In the age of digital and global commerce, managing customer disputes has become a crucial aspect for any business. A dispute, or contested charge, occurs when a customer challenges a charge on their credit or debit card, initiating a process known as a chargeback. This mechanism, created to protect consumers from fraud and unauthorized charges, can turn into a complex and costly problem for merchants. A thorough understanding of the dynamics of Dispute Resolution is essential not only for effective defense but also for preventing such situations from arising, thereby preserving profitability and business reputation.

This article is aimed at merchants operating in the Italian and European markets, a context characterized by strong consumer protection and a culture, especially Mediterranean, where trust and personal relationships still play a significant role. Navigating this landscape requires a balance between tradition and innovation: on one hand, nurturing customer relationships, and on the other, adopting advanced digital tools and procedures to manage payments securely and transparently. We will explore the best practices for reducing the risk of chargebacks and successfully managing the necessary documentation in the event of a dispute.

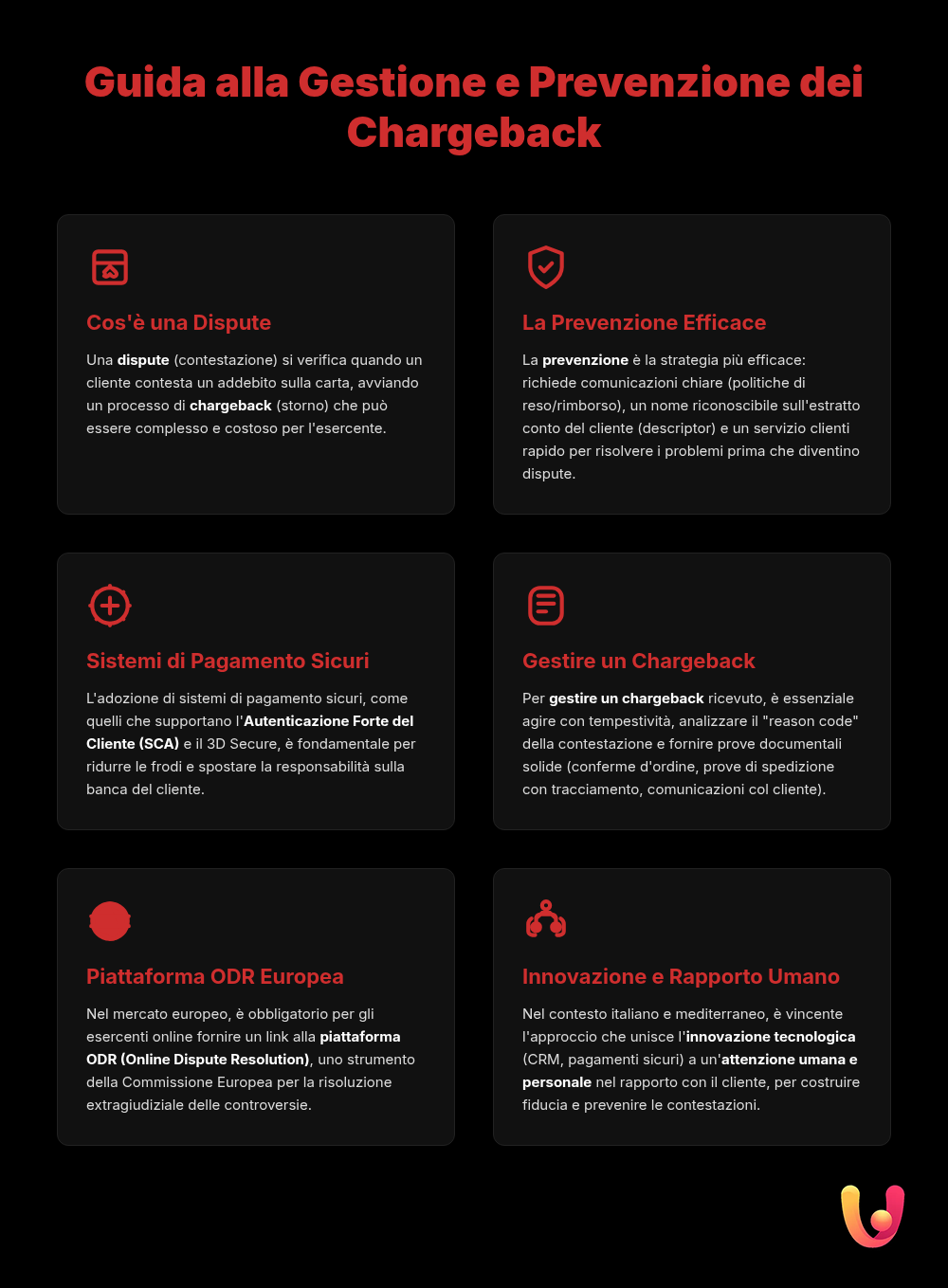

Understanding the Dispute and Chargeback Process

A chargeback is the procedure by which funds from a transaction are returned to the cardholder after they have disputed a payment. The reasons can vary: the customer does not recognize the transaction, claims they never received the goods, received a damaged product, or believes the transaction is fraudulent. Unlike a refund, which is a direct agreement between the merchant and the customer, a chargeback involves the banks (the customer’s bank, called the issuer, and the merchant’s bank, called the acquirer) and the payment networks (like Visa or Mastercard). The procedure is governed by European directives and network rules, designed to protect the consumer.

The process begins when the customer contacts their bank to dispute a charge. The issuing bank then initiates a formal dispute. At this point, the transaction amount is temporarily “frozen” or debited from the merchant, along with a fee for handling the case. The merchant receives a notification and has a limited time, usually from a few days to a few weeks, to respond and provide evidence supporting the transaction’s validity. If the merchant does not respond or the evidence provided is insufficient, the chargeback becomes final, and the financial loss is confirmed.

Prevention: The Merchant’s First Line of Defense

The most effective strategy for managing disputes is to prevent them. A proactive approach not only reduces direct financial losses but also enhances customer trust and brand reputation. Clear and transparent communication is the first step. It is essential that return, refund, and cancellation policies are easily accessible and understandable before the purchase. Likewise, the business name that appears on the customer’s statement (the so-called descriptor) must be immediately recognizable to avoid “unrecognized transaction” disputes, one of the most common causes of chargebacks.

Another pillar of prevention is transaction security. Adopting payment systems that support Strong Customer Authentication (SCA), such as 3D Secure, is crucial. This protocol adds a layer of verification, for example, via a code sent by SMS or an in-app authorization, which protects the merchant from fraud and shifts liability for the transaction to the customer’s bank in case of a fraud-related dispute. Additionally, it is useful to learn how to recognize suspicious orders, such as those with unusually high amounts or different shipping and billing addresses, and to proceed with additional verification if necessary. Finally, excellent, prompt, and effective customer service can defuse dissatisfaction before it turns into a costly formal dispute.

Managing the Dispute: How to Respond to a Chargeback

Despite the best prevention strategies, receiving a chargeback notification is a possibility to be prepared for. When it happens, it is crucial to act methodically and promptly. The first step is to carefully analyze the notification received, which includes the dispute’s reason code. This code, provided by the payment networks, explains why the customer initiated the dispute and guides the merchant in gathering the most relevant documentation to counter it.

Gathering evidence is the core of the defense process. The documentation to be provided varies depending on the reason for the dispute, but in general, it must irrefutably prove that the transaction was legitimate and that the merchant fulfilled their obligations. Essential evidence includes: payment receipts, order confirmations, proof of shipment with tracking that confirms delivery, communications with the customer (emails, chats), and any signed documents (such as a check-in receipt for a hotel). Submitting complete and well-organized documentation within the established deadlines is the only way to have a chance of winning the dispute and recovering the contested amount.

Alternative Tools and the European Context: ODR Platforms

In the context of the European Digital Single Market, the European Commission has introduced specific tools to facilitate dispute resolution between consumers and merchants, promoting a less confrontational and faster approach than traditional channels. One of these tools is the Online Dispute Resolution (ODR) platform. This multilingual web portal, active since 2016, allows consumers and businesses to resolve disputes related to online purchases out of court.

For online merchants operating in the EU, it is mandatory to include a link to the ODR platform on their website and provide a contact email address. The process is simple: the consumer files a complaint via an online form; the complaint is forwarded to the merchant, who can propose an Alternative Dispute Resolution (ADR) body from a list of accredited entities. If an agreement is reached on the body, the case is transferred and handled entirely online, with the goal of finding a solution within 90 days. Actively participating in this system is not just a legal obligation but also an opportunity for the merchant to demonstrate transparency and reliability, strengthening the trust-based relationship with the customer.

Tradition and Innovation in Mediterranean Culture

In the Italian and, more broadly, Mediterranean context, personal relationships and trust have always been pillars of commerce. A customer who feels betrayed or ignored is more likely to take formal action. Managing disputes in this cultural environment requires special attention to the human aspect. Often, a phone call or an empathetic communication can resolve a problem more effectively than a thousand automated procedures. Actively listening to the customer’s reasons and showing a willingness to find a solution is crucial for turning a negative experience into an opportunity to strengthen loyalty.

However, this traditional approach must be integrated with innovation. Technology offers indispensable tools for preventing and managing disputes. Using a CRM (Customer Relationship Management) to track all customer interactions, adopting secure payment systems like those offering tokenization, and implementing two-factor authentication procedures (2FA) are examples of how innovation can secure a business. The winning balance lies in combining the efficiency and security of technology with customer service that maintains a human and personalized touch, an added value particularly appreciated in the Italian market. In case of suspicious transactions, it is important to be aware of fraud techniques, such as phishing, to protect yourself adequately.

In Brief (TL;DR)

This comprehensive guide for merchants illustrates the best practices for managing customer disputes, reducing the risk of chargebacks, and successfully navigating the dispute resolution process.

We will analyze the best practices for reducing chargeback risk and for correctly managing documentation in the event of a dispute.

Finally, we will explore the best practices for reducing chargeback risk and managing documentation in the event of a dispute.

Conclusion

Managing customer disputes is a strategic activity that every merchant must master to thrive in today’s market. Disputes and chargebacks, while a protection for consumers, represent a significant challenge in terms of time, cost, and reputation. Tackling this phenomenon requires a dual approach that combines prevention with efficient management of disputes when they arise. Adopting transparent policies, investing in secure payment technologies, and offering impeccable customer service are the cornerstones for minimizing the incidence of chargebacks.

When a dispute is unavoidable, it is essential to respond quickly, methodically, and with irrefutable supporting documentation. Leveraging the tools made available by the European regulatory framework, such as the ODR platform, can offer a faster and less expensive resolution path. For Italian merchants, the key to success lies in knowing how to merge technological innovation with the traditional culture of customer care, building solid, trust-based relationships that are the best insurance against disputes. Effective dispute management is not just a defense, but an opportunity to improve and strengthen one’s business.

Frequently Asked Questions

A chargeback is the forced reversal of funds to a customer who disputes a transaction directly with their bank or card issuer. Unlike a refund handled directly with you, a chargeback involves financial institutions. You should be concerned because you not only lose the revenue from the sale, but you may also have to pay additional fees for handling the dispute. A high number of chargebacks can also damage your store’s reputation with payment networks.

Prevention is based on transparency and communication. Ensure you have detailed product descriptions, and clear and easily accessible shipping and return policies. Use a recognizable name on the customer’s bank statement to avoid confusion. Offer excellent and easy-to-contact customer service so that customers turn to you before initiating a dispute. It is also crucial to use secure payment systems, such as those with 3D Secure authentication, to reduce the risk of fraud.

As soon as you receive a notification, the first thing to do is analyze the reason for the dispute, usually indicated by a specific code. Next, you have a limited time (often between 7 and 45 days) to decide whether to accept the loss or contest the chargeback. If you decide to fight it, you must gather all the evidence in your favor to prove the charge’s legitimacy. Acting quickly is crucial, because failing to respond within the deadline means automatically losing the dispute.

To have a good chance of winning a dispute, you must provide compelling evidence. Essential documentation includes: the sales receipt, proof of delivery with a tracking number (crucial for ‘merchandise not received’ disputes), any communications with the customer (emails, chats), and the description of the product or service purchased. It is also helpful to show proof that the customer agreed to the terms and conditions at the time of purchase.

The time to provide the initial documentation is usually short, ranging from 7 to 45 days depending on the card network (e.g., Visa, Mastercard). The entire resolution process, however, can be much longer. After you submit your evidence, the customer’s bank reviews it and makes a decision. This can take anywhere from a few weeks to 60-75 days, and in some cases even longer, before a final conclusion is reached.

Still have doubts about Disputes: A Merchant’s Guide to Managing Contested Charges?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.