In Brief (TL;DR)

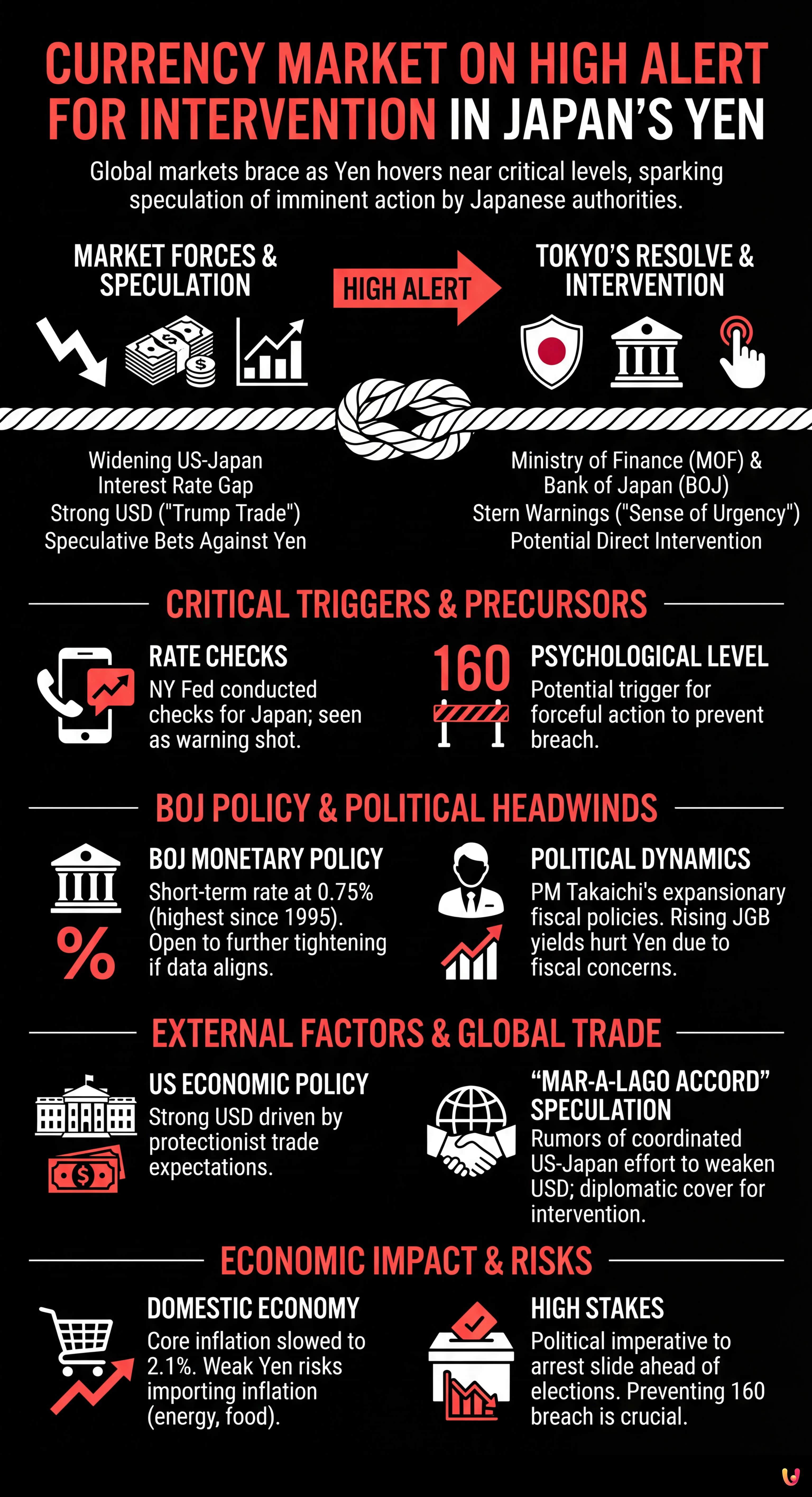

Global markets remain on high alert as the Japanese yen nears critical levels, prompting fears of imminent government intervention.

The currency faces pressure from conflicting domestic policies as increased fiscal spending complicates the central bank’s rate decisions.

Ongoing discussions between US and Japanese officials suggest potential coordinated action to address the yen’s sharp depreciation against the dollar.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

TOKYO — The global currency market remains on high alert this Sunday, January 25, 2026, as the Japanese yen hovers near critical levels, sparking widespread speculation of imminent intervention by Japanese authorities. Following a volatile week that saw the yen spike on suspected "rate checks" by the Ministry of Finance (MOF), traders are bracing for a potential showdown between market forces and Tokyo’s resolve to defend its currency.

The yen, which has been under sustained pressure due to the widening interest rate gap between the United States and Japan, experienced a sharp 1.7% rally late last week, strengthening to 155.73 per dollar. According to Reuters, this move was triggered by reports that the Federal Reserve Bank of New York, acting as a fiscal agent for Japan, had conducted rate checks with financial institutions—a maneuver often seen as a precursor to direct intervention. Despite this temporary reprieve, the currency remains fragile, with market participants eyeing the psychological 160 level as a potential trigger for forceful action.

Intervention Risks and “Rate Checks”

The specter of intervention has become the dominant theme in Asian trading. According to the Financial Times, the sudden appreciation of the yen on Friday was highly unusual for a major currency and signaled that authorities are on a "hair trigger." Japanese Finance Minister Satsuki Katayama has maintained a stern tone, stating earlier this month that she is monitoring foreign exchange moves "with a sense of urgency," a phrase often used to warn speculators against one-sided bets.

Market analysts believe the MOF is attempting to draw a line in the sand. "In the case of any actual intervention, the price action would show a much stronger follow-up," noted analysts at Forex.com, suggesting that the recent moves were likely warning shots rather than a full-scale campaign. However, the threat remains potent. Nomura analyst Yusuke Miyairi told Reuters that if the market perceives a coordinated stance between the U.S. and Japan, the "efficacy of future actual intervention, if any, will likely be more significant."

BOJ Policy and Political Headwinds

The yen’s weakness persists despite the Bank of Japan’s (BOJ) efforts to normalize monetary policy. On January 23, the BOJ Policy Board voted 8-1 to keep the short-term policy rate unchanged at 0.75%, the highest level since 1995, according to Trading Economics. Governor Kazuo Ueda emphasized that the central bank remains open to further tightening if economic data aligns with projections. In its latest quarterly outlook, the BOJ upgraded its GDP growth forecast for fiscal 2025 to 0.9% and for fiscal 2026 to 1.0%, citing the positive impact of government stimulus measures.

However, political dynamics are complicating the central bank’s task. Prime Minister Sanae Takaichi, who took office in October 2025, has championed expansionary fiscal policies reminiscent of "Abenomics." According to MarketScreener, concerns over increased government borrowing to fund these spending plans have pushed Japanese government bond (JGB) yields higher, paradoxically hurting the yen as investors fret over Japan’s fiscal health. The 40-year JGB yield recently surged to record highs, reflecting these anxieties.

Global Trade and the “Mar-a-Lago Accord”

External factors, particularly U.S. economic policy, continue to drive the yen’s trajectory. The "Trump trade" remains in full swing, with the U.S. dollar bolstered by expectations of protectionist trade policies. Investing.com reports that U.S. Treasury Secretary Scott Bessent has discussed currency valuations with his counterparts, leading to market speculation about a potential "Mar-a-Lago accord"—a coordinated effort to weaken the dollar against Asian currencies like the yen and the South Korean won.

Finance Minister Katayama confirmed that she and Secretary Bessent shared concerns over the yen’s "one-sided depreciation." While no formal agreement has been announced, the dialogue suggests that Tokyo is seeking diplomatic cover for its interventionist stance. Meanwhile, broader geopolitical tensions, including U.S. President Donald Trump’s tariff threats against trade partners, continue to fuel volatility, keeping the dollar in demand as a safe haven.

Economic Indicators and Inflation

Domestically, Japan’s economic fundamentals present a mixed picture. Data from the Ministry of Internal Affairs and Communications shows that core consumer inflation slowed to 2.1% in December, down from 2.9% the previous month. While this deceleration gives the BOJ some breathing room, the central bank expects underlying inflation to rise gradually toward its 2% target in the latter half of the projection period, driven by wage growth and labor shortages.

Despite the headwinds, the BOJ remains optimistic about a "virtuous cycle" of income and spending. However, the weak yen threatens to undermine this by importing inflation, raising the cost of energy and food for Japanese households. This creates a political imperative for the Takaichi administration to arrest the currency’s slide ahead of the upcoming upper house elections.

Conclusion

As markets open for the new week, the standoff between currency traders and the Japanese Ministry of Finance is set to intensify. With USD/JPY trading in a volatile range and the 160 threshold looming, the risk of direct intervention is higher than it has been in months. Whether through diplomatic coordination or unilateral market operations, Tokyo has signaled it is ready to act, leaving investors to navigate a treacherous landscape where policy shifts can occur without warning.

Frequently Asked Questions

The government is on high alert because the Yen is hovering near critical low levels against the US Dollar. This weakness is driven by the interest rate gap between the two nations and speculation about US trade policies. Authorities aim to prevent the currency from breaching the psychological 160 threshold, which would worsen inflation and economic instability in Japan.

A rate check occurs when the central bank calls financial institutions to ask for price quotes, signaling that they are closely watching market movements. This step is widely considered a precursor to direct intervention. Recent reports indicate the Federal Reserve Bank of New York conducted these checks on behalf of Japan, serving as a warning to speculators betting against the Yen.

Despite raising rates to 0.75 percent, the Bank of Japan maintains a policy that is still loose compared to the United States. This divergence keeps the Yen weak as investors seek higher returns elsewhere. While the central bank projects economic growth, political pressure for expansionary fiscal spending complicates their ability to tighten policy further and support the currency.

This term refers to market speculation regarding a potential coordinated agreement between the US and Asian nations to weaken the US Dollar. Discussions between US Treasury Secretary Scott Bessent and Japanese officials about one-sided depreciation have fueled these rumors. If realized, such an accord would provide diplomatic cover for Japan to intervene and strengthen the Yen effectively.

Traders view 160 Yen per Dollar as a major psychological barrier and a likely trigger point for aggressive government intervention. Crossing this line would exacerbate imported inflation, raising energy and food costs for Japanese households. Consequently, market analysts believe the Ministry of Finance will act decisively to defend this specific level against further speculative attacks.

Sources and Further Reading

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.