Forget remembering a PIN or searching for a card in your wallet. The future of payments is already here and looking you straight in the eye. We are talking about biometric payments, a technology that transforms your unique physical characteristics, such as your face or iris, into a secure and personal access key to authorize transactions. This evolution promises to make every purchase faster, simpler, and more protected, eliminating the material barriers we are used to. The basic idea is simple: if your body is your password, no one can steal or duplicate it.

In an increasingly digital world, where security is a priority, biometrics is establishing itself as the natural answer to the growing vulnerability of traditional passwords. We already use fingerprints to unlock smartphones or authorize purchases via digital wallets like Apple Pay and Google Pay. The next step, however, takes us toward even more sophisticated and secure frontiers: facial recognition and, above all, iris recognition, destined to become the new standards for an invisible and frictionless payment experience.

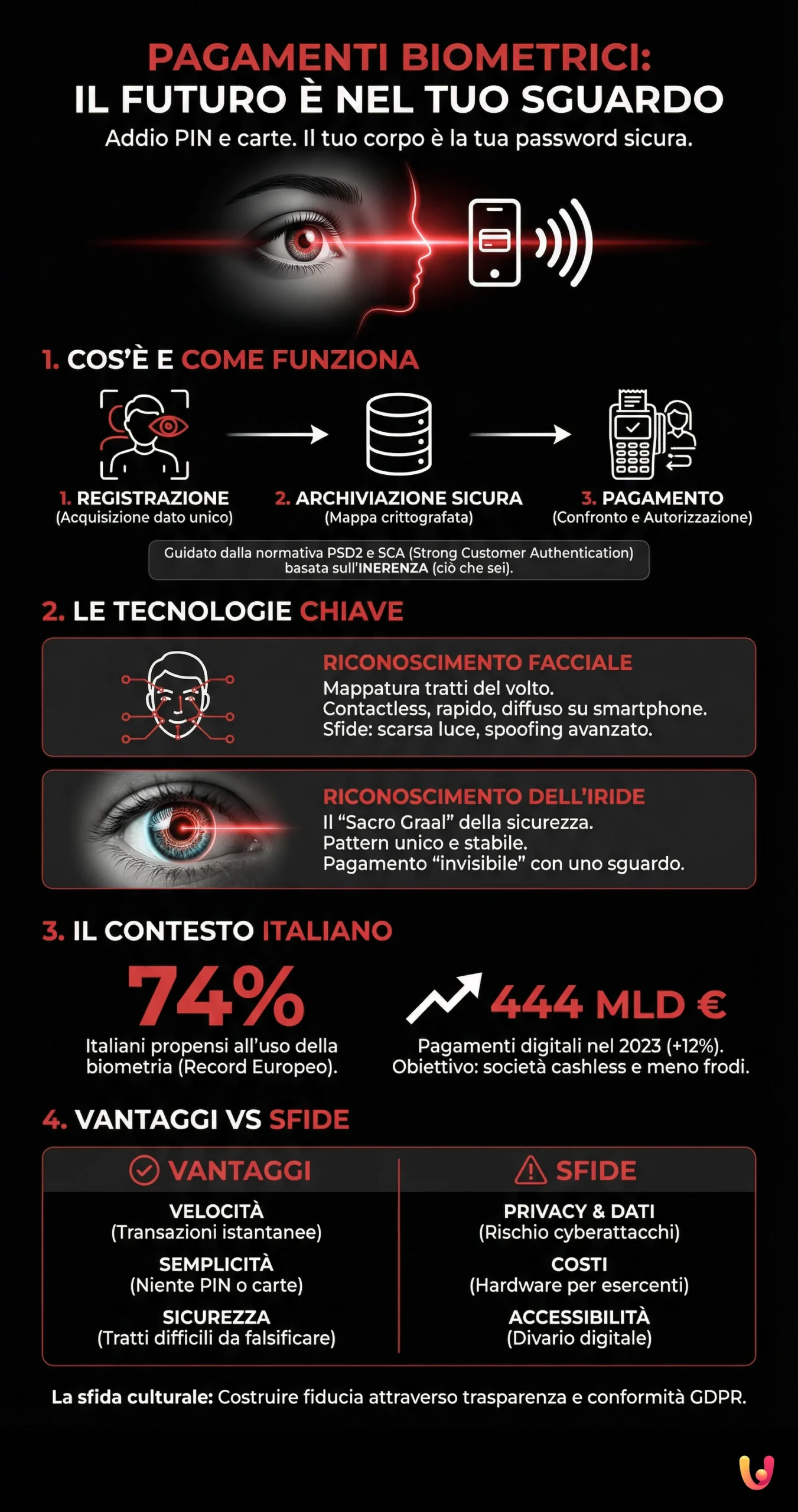

What Is Biometrics and How It Works in Payments

Biometrics is the science that measures and analyzes a person’s unique characteristics, both physical (such as fingerprints, face, iris) and behavioral (such as voice or typing patterns). In the payments sector, this technology is used to verify the identity of a user unequivocally. The process is intuitive: in a registration phase, the system acquires and stores the biometric data, for example, the map of your face. Subsequently, at the moment of payment, the device captures your characteristic again and compares it with the stored one to authorize the transaction.

This mechanism not only increases security, making fraud almost impossible, but drastically simplifies the shopping experience. It is no longer necessary to carry a credit, debit, or prepaid card or remember complex codes. Everything you need is already with you. European regulation PSD2 (Payment Services Directive 2) has strongly pushed in this direction, introducing Strong Customer Authentication (SCA), an authentication that requires at least two verification factors among knowledge (PIN), possession (smartphone), and inherence (biometrics). Biometrics perfectly meets this last requirement, becoming a pillar for future payments.

Beyond the Fingerprint: Facial Recognition

If the fingerprint represented the first mass step towards biometric payments, facial recognition is its natural evolution and is already widely diffused. This technology works by mapping a person’s unique facial features, such as the distance between the eyes, the shape of the nose, and the jawline, to create a facial fingerprint. When making a payment, a camera analyzes the face in real-time and compares it with the stored model. If there is a match, the transaction is approved in a fraction of a second.

The great advantage of facial recognition is its practicality. It is a “contactless” and “hands-free” method that requires no physical contact or manual action, making the shopping experience extremely fluid. Systems like Apple’s Face ID have already accustomed millions of users to this convenience for unlocking phones and authorizing payments. Smartphone payments are secure thanks to tokenization and biometrics, which work together to protect data. However, some challenges persist, such as correct functioning in low light conditions or potential vulnerability to deception attempts with photos or advanced masks.

The Frontier of Security: Iris Recognition

Considered the Holy Grail of biometrics, iris recognition offers a level of security that far exceeds other technologies. The iris, the colored part of the eye, possesses a unique pattern structure for every individual, even between identical twins, and remains stable throughout life. The payment system uses an infrared camera to capture a detailed image of these patterns, transforming it into a unique digital code that acts as an authentication key.

Its complexity and uniqueness make it extremely difficult to replicate, offering almost absolute protection against fraud. Another significant advantage is that it can work even if a person wears glasses, contact lenses, or in cultures where covering the face is required. Pilot projects in Europe, such as that of PayEye in collaboration with Mastercard, are already testing this technology in stores, allowing customers to pay simply with a glance. This solution represents the ultimate expression of an “invisible” payment, where identity itself becomes the tool to complete the purchase.

The European and Italian Market: Where Do We Stand?

Europe is welcoming the innovation of biometric payments, driven by the need for more secure transactions and the PSD2 directive. Italy, although still showing a strong attachment to cash, positions itself as a promising and receptive market. According to recent studies, almost two out of five Italian consumers are willing to use devices with biometric functions for payments. Furthermore, 74% of Italians are inclined to use biometrics for authentication, the highest percentage recorded in Europe. This indicates a remarkable cultural openness towards these new technologies.

In 2023, digital payments in Italy reached 444 billion euros, with a growth of 12% compared to the previous year. Within this trend, payments via smartphones and wearable devices have exploded, signaling a change in consumer habits. The adoption of biometrics could significantly reduce fraud, with estimates speaking of savings up to 483 million euros per year in Italy alone. Although our country still lags behind other European partners in the number of per capita transactions, the direction is clear: the combination of security and practicality offered by biometrics is the key to accelerating the transition towards a completely cashless society.

Tradition and Innovation: The Mediterranean Cultural Challenge

The introduction of biometric payments in Italy and the Mediterranean basin represents a fascinating meeting between innovation and tradition. Mediterranean culture, often characterized by a strong sense of community and established habits, such as the use of cash, faces a technology that redefines the very concept of a transaction, making it personal and intangible. While there is undeniable curiosity and openness towards the convenience offered by these solutions, questions regarding privacy and the management of such sensitive data also emerge.

The main challenge is building trust. Consumers must have the certainty that their biometric data is protected by stringent regulations like the GDPR, which imposes rigorous standards for the collection and processing of personal information. Transparency on how this data is stored and used is fundamental to overcoming natural mistrust. Experience shows that when technology is perceived as secure and advantageous, adoption accelerates. Therefore, a clear dialogue between financial institutions, technology companies, and consumers will be crucial to integrate this innovation into the social fabric, respecting the cultural peculiarities that define the Mediterranean identity.

Advantages and Disadvantages of Biometric Payments

The mass adoption of biometric payments brings with it a balance of opportunities and challenges that deserve careful analysis. Understanding both sides of the coin is essential for consumers and companies to navigate this transformation with awareness.

The Advantages: Speed, Security, and Simplicity

The main benefits of biometric payments are evident and directly impact daily life. First, speed: transactions are completed in a few moments, reducing lines and improving efficiency. Next is simplicity, as there is no longer a need to remember complex PINs or passwords, nor to carry physical cards. Finally, the most significant advantage is security. Biometric characteristics are unique and almost impossible to forge, offering a level of protection against fraud clearly superior to traditional methods. This combination makes the payment experience not only smoother but also safer.

The Disadvantages: Privacy, Costs, and Accessibility

Despite the notable advantages, there are also critical issues. The major concern regards privacy: the management and storage of databases containing biometric data raise serious questions about their protection from cyber attacks. A potential breach would have very serious consequences. Added to this are the implementation costs for merchants, who must equip themselves with specific hardware and software, an investment that can represent a barrier, especially for small businesses. Finally, there is the issue of accessibility: people with certain disabilities or the elderly might encounter difficulties in using these technologies, creating a potential digital divide.

In Brief (TL;DR)

The future of payments abandons PINs and passwords to rely on advanced biometric systems, such as facial and iris recognition, ensuring more secure and personal transactions.

Systems like facial recognition and iris scanning are defining new standards of security and convenience, transforming our body into the safest access key.

Let’s delve into how these advanced technologies not only promise almost inviolable security but also a fluid and frictionless user experience.

Conclusions

Biometric payments, particularly through facial and iris recognition, are no longer a futuristic vision but a concrete reality that is reshaping the landscape of financial transactions in Italy and Europe. The union of advanced security, speed, and unprecedented ease of use positions them as the natural evolution of digital payments, overcoming the limits of PINs and physical cards. Although the fingerprint paved the way, it is in the gaze that the promise of truly invisible and fraud-proof authentication lies.

However, the path towards widespread adoption requires a balanced approach. The main challenge will be harmonizing technological innovation with privacy protection, ensuring that an individual’s most personal data is protected with maximum rigor. Overcoming cultural mistrust, especially in tradition-bound contexts like the Mediterranean one, and ensuring accessibility for all citizens will be crucial steps. The future of payments is written in our unique features, but its realization will depend on the ability to build an ecosystem based on trust, transparency, and inclusivity.

Domande frequenti

Biometric payments utilize unique physical characteristics, such as the face or iris, to verify identity unequivocally. During a registration phase, the system maps these features, and at the moment of purchase, it scans the user again to match the stored data. This process eliminates the need for physical cards or PINs, making the transaction contactless and immediate.

Iris recognition is often regarded as the most secure form of biometrics because the iris possesses a unique pattern structure that remains stable throughout life, even distinguishing between identical twins. Unlike facial recognition, which can face challenges with low light or advanced masks, iris scanning offers almost absolute protection against fraud due to the complexity of replicating the human eye.

The primary benefits include enhanced speed, simplicity, and superior security since unique physical traits are nearly impossible to forge. However, challenges exist, such as potential privacy risks regarding the storage of sensitive biological data and the high implementation costs for merchants. Furthermore, accessibility remains a consideration, as elderly users or those with specific disabilities might face difficulties adapting to these new technologies.

Yes, the security of biometric data is a priority and is covered by stringent regulations. In Europe, the GDPR imposes rigorous standards for the collection and processing of personal information to ensure user privacy. Additionally, the Payment Services Directive 2 (PSD2) promotes these technologies as part of Strong Customer Authentication, ensuring that data is handled securely to prevent unauthorized access.

Europe is actively embracing this innovation driven by the need for secure transactions, and Italy shows remarkable receptiveness with nearly three-quarters of consumers willing to use biometric authentication. Despite a cultural attachment to cash, digital payments in Italy grew significantly in 2023, and the adoption of biometrics is seen as a key strategy to reduce fraud and accelerate the transition to a cashless society.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.