Today, the checking account is the true nerve center of every Italian citizen’s financial life. It is no longer just a safe place to deposit savings, as was the classic tradition in our Mediterranean culture, but has become an indispensable dynamic tool for daily operations. From managing household utilities to digital payments and investments, everything passes through this fundamental channel.

In recent years, the banking landscape in Italy has undergone a radical transformation, driven by technological innovation and new European regulations. However, despite the unstoppable advance of fintech and online banks, a strong attachment to tradition persists, with the average Italian saver remaining very cautious and attached to liquidity.

Knowing how to manage your account means more than just checking your balance at the end of the month. It requires an active understanding of costs, the potential of home banking, and, above all, cybersecurity threats. In this guide, we will analyze how to optimize the management of your finances, balancing the convenience of modern apps with the prudence necessary to protect your assets.

The Italian Banking Landscape: Between Branch and App

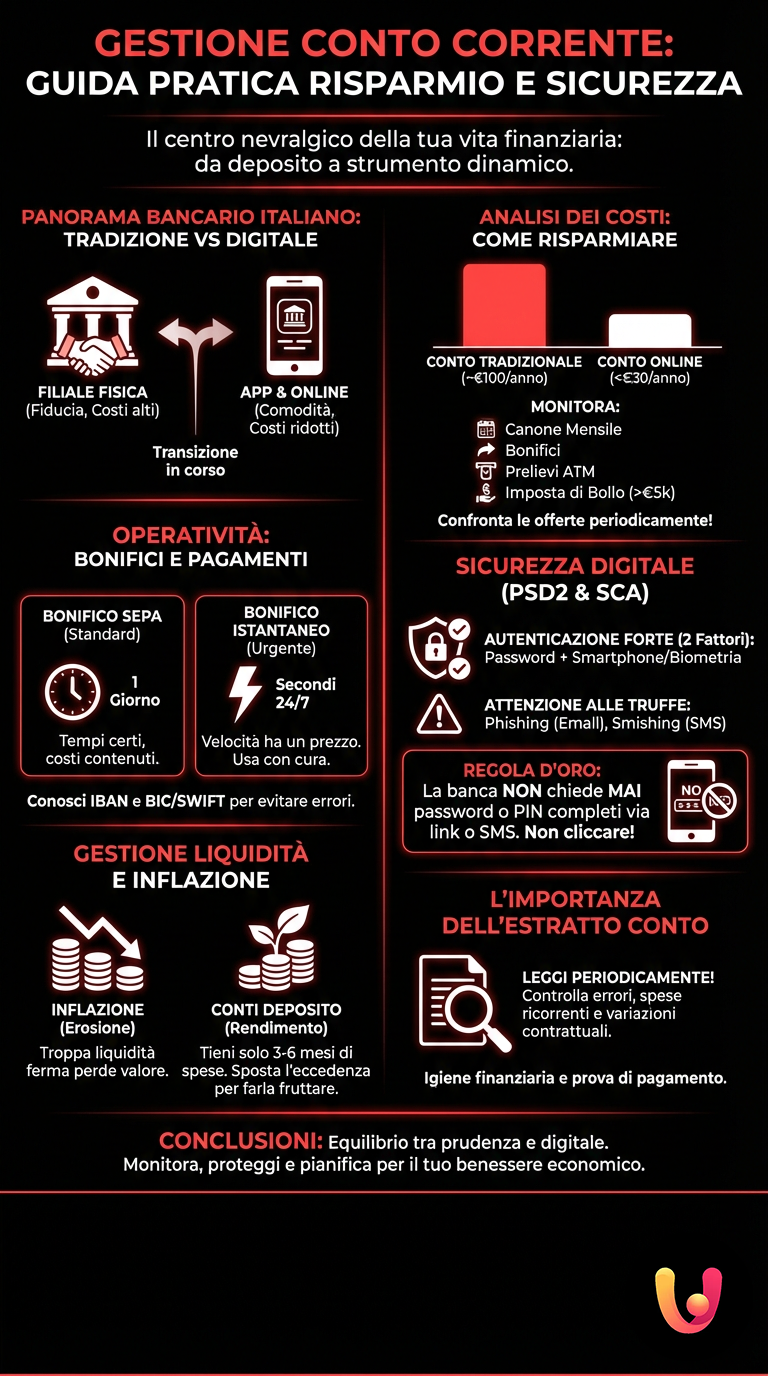

Italy is experiencing a unique transition phase within the European context. On one hand, there is the generation that considers the physical branch an irreplaceable point of reference, based on personal trust with the bank manager. On the other, new account holders manage entire assets directly from their smartphones, without ever setting foot in a physical branch.

This duality is reflected in the market’s offerings. Large traditional banks are hybridizing their services, offering advanced digital platforms while maintaining a physical network, albeit a shrinking one. At the same time, “challenger banks” and purely digital institutions are gaining significant market share by focusing on reduced costs and an immediate user experience.

Digitalization is no longer an option but a necessity: according to the latest surveys, the use of mobile banking in Italy has grown exponentially, becoming the primary channel for routine operations like wire transfers and balance checks.

The choice between a traditional and a digital model affects not only operations but also the cost structure that the account holder must bear annually. Understanding the differences between these models is the first step toward conscious management.

Cost Analysis: Fees, Transactions, and Taxes

One of the most critical aspects of checking account management is controlling fixed and variable expenses. Recent data from the Bank of Italy highlight a clear gap: traditional accounts can cost over 100 euros a year, while online accounts often manage to slash this figure, settling on a decidedly lower average, sometimes close to zero for basic profiles.

The main expense items to monitor include the monthly fee, wire transfer commissions (often free online but charged at the branch), and costs for cash withdrawals at other banks’ ATMs. In addition, there is the ‘imposta di bollo’ (stamp duty), a state tax of 34.20 euros per year for individuals, which is triggered when the average balance exceeds 5,000 euros.

For those looking to optimize their expenses, it is essential to compare offers periodically. Many banks offer promotions for new customers but tend to increase costs for long-standing account holders. For a detailed overview of current options, it is useful to consult a guide to checking account costs and best offers, so you can assess whether your current institution is still competitive.

Daily Operations: Transfers and Payments

Active account management involves mastering payment tools. The SEPA transfer is now the standard for transfers in euros, ensuring reliable timing (usually one business day) and low costs. However, innovation has introduced the instant transfer, which allows money to be transferred in seconds, 24 hours a day, 7 days a week.

This speed comes at a price, which varies from bank to bank, but it offers unparalleled convenience for urgent payments or private sales. It is essential to know the difference between these types to avoid unnecessary expenses: using an instant transfer when it is not strictly necessary is a common management mistake.

To operate correctly, you need to be familiar with bank details. The IBAN is the alphanumeric code that uniquely identifies the account, but for international or specific transactions, the BIC/SWIFT code may also be required. To learn more about the structure of these codes and avoid typing errors, it can be useful to read the complete article on the structure of the IBAN.

Digital Security and European Regulations

With the increase in online activity, security has become the top priority. The European PSD2 directive introduced Strong Customer Authentication (SCA), which requires banks to request at least two authentication factors to authorize access or payments. Typically, this is done by combining something you know (password) with something you have (smartphone) or something you are (fingerprint).

Despite these advanced protections, the human factor remains the weakest link. Scams via SMS (smishing) or email (phishing) are increasingly sophisticated, simulating urgent communications from the bank to steal credentials. The golden rule is to never click on links received via messages that ask for sensitive data.

Remember: your bank will never ask for your full passwords or PIN codes via email or SMS. Any request of this kind is almost certainly a fraud attempt.

To protect yourself effectively, it is vital to enable push notifications for every outgoing transaction and monitor your account regularly. If you suspect you have been attacked or notice unusual activity, you must act promptly. To learn more about the techniques used by scammers, it is advisable to read the in-depth article on checking account scams and how to defend yourself.

Liquidity Management and Inflation

A classic mistake of the Italian saver is to leave too much “dormant” liquidity in their checking account. While having a reserve for emergencies is a wise practice, accumulating large sums in an operating account exposes the capital to the erosion of inflation. Idle money loses purchasing power year after year, reducing the real value of savings.

Modern account management involves keeping only the necessary liquidity for current expenses and short-term emergencies (generally 3-6 months of expenses) in the checking account. The surplus should be moved to more efficient instruments that, while maintaining low risk, offer a return.

Among the simplest solutions for separating operating liquidity from savings are savings accounts, which allow you to lock in or leave funds accessible while earning an interest rate. To understand how to make excess liquidity work for you without excessive risk, it is useful to consult the analysis of savings account returns.

The Importance of the Bank Statement

Often ignored or filed away without being read, the bank statement is the official document that summarizes all transactions and the conditions applied during the reference period. Reading it carefully allows you to identify not only possible accounting errors but also unilateral changes to the contract that the bank may have communicated.

Banks are legally required to send the statement periodically (usually quarterly), and it is the ideal time to perform a check-up on your finances. Verifying recurring expenses, forgotten subscriptions, or unexpected fees is a financial hygiene practice that can lead to significant long-term savings.

Furthermore, the bank statement serves as proof of payment in case of disputes. In the digital age, it is easy to retrieve the history online, but downloading and saving a digital copy of the quarterly documents is a good habit to always have a record of your banking history.

In Brief (TL;DR)

Discover the essential guide to managing your finances, monitoring expenses, and using home banking in complete security.

Learn to monitor expenses and use home banking securely to better manage your personal finances.

Find out how to use home banking securely to monitor expenses and protect your savings.

Conclusions

Managing a checking account in Italy today requires a dynamic balance between traditional prudence and the adoption of new digital tools. The market offers significant savings opportunities for those willing to operate online, but it also imposes greater responsibility in terms of cybersecurity and financial planning.

There is no single “perfect account,” but there is an account that is best suited to your specific needs. Monitoring costs, using instant transfers intelligently, protecting your credentials, and not letting inflation erode your savings are the pillars of modern and conscious management. Financial education begins with the management of this daily tool, transforming it from a simple deposit to an engine for your economic well-being.

Frequently Asked Questions

The latest data from the Bank of Italy show a significant gap: while the average annual cost of a traditional account is around 100 euros, purely online accounts have a much lower average cost, often under 30 euros. The choice depends on the need for a physical contact at a branch (tradition) versus a preference for operational autonomy and savings (innovation).

The ICC (Indicatore dei Costi Complessivi, or Total Cost Indicator) is a value in euros that summarizes the indicative annual cost of a checking account for different user profiles (young people, families, retirees). It is the most transparent tool for comparing offers, as it includes both fixed costs (fees) and variable costs (transactions), helping you avoid surprises on your bank statement.

The European PSD2 directive introduced SCA (Strong Customer Authentication), which requires at least two verification factors to access or authorize payments: something you know (password), something you have (smartphone), or something you are (fingerprint/FaceID). This standard drastically reduces the risk of online fraud.

No, thanks to the bank account portability procedure, the transfer is free and must be completed within 12 business days. The new bank handles everything, including transferring direct debits (bills) and closing the old account, relieving the account holder of most of the bureaucracy.

Modern banking apps integrate Personal Financial Management (PFM) features that automatically categorize expenses (e.g., groceries, transportation, entertainment). Setting up real-time push notifications and monthly spending limits helps you stay in control of your family budget, combining traditional savings management with modern technology.

Still have doubts about Checking Account Management: A Practical Guide to Saving and Security?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.