In Brief (TL;DR)

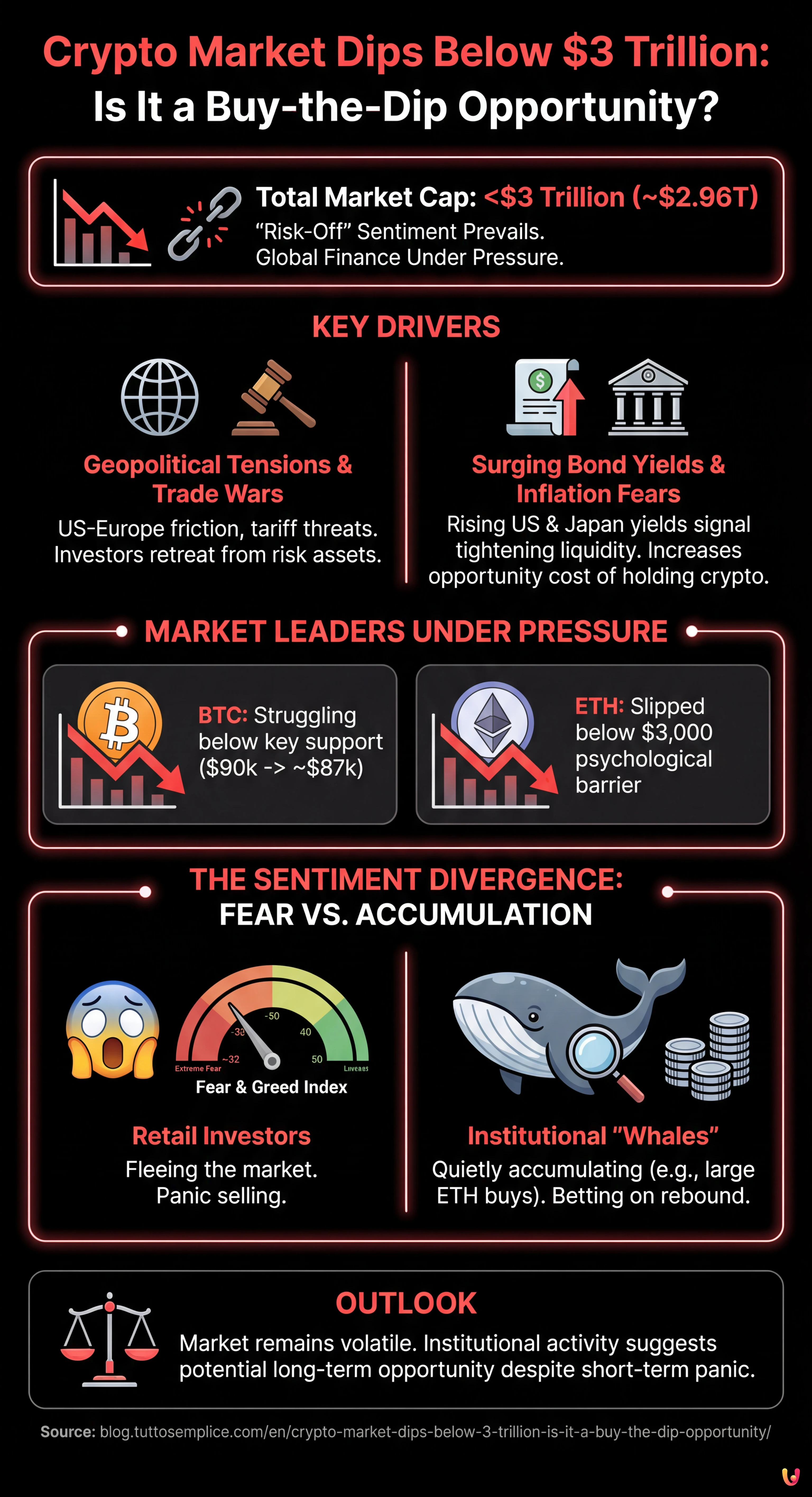

Intense macroeconomic pressures and trade war fears have pushed the total crypto market capitalization below the critical $3 trillion threshold.

Major assets like Bitcoin and Ethereum are struggling as investors rotate capital into gold amid surging yields and inflation fears.

While retail investors panic, institutional whales are actively accumulating discounted assets, signaling confidence in a potential market rebound.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

The global cryptocurrency market has faced a tumultuous start to the week, with the total market capitalization dipping below the psychological $3 trillion mark. As of Monday, January 26, 2026, data from major tracking platforms indicates a market under severe pressure, hovering around $2.96 trillion. This latest correction has reignited the fierce debate between bearish analysts predicting further downside and bullish investors eyeing a prime buy-the-dip opportunity.

The downturn is not an isolated event but part of a broader “risk-off” sentiment sweeping through global finance. Investors are reacting to a potent cocktail of macroeconomic stressors, including escalating trade tensions and surging bond yields. According to Binance, the total crypto market cap had already touched a low of $2.71 trillion earlier last week before attempting a fragile recovery, only to face renewed selling pressure today.

With Bitcoin struggling to reclaim key support levels and Ethereum slipping below $3,000, fear is palpable in the markets. However, on-chain data suggests that while retail investors are fleeing, institutional “whales” may be quietly accumulating assets, betting on a rebound once the geopolitical dust settles.

Geopolitical Tensions and Trade Wars Rattle Markets

The primary catalyst for the current sell-off appears to be the intensifying geopolitical friction between the United States and Europe. According to reports from Binance and AMBCrypto, markets have reacted negatively to U.S. President Donald Trump’s recent tariff threats, specifically those linked to a diplomatic standoff over Greenland. These trade policy shifts have raised concerns about global GDP growth, prompting investors to retreat from riskier assets like stocks and cryptocurrencies.

This uncertainty has spilled over into traditional finance, with the S&P 500 sliding 1.9% in recent sessions. In contrast, traditional safe-haven assets are soaring. The Economic Times reports that gold has hit a fresh all-time high of $4,725, as capital rotates out of “digital gold” (Bitcoin) and into physical bullion. The correlation between crypto and broader equity markets remains tight, leaving digital assets exposed to these macroeconomic headwinds.

Bond Yields and Inflation Fears

Adding to the pressure are rising government bond yields, which often signal tightening liquidity and persistent inflation expectations. The U.S. 5-year Treasury yield has climbed to six-month highs, while Japan’s 20-year government bond yields have surged to record levels. According to Binance, this spike in yields is a “warning sign” of mounting macro stress, driven by concerns over Japan’s debt-to-GDP ratio, which exceeds 200%.

When risk-free rates rise, the opportunity cost of holding non-yielding assets like crypto increases. This dynamic has forced a repricing of risk assets, contributing heavily to the current dip below the $3 trillion threshold. Investors are closely watching central bank responses to these inflationary signals, as any further tightening could exacerbate the sell-off.

Bitcoin and Ethereum Lead the Slide

The market leaders have borne the brunt of this correction. Bitcoin (BTC), which had been trading comfortably above $90,000 earlier in the month, has retreated significantly. Data from CoinGecko and Kraken shows Bitcoin trading in the $87,000 range, struggling to maintain momentum. Analysts cited by The Economic Times warn that a break below the critical $90,000 support level could trigger a deeper slide toward $75,000.

Ethereum (ETH) has also been hit hard, slipping below the psychological $3,000 barrier to trade around $2,964, according to AMBCrypto. The asset has underperformed relative to Bitcoin, with its market dominance waning slightly. However, the network’s fundamentals remain robust, leading some to believe the sell-off is driven more by sentiment than by any structural failure in the Ethereum ecosystem.

Whales Accumulate: A Signal for the Bulls?

Despite the gloom, there are signs of smart money activity that could signal a potential bottom. While retail sentiment—measured by the Fear & Greed Index—has dropped to “extreme fear” levels (around 32), institutional players appear to be buying the dip. According to AMBCrypto, a large institutional entity identified as “Trend Research” recently borrowed $70 million in USDT to purchase approximately 24,555 ETH.

This accumulation suggests that sophisticated investors view the sub-$3,000 level for Ethereum as a discounted entry point. Furthermore, WEEX Crypto News notes that while some high-profile traders have faced liquidations, others are hedging their bets, anticipating that the market will stabilize once the immediate trade shocks are absorbed. If this accumulation continues, it could form a “buy wall” that prevents further capitulation.

Conclusion

The crypto market’s dip below $3 trillion serves as a stark reminder of the asset class’s sensitivity to global macroeconomic forces. With trade wars, inflation fears, and rising bond yields dominating the narrative, the short-term outlook remains volatile. However, the divergence between retail panic and institutional accumulation offers a glimmer of hope for the bulls. As the market digests these developments, the coming days will be critical in determining whether this is a fleeting correction or the start of a prolonged crypto winter.

Frequently Asked Questions

The decline is primarily driven by a risk-off sentiment in global finance caused by escalating trade tensions between the United States and Europe, alongside rising government bond yields. Investors are reacting to these macroeconomic stressors by moving capital away from riskier assets like cryptocurrencies and into traditional safe havens.

Market opinions are divided, but on-chain data reveals that institutional whales are accumulating assets like Ethereum despite retail panic. While the short-term outlook remains volatile due to geopolitical friction, this smart money activity suggests that sophisticated investors view current prices as a discounted entry point for a potential future rebound.

Rising yields on US and Japanese government bonds signal tightening liquidity and increase the opportunity cost of holding non-yielding assets like Bitcoin. This dynamic forces a repricing of risk assets, contributing heavily to the market dropping below the 3 trillion dollar threshold as investors seek safer returns.

There is a distinct divergence in sentiment where retail investors are fleeing the market, pushing the Fear and Greed Index to extreme lows. In contrast, large institutional entities are borrowing funds to accumulate cryptocurrencies, betting on market stabilization once the immediate trade shocks are absorbed.

Investors are rotating capital out of digital assets and into physical bullion as a hedge against inflation and geopolitical instability. This shift has caused gold to hit fresh all-time highs while cryptocurrencies suffer from a tight correlation with the struggling stock market and global GDP concerns.

Sources and Further Reading

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.