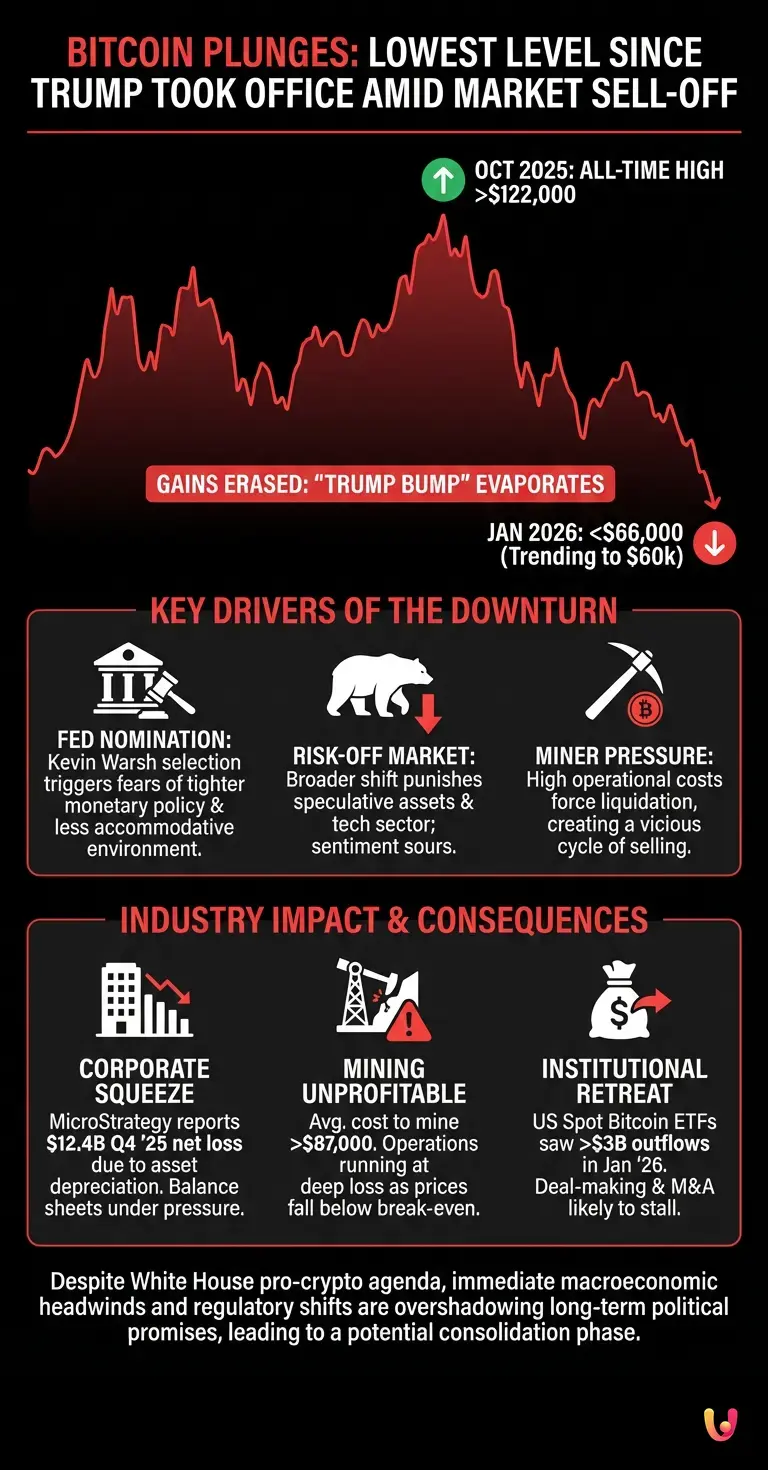

Bitcoin has plummeted to its lowest level since President Donald Trump took office in January 2025, erasing the substantial gains that characterized the first year of his second term. The world’s largest cryptocurrency dropped sharply in early trading on Friday, falling below the $66,000 mark and trending toward $60,000, according to data from major exchanges. The sell-off marks a dramatic reversal for the digital asset, which had reached an all-time high of over $122,000 in October 2025, fueled by the administration’s aggressive pro-crypto agenda.

The sudden downturn has sent shockwaves through the global financial markets, with trending searches for "bitcoin prices" exceeding 20,000 on Friday morning. Despite President Trump’s vocal support for the industry—including an executive order aimed at positioning the U.S. as the "crypto capital of the planet"—investor sentiment has soured. Market analysts point to a confluence of factors, including the nomination of Kevin Warsh as Federal Reserve Chair and a broader "risk-off" environment that has punished speculative assets alongside the technology sector.

The “Trump Bump” Evaporates

The decline represents a significant psychological blow to the "Trump trade" narrative that dominated 2025. Following his election victory, Bitcoin prices surged, buoyed by promises of deregulation and the launch of World Liberty Financial, a crypto venture backed by the Trump family. However, according to The Telegraph, the recent crash has effectively wiped out the "Trump bump," returning prices to levels not seen since the early days of his administration. The optimism that drove the asset to six-figure valuations last autumn has been replaced by anxiety over monetary policy and the sustainability of the rally.

Investors are particularly concerned about the shifting regulatory and monetary landscape. While the White House remains supportive, the nomination of Kevin Warsh to lead the Federal Reserve has triggered fears of a tighter balance sheet. According to BBC reports, the market is pricing in a less accommodative monetary environment, which historically dampens the appeal of non-yielding assets like cryptocurrency. This macroeconomic headwind is compounding the pressure on digital assets, causing them to decouple from the inflation-hedge narrative that attracted many institutional buyers.

Corporations and Miners Feel the Squeeze

The price collapse is having severe repercussions for companies and corporations deeply invested in the digital asset ecosystem. MicroStrategy, the largest corporate holder of Bitcoin, reported a staggering $12.4 billion net loss in the fourth quarter of 2025, driven primarily by the asset’s depreciation. As prices fall toward the $60,000 range, the pressure on corporate balance sheets is intensifying. Data indicates that the average cost to mine one Bitcoin has risen above $87,000, meaning many mining operations are now running at a deep loss. This has forced miners to liquidate their holdings to cover operational costs, creating a vicious cycle of selling pressure.

The downturn is also expected to chill activity regarding mergers and acquisitions within the sector. During the boom of 2025, crypto-native firms were aggressive in acquiring smaller competitors and integrating with traditional finance. However, with valuations slashing across the board, deal-making is likely to stall. Investment banks and venture capital firms are reassessing the risk profiles of these companies, leading to a potential consolidation phase where only the most capitalized players survive. The Guardian notes that U.S. spot Bitcoin ETFs saw over $3 billion in outflows in January 2026 alone, signaling a retreat by the institutional capital that had previously underpinned the market’s growth.

In Brief (TL;DR)

Bitcoin plummeted below $66,000, erasing all gains achieved since President Trump took office and ending the previous market rally.

Investor sentiment soured following Kevin Warsh’s Federal Reserve nomination, sparking fears of tighter monetary policy and driving a broader sell-off.

Corporate holders and miners face severe financial strain, as mining costs now exceed market prices and institutional capital retreats rapidly.

Conclusion

As Bitcoin hovers near critical support levels, the market faces a period of extreme uncertainty. The erasure of the gains made since President Trump took office highlights the volatility inherent in the asset class, regardless of political patronage. While the administration’s long-term commitment to a crypto-friendly America remains unchanged, the immediate economic realities of high mining costs, regulatory shifts at the Fed, and institutional caution are driving the current sell-off. Investors and corporate leaders alike will be watching closely to see if the $60,000 floor holds, or if the digital currency is poised for a deeper correction in the months ahead.

Frequently Asked Questions

The sharp decline results from a combination of macroeconomic fears and operational pressures on miners. Investors are reacting to the nomination of Kevin Warsh as Federal Reserve Chair, anticipating a tighter monetary environment that reduces the appeal of non-yielding assets. Additionally, massive outflows from ETFs indicate that institutional capital is retreating from the market despite political support.

The crash has made mining largely unprofitable because the average cost to produce one Bitcoin has surged above 87,000 dollars. With market prices falling well below this break-even point, mining companies are forced to sell their holdings to cover operational expenses. This necessity to liquidate assets creates a cycle of selling pressure that further depresses the cryptocurrency value.

The substantial gains achieved during the first year of the second term of President Trump have been effectively erased. Although the asset reached an all-time high exceeding 122,000 dollars in October 2025, market sentiment soured due to economic headwinds. This reversal has wiped out the optimism known as the Trump trade, returning prices to levels seen when he first took office.

Large corporate investors are facing severe balance sheet pressure, with MicroStrategy reporting a net loss of over 12 billion dollars in late 2025 due to asset depreciation. The decline in value is causing investment banks to reassess risk profiles and is likely to halt mergers and acquisitions within the sector. Consequently, the industry may see a consolidation phase where only the most capitalized firms survive.

The White House maintains a supportive stance with an agenda to position the US as a global crypto leader. However, this political patronage is currently being overshadowed by immediate economic realities and regulatory shifts at the Federal Reserve. Despite executive orders favoring the industry, the market is prioritizing the impact of monetary policy over long-term government promises.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.