In the digital age, every online purchase involves a choice of trust. Entering your credit card details on an unknown site can cause some apprehension. It’s a hesitation rooted in an ancient, almost Mediterranean prudence—the careful protection of one’s assets. Today, this traditional wisdom meets technological innovation in disposable prepaid cards. This is a modern digital shield, designed to offer a superior level of security for single transactions, separating our main savings from the risks of the web. This financial tool, as simple as it is effective, is redefining the rules of security for European consumers.

This article explores the world of single-use cards in detail, analyzing what they are, how they work, and why they represent an ideal solution for navigating the vast ocean of e-commerce with peace of mind. From their origin as a response to growing cyber threats to practical usage scenarios, we will discover how to combine the need to shop online with the desire for maximum protection—a fundamental balance in the daily life of every digital consumer.

The Evolution of Security in Digital Payments

The payment journey has seen a rapid transformation: from cash to credit cards, and on to digital wallets. The explosion of e-commerce has accelerated this evolution, bringing enormous advantages but also new vulnerabilities. Online fraud has become a concrete threat, prompting European authorities to intervene. The regulatory response was the Payment Services Directive 2 (PSD2), which introduced stricter requirements like Strong Customer Authentication (SCA) to make transactions more secure. This directive mandates two-factor authentication, combining elements such as a password, a physical device, or a biometric datum.

In this context, disposable cards represent a further step, a proactive security initiative that goes beyond legal obligations. While PSD2 strengthens defenses at the system level, a single-use card acts as a personal and impenetrable barrier. It is the manifestation of a new awareness, where the protection of financial data is not just delegated to banks, but becomes an active choice by the consumer. The innovation of tokenization, the secure secret of your digital payments, has already shown the way, but single-use cards make it even more accessible.

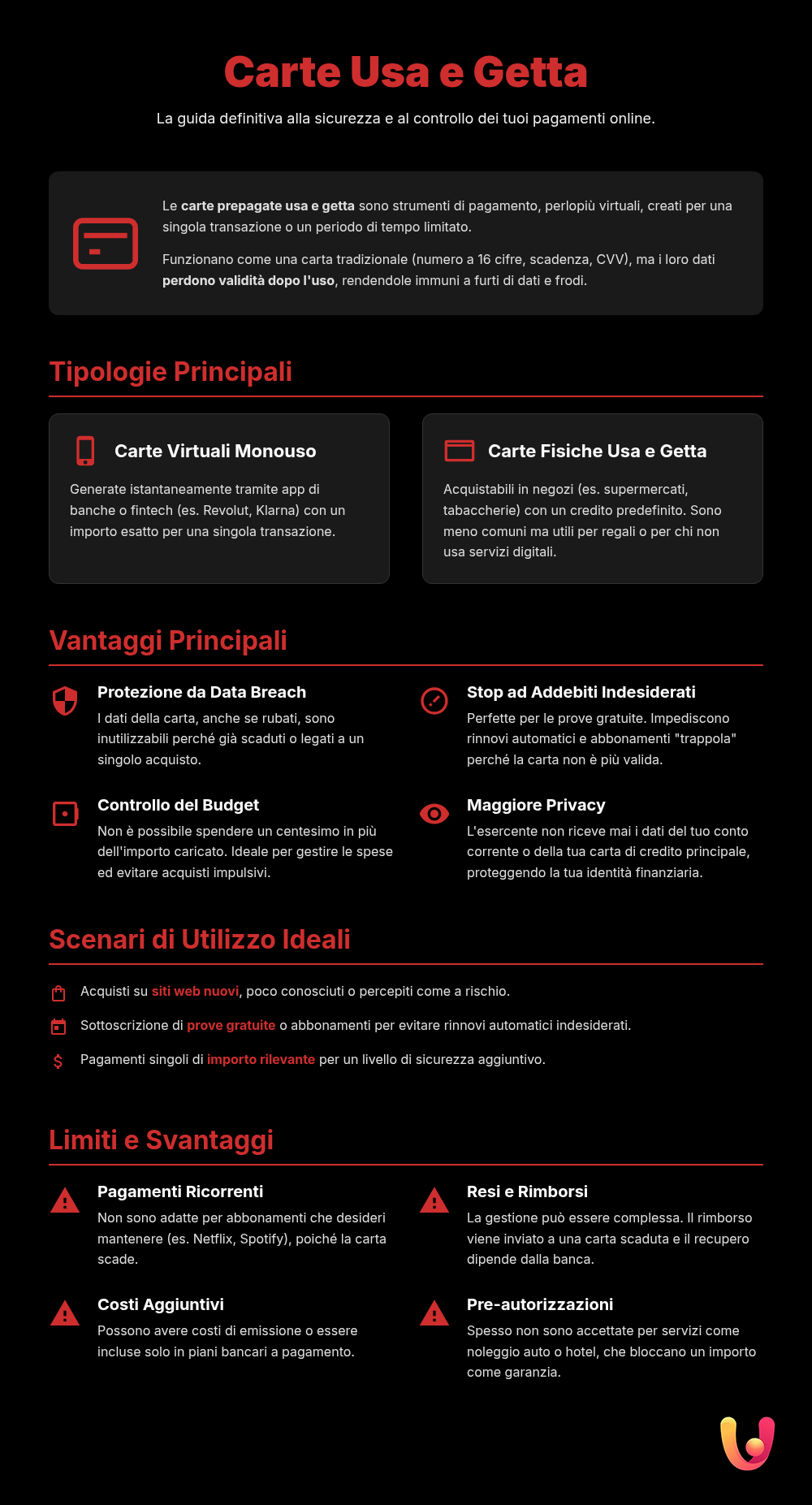

What Exactly Are Disposable Prepaid Cards?

A disposable prepaid card is a payment instrument, almost always virtual, created for a single transaction or for a very limited period. It works like a normal debit or credit card, with a 16-digit number, an expiration date, and a CVV code, but with a crucial difference: once the purchase is completed, these details become invalid, making them useless to anyone who tries to steal them. Think of it like a movie ticket: valid for one show only, and once you leave the theater, it can no longer be used. This simple but powerful mechanism makes it a fortress for online payments.

Generate, Pay, Forget. Security in three simple steps.

These cards are not reloadable, and their credit is predefined at the time of creation. European anti-money laundering regulations have introduced stricter rules, prohibiting anonymous cards for amounts exceeding 150 euros to prevent illicit use. There are mainly two variations of this tool, each with its own specifics.

Single-Use Virtual Cards

The most common and versatile form is the single-use virtual card. Generated in moments through your bank’s or a fintech service’s app, it exists only in digital format. When creating it, the user decides the exact amount to load, corresponding to the cost of the purchase they intend to make. After the transaction, the card virtually “self-destructs” or expires within a short period, often 24 hours. This feature makes it the perfect solution for purchases on sites you’ve never used before or for activating free trials without risking unwanted future charges.

Physical Disposable Cards

Less common but still on the market, physical disposable cards are purchased in stores like tobacco shops, supermarkets, or at bank branches. They are often designed as gift cards and have a fixed, pre-loaded amount. Although they offer a high level of anonymity, they are less flexible than their virtual counterparts. Their utility is found in specific contexts, such as for a gift or for someone who wants to make a purchase without leaving any digital trace linked to their main account. Intesa Sanpaolo, for example, offers the “Carta Flash al portatore” (bearer card), which can only be loaded once.

How They Work and Where to Find Them

Getting and using a single-use virtual card is an intuitive and fast process, designed to be accessible to everyone. Generally, the steps are few and simple. The user accesses their banking institution’s or fintech service’s app, selects the option to create a new virtual card, chooses the “disposable” type, and defines the amount to load. In a few seconds, the application generates the card details (number, expiration, CVV), ready to be copied and pasted onto the merchant’s site. Once the payment is confirmed, the card’s mission is complete.

These tools are offered by a growing number of financial operators. Many traditional banks, like Intesa Sanpaolo and isybank, have integrated this feature into their home banking services. However, it is mainly digital banks and fintechs like Revolut, Klarna, and Wise that are pushing this technology, often offering it as a standard feature in their accounts. Costs can vary: some services charge a small fee for each card generated, while others include an unlimited number of virtual cards in the account’s monthly fee.

The Undeniable Advantages for Personal Security

Adopting disposable cards offers a series of concrete benefits that significantly strengthen personal financial security. These tools are designed to neutralize some of the most common threats in the world of digital payments.

- Total protection from data breaches: The main advantage is immunity from data theft. If an e-commerce site suffers a cyberattack and card information is stolen, the data from a single-use card is already expired and therefore completely useless to malicious actors. This provides priceless peace of mind, especially considering how frequently these incidents occur.

- Stop unwanted charges: Disposable cards are the perfect ally against the “subscription trap.” By using them to activate a free trial, you eliminate the risk of forgetting to cancel and incurring automatic renewals, as the card will no longer be valid.

- Absolute budget control: Each card is loaded with a specific amount. This prevents any charge higher than the intended amount, whether due to error or fraud attempt, and helps maintain stricter management of one’s expenses.

- Greater privacy: Since the card details change with each transaction, your financial digital footprint is reduced. Your main account or primary card details are not exposed, ensuring an additional layer of privacy. For those concerned about security, it’s also useful to know about credit card cloning techniques and how to defend against them.

When to Use a Disposable Card: Practical Scenarios

The versatility of single-use cards makes them a valuable tool in many everyday situations. Their effectiveness is maximized in contexts where the perceived risk level is higher or where you simply want more control. A classic use case is purchasing from new or little-known websites. Whether it’s a small online boutique discovered on social media or an international portal you’re not familiar with, using a disposable card eliminates any concern about the security of your financial data.

Another extremely common scenario is signing up for free trials and subscriptions. Many online services require a credit card to access a trial period. Using a single-use card with a minimal balance ensures that, at the end of the free period, no unwanted recurring charges can be made. Finally, this tool is also useful for single payments of a significant amount, such as buying a plane ticket or an electronic product, where an additional security barrier is never superfluous. Their nature, however, makes them less suitable for situations that require pre-authorizations, such as in hotels and for rentals, where the merchant blocks a sum as a guarantee.

Limitations and Disadvantages to Consider

Despite the clear security advantages, disposable prepaid cards have some limitations that are important to be aware of for informed use. Their single-use design makes them, by definition, unsuitable for recurring payments like subscriptions to streaming services or utilities, which require a card with stable data over time. Another critical point concerns the handling of returns and refunds. If a product purchased with a single-use card is returned, the refund is sent to a card that has since expired. Recovering the funds can become a complex process, often requiring you to contact your bank’s customer service to track and redirect the payment.

Additionally, one must consider the possible additional costs. While many fintechs offer the service for free within their plans, some banks may apply a small fee for generating each individual card. Lastly, as already mentioned, disposable cards may not be accepted for services that require a pre-authorization, such as car rentals or hotel bookings, as these services block an amount as a security deposit that could exceed the card’s limit or its short validity.

In Brief (TL;DR)

Disposable prepaid cards are the ultimate solution for those seeking maximum security in single payments, protecting financial data from fraud and cloning during online purchases.

Discover how they work, where to get them, and why they are the safest solution to protect your online purchases on potentially risky sites.

Find out where to get them and how to use them to make your online purchases completely secure.

Conclusions

Disposable prepaid cards are not meant to completely replace traditional payment methods, but they establish themselves as an indispensable complement in the arsenal of every security-conscious digital consumer. They represent the perfect synthesis of traditional prudence, rooted in Mediterranean culture, and the innovation offered by financial technology. They provide a simple and effective answer to one of the biggest concerns of the digital age: the protection of personal financial data. Whether it’s exploring a new online store, trying a subscription service, or simply adding an extra lock to an important purchase, single-use cards provide control, peace of mind, and an almost impenetrable barrier against fraud. In an increasingly connected world, where threats are constantly evolving, adopting tools like these is not just a smart choice, but an act of awareness to regain full control of one’s financial security.

Frequently Asked Questions

Disposable prepaid cards, available in both physical and virtual formats, are payment instruments with a pre-loaded amount. Unlike reloadable cards, once the credit is used up, they can no longer be used. Since they are not linked to a bank account, they offer a high level of security and privacy, as personal data is not exposed during the transaction. They work on international networks like Visa or Mastercard, allowing for online and in-store purchases.

Physical single-use prepaid cards can be found at various retail locations such as tobacco shops, betting shops, supermarkets, and post offices. Many banking institutions, like Intesa Sanpaolo, offer disposable versions of their cards. Virtual cards, on the other hand, are generated instantly through home banking services or apps from financial providers like Revolut, Hype, and N26, often at no additional cost.

Although disposable cards offer a high level of privacy because they do not bear the user’s name, they do not guarantee absolute anonymity. Anti-money laundering regulations (Legislative Decree 90/2017) impose strict rules, limiting the issuance of completely anonymous cards to very low amounts, generally under 150 euros. To obtain most cards, even ‘bearer’ ones, you must provide your personal data to the issuing entity at the time of purchase or activation.

The main advantage is security: since it can be used for a single transaction or until a small amount is depleted, the risk in case of fraud or cloning is limited to only the loaded credit. Furthermore, by not being linked to an account, it protects your main banking details. This makes it ideal for purchases on little-known websites or for one-time payments where you prefer not to share your financial information.

Yes, there are limits and costs. Physical cards often have an activation or issuance fee. Anti-money laundering regulations impose maximum loading and usage caps. Virtual cards, generated via an app, may be free, but the service might be included in a monthly fee for the account they are associated with. Generally, you cannot withdraw cash from ATMs, and they are not suitable for recurring payments like subscriptions.

Still have doubts about Disposable Cards: Maximum Security for Single Payments?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.