Have you ever found yourself at the supermarket, ready to pay, only to discover your card is blocked? Or wanted to make an online purchase and received the message “card not enabled, contact your institution”? A frustrating experience, right? But don’t worry, it happens more often than you think! In this article, you will discover exactly what this message means, why your card might have been blocked and, most importantly, how to solve the problem quickly and easily. Additionally, we will reveal some tricks and tips to prevent your card from being blocked in the future, so you can shop with complete peace of mind. Keep reading and discover how to best manage your payment card!

What Does “Card Not Enabled” Mean?

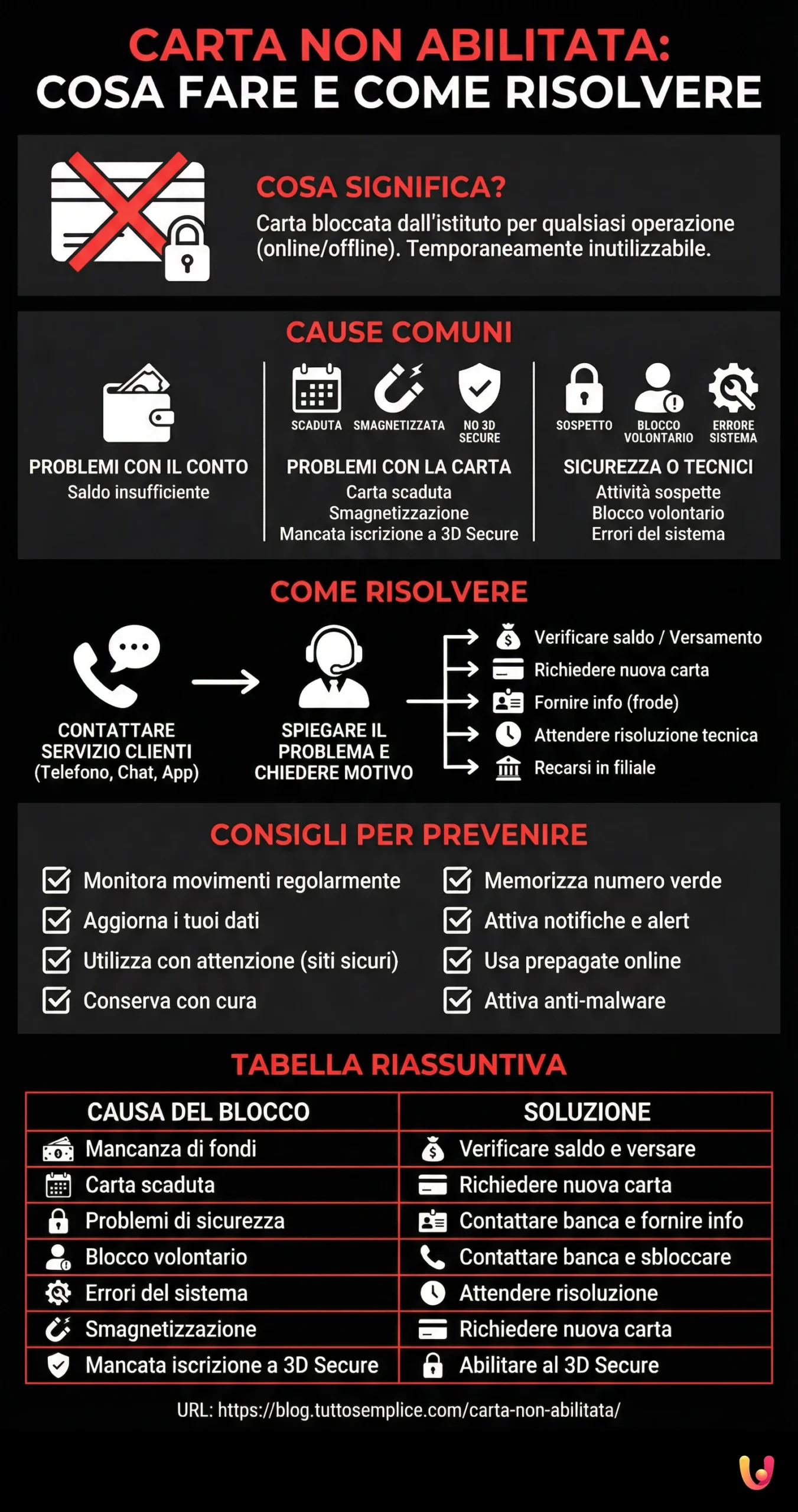

When a message alerts you that your card is not enabled, it means that the issuing institution (your bank or financial entity) has blocked it, preventing you from using it for any operation, both online and offline. This can happen with any type of card, whether it is a credit card, a debit card or a prepaid card. Basically, your card is temporarily unusable.

Causes of a Card Not Being Enabled

There are multiple causes that can lead to a card block. Here are the most common ones, grouped by type:

Account Issues

- Insufficient funds: If you are trying to make a payment that exceeds the available balance on your card, it might be blocked.

Card Issues

- Expired card: Check the expiration date on your card. If it has expired, you will no longer be able to use it.

- Demagnetization: The card might have become demagnetized due to wear and tear, improper storage, or proximity to devices emitting electromagnetic waves, such as cell phones or televisions.

- Failure to enroll in 3D Secure: For online purchases, the card must be enabled for the 3D Secure security protocol.

Security or Technical Issues

- Suspicious activity: If the bank detects suspicious activity on your card, such as unusual transactions or attempted fraud, it might block it to protect your funds.

- Voluntary block: You might have blocked the card in the past due to loss or theft and then forgot to unblock it.

- System errors: Sometimes, the card block can be caused by a malfunction in the bank’s computer system.

How to Solve the Problem

Contacting customer service immediately is essential to unblock the card and understand the cause of the problem. You can contact your bank by phone at the number usually found on the back of the card or on the bank’s website. Alternatively, many banks offer the option to contact customer service via online chat on their website or app. Some banks even allow you to enable the card directly via the app, offering a quick and convenient solution.

Once you have contacted customer service, explain the problem to the operator and ask for information regarding the reason for the block. Depending on the cause, you might need to:

- Check the available balance on your account and, if necessary, make a deposit.

- Request a new card if the current one is expired or damaged.

- Provide additional information to verify your identity and unblock the card in case of suspected fraud.

- Wait for the resolution of any technical issues by the bank.

- Go to a branch to unblock the card.

Tips to Prevent the Problem

Here are some useful tips to prevent your card from being blocked in the future:

- Monitor transactions: Regularly check your card transactions via the bank statement or app. In this way, you can spot any suspicious transactions and report them promptly. For example, if you notice a purchase you didn’t make, you can contact the bank immediately and block the card.

- Update your details: Keep your personal data updated with the bank, such as your phone number and email address, so the institution can contact you easily if needed.

- Use the card carefully: Avoid withdrawing cash or making payments in unsafe places or on unreliable websites.

- Store the card with care: Avoid bending it, scratching it, or exposing it to heat or magnetic sources.

- Save the toll-free number: Write down the toll-free number to block the card in case of loss or theft.

- Enable notifications: Set up notifications to be alerted of every transaction made with your card.

- Request SMS or email alerts: Activate the SMS or email alert service to stay updated on expenses made.

- Use prepaid cards online: For online purchases, use prepaid cards to limit damage in case of fraud.

- Activate anti-malware: On your devices, activate the anti-malware feature to protect yourself from malicious software.

Summary Table

| Block Cause | Solution |

|---|---|

| Insufficient funds | Check balance and make a deposit |

| Expired card | Request a new card |

| Security issues | Contact the bank and provide information |

| Voluntary block | Contact the bank and request unblocking |

| System errors | Wait for the problem to be resolved |

| Demagnetization | Request a new card |

| Failure to enroll in 3D Secure | Enable the card for 3D Secure |

In Brief (TL;DR)

If your card is not enabled, it means it has been blocked and you cannot use it.

Causes can vary, such as lack of funds, expired card, or security issues.

To solve the problem, contact your bank immediately.

Conclusions

Ultimately, if you are faced with the message “card not enabled“, staying calm and contacting your bank promptly is the best solution. A card block can be a frustrating experience, especially if it occurs in a moment of need. However, it is important to remember that it is a security measure designed to protect your funds. By following the advice provided in this article, you can reduce the risk of your card being blocked and face the problem with greater peace of mind.

The European PSD2 Directive (Payment Services Directive 2) has introduced the obligation of strong customer authentication for most online payments, increasing the security level of transactions and helping to prevent fraud and unauthorized card use. This could also reduce the occurrence of “card not enabled” errors related to security issues.

With the evolution of payment technologies, it is likely that new security systems and new ways to unblock cards more quickly and easily will be introduced in the future. For example, some banks are already experimenting with the use of biometrics for user authentication and card unblocking. In this way, card blocking in case of PIN loss or theft could be avoided, making transactions even safer.

Furthermore, it is important to emphasize that prevention plays a fundamental role in payment card security. Being aware of risks and adopting responsible behaviors can help significantly reduce the likelihood of running into problems like a card block. For example, it is essential to guard your card carefully, avoid sharing your PIN with third parties, and pay attention to the websites where you make online purchases.

Finally, it is worth remembering that the digitalization of financial services is leading to an increase in online transactions and, consequently, also the risks related to payment card security. For this reason, it is important to stay informed about new technologies and security measures adopted by banks to protect their customers.

Frequently Asked Questions

The physical card can be activated via the issuing institution’s app or website.

Contact your bank’s customer service immediately to unblock the card and find out the cause of the block.

Never share your PIN with anyone, be wary of suspicious ATMs, and enable transaction notifications.

Most cards can be used abroad, but check conditions and fees with your bank.

It means that your card has been blocked by the issuing institution and cannot be used.

Common causes include lack of funds, expired card, security issues, or voluntary blocks.

Contact your bank and request a limit increase. The bank will evaluate your request based on your financial situation.

Still have doubts about Card Not Enabled: What to Do and How to Fix It?

Type your specific question here to instantly find the official reply from Google.

Sources and Further Reading

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.