In an increasingly connected world, money is also going digital. The traditional allowance in coins is giving way to prepaid cards, apps, and online transactions. For parents in Italy, a country where Mediterranean culture combines strong ties to tradition with a rapid push toward innovation, a fundamental question arises: how can we teach our children to use digital payments responsibly and safely? This is not just a technological shift, but a true cultural transformation that requires new skills. The goal of this guide is to offer practical tools and clear advice to guide young people on this journey, turning risks into opportunities for growth and responsibility.

The abstract nature of electronic money can make it difficult for young people to understand its real value. Unlike banknotes, which physically disappear from a wallet, a balance on an app can seem like an endless supply. This perception increases the risk of overspending and impulse buying. Furthermore, the web hides pitfalls like scams, phishing, and deceptive subscriptions. Without proper guidance, kids can easily fall into traps designed to exploit their naivety. For this reason, a financial education that integrates cybersecurity is no longer an option, but a necessity to protect their data and their future.

Allowance 2.0: A New Reality for Italian Families

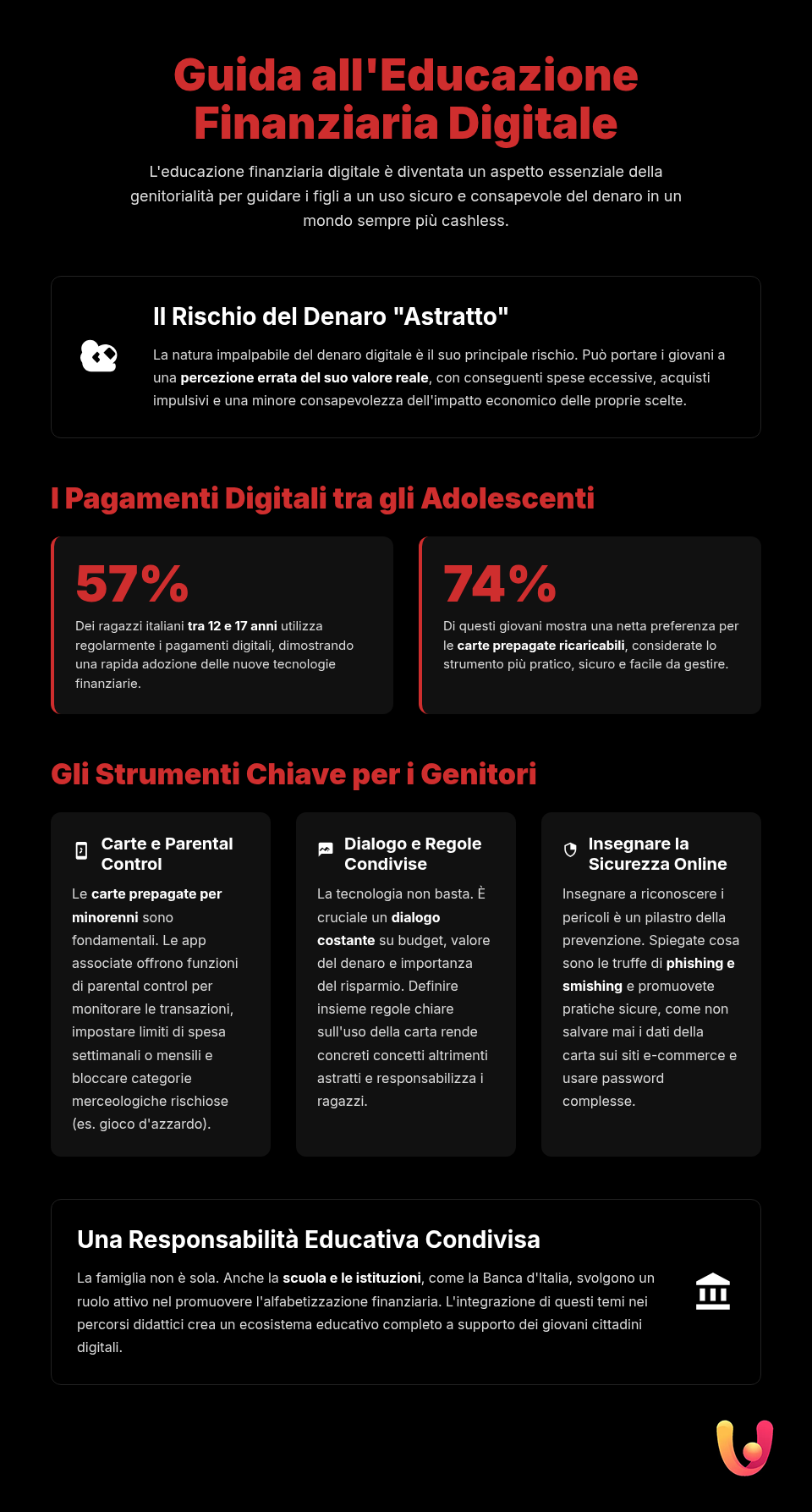

The era of the digital allowance is already an established reality in Italy. According to a study from early 2025, 57% of Italian teenagers between 12 and 17 regularly use digital payment tools, with a peak of 66% in the 15-17 age group. These figures highlight an unstoppable generational shift: young people prefer the convenience of a card or an app over handling cash. The majority (74%) rely on prepaid cards, while a growing number are exploring digital wallets and dedicated bank accounts. This transition affects not only spending habits but also money management: 38% of kids check their balance, and 37% use digital tools to manage their savings, demonstrating surprising financial awareness.

However, this scenario presents significant challenges. While young people between 18 and 30 are leading the adoption of smartphone payments (over 76%), the very young, between 14 and 18, still show some resistance, with 57% preferring cash. The main reasons are the fear of uncontrolled spending and the fear of online fraud, concerns also shared by parents. This gap suggests that familiarity with technology does not automatically translate into trust in digital financial tools. Overcoming this barrier requires a strong investment in education to transform the perception of risk into a conscious management of opportunities.

Why Digital Financial Education is Crucial

Teaching kids to use digital money isn’t just about explaining how an app works, but about conveying the value of money in a context where it is invisible. Electronic money is an abstract concept that children struggle to grasp. Without the physical experience of exchanging coins, the risk is that young people perceive financial resources as limitless, leading them to spend carelessly. Digital financial education serves to bridge this perceptual gap, helping them understand that every “tap” to pay corresponds to a real decrease in their available funds, just like using a traditional piggy bank.

The benefits of early education are enormous. Kids learn to plan, set savings goals, and distinguish between wants and needs. They develop a sense of responsibility and autonomy, skills that will be essential in their adult lives. Addressing these topics as a family opens up a constructive and transparent dialogue about money, breaking down any taboos. Conversely, a lack of preparation exposes young people to real risks: from getting into debt from “in-app” purchases in video games to falling for increasingly sophisticated online scams. Educating them means providing the tools to navigate the economic world of tomorrow safely.

Practical Tools for Parents and Kids

Guiding kids into the world of digital payments requires the right tools that balance autonomy and control. Fortunately, the market today offers several solutions designed specifically for families, which allow you to introduce young people to money management in a protected and customizable environment.

Prepaid Cards for Minors

Prepaid cards for minors are one of the most effective and safe tools to get started. They work like a regular debit card, but with a key difference: you can’t spend more than the amount loaded onto it. This eliminates the risk of “going into the red.” Many of these cards, often equipped with an IBAN, are linked to apps that offer parental control features. This allows parents to monitor spending in real time, set daily or monthly spending limits, receive notifications for every transaction, and even block certain merchant categories (like gambling or alcohol). Tools like these turn an allowance into an educational experience, teaching kids how to manage a set budget. To help you choose, it’s useful to consult a guide to the best prepaid cards for minors, evaluating costs and features.

Payment Apps and Digital Wallets

As kids get older, they can also start using digital wallets like Google Wallet or Apple Pay, linked to their prepaid card. These tools offer an additional layer of convenience and security, allowing for contactless payments via smartphone. Here too, the parent’s role is crucial during the setup phase. It’s important to ensure the device is protected by a passcode or biometric data and that the app’s security settings are enabled. Using a secure digital wallet gets young people used to managing their finances through the devices they use daily, preparing them for future payment methods in a controlled environment.

Parental Control Tools

In addition to the features built into card apps, there are more general parental control applications that offer comprehensive monitoring of kids’ digital activities. Apps like Qustodio or Norton Family allow you not only to control spending but also to limit screen time on shopping apps, block access to unsafe e-commerce sites, and monitor online searches. These tools are useful for creating a protected digital ecosystem. Another valuable feature is the ability to monitor spending with alerts and notifications, which allows parents to intervene promptly in case of suspicious activity, turning every transaction into an opportunity for dialogue and teaching.

Dialogue and Rules: The Foundation for Responsible Use

Technological tools alone are not enough. True financial education is built through constant dialogue and setting clear rules. Talking about money in the family shouldn’t be a taboo. It’s essential to explain to kids where the money loaded onto their card comes from, connecting it to work and the family budget. Using simple analogies, like comparing the app’s balance to an old piggy bank, helps make an abstract concept concrete. This dialogue allows you to introduce basic principles like the difference between a need (something necessary) and a want (something extra), encouraging critical thinking before every purchase.

Establishing shared rules is just as important. Set a weekly or monthly budget together, deciding how to allocate it between savings and spending. Set clear boundaries for online purchases: for example, always asking for permission before buying something or never saving card details on e-commerce sites. It’s also useful to teach them to recognize risks. Explain in simple terms what online scams are and why it’s vital to protect their personal data. Teaching them to recognize scams like phishing and smishing and promoting the habit of making secure online purchases are essential steps to make them autonomous and prudent digital users.

The Role of Schools and Institutions

The family is not the only educational agent. Schools also play an increasingly crucial role in shaping digitally and financially literate citizens. In Italy, financial education has been officially included as part of Civics education, recognizing its strategic importance for the future of young people. Institutions like the Bank of Italy and the Ministry of Education actively promote projects and educational resources to support teachers in this task. These programs aim to provide students with the skills to understand basic economic concepts, interpret reality, and make informed choices, overcoming the socioeconomic gaps that often influence financial knowledge.

The goal is to create an educational ecosystem where the skills learned at school can be discussed and applied at home. Projects like those promoted by FEduF (Foundation for Financial Education and Savings) or by banking institutions aim for just that, offering programs that range from elementary to high school. When school and family work in synergy, financial education becomes a living, concrete knowledge, capable of turning young people into responsible adults, ready to face the economic challenges of a constantly evolving world.

In Brief (TL;DR)

In an increasingly digitized world, guiding children toward a responsible and safe use of digital payments is essential for their financial education.

From prepaid cards for minors to parental control tools, discover how to guide your children toward responsible and secure financial management.

From prepaid cards for minors to parental control tools, here are the solutions to monitor spending and prevent risks.

Conclusions

Educating kids about digital payments is one of the most current challenges for today’s parents, a task that intertwines tradition and innovation. It’s not just about providing a technological tool, but about building a path of growth, dialogue, and trust. From choosing the first prepaid card to setting shared rules, every step is an opportunity to teach the value of money, the importance of saving, and the need for online caution. In a context like Italy’s, accustomed to combining the warmth of human relationships with the efficiency of technology, this journey becomes an occasion to strengthen family bonds.

Tools like cards for minors and parental control apps are valuable allies, but the irreplaceable element remains dialogue. Talking about money, budgets, and security transforms an apparent source of risk into a powerful educational tool. Facing this challenge with awareness means preparing our children not only to be mindful consumers but also responsible citizens and protagonists of their own economic future. In this way, allowance 2.0 becomes much more than a simple means of payment: it transforms into a true life-training ground.

Frequently Asked Questions

There is no fixed age; it largely depends on the individual child’s maturity. Many banks and financial institutions in Italy offer products starting from 10 or 12 years old. The crucial aspect is not just the chronological age, but starting an educational dialogue about the value of money and responsible spending before handing over the card. Some solutions are also available for younger children, starting from 6 or 8 years old, but with even stricter parental controls.

Almost all prepaid cards for minors are linked to a smartphone app that includes specific *parental control* features. Through these apps, a parent can monitor every transaction in real time, set daily or monthly spending limits, block certain purchase categories (like gambling), and receive instant notifications for every payment. This allows you to grant autonomy in a safe and controlled environment.

The main risks include the difficulty in perceiving the value of ‘invisible’ money, which can lead to overspending, and exposure to online fraud like phishing. Kids might be tricked into sharing card details on insecure sites or falling into traps related to deceptive offers in video games. For this reason, cybersecurity education must go hand in hand with financial education.

No, there are different types of cards for minors with different features. Some are simple ‘disposable’ or reloadable prepaid cards, ideal for specific purchases. Others, which are increasingly common, are cards with an IBAN that allow you to receive bank transfers, like an allowance, and make more complex payments. Many offer additional features like savings pots, cashback on certain purchases, and compatibility with digital wallets like Apple Pay and Google Pay.

In an increasingly *cashless* world, education about digital money is essential to prepare young people for the future. Getting them used to managing electronic payment tools not only teaches them to monitor their finances in a digital context but also to understand crucial concepts like online security, personal data protection, and the value of money in a non-physical form. It is a vital skill that complements and updates traditional financial education.

Still have doubts about Digital Payments and Kids: A Safety Guide for Parents?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.