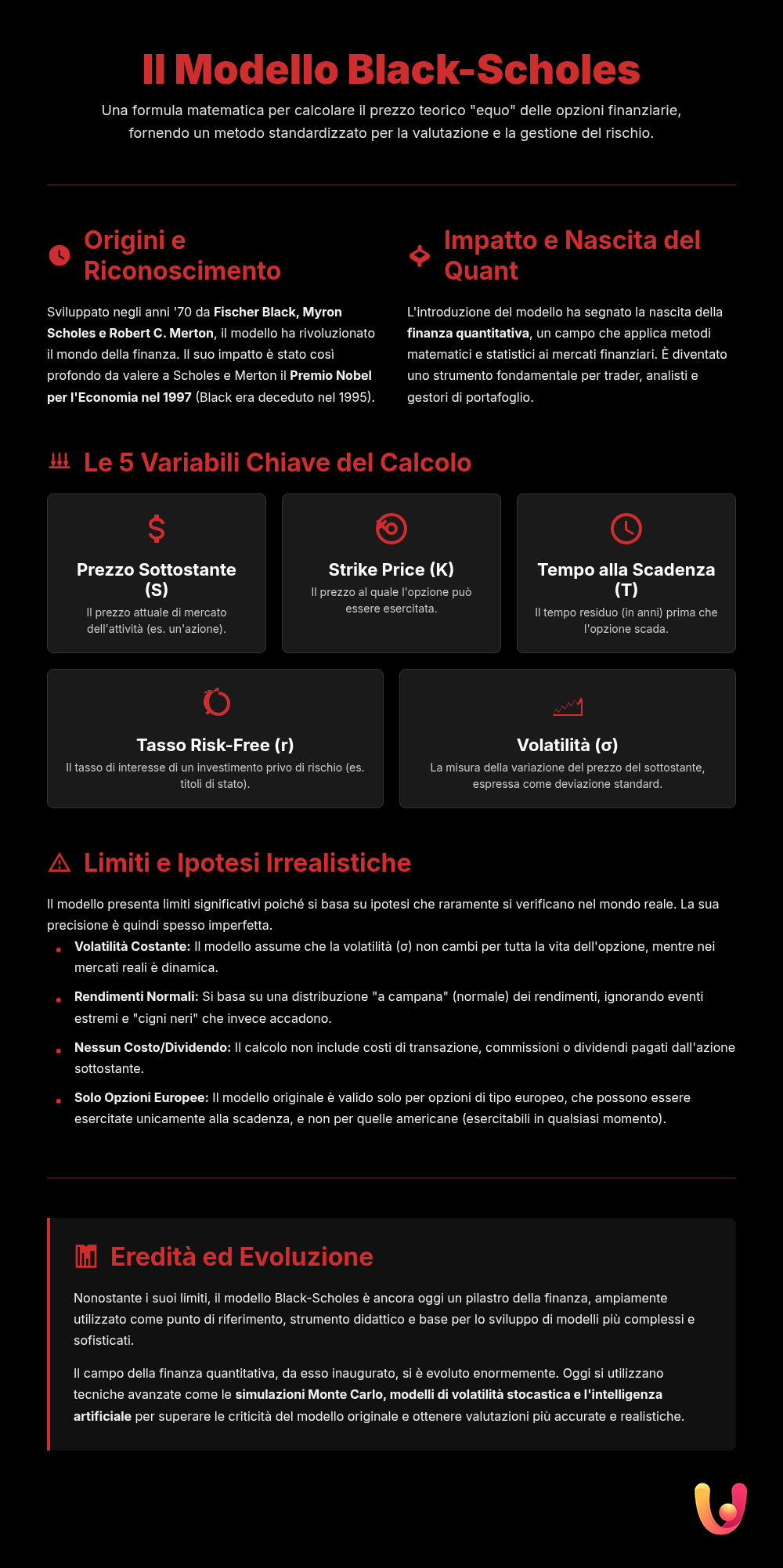

In the world of finance, few ideas have had an impact as profound and lasting as the Black-Scholes model. If you’ve ever heard of options, derivatives, or financial engineering, it’s almost certain that this formula’s name has come up. But what is it exactly? Imagine having a mathematical “recipe” that can determine the correct price of a financial option, an inherently complex instrument. This is, in essence, what Black, Scholes, and Merton created: a bridge between the uncertainty of the markets and the rigorous logic of mathematics.

This model is not just an academic exercise but a practical tool that has revolutionized global financial markets, including the Italian Stock Exchange (Borsa Italiana). It has provided traders, investors, and analysts with a common language and a standardized method for pricing and managing the risk associated with options. In this article, we will explore together, in simple and accessible language, the secrets of this formula, its connection to European financial culture, and how, despite its limitations, it continues to be a cornerstone of innovation in the industry.

The Origins of the Model: A Bit of History Between Tradition and Innovation

The story of the Black-Scholes model begins in the late 1960s, a period of great intellectual ferment and innovation. Fischer Black, a mathematician with a Ph.D. in applied mathematics, and Myron Scholes, a young assistant professor of finance at MIT, joined forces. Their goal was ambitious: to solve a problem that had long plagued the markets—how to determine a “fair” price for options. They were soon joined by Robert C. Merton, who helped refine and popularize the model. The fundamental idea was as simple as it was brilliant: to create an investment portfolio that completely eliminated risk by balancing the purchase of the option with the sale of the underlying stock.

After being initially rejected by major academic journals, their paper “The Pricing of Options and Corporate Liabilities” was finally published in 1973, changing finance forever.

The impact was so significant that, in 1997, Scholes and Merton received the Nobel Prize in Economics for their revolutionary contribution (Fischer Black had unfortunately passed away in 1995). This formula was not just a theoretical triumph but also met a growing practical need in an era when the options market was about to explode, providing traders with a powerful and standardized tool.

The Ingredients of the Formula: What Influences an Option’s Price?

To understand the Black-Scholes model, you don’t need to be a mathematician. Just think of it as a recipe with five main ingredients that, when combined, determine the value of an option. Each ingredient represents a key factor that influences the probability of the option generating a profit at its expiration. Let’s look at them one by one in an intuitive way, as if we were preparing a traditional dish, where each element contributes to the final flavor.

The five fundamental “ingredients” of the model are:

- Current price of the underlying asset (S): This is the starting point, the current price of the stock or index to which the option is linked. The higher this price is for a call option (which gives the right to buy), the more valuable the option will be.

- Strike price (K): Also known as the exercise price, this is the price at which the option can be exercised. It’s our target, the finish line to cross.

- Time to expiration (T): Time is a crucial factor. The more time remaining until the option expires, the greater the chances that the underlying asset’s price will move in our favor.

- Risk-free interest rate (r): This represents the return we could get from a safe investment, like a government bond. It influences the opportunity cost of tying up capital in purchasing the option.

- Volatility (σ): This is perhaps the most fascinating ingredient and the only one not directly observable. It measures uncertainty, the fluctuation of the underlying asset’s price. Higher volatility implies a greater chance of large price movements, making the option more valuable.

How the Black-Scholes Model Works: A Practical Example

Let’s imagine we’re interested in a call option on a major stock in the Italian market, for example, a company listed on the FTSE MIB. A call option gives us the right, but not the obligation, to buy that stock at a predetermined price (the strike price) by a certain date. How do we know how much we should pay for this right? This is where the Black-Scholes model comes in.

Suppose the stock is worth €100 today. We want to buy a call option with a strike price of €105, expiring in six months. We also know that the stock’s historical volatility is 20% and the interest rate offered by European government bonds is 3%. By plugging this data into the Black-Scholes formula, the model calculates the probability that the stock price will exceed €105 before expiration. The result is not a certainty, but a fair theoretical price that balances the probabilities of profit and loss.

The model acts like a financial navigator: it doesn’t predict the future, but it calculates the most likely path and the “ticket price” for that journey, based on the information available today.

If the model tells us the option price is €2.50, this value represents the equilibrium point. A higher market price might indicate an overvalued option, while a lower price could signal an opportunity. This is how traders use the model every day to make informed decisions, combining the tradition of market analysis with the innovation of quantitative models.

The Model Today: Between European Markets and Known Limitations

Although it was developed over fifty years ago, the Black-Scholes model remains a standard in the financial industry, widely used even in European markets like Eurex or Borsa Italiana. Its mathematical elegance and relative simplicity make it an irreplaceable teaching tool and a benchmark for more complex models. However, it’s crucial to recognize its limitations, which have become clear over the years and through financial crises. The model is based on very restrictive assumptions that don’t always reflect market reality.

The main assumptions, and therefore the limitations, of the model include:

- Constant volatility: The model assumes that the underlying asset’s volatility does not change throughout the life of the option, a clearly unrealistic assumption. In reality, volatility fluctuates constantly.

- Normal distribution of returns: It assumes that stock returns follow a bell curve (normal distribution), ignoring the possibility of extreme and sudden events, the so-called “black swans.”

- No transaction costs and constant rates: The model does not account for commissions, taxes, and changes in interest rates, elements that in practice affect returns.

- European-style options: The original formula was developed for European options, which can only be exercised at expiration, unlike American options.

These limitations don’t make the model obsolete, but they do define its proper scope of application. Today, the financial industry uses modified versions and more sophisticated models, such as those that incorporate stochastic volatility or price jumps, to overcome these issues. Modern financial engineering has evolved, building on the foundations laid by Black and Scholes.

Beyond Black-Scholes: The Evolution of Quantitative Finance

The Black-Scholes model was the starting point of a true revolution: the birth of quantitative finance. It demonstrated that it was possible to use complex mathematical tools to understand and manage financial risk. After its publication, a new generation of “quants” began to explore increasingly sophisticated models to price complex derivative instruments and better capture the dynamics of real markets. Innovation has never stopped, driven both by the shortcomings of the original model and the growing complexity of the financial world.

Today, quantitative analysts use a wide range of tools and techniques. Monte Carlo simulations, for example, allow for the modeling of thousands of possible future scenarios to price exotic instruments. Models like Heston’s or jump-diffusion models were developed to address the problem of non-constant volatility and extreme market events. Furthermore, the advent of technologies like artificial intelligence and machine learning, along with programming languages such as Python, is opening new frontiers, enabling even more powerful and customized quantitative analysis.

In Brief (TL;DR)

In this article, we explain the Black-Scholes model in a simple and intuitive way—one of the most important formulas in finance for calculating option prices.

In this article, we explain in a simple and intuitive way how this famous formula works, what factors it considers for valuation, and what its practical limitations are.

Finally, we will delve into the meaning of the equation, its practical impact, and the limitations that every investor should know.

Conclusion

The Black-Scholes model is much more than a simple mathematical formula; it is a symbol of the meeting between tradition and innovation in the world of finance. Born from a brilliant insight, it provided for the first time a logical and replicable method for pricing uncertainty, transforming options from niche instruments into mass-market financial products. Although its limitations are well-known and more advanced models are used today, its historical and educational importance remains unchanged. Understanding Black-Scholes means understanding the foundations on which much of modern finance is built, an essential step for anyone, from the small saver to the experienced investor, who wishes to navigate the financial markets with greater awareness, even in the Italian and European context.

Frequently Asked Questions

The Black-Scholes model is a mathematical formula used to determine the theoretical price of financial options, particularly European-style ones. Developed in the 1970s, it helps calculate the fair value of an option by considering factors like the current price of the stock, the time remaining until expiration, and its volatility.

Its importance stems from being the first to provide a standard and objective model for pricing options. This revolutionized financial markets, facilitating risk management and the creation of new financial instruments. For this work, its authors received the Nobel Prize in Economics in 1997.

The formula considers five key variables: the current price of the underlying asset (e.g., a stock), the option’s strike price, the time remaining until expiration, the risk-free interest rate (like that of government bonds), and the volatility of the underlying asset.

Yes, the model has several limitations. It is based on assumptions that are not always met in reality, such as perfect market efficiency, no transaction costs, and, most importantly, constant volatility over time. Sudden market events can make it less accurate.

Absolutely. Despite its limitations and the development of more complex models, Black-Scholes remains a cornerstone of modern finance. It is widely used as a benchmark for option valuation, for risk management, and as a basis for more advanced models.

Still have doubts about Black-Scholes Model: Option Pricing Made Easy?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.