Italy has historically been a country of homeowners. For decades, Mediterranean culture has taught us that “bricks and mortar” are the only true safe haven for our savings. However, the financial world has changed radically in recent years, offering opportunities that challenge tradition.

Today, we find ourselves at a crucial crossroads for wealth management. On one hand, there is the tangibility of a home, a physical asset you can see and touch. On the other, there is the dynamism of the financial markets, which promise potentially higher returns but require a different mindset.

The choice is no longer as straightforward as it once was. Inflation, variable interest rates, and the digitalization of the economy demand deep reflection. It’s not just about choosing where to put your money, but about understanding what lifestyle and financial goals you want to pursue.

Choosing between real estate and stocks isn’t just a matter of numbers, but of temperament: do you prefer the peace of mind of a tangible asset or the instant liquidity of a click?

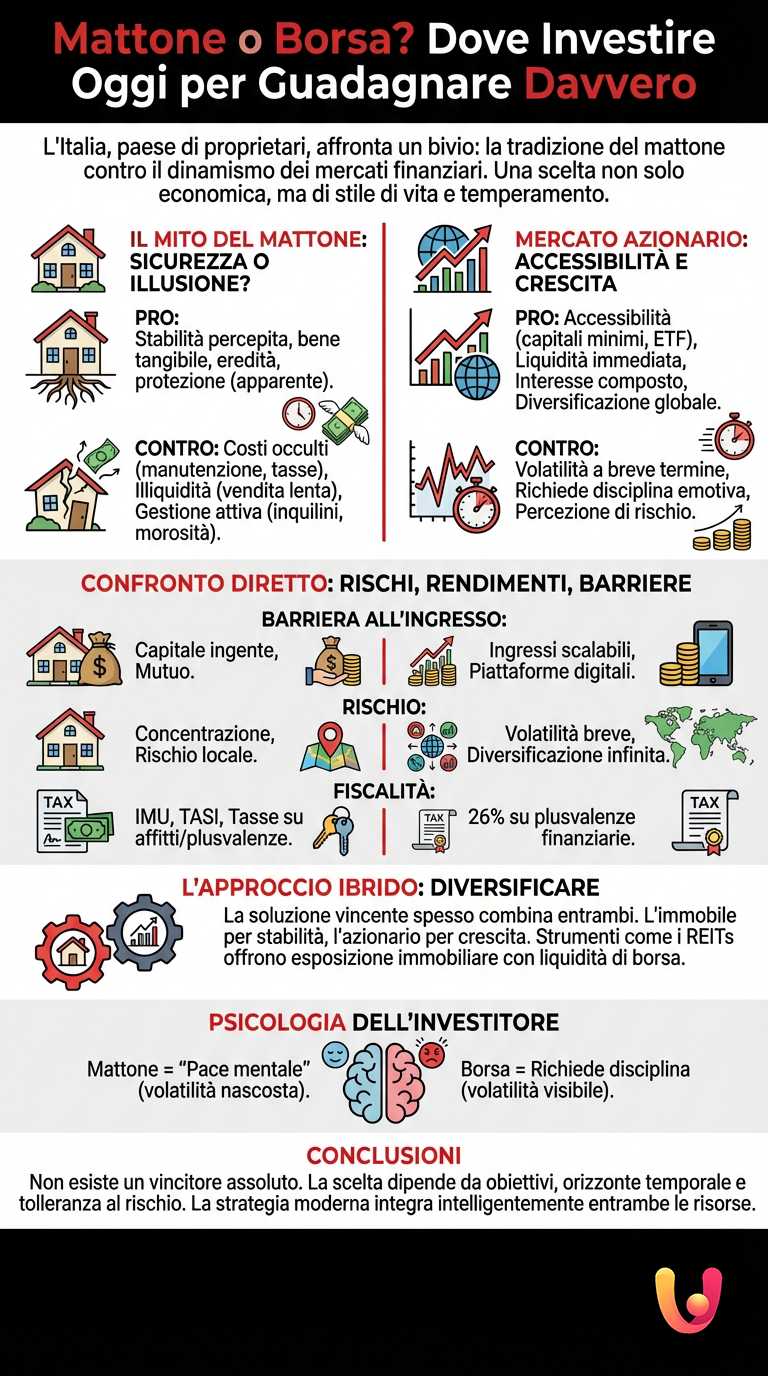

The Myth of Bricks and Mortar: Security or Illusion?

Investing in real estate is deeply rooted in the Italian DNA. A home represents stability, an inheritance to leave to children, and protection against uncertainty. The common perception is that the value of real estate can never drop to zero, unlike the shares of a single company.

However, real estate investment involves hidden costs that are often overlooked. Major maintenance, unexpected condo fees, and property taxes constantly erode the gross return. Furthermore, liquidity is the real Achilles’ heel of this sector: selling an apartment at the right price can take months, if not years.

Then there’s the option of renting it out. Renting can generate a steady cash flow, but it requires active management. You have to deal with tenants, contracts, and potential rent arrears. To delve deeper into the current dynamics of the rental market, it’s useful to consult a specific analysis on investing in real estate and the benefits of renting.

The Stock Market: Accessibility and Compound Interest

The stock market, in contrast, has democratized access to wealth. Today, thanks to digital platforms and tools like ETFs, it’s possible to invest in a diversified basket of global companies with minimal capital. You no longer need to be a millionaire to share in the profits of the world’s largest corporations.

The main advantage of stocks lies in their instant liquidity. If you need to access your capital, you can sell your securities in seconds during market hours. There are no notaries, real estate agencies, or lengthy bureaucratic negotiations to deal with.

Historically, the global stock market has offered higher average annual returns than real estate, especially when considering the power of compound interest over the long term. For those just starting out, a simple guide to start investing in the stock market is the ideal starting point to understand the basic mechanics without getting overwhelmed by technical jargon.

While real estate requires capital and physical maintenance, the stock market works for you 24/7, harnessing global economic growth without you having to change a single lightbulb.

Direct Comparison: Risks, Returns, and Barriers to Entry

To make an informed decision, it’s necessary to compare the two assets on objective parameters. The first hurdle is the barrier to entry. Buying a property requires a large initial capital or taking out a mortgage, which ties up future income for decades. Stocks allow for scalable entries, suitable for all budgets.

On the risk front, real estate is perceived as less volatile, but it is subject to concentration risk. If the neighborhood deteriorates or the local market crashes, the entire investment suffers. Stocks are very volatile in the short term, with daily price fluctuations, but they allow for almost infinite geographical and sectoral diversification.

A crucial aspect is taxation. Real estate is subject to IMU, TASI, and registration taxes, in addition to taxation on rental income. Financial investments in Italy are generally taxed at 26% on realized capital gains. Understanding how to optimize the tax burden is essential; for this, we recommend reading the guide on taxes and investments to avoid mistakes with the tax authorities.

The Hybrid Approach: Diversify to Protect Capital

The stark contrast between bricks and stocks is often a false dilemma. The most resilient portfolios are those that manage to combine both asset classes. From a modern diversification perspective, real estate provides stability and inflation protection, while stocks offer growth and liquidity.

For those who don’t have enough capital to buy a physical property, there are financial instruments like REITs (Real Estate Investment Trusts). These allow you to invest in the real estate sector through the stock market, gaining the benefits of both worlds: exposure to bricks and mortar but with the liquidity of a stock.

Building a balanced portfolio requires study and planning. You shouldn’t limit yourself to traditional assets but evaluate a comprehensive strategy that includes different types of instruments. To explore this concept further, it’s useful to study how to build a modern portfolio beyond stocks and bonds.

Investor Psychology: The Emotional Factor

Beyond the numbers, the choice largely depends on your stress tolerance. Watching your stock portfolio drop by 20% during a crisis can cause panic and lead to irrational selling. Real estate, by not having a price updated in real-time on a screen, “hides” volatility and helps the investor stay calm.

Italian culture favors the “peace of mind” that comes from physical ownership. However, this tranquility has an opportunity cost. Capital tied up in concrete cannot be used to seize new market opportunities or to deal with immediate emergencies without selling the asset at a loss.

The real risk is not in the market, but in the investor’s reaction: a house protects from emotional decisions because it is illiquid, while the stock market requires iron discipline not to sell at the wrong time.

In Brief (TL;DR)

We analyze in detail the pros and cons of real estate investments versus the stock market to help you diversify your portfolio effectively.

We analyze the advantages and risks of both strategies to help you diversify your portfolio and maximize returns.

We examine the pros and cons of both options to help you diversify your portfolio and maximize profits.

Conclusions

There is no absolute winner in the challenge between real estate investments and the stock market. The answer depends entirely on personal goals, time horizon, and risk appetite. Real estate remains a valid choice for those seeking stability, direct use of the asset, and very long-term protection, while accepting management costs and poor liquidity.

The stock market, on the other hand, is the primary tool for those who want to build wealth over time by leveraging compound interest, while maintaining maximum flexibility and diversification. For the modern investor, the winning strategy is not exclusion, but the intelligent integration of both resources within a solid and well-structured financial plan.

Frequently Asked Questions

There’s no single answer, but there are statistics. The global stock market has historically returned 7-10% annually, often outperforming the net return of residential real estate, which is eroded by taxes (IMU), maintenance, and entry costs. Bricks and mortar remain ideal for those seeking tangible stability and periodic rental income, while stocks are preferable for those seeking greater capital growth in the long term and maximum liquidity.

Financial income (stocks, bonds, ETFs) is taxed at 26%. For real estate, rental income can benefit from the ‘Cedolare Secca’ (a flat tax of 21% or 10% for agreed-upon rents), but the 2024 Budget Law introduced a change: for short-term rentals (under 30 days), the rate increases to 26% starting from the second rented property. Additionally, a home is subject to IMU and registration taxes upon purchase, while real estate capital gains are taxed if sold within 5 years.

It’s a deeply rooted cultural perception in Italy (the safe-haven asset), but it’s not without risks. While stocks are volatile in the short term (prices fluctuate), real estate suffers from specific risks: illiquidity (it can take months to sell), tenant risk (rent arrears or vacancies), and concentration (all capital is in a single asset). A well-diversified stock portfolio can, paradoxically, be less risky than a single apartment.

For the traditional real estate market, yes: you need cash for the mortgage down payment (often 20%) and for ancillary costs like notary and agency fees (about 10-15% of the value). In contrast, the stock market is now accessible to everyone: thanks to ETFs and accumulation plans (PACs), you can invest in global markets starting with as little as 50 euros a month, breaking down the barriers to entry.

Yes, through financial innovation. You can invest in REITs (Real Estate Investment Trusts) or real estate ETFs. These instruments allow you to buy shares in companies that manage large property portfolios (shopping malls, offices, residential) worldwide. They offer the benefits of the sector (dividends) with the liquidity of the stock market, eliminating bureaucracy and maintenance costs.

Still have doubts about Bricks or Stocks? Where to Invest Today for Real Gains?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.