In Brief (TL;DR)

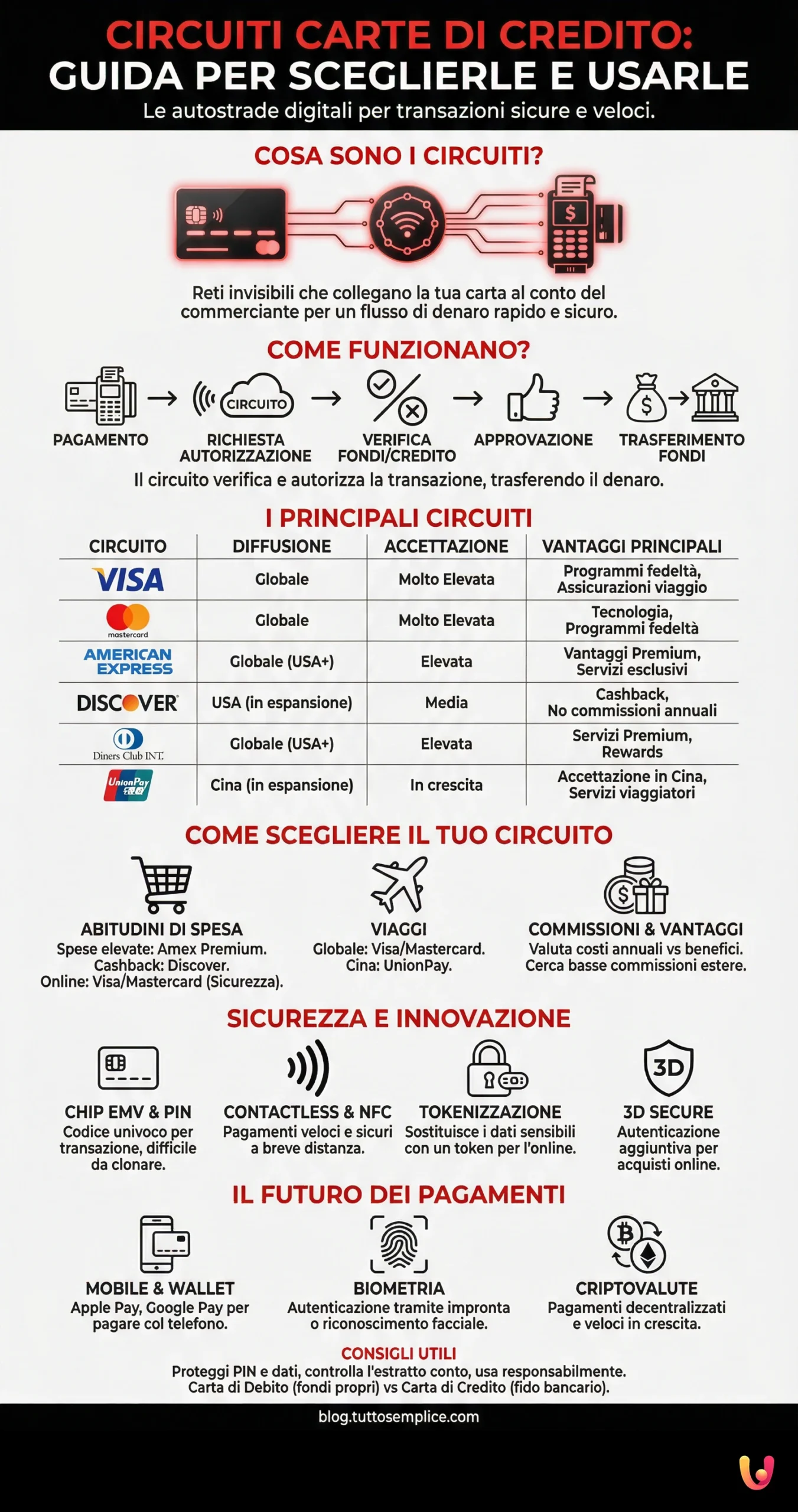

Credit card networks, such as Visa, Mastercard, and American Express, are essential networks that enable transactions, offering different benefits and services depending on the type of card and the network chosen.

Security is a priority for networks, which invest in technologies like EMV chips, Contactless, and tokenization to protect user data.

The future of payments is constantly evolving, with the advent of mobile payments, digital wallets, and cryptocurrencies promising to change the way we interact with money.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Every day, millions of people around the world use their credit cards and debit cards to make purchases, withdraw cash, or pay bills. But have you ever wondered how the magic behind these transactions happens? The answer lies in payment networks, the invisible webs that connect your card to the merchant’s bank account, allowing for a rapid and secure flow of money.

In this comprehensive guide, we will explore the fascinating world of credit card networks, revealing how they work, the differences between the major market players, and how to choose the network best suited to your needs. Whether you are an avid traveler, an online shopping enthusiast, or simply curious to understand how money works in the digital world, this guide will provide you with all the information necessary to make informed decisions and get the most out of your credit card.

What are credit card networks?

Let’s imagine credit card networks as digital highways that allow money to travel safely and quickly between your account and the merchant’s. But how exactly do they work?

When you make a payment with your credit card, the store’s terminal sends an authorization request to the payment network to which the card belongs (for example, Visa or Mastercard). The network verifies if you have sufficient funds or available credit, and if everything is in order, it authorizes the transaction. At this point, the money is transferred from your account to the merchant’s account, completing the purchase.

But networks don’t stop there. They establish the rules of the game, defining the fees applied to transactions, managing security programs to prevent fraud, and offering additional services such as travel insurance or loyalty programs.

Furthermore, payment networks are associated with different types of cards, each with specific characteristics:

- Pay-in-full credit cards (Charge cards): The entire amount spent is debited from your checking account at the end of the month.

- Revolving credit cards: You can choose to repay the amount owed in installments, paying interest on the unpaid portion.

Prepaid cards: These cards are not technically credit cards, but rather payment cards that work with a different mechanism. You must load the card with a sum of money before you can use it, and you can only spend the loaded amount.

Understanding how networks work and the different types of cards is fundamental to choosing the payment tool best suited to your needs and spending habits.

The major credit card networks

Now that we understand how networks work, it’s time to meet the protagonists of this world. Credit card networks are numerous, but a few dominate the global market thanks to their wide reach and the services offered.

| Feature | Visa | Mastercard | American Express | Discover | Diners Club International | UnionPay |

|---|---|---|---|---|---|---|

| Reach | Global | Global | Global (higher in USA) | USA (expanding) | Global (higher in USA) | China (expanding) |

| Acceptance | Very high | Very high | High | Medium | High | Growing |

| Main benefits | Loyalty programs, travel insurance | Loyalty programs, technology | Premium benefits, exclusive services | Cashback, no annual fees | Premium services, rewards programs | Acceptance in China, traveler services |

| Fees | Variable | Variable | Generally higher | Low or none | Generally higher | Variable |

| Main cards | Classic, Gold, Platinum, Signature, Infinite | Standard, Gold, Platinum, World, World Elite | Green, Gold, Platinum, Centurion | It, Miles, Cashback | Club, Elite | Debit, Classic, Platinum, Diamond |

| Best for… | Frequent travelers, users seeking premium benefits | Frequent travelers, tech-savvy users | High spenders, frequent travelers, lovers of exclusive perks | Purchases in the USA, cashback-focused users | High spenders, frequent travelers, lovers of exclusive perks | Travelers and consumers in China |

Fees and benefits may vary depending on the issuing bank and the type of card.

Visa

Visa is the most widely used payment network in the world, accepted in over 200 countries and territories. Founded in 1958, Visa revolutionized the way we pay, offering a vast range of credit, debit, and prepaid cards.

Benefits

- Global acceptance: You can use your Visa card practically anywhere, both online and in physical stores.

- Loyalty programs: Many Visa cards offer point collection programs that you can convert into rewards, discounts, or cashback.

- Travel insurance: Some Visa cards include travel insurance, purchase protection, and extended warranties.

- Security: Visa uses advanced technologies like the EMV chip and 3D Secure to protect your transactions.

Types of credit cards

- Visa Classic: The basic card, ideal for those seeking simplicity and functionality.

- Visa Gold: Offers additional benefits like travel insurance and medical assistance.

- Visa Platinum: For those desiring premium services like airport lounge access and concierge.

- Visa Signature: A premium card offering exclusive perks like discounts on travel and dining, and access to special events.

- Visa Infinite: The most exclusive card, with luxury benefits and services.

Fees

The fees applied by Visa vary depending on the issuing bank and the type of card. In general, more exclusive cards have higher annual fees, but they also offer greater benefits.

Mastercard

Mastercard is another giant in the sector, second only to Visa in global reach. Founded in 1966, Mastercard offers a vast range of credit, debit, and prepaid cards, with services and benefits similar to those of Visa.

Differences compared to Visa

- Specific programs: Mastercard offers exclusive programs like World Elite Mastercard, which offers luxury benefits and personalized services.

- Focus on technology: Mastercard invests heavily in innovation, developing cutting-edge payment solutions like Contactless technology and biometric payments.

Benefits and fees

The benefits and fees of Mastercard cards are similar to those of Visa cards. The choice between the two networks often depends on personal preferences and the specific offers from issuing banks.

American Express

American Express, often abbreviated as Amex, stands out for its focus on premium cards and exclusive services. Founded in 1850, Amex is known for its prestigious image and for its cards aimed at a more demanding clientele.

Premium benefits

- Airport lounge access: Many Amex cards offer free or discounted access to airport lounges, where you can relax and enjoy exclusive comforts before your flight.

- Concierge services: Amex provides its customers with a personalized concierge service, which can help you book restaurants, event tickets, travel, and much more.

- Purchase protection and extended warranties: Amex cards often offer purchase protection against accidental damage, theft, or loss, as well as extended warranties on purchased products.

- Exclusive experiences: Amex organizes events and special offers reserved for its cardholders, such as private concerts, meetings with starred chefs, and movie premieres.

Types of credit cards

- Amex Green: The basic Amex card, ideal for those looking for a first taste of premium benefits.

- Amex Gold: Offers a more advantageous points collection program and credits for travel and dining.

- Amex Platinum: The most popular Amex card, with airport lounge access, travel and hotel credits, and concierge services.

- Amex Centurion (Black Card): The most exclusive Amex card, available by invitation only and featuring top-tier benefits and services.

Fees

Amex cards generally have higher annual fees compared to Visa and Mastercard cards, but they also offer greater benefits and premium services. Additionally, Amex acceptance is slightly lower compared to the other two networks, especially in some countries.

Discover

Discover is a payment network primarily widespread in the United States. Founded in 1986, Discover distinguished itself with its cashback program, which returns a percentage of purchases made.

Benefits

- Cashback: Discover offers a cashback program that allows you to earn a percentage on purchases made with the card.

- Loyalty programs: Discover also offers loyalty programs that allow you to accumulate points and obtain discounts or rewards.

- No annual fee: Many Discover cards have no annual fees, making them a convenient choice for those looking for a card without fixed costs.

Limited acceptance

Discover acceptance is primarily limited to the United States, though it is gradually expanding internationally, but it is still far from being comparable to Visa or Mastercard. If you travel abroad often, you might find it difficult to use your Discover card in some countries.

Diners Club International

Diners Club International, often abbreviated as Diners Club, is a payment network specialized in premium and corporate cards. Founded in 1950, Diners Club was the first independent credit card network in the world. Unfortunately, Diners Club Italia has announced the suspension of activities in the Italian market, resulting in the closure of all existing contracts.

Benefits

- Premium services: Diners Club offers exclusive services like airport lounge access, concierge services, and premium travel insurance.

- Rewards programs: Diners Club cardholders can accumulate points and take advantage of discounts and special offers at selected partners.

- Global acceptance: Diners Club is accepted in many countries, although its reach is lower compared to Visa and Mastercard.

Fees

Diners Club cards generally have high annual fees, but they also offer premium benefits and services.

UnionPay

UnionPay is the most widespread payment network in China, with a rapidly growing presence globally. Founded in 2002, UnionPay offers a vast range of credit, debit, and prepaid cards, with services and benefits specific to the Chinese market.

Benefits

- Acceptance in China: UnionPay is accepted practically everywhere in China, making it the ideal choice for those traveling or doing business in the country.

- Services dedicated to travelers: UnionPay offers services dedicated to travelers, such as customer support in Chinese and discounts at participating merchants.

- Global expansion: UnionPay is expanding its presence globally, making its cards increasingly accepted outside of China as well.

How to choose the right network for you

Now that you know the main credit card networks, you might be wondering: “Which one is best for me?”. The answer is not unique, as it depends on your needs and spending habits. Here are some factors to consider to make the right choice:

- Spending habits

- High spending: If you have high expenses, you might opt for a premium American Express card, which offers exclusive benefits like airport lounge access and concierge services.

- Cashback and discounts: If you are looking to maximize savings, Discover could be the ideal choice, thanks to its cashback program and special offers.

Online purchases: Visa and Mastercard offer greater security for online purchases, thanks to technologies like 3D Secure.

- Travel

- Frequent travel: If you travel abroad often, Visa and Mastercard are the best choices, thanks to their wide global acceptance.

Travel to China: If you plan to visit China, UnionPay is indispensable, as it is the most accepted network in the country.

- Fees

- Annual fees: Some cards, like premium American Express ones, have high annual fees but also offer greater benefits. Evaluate if the perks justify the cost.

Foreign transaction fees: If you travel abroad often, choose a card with low or no fees on foreign currency transactions.

- Benefits and services

- Loyalty programs: If you like accumulating points and getting rewards, choose a network that offers an advantageous loyalty program.

- Travel insurance: If you travel often, a card with included travel insurance can be a great option.

Premium services: If you are looking for exclusive services like airport lounge access or a personal concierge, consider premium American Express cards.

- Compare offers

- Before making a decision, compare offers from different banks and networks. Use online tools like credit card comparison sites to find the card that best fits your needs.

Security and technology in credit card networks

Security is a fundamental aspect when talking about credit cards. Payment networks constantly invest in cutting-edge technologies to protect your data and prevent fraud. Here are some of the main innovations that make your transactions safer:

EMV Chip and PIN

The EMV chip (Europay, Mastercard, and Visa) is a small chip embedded in credit and debit cards that generates a unique code for each transaction. This code, together with the PIN (Personal Identification Number), makes card cloning and fraudulent use much more difficult.

The EMV chip replaced the old magnetic stripe, which was more vulnerable to fraud. Today, most credit and debit cards are equipped with an EMV chip, and many stores require PIN entry to authorize payment.

Contactless and NFC

Contactless technology allows you to pay simply by bringing the card close to the reader, without having to insert or swipe it. This technology is based on NFC (Near Field Communication), which enables short-range wireless communication between the card and the reader.

Contactless payments are fast, convenient, and secure. Each transaction generates a unique code, making data interception difficult. Furthermore, many networks impose a spending limit for Contactless payments, requiring PIN entry for higher amounts.

Tokenization

Tokenization is a process that replaces your sensitive credit card data with a unique code, called a token. This token is used for online transactions, protecting your real data from potential hackers.

Even if a hacker were to intercept the token, they could not use it to make purchases, as it does not contain your card information. Tokenization is an increasingly widespread technology in online payments, ensuring greater security for your data.

3D Secure

3D Secure is a security protocol that adds an extra layer of authentication to online payments. When you make an online purchase, you will be asked to enter a security code sent via SMS or generated by an app on your smartphone.

This code, together with your card data, verifies your identity and authorizes the transaction. 3D Secure is supported by major payment networks (Visa, Mastercard, American Express) and is increasingly used by online stores to protect customers from fraud.

The future of credit card networks

The world of payments is constantly evolving, and credit card networks are no exception. New emerging technologies are changing the way we make transactions, paving the way for an increasingly digital and cashless future.

Mobile payments and digital wallets

Mobile payments are becoming increasingly popular, thanks to the spread of smartphones and payment apps. Services like Apple Pay, Google Pay, and Samsung Pay allow you to pay simply by bringing your phone close to the POS terminal, without needing to carry the physical card with you.

Digital wallets are another growing trend. These apps allow you to securely store credit and debit card information, as well as loyalty cards, tickets, and other documents. Digital wallets offer convenience and security, simplifying payments online and in physical stores.

Biometrics

Biometrics is revolutionizing payment authentication. The use of fingerprints, facial recognition, or iris scanning offers a superior level of security compared to traditional PINs and passwords. Biometric payments are fast, convenient, and difficult to forge, making them a promising solution for the future of payments.

Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum are gaining more and more ground in the world of payments. Although their adoption is still limited, cryptocurrencies offer advantages such as decentralization, transaction speed, and the ability to make low-cost international payments.

The impact of cryptocurrencies on traditional credit card networks is still uncertain. Some experts believe that cryptocurrencies could replace credit cards in the future, while others believe that the two systems will coexist, each with its own advantages and disadvantages.

Co-Branded Credit Cards: A World of Personalized Benefits

In addition to traditional networks, there is another category of credit cards that deserves attention: co-branded cards. These cards are born from the collaboration between an issuing bank and a partner company, such as airlines, hotel chains, fashion brands, or fuel distributors.

What are co-branded cards?

Co-branded cards are credit cards that bear the logo of both partners (bank and company) and offer exclusive benefits linked to the partner company. These benefits can include:

- Air miles or loyalty points: You accumulate miles or points every time you use the card, which you can then convert into airline tickets, hotel stays, upgrades, or other rewards.

- Discounts and special offers: Get exclusive discounts at the partner company’s stores or services.

- Access to premium services: Some co-branded cards offer benefits like airport lounge access, priority check-in, or preferred boarding.

- Travel insurance: Many co-branded cards include free travel insurance, such as medical insurance, baggage insurance, and trip cancellation insurance.

How do co-branded cards work?

Co-branded cards work like regular credit cards, but with the addition of benefits linked to the partner company. Every time you make a purchase with the card, you accumulate miles or points that you can use to obtain rewards provided by the loyalty program.

Pros and cons of co-branded cards

Pros

- Exclusive benefits: Co-branded cards offer unique benefits you wouldn’t find in a regular credit card.

- Accumulation of miles or points: If you often use the partner company’s services, you can quickly accumulate miles or points and get interesting rewards.

- Possibility of upgrades: Some co-branded cards offer the possibility of obtaining status upgrades in the partner company’s loyalty programs.

Cons

- Annual fees: Many co-branded cards have annual fees, so it’s important to evaluate if the benefits offered justify the cost.

- Interest rates: Like regular credit cards, co-branded cards can also have high interest rates on the unpaid debit portion.

- Tie to the partner company: If you don’t use the partner company’s services, the card’s benefits might not be as attractive.

How to choose the right co-branded card?

To choose the right co-branded card, consider the following factors:

- Your spending habits: Choose a card that offers benefits linked to your interests and purchasing habits.

- The benefits offered: Evaluate the benefits offered by the card and verify if they align with your needs.

- The fees: Compare the annual fees and interest rates of different cards.

- Acceptance: Ensure the card is accepted in the places where you plan to use it.

Credit Cards for Specific Needs: Find Your Perfect Card

Not all credit cards are the same. Some are designed to meet specific needs, offering benefits and services targeted at certain categories of users. Here is an overview of the best credit cards for different needs:

Travelers

For those who love to travel, credit cards can be a valuable ally. The best cards for travelers offer benefits like:

- Air mile accumulation: You earn miles every time you use the card, which you can then convert into airline tickets or upgrades.

- Airport lounge access: Relax and enjoy exclusive comforts before your flight.

- Travel insurance: Protect yourself from unforeseen events like cancellations, delays, lost luggage, and medical expenses.

- No foreign transaction fees: Save on exchange fees when you use the card abroad.

Examples of cards for travelers

- American Express Platinum

- Chase Sapphire Reserve

- Capital One Venture Rewards

Students

Students can benefit from credit cards with advantageous conditions and financial education programs. The best cards for students offer:

- No annual fee: Save on the card’s fixed costs.

- Cashback programs: Earn a percentage on purchases made.

- Contained spending limits: Learn to manage your budget responsibly.

- Expense tracking tools: Keep track of your expenses and manage your money more effectively.

Examples of cards for students

- Discover it® Student Cash Back

- Journey® Student Rewards from Capital One

- Deserve® EDU Mastercard for Students

Families

Families can find credit cards that offer benefits for the whole family, such as:

- Cashback on essential purchases: Earn a percentage on purchases of groceries, fuel, and other necessities.

- Family insurance: Protect your loved ones with travel insurance and medical assistance.

- Free additional cards: Get additional cards for family members, simplifying expense management.

- Family loyalty programs: Accumulate points together with your family members and get rewards faster.

Examples of cards for families

- Citi® Double Cash Card

- Blue Cash Preferred® Card from American Express

- Chase Freedom Unlimited®

Freelancers

Freelancers have specific needs in terms of expense management and accounting. The best cards for freelancers offer:

- Expense management tools: Categorize your expenses, generate reports, and simplify accounting.

- Flexible credit lines: Access a credit line to manage cash flow fluctuations.

- Benefits for business expenses: Get discounts on travel, car rentals, and other useful services for your business.

- Personalized cashback programs: Earn a percentage on purchases you make most often for your business.

Examples of cards for freelancers

- Ink Business Preferred® Credit Card

- Capital One Spark Cash Plus

- The Business Platinum Card® from American Express

Tips for Safe Credit Card Use

Credit cards offer convenience and flexibility, but it is essential to use them responsibly and securely to avoid problems and protect your financial data. Here are some practical tips for safe use of your cards:

Protect your PIN and card data

- Memorize your PIN: Memorize your PIN and never write it on the card or in easily accessible places.

- Do not share card data: Never communicate your card number, expiration date, or CVV/CVC code to anyone, unless strictly necessary (for example, for an online purchase on a secure site).

- Be careful with websites and apps: Make sure to use only secure websites and apps for your online purchases. Check for the padlock symbol in the address bar and check that the site address starts with “https://”.

- Use strong passwords: Protect your online accounts with complex and different passwords for each site.

- Update your antivirus and antispyware: Install and keep security software updated on your computer and smartphone to protect yourself from malware and viruses.

Check your statement regularly

- Verify transactions: Regularly check your credit card statement to verify that all transactions are correct and that there are no unauthorized charges.

- Report problems promptly: If you notice suspicious transactions or errors, contact your bank or card issuer immediately.

Use credit cards responsibly

- Don’t spend more than you can afford: Use the credit card as a payment tool, not as a source of financing.

- Pay the full balance every month: If possible, repay the entire amount owed by the due date to avoid paying interest.

- Set a spending limit: Many banks allow you to set a daily or monthly spending limit for your credit card.

- Avoid withdrawing cash: Cash withdrawals with a credit card are subject to high fees and interest.

Watch out for theft and scams

- Do not leave the card unattended: Never leave your credit card unattended in public places or in the car.

- Watch out for skimming: Skimming is a technique used by thieves to copy your card data when you insert it into an ATM or POS. Always check that the ATM or POS does not present anomalies and cover the keypad when typing the PIN.

- Be wary of suspicious emails and SMS: Never click on links or attachments contained in suspicious emails or SMS, as they may contain malware or viruses.

Report loss or theft of the card: If you lose your credit card or suspect it has been stolen, contact your bank or card issuer immediately to block it.

By following these simple tips, you can use your credit cards safely and protect your financial data from potential fraud.

Credit Cards vs. Debit Cards: Which is the Right Choice?

Often people tend to use the terms “credit card” and “debit card” interchangeably, but in reality, they are two payment tools with very different characteristics and functionalities. Understanding the differences will help you choose the one best suited to your needs.

Debit cards

Debit cards are linked directly to your checking account. When you make a payment, the amount is debited immediately from your account. If you do not have sufficient funds, the transaction is declined.

Pros

- Expense control: You cannot spend more than you have in your account, avoiding the risk of getting into debt.

- Reduced fees: Debit cards generally have lower fees compared to credit cards.

- Cash withdrawals: You can withdraw cash from automated teller machines (ATMs) without paying interest.

Cons

- No credit: You cannot spend more than you have in your account.

- Fewer benefits: Debit cards offer fewer benefits compared to credit cards, such as loyalty programs or travel insurance.

- Less protection: Debit cards offer less protection against fraud compared to credit cards.

Credit cards

Credit cards allow you to spend money you don’t have yet, up to a certain limit (the available credit). The amount spent is debited from your checking account at the end of the month or at a later time, depending on the type of card.

Pros

- Flexibility: You can spend even if you don’t have sufficient funds in your account, provided you stay within the credit limit.

- Benefits and services: Credit cards often offer loyalty programs, cashback, travel insurance, and other benefits.

- Protection: Credit cards offer greater protection against fraud compared to debit cards.

Cons

- Risk of debt: If you do not repay the entire amount owed by the due date, you pay high interest.

- Fees: Credit cards can have annual fees, foreign transaction fees, and other charges.

Which one to choose?

The choice between a credit card and a debit card depends on your spending habits and your needs.

- If you prefer to have greater control over your expenses and don’t want to risk getting into debt, a debit card might be the best choice.

If you are looking for flexibility, benefits, and additional services, a credit card might be more suited to your needs.

In any case, it is important to use both cards responsibly, respecting your budget and always paying credit card installments on time.

Environmental Impact of Credit Card Networks

Although digital transactions seem intangible, credit card networks have an environmental impact that should not be underestimated. The production of the cards themselves, the energy consumed by data centers, and emissions related to employee business travel contribute to the sector’s carbon footprint.

However, networks are adopting measures to reduce their environmental impact. Many use recycled materials for card production, invest in renewable energy to power their data centers, and promote carbon offset initiatives.

Some networks, like Mastercard, have launched programs to calculate and offset the carbon footprint of transactions made by their customers, incentivizing more sustainable purchasing behaviors.

Although the road to sustainability is still long, credit card networks are demonstrating a growing commitment to reducing their environmental impact and contributing to a greener future.

Conclusions

In this journey into the world of credit card networks, we have explored how they work, the major market players, and the benefits and challenges they present. We have seen how choosing the right network can make a difference in the payment experience, offering personalized benefits and exclusive services.

We also delved into the security technologies that protect our transactions, such as the EMV chip, tokenization, and 3D Secure, and we took a look at the future of payments, with the advent of mobile payments, digital wallets, and biometrics.

Remember that choosing the ideal credit card depends on your needs and spending habits. Compare the different options, consider the benefits, the fees, and the acceptance of each network, and choose the card that best fits your lifestyle.

Get informed, compare, and choose consciously. The world of payments is constantly evolving, and knowing about credit card networks will allow you to stay up to date and make the most of the opportunities offered by this increasingly indispensable financial tool.

Frequently Asked Questions

Visa and Mastercard are very similar in terms of acceptance and services. Mastercard stands out for some specific programs (like World Elite) and a greater focus on technology.

Amex offers premium benefits like airport lounge access, concierge services, and travel insurance, but has higher fees and slightly lower acceptance compared to Visa and Mastercard.

Discover offers a cashback program that returns a percentage of purchases made with the card.

UnionPay is the main network in China, but it is expanding its acceptance globally.

Memorize your PIN, do not share card data, use strong passwords online, check your statement regularly, and report any suspicious transactions.

A credit card allows you to spend money you do not have yet, while a debit card debits the amount directly from your checking account.

They are cards issued in partnership between a bank and a company (e.g., airlines), offering specific benefits linked to the partner.

Mobile payments, digital wallets, and biometrics are revolutionizing the way we pay, offering greater convenience and security.

Sources and Further Reading

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.