Managing your credit card security is a fundamental aspect that requires special attention. Every day we access digital payments, online reservations, and transactions that require frequent use of our cards. But what happens when our card is compromised or lost? It is crucial to understand the consequences and know how to act promptly. In this article, we will explain the difference between credit card blocking and suspension, after describing the characteristics of both measures. So, let’s not waste any more time and start reading!

Definition of Credit Card Blocking

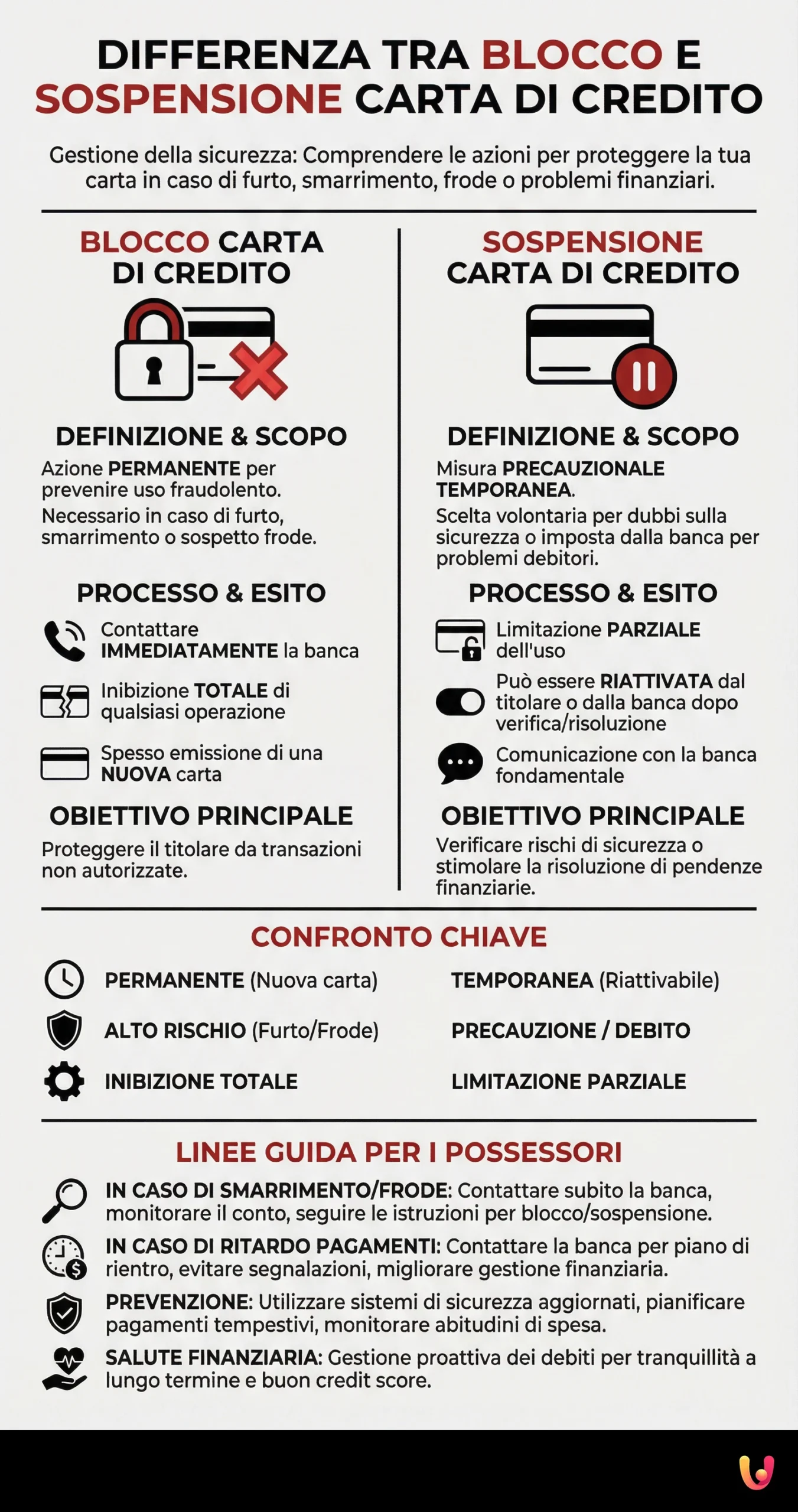

Credit card blocking is an action taken to prevent fraudulent use of the card. Generally, blocking is necessary in cases of theft, loss, or suspected fraud.

The blocking process takes place by immediately contacting the bank or credit institution that issued the card, which will proceed to inhibit any operation on it.

It is an effective security measure that serves to protect the holder from liability for unauthorized transactions.

Definition of Credit Card Suspension

Unlike blocking, credit card suspension is used as a precautionary measure.

It can be a temporary choice in case of doubts about the security of one’s card, but without real evidence of misuse.

Suspension partially limits the use of the card until the holder reactivates full functionality or after verifying that there are no security risks.

Suspension, unfortunately, can also be imposed by the credit institution due to the holder’s debt problems. This means that, in the presence of missed payments or financial irregularities, the bank has the right to inhibit the use of the card to preserve its interests.

While this action may seem drastic, it is important to consider it as a means to stimulate a resolution of financial pending issues and to prevent further complications.

In such contexts, open communication with the credit institution is fundamental to explore possible solutions and to restore full credit card functionality.

Comparison Between Credit Card Blocking and Suspension

The bank blocks the credit card in case of risk. This measure is permanent. A new card is often issued for the customer.

On the other hand, card suspension is temporary and can be activated to stop card use in emergency situations. It can be revoked once the risk is resolved.

Immediate actions, temporary measures, and permanent ones can differently influence both usability and the security of credit card operations.

Guidelines for Credit Card Holders

The moment you realize your card is lost or compromised, it is essential to intervene without delay:

- Contact the issuing institution immediately.

- Monitor your account to see if there have been suspicious transactions.

- Act according to the instructions received from the financial institution to block or suspend the card.

- Always maintain a preventive attitude, adopting updated security systems and following recommended practices for managing your credit card.

If, instead, you realized you are late with the statement payment, it is good practice to:

- Contact the issuing institution and try to agree on a deferred repayment plan. In this way, you will avoid being reported to the credit bureau as a bad payer.

- Consider the causes of the delay to improve your future financial management.

Remember, the credit card can be a useful and safe tool if used with care and responsibility.

Credit Card Blocking Due to Late Statement Payment

Delays in credit card payments can cause serious financial problems, such as card blocking due to an overdrawn account.

It is important to understand that if you do not pay on time, you may incur default interest and an increase in the interest rate. This can damage your credit score.

Effective financial management requires planning timely payments. Many financial institutions offer automated payment solutions, which can help prevent accidental delays.

If you have financial problems, talk to your bank. You might obtain a more flexible payment plan, or renegotiate repayment terms.

Credit card holders should be aware of their financial options, constantly monitoring their spending habits and adopting proactive debt management strategies.

Ensuring one’s financial health not only safeguards one’s credit score but also ensures long-term peace of mind.

In Brief (TL;DR)

The difference between blocking and suspension lies in the severity and type of anomalies regarding the credit card and its security.

While blocking is a total and definitive interruption of card use, suspension can be considered a temporary block awaiting further actions by the holder.

Often banks and credit institutions may adopt these measures in case of delays in payment of the card statements themselves.

Conclusions

Knowing and understanding the difference between credit card blocking and suspension is vitally important for every holder.

Being aware and informed about the measures to adopt in case of card compromise is crucial to protect one’s financial security.

Stay constantly vigilant, keep updated on best practices, and act promptly to guarantee the integrity of your payment methods.

Paying credit card statements on time is important to prevent banks from adopting uncomfortable procedures such as forced recovery of amounts due.

Frequently Asked Questions

You should block your card if it has been stolen or if you have reason to believe that the card details have been compromised.

If you lose the card, blocking is generally the recommended path, as it eliminates the possibility that someone can use your card.

Yes, suspension is temporary, and you can typically easily reactivate the card once its security is confirmed.

If your credit card has been blocked by the bank, contact customer service immediately to understand why it happened. Very often, the block can be the result of suspicious fraudulent activities or a missed payment. Once the problem is identified, you can discuss possible solutions with the bank representative.

Still have doubts about Difference Between Credit Card Blocking and Suspension?

Type your specific question here to instantly find the official reply from Google.

Sources and Further Reading

- Federal Trade Commission: Lost or Stolen Credit, ATM, and Debit Cards

- Consumer Financial Protection Bureau: What to do if your credit card is lost or stolen

- Office of the Comptroller of the Currency: Lost or Stolen Credit Cards

- Consumer Financial Protection Bureau: Consequences of late credit card payments

- Wikipedia: Credit card fraud

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.