NEW YORK — U.S. stock index futures pointed to a lower opening on Monday, February 2, 2026, as Wall Street braced for a pivotal week of corporate earnings and digested unsettling news from the technology sector. The negative sentiment was compounded by fresh questions regarding the Federal Reserve’s future policy path following the nomination of a new chairperson. Search interest in "Dow Jones stock markets futures" spiked early Monday, reflecting heightened investor anxiety as the blue-chip index futures shed over 350 points in pre-market trading.

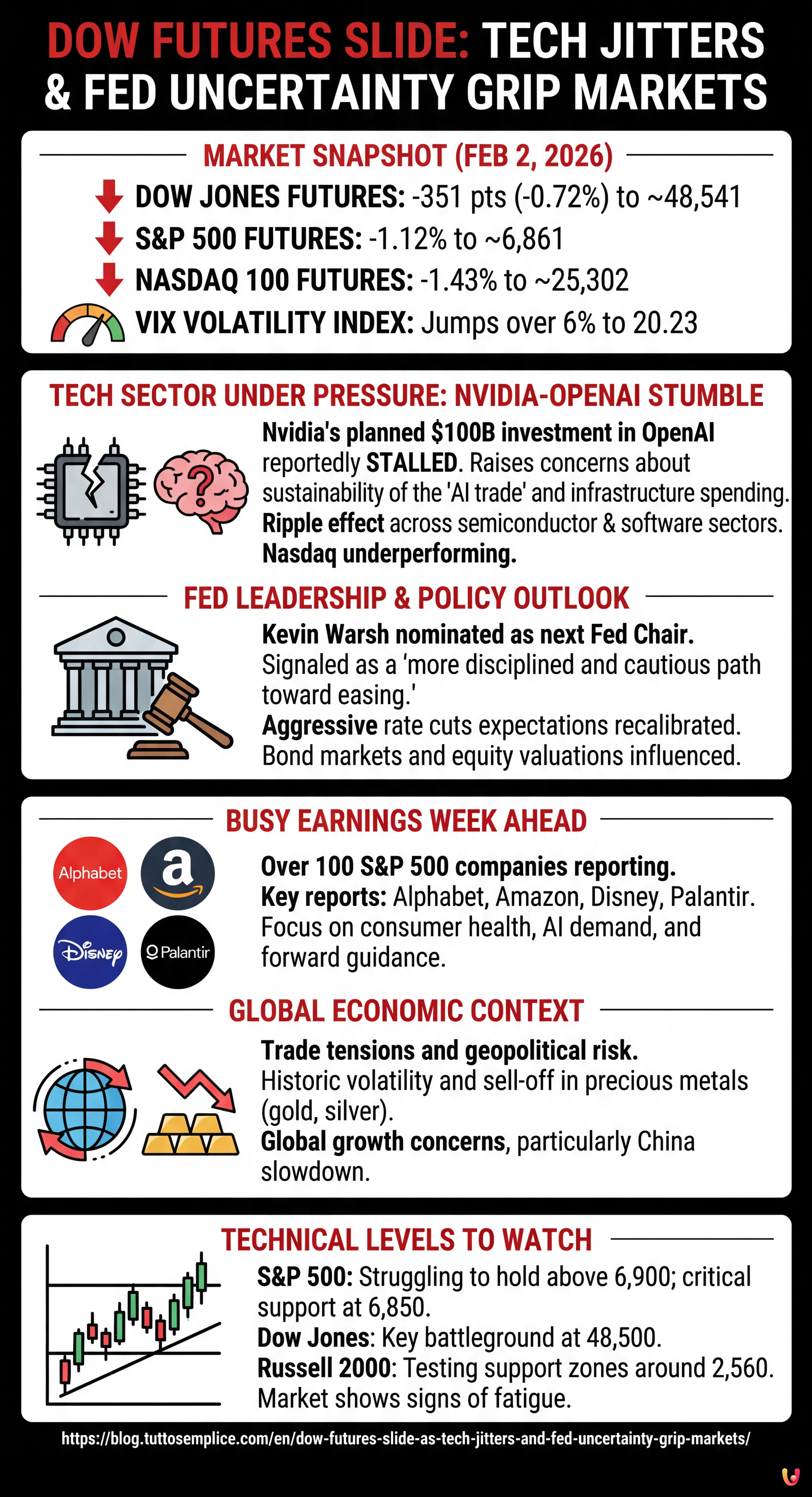

According to data from Investing.com, Dow Jones Industrial Average futures fell approximately 351 points, or 0.72%, to trade around 48,541. The broader market showed even significant weakness, with S&P 500 futures declining 1.12% to 6,861, and the tech-heavy Nasdaq 100 futures tumbling 1.43% to 25,302. The volatility comes as traders return from the weekend to face a "busy earnings calendar," with more than 100 S&P 500 companies scheduled to report results this week, including industry titans like Alphabet, Amazon, and Disney.

The market’s retreat from recent highs underscores the fragility of the current rally, which has been heavily reliant on the artificial intelligence narrative and hopes for monetary easing. With the VIX volatility index jumping over 6% to 20.23, investors are clearly hedging against potential downside risks in the days ahead.

Tech Sector Under Pressure: The Nvidia-OpenAI Stumble

A primary catalyst for Monday’s pre-market sell-off appears to be a developing story involving the semiconductor giant Nvidia. According to reports cited by Trading Economics, Nvidia’s ambitious plans to invest $100 billion in OpenAI have reportedly stalled. This unexpected hurdle has raised fresh concerns about the sustainability of the "artificial intelligence trade" that has powered much of the stock market’s gains over the past two years. Investors are reassessing the growth trajectory of AI infrastructure spending, causing a ripple effect across the semiconductor and software sectors.

The stalled deal has cast a shadow over the Nasdaq, which was already underperforming relative to the Dow and S&P 500. "The inability to reclaim new highs while the S&P 500 touches 7,000 is a warning sign that concentration in mega-cap tech has reached the point where incremental buyers are harder to find," noted analysts at TradingNEWS. With high-stakes earnings reports due later this week from Alphabet (Google), Amazon, and AMD, the market is on edge, fearing that any sign of slowing growth or reduced capital expenditure could trigger a deeper correction.

Fed Leadership and Monetary Policy Outlook

Beyond the corporate headlines, the macroeconomic landscape remains a significant source of uncertainty. Markets are reacting to President Donald Trump’s nomination of Kevin Warsh as the next Chair of the Federal Reserve. According to Trading Economics, Wall Street views this move as a signal for a "more disciplined and cautious path toward easing." While the current Fed recently left interest rates unchanged in its late January meeting, the prospect of a Warsh-led central bank suggests that the aggressive rate cuts some investors had hoped for might not materialize as quickly as anticipated.

This shift in expectations is influencing bond markets and equity valuations alike. Investors are closely monitoring inflation data, looking for evidence that price stability is being maintained without stifling economic growth. The nomination has introduced a new variable into the equation, forcing traders to recalibrate their models for the coming year. The 10-year Treasury yield remains a key metric to watch, as any spike in yields could further pressure the high-valuation growth stocks that dominate the major indices.

Earnings Season Intensifies

The week of February 2, 2026, is set to be one of the busiest of the quarter. According to Investing.com, investors are preparing for a deluge of reports that will offer a health check on the American consumer and the corporate sector. In addition to the tech giants, companies like Disney and Palantir Technologies are set to release their figures. These reports will be scrutinized not just for top-line revenue and earnings per share, but for forward-looking guidance regarding trade conditions and consumer demand.

The retail and entertainment sectors, represented by companies like Disney, will provide insight into whether consumer spending is holding up despite the lingering pressures of inflation. Meanwhile, Palantir’s results will be another litmus test for the enterprise software and AI demand, serving as a secondary data point to the Nvidia news. A disappointment from any of these heavyweights could exacerbate the negative momentum seen in the futures markets.

Global Economic Context: Trade and Commodities

Global factors continue to weigh on investor sentiment. Recent tensions regarding trade tariffs, specifically the "Greenland tariff threat" mentioned in market reports from late January, have added a layer of geopolitical risk. While some of the immediate angst has eased following a framework deal, the underlying friction remains a concern for multinational corporations with significant exposure to global supply chains.

Furthermore, the commodities market is witnessing historic volatility. Reports indicate a "historic crash in gold, silver, and other metals," which has triggered cross-asset margin calls and liquidity adjustments. This sell-off in precious metals is unusual during periods of stock market weakness, suggesting that investors might be raising cash indiscriminately or reacting to a strengthening U.S. dollar driven by the hawkish Fed outlook. The GDP growth outlook for major economies, particularly China, also remains in focus, with recent data suggesting a slowdown that could dampen global demand for raw materials and industrial goods.

Technical Levels to Watch

From a technical analysis perspective, the major indices are testing critical support levels. The S&P 500, having briefly flirted with the psychological 7,000 mark, is now struggling to hold above 6,900. According to TradingNEWS, the index is "sitting at extreme price levels with clear signs of fatigue." A decisive break below the 6,850 support zone could open the door to a more significant retracement.

For the Dow Jones Industrial Average, the 48,500 level is a key battleground. The index has been relatively resilient compared to the Nasdaq, but the broad-based selling pressure on Monday suggests that defensive sectors are not immune to the current bout of risk aversion. The Russell 2000, which tracks small-cap stocks, also retreated, testing support zones around 2,560. Analysts suggest that while the primary uptrend for small caps remains intact, the near-term outlook is one of consolidation.

In Brief (TL;DR)

Dow futures slid over 350 points as Wall Street braced for high-stakes earnings reports from industry titans like Alphabet and Amazon.

Sentiment soured on news that Nvidia’s planned investment in OpenAI stalled, raising fears about the sustainability of the AI trade.

Markets also reacted nervously to Kevin Warsh’s nomination as Fed Chair, signaling a potentially slower path for interest rate cuts.

Conclusion

As the trading day begins on February 2, 2026, the stock market faces a confluence of headwinds. The combination of stalled AI investments, uncertainty over the Federal Reserve’s future leadership, and a high-stakes earnings calendar has prompted a sharp pullback in Dow Jones futures and broader market indices. While the long-term trends for equities remain positive, the immediate outlook suggests a period of heightened volatility and caution. Investors will be listening closely to corporate guidance and economic data releases this week to determine if this pullback is a healthy correction or the start of a more prolonged downturn. As always, prudent risk management remains essential in navigating these turbulent financial waters.

Frequently Asked Questions

The market decline is primarily driven by a stalled 100 billion dollar investment deal between Nvidia and OpenAI, which has raised doubts about the sustainability of the AI trade. Furthermore, the nomination of Kevin Warsh as Federal Reserve Chair has introduced uncertainty regarding the pace of future interest rate cuts, causing investors to reduce risk ahead of a busy earnings week.

The reported pause in the massive investment partnership suggests potential hurdles in the growth trajectory of AI infrastructure spending. This news has caused a ripple effect across the semiconductor and software sectors, leading investors to question whether the artificial intelligence rally has reached a saturation point where incremental buyers are becoming harder to find.

Wall Street interprets the nomination of Kevin Warsh as a move toward a more disciplined and cautious path regarding monetary easing. Consequently, traders are recalibrating their expectations, fearing that the aggressive rate cuts previously hoped for might not materialize, which places renewed pressure on bond markets and high-valuation growth stocks.

Investors are bracing for a heavy volume of reports from over 100 S&P 500 companies, including major tech giants like Alphabet and Amazon, as well as consumer-focused firms like Disney. These results will serve as a critical health check on the American consumer and corporate demand for AI, potentially determining the near-term direction of the broader market indices.

Technical analysis indicates that the S&P 500 is testing support near the 6,900 level, with a breach below 6,850 potentially signaling a more significant correction. Simultaneously, the Dow Jones Industrial Average is fighting to maintain the 48,500 level, while the Russell 2000 small-cap index is consolidating around its own support zones near 2,560.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.