In Brief (TL;DR)

The debit card is your passport to checking account funds, ideal for everyday expenses.

The credit card offers you flexibility and the ability to pay later, but requires attention to avoid interest.

The prepaid card is perfect for keeping your budget under control and for safe online purchases. Finally, the prepaid card with IBAN combines the practicality of the prepaid card with the features of a basic checking account.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Hello to all friends of TuttoSemplice.com! Today I want to tackle a topic that, I know, can sometimes seem a bit complicated: the world of payment cards. Debit card, credit card, prepaid card, and prepaid card with IBAN: so many options! And which one is the right one for us? If you have found yourself asking this at least once, you are in the right place. In this article, which I have carefully prepared for you, we will clarify the differences and similarities between these different types of cards, analyzing the advantages and disadvantages of each. The goal is to provide you with a complete and simple guide to help you choose the solution best suited to your needs.

It often happens that one feels a bit confused when faced with all these options. After all, banks and financial institutions are constantly proposing new products, and navigating through technical terms and specific features may not be immediate. But don’t worry, I’m here to simplify your life! Together, we will explore the distinctive features of each type of card, understand how they work, and in which situations they are most convenient. Whether you are a young person dealing with your first card, a professional needing a versatile payment tool, or simply someone who wants to manage their finances better, you will surely find useful information in this deep dive.

Get ready for a journey into the world of payment cards, where I will try to be as clear and direct as possible. I will avoid unnecessary technical jargon and focus on the key concepts, the ones that really interest you for making the right choice. I promise you that, by the end of this article, you will have a complete and detailed view of all the options at your disposal, and you will be able to choose the perfect card for you, the one that will truly simplify your life. Let’s start this journey together immediately, discovering the differences between debit card, credit card, prepaid card, and prepaid card with IBAN.

Debit Card: Your Immediate Access to Funds

Let’s start with the debit card, probably the most widespread and used one. If you have a bank checking account, it is very likely that you already own one. But do you really know how it works and what its main advantages and disadvantages are? Let’s try to understand it together.

What is a Debit Card?

The debit card is an electronic payment instrument that allows you to access the funds present in your bank checking account directly. In practice, every time you make a payment with your debit card, the amount spent is immediately deducted from the available balance on your account. This is its main and distinctive feature.

Sometimes, the debit card is also called a Bancomat (in Italy), although technically Bancomat is the name of a specific payment circuit very widespread in Italy. However, in common usage, the two terms are often used as synonyms. Your debit card is linked to your checking account and allows you to make payments at physical stores equipped with POS (Point of Sale), online on websites that accept this type of payment, and to withdraw cash from ATM (Automated Teller Machine) kiosks.

How Does the Debit Card Work?

The operation of the debit card is quite simple. When you want to make a payment in a store, you insert the card into the POS or tap it if it is enabled for contactless technology. You enter your PIN code (Personal Identification Number) to authorize the transaction (unless the amount is below a certain threshold for contactless payments, in which case it might not be required). Once authorized, the amount is immediately debited from your checking account.

For online payments, you are usually asked for the card number, the expiration date, and the CVV code (Card Verification Value) found on the back of the card. In some cases, it might be necessary to further authenticate the transaction via a temporary code received via SMS or through your bank’s app, for greater security. When you withdraw cash from an ATM, you insert the card, type the PIN, and select the desired amount. In this case too, the amount is immediately deducted from your available balance.

Advantages of the Debit Card

The debit card offers numerous advantages that make it a highly appreciated payment tool. One of the main ones is immediate access to funds. You can use the money you actually have available in your account, without the need to resort to credit. This can help you keep your expenses under control and avoid getting into debt.

Another significant advantage is its wide acceptance. Debit cards are accepted in very many physical and online stores worldwide, especially those belonging to international circuits like Visa or Mastercard. This makes them a convenient and versatile tool for your daily purchases and your travels. Furthermore, the debit card also acts as a cash withdrawal tool at ATM kiosks, offering you the possibility to always have physical money available when you need it.

The debit card can also be a useful budgeting tool. Since you can only spend the funds present in your account, it helps you stay within the limits of your budget and not spend more than you can afford. Additionally, transactions made with the debit card are recorded on your checking account statement, which allows you to have complete traceability of your expenses.

Finally, generally, debit cards do not involve the payment of interest, unlike credit cards, as you are not using borrowed money. This can represent significant savings in the long run.

Disadvantages of the Debit Card

Despite the numerous advantages, the debit card also presents some disadvantages that are important to consider. One of the main ones is the spending limit, which is directly tied to the available balance on your checking account. If you do not have sufficient funds, the transaction could be declined.

Furthermore, the debit card might not be accepted for some types of transactions, such as car rentals or hotel reservations, where a credit card is often required as a guarantee. This is because the credit card offers greater security to the merchant in case of subsequent charges or damages.

Another disadvantage is that the debit card does not allow you to obtain “credit” in the strict sense of the term. You cannot spend money you do not yet have and pay for it at a later time. This can be limiting in some situations where you might need to make a major purchase but do not immediately have the necessary liquidity. Finally, unlike credit cards, debit cards generally do not offer reward programs or additional insurance on purchases.

Practical Examples of Debit Card Usage

The debit card is perfect for your daily expenses: grocery shopping, paying for coffee at the bar, buying books or clothes. It is also very convenient for online payments on websites that accept it. You can use it to withdraw cash from ATM kiosks when you need physical money.

Imagine being at the supermarket and having to pay for groceries. Instead of looking for cash in your wallet, you can simply insert your debit card into the POS and type the PIN. The amount will be immediately deducted from your account. Or, if you are buying a book online, you can enter your card details and complete the purchase in a few seconds.

The Debit Card and the Bancomat Circuit

As I mentioned earlier, in Italy the term Bancomat is often used as a synonym for debit card. However, it is important to clarify that Bancomat is a specific payment circuit, very widespread in our country. Your debit card might belong to the Bancomat circuit, but also to other international circuits like Visa (V Pay) or Mastercard (Maestro).

Cards belonging to the Bancomat circuit are generally accepted in all commercial establishments and ATMs displaying the Bancomat logo in Italy. Cards belonging to international circuits, on the other hand, offer greater flexibility and are also accepted abroad. Often, modern debit cards are co-badged, meaning they belong to both the Bancomat circuit and an international circuit, combining the advantages of both.

Debit Card Security

Security is a fundamental aspect when talking about payment cards. Debit cards are equipped with various security measures to protect your funds. The PIN code is essential for authorizing payments and withdrawals at ATMs. Most modern cards are equipped with a microchip which makes cloning more difficult compared to old cards with only the magnetic stripe.

Contactless technology offers convenience, but also a certain level of security, as for amounts above a certain threshold, PIN entry is still required. Banks and financial institutions constantly monitor transactions to identify any suspicious activity and often offer notification services via SMS or email to alert you of every movement on your account. In case of loss or theft, it is fundamental to block the card immediately to avoid fraudulent use.

How to Get a Debit Card

Getting a debit card is usually very simple. It is issued automatically when you open a checking account at a bank or another financial institution. The procedure may vary slightly depending on the institution, but generally, you will need to fill out a request form and provide some identity documents. Once your request is approved, the card will be sent to you by mail or you can pick it up directly at the branch.

Costs Associated with the Debit Card

Generally, debit cards have rather low costs. Often there is no annual fee for the card itself, or it is included in the checking account management cost. There might be commissions for cash withdrawals at ATMs of other banks or abroad, so it is always good to check the contractual conditions of your card.

Debit Card for Youth and Students

Many banks offer debit cards specifically for young people and students, often with particularly advantageous conditions, such as no annual fee or reduced commissions. These cards can be an excellent tool for learning to manage one’s money responsibly.

The Future of the Debit Card

The debit card continues to evolve with the introduction of new technologies. More and more often we find virtual debit cards, usable via smartphone or smartwatch, and advanced management features via banking apps. The future seems oriented towards ever-greater integration with mobile devices and towards greater security and ease of use.

Credit Card: Financial Flexibility and Deferred Payments

After exploring the debit card in depth, let’s now move on to the credit card. Although both are electronic payment instruments, their operation and characteristics are quite different. Let’s see together what distinguishes the credit card and in which situations it can be particularly useful.

What is a Credit Card?

The credit card is a payment instrument that allows you to make purchases and cash withdrawals using a line of credit made available to you by the bank or financial institution that issued the card. In practice, when you use your credit card, you are not spending the money present in your checking account (as happens with the debit card), but you are using a credit limit, which is a maximum amount you can spend.

Periodically (usually once a month), you receive a statement that summarizes all transactions made with the credit card in the previous period. You then have the option to choose whether to pay the entire amount due by the due date indicated on the statement, or whether to pay only a part (the so-called “minimum payment”). In case you choose not to pay the entire amount, interest will be applied to the remaining part, the rate of which may vary depending on your credit card contract.

How Does the Credit Card Work?

The operation of the credit card is slightly more complex than that of the debit card. When you make a purchase with your credit card, the amount is recorded and added to your outstanding balance. This balance increases as you make transactions, up to the maximum credit limit established by the bank.

At the end of the billing period (usually a month), you receive the statement with the summary of expenses. At this point, you can decide how to pay the amount due. If you pay the entire amount by the due date, you will not have to pay any interest. If instead you choose to pay only a part, interest will be calculated on the remaining sum, which will be added to the next month’s balance. It is important to keep in mind that interest rates on credit cards can be quite high, so it is always advisable to pay the full amount to avoid additional costs.

For online payments, the use of the credit card is similar to that of the debit card: the card number, expiration date, and CVV code are required. In this case too, further authentication might be necessary for greater security. For cash withdrawals at ATMs with the credit card, commissions might be applied and, in some cases, even interest starting from the day of withdrawal.

Advantages of the Credit Card

The credit card offers several advantages that can make it a very useful tool. One of the main ones is financial flexibility. It allows you to make purchases even when you do not immediately have funds available in your checking account, with the possibility of paying at a later time. This can be particularly useful for dealing with unexpected expenses or making major purchases.

Many credit cards offer reward programs, such as accumulating points or air miles for every euro spent, which can be converted into discounts, prizes, or free travel. Some cards also offer additional insurance on purchases, such as protection in case of theft or damage, or travel insurance.

The credit card can also be a useful tool for building a good credit history. If you use the card responsibly and always pay the statements by the due date, you demonstrate that you are a good payer, which can facilitate your access to other types of financing in the future, such as a home mortgage.

Finally, the credit card can offer greater protection against fraud. In case of unauthorized use of your card, your liability might be limited, provided that you have promptly reported the incident to your bank.

Disadvantages of the Credit Card

The main disadvantage of the credit card is the risk of indebtedness. If not managed carefully, the credit card can lead to accumulating debt and having to pay high interest. It is fundamental to be aware of one’s repayment capacity and not spend more than one can afford.

Another disadvantage is that many credit cards involve the payment of an annual fee. Furthermore, as mentioned, if the entire amount due is not paid by the due date, interest is applied, which can significantly impact the total cost of purchases. There might also be commissions for cash withdrawals or for some specific operations.

Finally, obtaining a credit card can be more difficult compared to a debit or prepaid card, as the bank performs checks on your creditworthiness before granting you a line of credit.

Practical Examples of Credit Card Usage

The credit card is often used for online purchases, especially on foreign sites, and for travel and hotel bookings. It can be useful for dealing with unexpected expenses or for making major purchases that you wish to pay in installments (although in this case, it is good to carefully evaluate the interest costs).

Imagine having to book a flight and a hotel for a vacation. The credit card allows you to make the reservation even if you do not have the entire sum available in your account at that moment, with the possibility of paying the statement the following month. Or, if the washing machine breaks and you need to replace it urgently, the credit card can give you the flexibility to make the purchase and defer the payment.

Types of Credit Cards

There are different types of credit cards, which differ in spending limits, services offered, and costs. Classic credit cards are the most common and offer a standard credit limit. Likewise, gold and platinum credit cards offer higher spending limits and additional services, such as more comprehensive travel insurance or more advantageous reward programs, but often also have a higher annual fee. Revolving credit cards allow you to repay the amount due in installments, but generally with higher interest rates.

Credit Score and the Credit Card

The credit score is an indicator of your creditworthiness, based on your payment history. Using the credit card responsibly, always paying statements by the due date, can help you build a good credit score, which can be important for obtaining financing in the future.

Credit Card Security

As with debit cards, security is a priority for credit cards too. In addition to the PIN code, credit cards are equipped with a CVV code on the back, necessary for online payments. Banks monitor transactions to identify any suspicious activity and offer notification services. In case of fraud, your liability is generally limited.

How to Get a Credit Card

To obtain a credit card, it is usually necessary to have a demonstrable income and a good credit history. The bank or financial institution will evaluate your request and decide whether or not to grant you the card and what your credit limit will be. The procedure may vary depending on the institution.

Costs Associated with the Credit Card

Costs associated with the credit card may include an annual fee, interest rates (APR) applied to the balance not paid by the due date, commissions for cash withdrawals or other operations, and penalties for late payments. It is fundamental to read your credit card contract carefully to know all the costs.

Managing the Credit Card Responsibly

To use the credit card responsibly, it is important to keep your expenses under control, try to always pay the entire amount due by the due date to avoid interest, and not exceed your credit limit.

The Future of the Credit Card

The world of credit cards is also constantly evolving. We are witnessing the spread of digital credit cards, integrated into banking apps and digital wallets, and new features such as the ability to pay for purchases in installments directly from the app.

Prepaid Card and Prepaid Card with IBAN: Budget Control and Additional Features

Now let’s move on to another very interesting type of card: the prepaid card. This card has unique features that make it suitable for specific uses. There are also prepaid cards with IBAN, which offer even more advanced features. Let’s see together what it’s about.

What is a Prepaid Card?

The prepaid card is a payment card that works similarly to a phone top-up. It is not linked to a bank checking account and to be able to use it, it is necessary to load it with a certain amount of money. You can only spend the funds you have previously loaded onto the card. Once the credit runs out, the card must be reloaded to be used again.

How Does the Prepaid Card Work?

The operation of the prepaid card is very simple. You buy the card (which can be anonymous or registered) and load it with the desired amount. Reloading can take place in different ways, depending on the card: via bank transfer, in cash at affiliated betting shops or tobacconists, or online via the website or app of the issuing company.

Once loaded, you can use the prepaid card to make payments at physical and online stores that accept the circuit to which the card belongs (usually Visa or Mastercard). The amount of each transaction is deducted from the available balance on the card. You can also withdraw cash from ATM kiosks, up to the maximum amount available on the card.

Advantages of the Prepaid Card

The prepaid card offers several interesting advantages. One of the main ones is budget control. Since you can only spend the loaded amount, it is an excellent tool for keeping expenses under control and avoiding exceeding your budget.

Another advantage is that to obtain a prepaid card it is generally not necessary to have a bank checking account. This makes it accessible even to those who do not have an account or prefer not to use it for certain types of expenses. Prepaid cards are also very useful for online purchases, as they allow you to avoid sharing your main credit card details, reducing the risk of fraud.

Prepaid cards can also be an excellent solution as a gift card or for giving an allowance to children, allowing them to manage a limited sum of money independently and safely.

Disadvantages of the Prepaid Card

Among the disadvantages of the prepaid card, we often find reloading costs, i.e., commissions that are applied every time the card is reloaded. Furthermore, there might be maximum spending limits or withdrawal limits, which can be lower than those of a debit or credit card.

Some prepaid cards, especially the more basic ones, might not be accepted for some types of transactions, such as car rentals or hotel reservations, where a credit card is often required as a guarantee.

Practical Examples of Prepaid Card Usage

The prepaid card is ideal for online purchases, especially on lesser-known sites, as it limits the risk in case of problems. It is perfect for travel abroad, as it allows you to load a sum of money and use it for expenses without having to carry large amounts of cash. It can be used to give an allowance to children or as a gift card.

Imagine wanting to make a purchase on a website you don’t know very well. Instead of using your main credit card, you can use a prepaid card with a limited amount, reducing the risk in case of problems. Or, if your child is going on a school trip, you can give them a prepaid card with a certain sum of money, so they can manage their expenses independently and safely.

What is a Prepaid Card with IBAN?

The prepaid card with IBAN is an evolution of the traditional prepaid card. Its main distinctive feature is the presence of an IBAN code (International Bank Account Number), the same code that identifies a bank checking account. This code allows the prepaid card to offer additional features, similar to those of a basic checking account.

How Does the Prepaid Card with IBAN Work?

Thanks to the IBAN, the prepaid card with IBAN not only allows you to make payments and withdrawals like a normal prepaid card, but it also allows you to send and receive bank transfers, just as you would with a checking account. You can also credit your salary or pension to the card, receive payments from third parties, and set up direct debits for utilities.

The operation for payments and withdrawals is the same as a normal prepaid card: the amount is deducted from the available balance on the card. The main difference is the ability to perform and receive banking operations via the IBAN.

Advantages of the Prepaid Card with IBAN

The prepaid card with IBAN offers all the advantages of a normal prepaid card (budget control, no need for a checking account for activation) to which are added the features of a basic checking account. This makes it a very versatile solution, suitable for those who want greater control over their finances but also need to be able to make and receive transfers.

It is particularly useful for those who do not have a traditional checking account or for those who want a secondary account with basic features. The possibility of crediting salary or pension makes it a valid alternative to the checking account for some people.

Disadvantages of the Prepaid Card with IBAN

The prepaid card with IBAN can also present some disadvantages. There might be monthly or annual management costs, in addition to any commissions for reloads or for some specific operations. The spending limits and withdrawal limits might be lower than those of a traditional checking account.

Furthermore, it is important to verify if the funds deposited on the prepaid card with IBAN are protected by the deposit guarantee fund, as happens for bank checking accounts.

Practical Examples of Prepaid Card with IBAN Usage

The prepaid card with IBAN can be used to receive salary or pension, pay bills, send and receive transfers, make purchases online and in stores, and withdraw cash. It is a practical solution for those who need an account with basic features but do not want or cannot open a traditional checking account.

Imagine being a freelancer and having to receive payments from your clients. With a prepaid card with IBAN, you can simply communicate your IBAN code and receive transfers directly to the card. Or, if you need to pay a bill via bank transfer, you can do it conveniently from your prepaid card with IBAN.

Key Differences between Standard Prepaid Card and with IBAN

The fundamental difference between a standard prepaid card and a prepaid card with IBAN is the presence of the IBAN code. The standard prepaid card only allows you to make payments and withdrawals up to the loaded amount, while the prepaid card with IBAN also offers the possibility of sending and receiving transfers and performing other basic banking operations.

Security of Prepaid Cards (with and without IBAN)

Prepaid cards, both standard and with IBAN, offer a good level of security. They are generally equipped with a PIN code and can be blocked in case of loss or theft. For online purchases, a two-factor authentication system is often available for greater security.

How to Get a Prepaid Card (with and without IBAN)

Getting a prepaid card is generally simpler than getting a credit card. Often, no particular guarantees or credit checks are required. You can buy a prepaid card at banks, post offices, tobacconists, or online. For the prepaid card with IBAN, it might be necessary to provide some identity documents for activation.

Costs Associated with Prepaid Cards (with and without IBAN)

Costs associated with prepaid cards can vary depending on the type of card and the issuing company. There might be activation costs, reloading costs, monthly or annual management costs, commissions for withdrawals or for other operations. It is important to read the card’s information sheet carefully to know all the costs.

The Future of Prepaid Cards

Prepaid cards are becoming increasingly popular, thanks to their flexibility and the control they offer over expenses. The future seems oriented towards greater integration with mobile apps and towards offering increasingly personalized services.

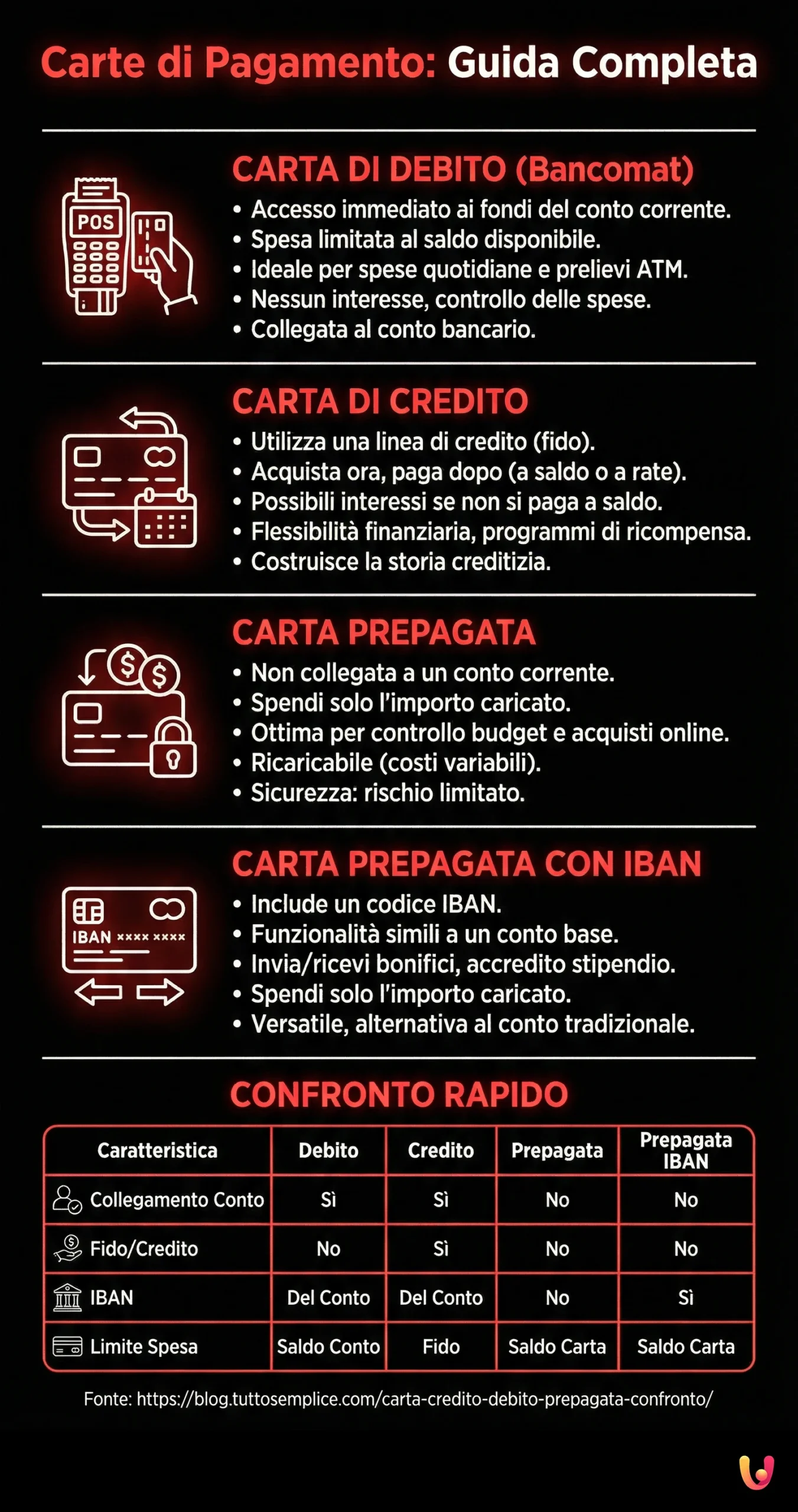

Comparative and Summary Table

To help you better visualize the differences and similarities between the different types of cards, I have prepared a summary comparative table:

| Feature | Debit Card | Credit Card | Prepaid Card | Prepaid Card with IBAN |

|---|---|---|---|---|

| Linked to account | Yes | Generally yes | No (except some exceptions) | No |

| Credit Line/Credit | No | Yes (credit line) | No (you spend only the loaded amount) | No (you spend only the loaded amount) |

| IBAN | Same IBAN as checking account | No | No | Yes |

| Spending | Immediately deducted from account | Deferred debit (usually monthly) | Only loaded amount | Only loaded amount |

| Interest | Generally no | Yes, if the full balance is not paid by the due date | Generally no | Generally no |

| Main Advantages | Immediate access to funds, wide acceptance | Financial flexibility, reward programs | Budget control, does not require checking account | Basic checking account features, budget control |

| Main Disadvantages | Limit given by balance, not always accepted for everything | Risk of indebtedness, potential interest and costs | Reloading costs, spending/withdrawal limits | Potential management costs, spending/withdrawal limits |

| Typical Uses | Daily expenses, ATM withdrawals, online purchases | Online purchases, travel, unexpected expenses | Secure online purchases, gifts, budget management | Receiving/sending transfers, online/offline payments |

Conclusions

We have reached the end of this deep dive into the world of payment cards. I hope this guide has helped you better understand the differences and similarities between debit card, credit card, prepaid card, and prepaid card with IBAN. As you have seen, each type of card has its specificities, its advantages, and its disadvantages. There is no “best” card in absolute terms, but there is the card most suitable for your needs and your lifestyle.

The choice of the right card depends on several factors: your spending habits, your need for financial flexibility, your ability to manage credit, your preference for budget control, and your potential need for an IBAN to make and receive payments. If you are looking for immediate access to your funds and a card accepted everywhere, the debit card might be the ideal choice.

However, if you need flexibility and want to benefit from reward programs, considering a credit card could be a good option, provided you use it responsibly. If you want to keep your expenses under control and perhaps make online purchases safely, the prepaid card might be right for you. Finally, if you need an IBAN to make and receive transfers but prefer the practicality of a prepaid card, the prepaid card with IBAN could be the perfect solution.

Always remember to carefully evaluate the costs associated with each card, such as annual fees, withdrawal or reloading commissions, and interest rates in the case of credit cards. Read the contracts and information sheets carefully to be aware of all conditions. The world of payments is constantly evolving, with the introduction of new technologies and features. The cards I presented to you today are powerful tools that can simplify your financial life, provided you know them well and use them consciously. I hope the information I provided is useful for making the right choice and managing your payments in the best way.

Frequently Asked Questions

The debit card uses the funds present in your checking account, while the credit card allows you to spend money «borrowed» from the bank, with the obligation to repay it later.

A prepaid card is ideal for secure online purchases, for travel (to keep the budget under control), as a gift, or for giving an allowance to children.

The IBAN on a prepaid card allows you to send and receive bank transfers, just as you would with a checking account.

All payment cards offer a certain level of security, but prepaid cards can be considered safer for online purchases as they are not directly linked to your main account.

Yes, you can withdraw cash from ATM kiosks with all four types of cards, although commissions might be applied depending on the card and the bank.

Both the debit card, the credit card, and the prepaid card are suitable for online purchases. The prepaid card may be preferable for greater security.

Generally no, the debit card allows you to spend only the funds available in your checking account.

Yes, the prepaid card has a maximum spending limit, which corresponds to the amount loaded onto the card. There might also be maximum reloading and withdrawal limits.

You can reload a prepaid card via bank transfer, in cash at affiliated betting shops or tobacconists, or online via the website or app of the issuing company.

The credit card can be suitable for young people, but it is fundamental to use it responsibly to avoid accumulating debt. A debit or prepaid card might be more suitable for starting to manage one’s finances.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.