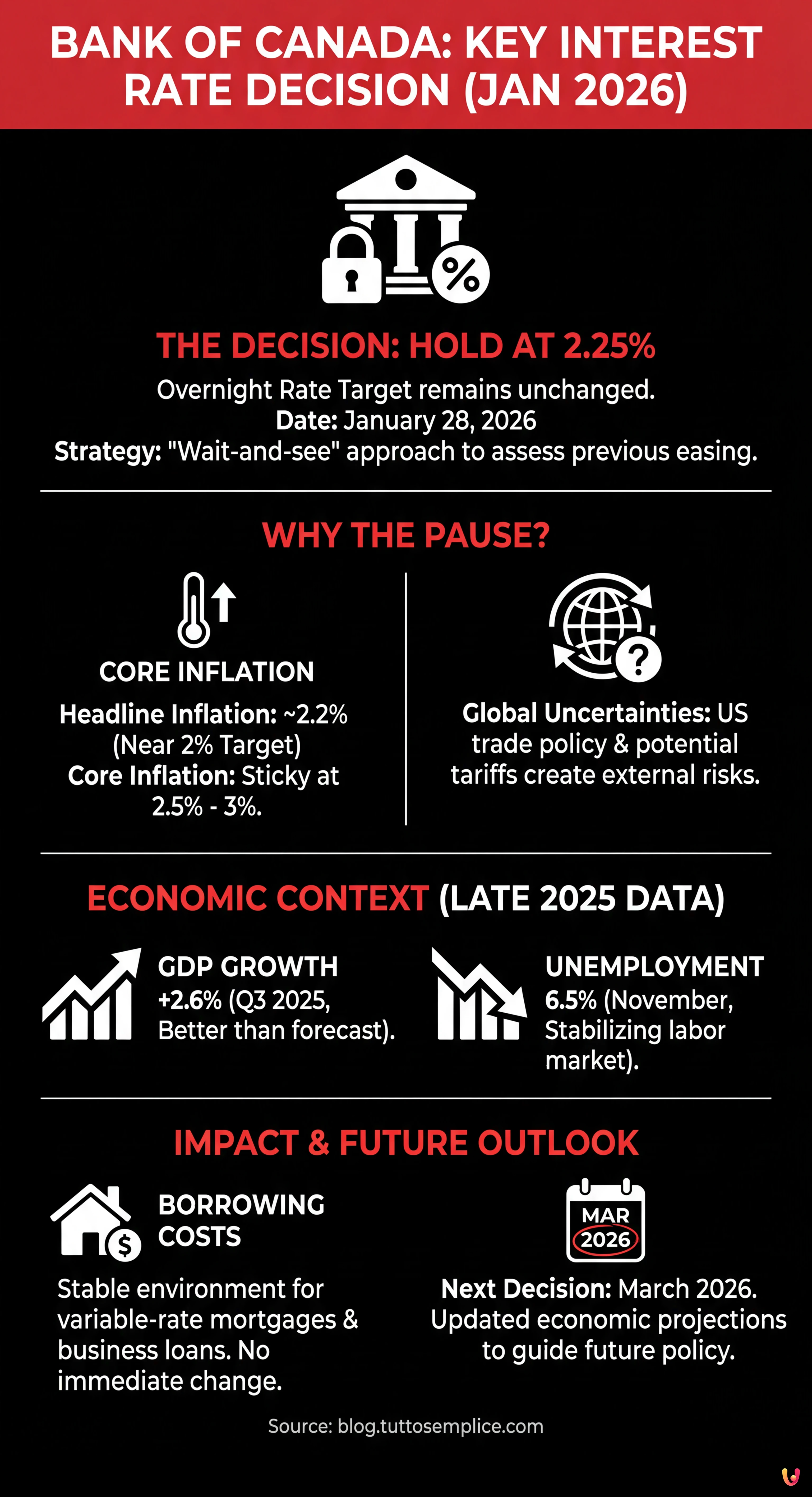

On Wednesday, January 28, 2026, the Bank of Canada announced its decision to maintain the overnight rate target at 2.25%. This move, widely anticipated by economists and financial markets, marks a continuation of the central bank’s strategy to stabilize the national economy following a series of rate cuts throughout 2025. Governor Tiff Macklem emphasized that while inflation remains near the target, global economic uncertainties necessitate a cautious approach.

The decision to hold the rate steady comes as the Canadian economy shows signs of resilience. According to reports from La Presse, the central bank is opting for a “wait-and-see” stance to assess the full impact of previous monetary easing. With the policy rate sitting at 2.25%, the Bank aims to support sustainable growth without reigniting inflationary pressures. This announcement has immediate implications for finance sectors, particularly regarding variable-rate mortgages and business loans.

Economic Context and Inflation Trends

The backdrop for today’s announcement is an economy that is performing slightly better than expected. Data cited by Le Devoir indicates that Canada’s Gross Domestic Product (GDP) expanded by 2.6% in the third quarter of 2025, surpassing earlier forecasts. Furthermore, the unemployment rate dipped to 6.5% in November, suggesting a labor market that is stabilizing after a period of volatility.

Inflation remains the primary gauge for the Bank’s Governing Council. Headline inflation has decelerated to approximately 2.2%, hovering close to the Bank’s 2% target. However, core inflation measures—which strip out volatile items like food and energy—remain sticky, fluctuating between 2.5% and 3%. As noted by Les Affaires, this persistence in core price pressures is a key reason why the Bank is reluctant to lower rates further at this time. The central bank is committed to ensuring that the progress made in taming the cost of living is not jeopardized by premature easing.

Global Trade and Market Uncertainty

Beyond domestic indicators, international factors played a significant role in the Bank’s deliberations. The global trade environment faces renewed friction, specifically concerning potential tariffs and trade policies from the United States. These external risks create a climate of uncertainty that weighs on business investment and export projections. By maintaining the rate at 2.25%, the Bank of Canada retains policy flexibility to respond to potential external shocks.

Financial markets reacted calmly to the news, as the hold was fully priced in by investors. The Canadian dollar showed little movement against the U.S. greenback immediately following the announcement. Analysts suggest that stocks in the banking and real estate sectors may benefit from the stability, as a predictable interest rate environment allows for better long-term planning. The focus now shifts to the Bank’s next announcement in March, where updated economic projections will provide further clarity on the trajectory of monetary policy for the remainder of 2026.

In Brief (TL;DR)

The Bank of Canada maintained its key interest rate at 2.25 percent to stabilize the economy amid global uncertainties.

Policymakers remain cautious due to sticky core inflation and external trade risks despite positive signs in domestic GDP growth.

This strategy allows the central bank to assess previous rate cuts while ensuring inflation stays close to the target.

Conclusion

In summary, the Bank of Canada’s decision to hold the key interest rate at 2.25% reflects a balanced strategy aimed at nurturing economic growth while keeping a vigilant eye on inflation. With GDP showing positive momentum and the labor market firming up, the central bank can afford to be patient. However, persistent core inflation and global trade uncertainties ensure that policymakers will remain data-dependent in the months ahead. As households and businesses adjust to this stable rate environment, all eyes will remain on the Bank’s next moves to navigate the evolving economic landscape.

Frequently Asked Questions

The Bank of Canada decided to hold its key overnight rate at 2.25 percent on January 28, 2026. This decision reflects a pause after previous cuts to assess economic stability. The rate remains unchanged to balance the need for economic growth while keeping inflation near the 2 percent target.

The decision to hold the rate stems from persistent core inflation, which remains between 2.5 and 3 percent despite headline inflation dropping. The central bank is also monitoring global trade uncertainties, particularly potential tariffs from the United States. By maintaining the current rate, policymakers aim to avoid reigniting inflationary pressures while observing how the economy reacts to previous easing measures.

Homeowners with variable-rate mortgages will not see a reduction in their payments immediately, as the prime rate remains influenced by the steady 2.25 percent policy rate. However, this stability offers a predictable environment for budgeting and financial planning. Those looking to renew mortgages or take out business loans face a consistent borrowing cost environment, allowing the real estate market to function without the volatility associated with rapid rate fluctuations.

The Canadian economy is performing slightly better than anticipated, with GDP growing by 2.6 percent in late 2025 and the labor market stabilizing. While the immediate outlook suggests resilience, the Bank of Canada remains data-dependent due to external risks like global trade friction. Future monetary policy adjustments in 2026 will depend heavily on whether core inflation continues to cool and how international economic factors evolve.

The next interest rate announcement is scheduled for March 2026. At that meeting, the Bank will release updated economic projections that will guide future policy. Markets and analysts will be looking for signs of whether the central bank intends to resume rate cuts or maintain the current holding pattern based on fresh data regarding inflation and economic growth.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.