Imagine a financial world without intermediaries, where loans, insurance, and investments are managed automatically, transparently, and securely by computer code. This isn’t the plot of a science fiction movie, but the promise of Decentralized Finance (DeFi), a rapidly growing ecosystem based on blockchain technology. This revolution is touching every corner of finance, but it’s in the complex world of derivatives that it’s showing its most disruptive potential. Italy, with its economic fabric that balances a solid tradition and a strong drive for innovation, is in a unique position to observe and, potentially, lead this transformation in the European context.

Finance is changing at an impressive speed, driven by technologies like blockchain and artificial intelligence. This change is introducing more efficient and secure systems for managing transactions and payments. At the heart of this evolution are smart contracts, which promise to automate and make financial agreements more transparent, reshaping the role of traditional intermediaries like banks. In this article, we will explore how these technologies are rewriting the rules of derivatives, one of the most powerful and complex instruments in modern finance.

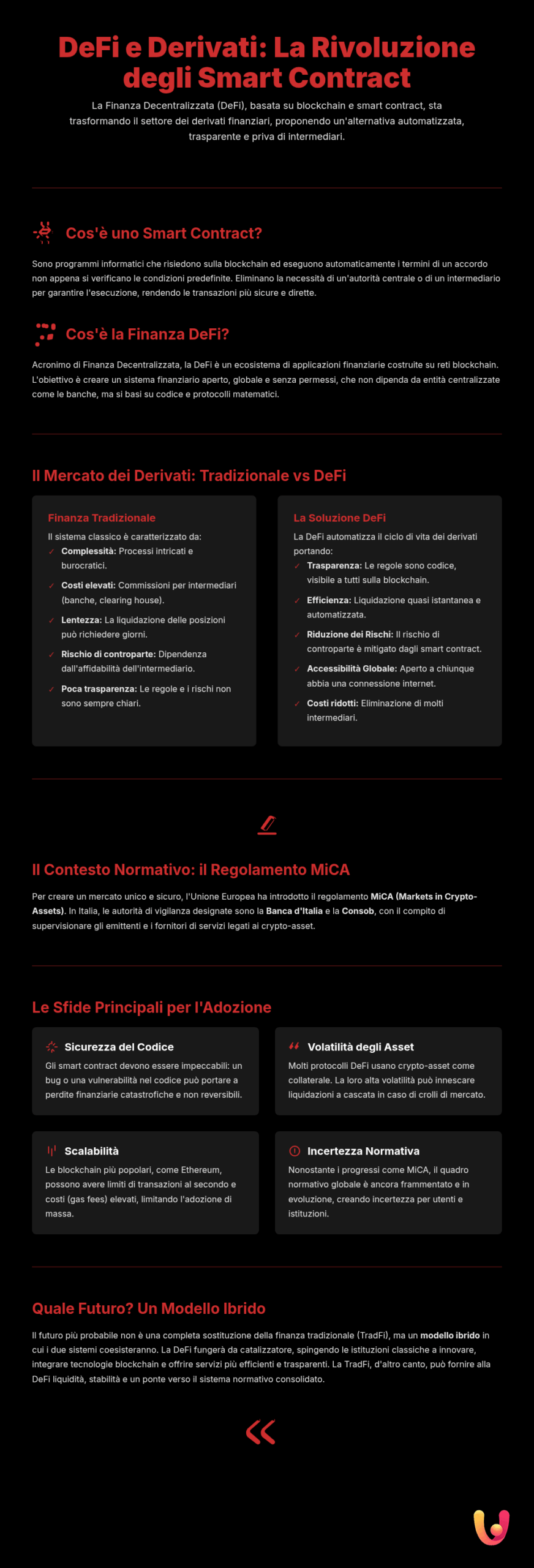

What Are Smart Contracts and How Do They Work

The concept of a smart contract was first introduced in 1994 by computer scientist Nick Szabo, long before the birth of Bitcoin. A smart contract is essentially a computer program that automatically executes the terms of an agreement when certain conditions are met. It operates on a simple “if/then” logic: if a specific event occurs, then the contract executes a predefined action. These digital contracts are stored and replicated on a blockchain, a distributed and immutable ledger that ensures transparency and security. Once a smart contract is active on the blockchain, it cannot be modified, and its operations are visible to all participants, eliminating the need for a central authority to verify and validate transactions.

To understand it better, think of a vending machine: you insert a coin (the “if” condition), and the machine gives you a drink (the “then” action). A smart contract is like a digital vending machine, but for complex financial operations, without the need to trust a human counterparty.

Traditional Financial Derivatives: A Complex World

Derivatives are financial instruments whose value “derives” from an underlying asset, such as stocks, commodities, interest rates, or currencies. These contracts allow investors and companies to manage risks (hedging) or speculate on future price movements. However, the traditional derivatives market is known for its complexity, lack of transparency, and heavy reliance on intermediaries. Investment banks, clearing houses, and lawyers play a crucial role in drafting, executing, and settling these contracts—processes that can be slow, expensive, and subject to counterparty risk, which is the risk that one of the parties will not fulfill its obligations. The lack of standardization, especially in Over-The-Counter (OTC) markets, further increases complexity and risks.

The DeFi Revolution: Derivatives Become Automatic and Transparent

Decentralized Finance (DeFi) leverages smart contracts to recreate and improve traditional financial services on a blockchain network. In the context of derivatives, this means automating the entire lifecycle of a contract. From creation to final settlement, every stage is managed by immutable code, drastically reducing the need for intermediaries. DeFi platforms allow users to create, trade, and manage futures contracts, options, and swaps in a completely decentralized manner, with clear and accessible rules for everyone. This not only lowers costs but also opens the market to a global audience, previously excluded by geographical or economic barriers.

Concrete Advantages for Investors and Companies

The application of smart contracts to derivatives brings a series of tangible benefits. Transparency is perhaps the most obvious: the contract’s rules are written in code and visible to everyone on the blockchain, eliminating ambiguity and information asymmetry. Efficiency increases significantly thanks to automation, which reduces settlement times from days to a few seconds and cuts costs related to intermediaries. Another key advantage is the reduction of counterparty risk: execution is guaranteed by the code, and funds are often locked as collateral within the smart contract itself. Finally, accessibility is democratized: anyone with an internet connection can interact with these financial instruments, fostering greater financial inclusion.

Italy and Europe Facing Innovation: Between Tradition and Regulation

The Italian approach to financial innovation is an interesting mix of caution and curiosity. In a country with a strong culture of personal relationships and trust based on a handshake, the idea of relying on “trustless” code represents a paradigm shift. However, Italy is showing growing interest, with 329 active blockchain projects registered in 2023, according to the Polytechnic University of Milan. The financial sector is the one investing the most in this technology.

At the European level, the response has been more structured. The European Union has introduced the MiCA (Markets in Crypto-Assets) regulation, a legal framework aimed at creating a single, secure market for crypto-assets. Approved in 2023 and fully operational by the end of 2024, MiCA introduces clear rules on transparency, authorization, and supervision for issuers and service providers, including stablecoins. This regulatory step, which designates the Bank of Italy and Consob as the competent national authorities, is crucial for providing legal certainty to operators and protecting investors, thereby encouraging the institutional adoption of DeFi.

“The European Regulation represents a significant step forward in helping to reduce regulatory uncertainty and bring order to the crypto-asset market.” – Bank of Italy

Practical Cases and Future Challenges

The application of blockchain to finance is not just theoretical; there are already numerous concrete use cases that demonstrate the potential of this technology. However, the path to mass adoption is still fraught with technical, regulatory, and cultural challenges that must be addressed.

Examples of Derivatives on Blockchain

Smart contracts are already powering a new generation of derivative products. A practical example is parametric insurance. Imagine a policy for a farmer that protects them from drought. A smart contract could be programmed to monitor rainfall data from a reliable external source (an “oracle”). If rainfall drops below a predefined threshold, the contract automatically pays out a claim to the farmer, without the need for expert assessments or bureaucratic paperwork. Similarly, in the trading world, there are DeFi platforms that offer perpetual futures, a type of derivative with no expiration date that is very popular in the crypto market, and decentralized options that allow for speculation or hedging against the volatility of digital assets.

The Obstacles to Overcome

Despite the enthusiasm, the road for DeFi is still uphill. One of the main challenges is security: a bug or error in a smart contract’s code can lead to catastrophic losses, as demonstrated by some well-known hacks in the past. The volatility of digital assets used as collateral represents another significant risk. On a technical level, the scalability of blockchains remains a problem: some networks can be slow and expensive during periods of high congestion, making operations impractical. Finally, although MiCA has laid an important foundation, regulatory uncertainty persists, especially for fully decentralized models where identifying a responsible party is not easy.

In Brief (TL;DR)

The article explores how Decentralized Finance (DeFi), thanks to blockchain and smart contracts, is transforming the derivatives sector, offering an automated and transparent alternative to traditional finance.

We will analyze how DeFi and smart contracts enable the creation of automatic and transparent derivatives, eliminating the need for traditional intermediaries.

We will delve into how DeFi is creating automatic and transparent derivatives, laying the groundwork for a more efficient and intermediary-free financial system.

Conclusions

Smart contracts and Decentralized Finance are undeniably reshaping the future of derivatives and the entire financial sector. They offer a vision of a more transparent, efficient, and accessible system, capable of reducing costs and democratizing access to complex instruments. It is unlikely that blockchain will completely replace banks and traditional finance in the short term. Rather, we are witnessing the beginning of a hybridization phase, where the two worlds will learn to coexist and integrate. The innovative drive of DeFi is forcing traditional institutions to modernize, while the stability and regulatory certainty of the classic system offer a model for the maturation of decentralized finance. For Italy and Europe, the challenge will be to balance tradition and innovation, creating an environment that fosters technological development while ensuring investor protection and market stability.

Frequently Asked Questions

A smart contract is a computer program that lives on a blockchain. It works like a traditional contract, but its terms are written in code and execute automatically when certain conditions are met, without the need for intermediaries like notaries or lawyers. Think of a vending machine: you insert a coin (condition), and the machine gives you a drink (result). A smart contract does the same thing, but with digital operations, making agreements transparent, fast, and secure.

In traditional finance, banks act as intermediaries for derivative contracts, managing transactions and guaranteeing agreements. Decentralized Finance (DeFi) uses smart contracts to automate this process. The derivative contract is transformed into code on a blockchain: when the specified market conditions are met (for example, a stock’s price reaches a certain value), the smart contract automatically executes the payment between the parties. This eliminates the need for an intermediary, reduces costs, and makes the process almost instantaneous and transparent.

Security is a crucial point. Although the blockchain makes smart contracts immutable once created, their security depends on the quality of the code. Programming errors can lead to significant losses. On the legal front, Europe is creating a regulatory framework with the MiCA (Markets in Crypto-Assets) regulation, which aims to protect investors and establish clear rules for operators in the sector. Italy has adopted these rules, entrusting supervision to the Bank of Italy and Consob. Although DeFi is not yet fully regulated, these are important steps toward the legitimization and security of the sector.

The main advantages are fourfold: transparency, efficiency, accessibility, and lower costs. *Transparency*, because all rules and transactions are recorded on a public and verifiable ledger. *Efficiency*, because the automatic execution of smart contracts eliminates bureaucracy and waiting times. *Accessibility*, because anyone with an internet connection can access these instruments, overcoming the geographical and social barriers of traditional markets. *Lower costs*, because the absence of intermediaries drastically reduces fees.

Currently, using Decentralized Finance (DeFi) tools still requires some familiarity with the technology and an awareness of the risks. The platforms are becoming increasingly user-friendly, but directly managing your own funds and understanding concepts like price volatility are essential. You don’t need to be a professional trader, but it is important to do your research, start with small amounts, and fully understand how the protocols you use work. DeFi aims to democratize finance, but the responsibility for risk management falls entirely on the user.

Still have doubts about DeFi and Derivatives: Will Blockchain Replace Banks??

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.