In Brief (TL;DR)

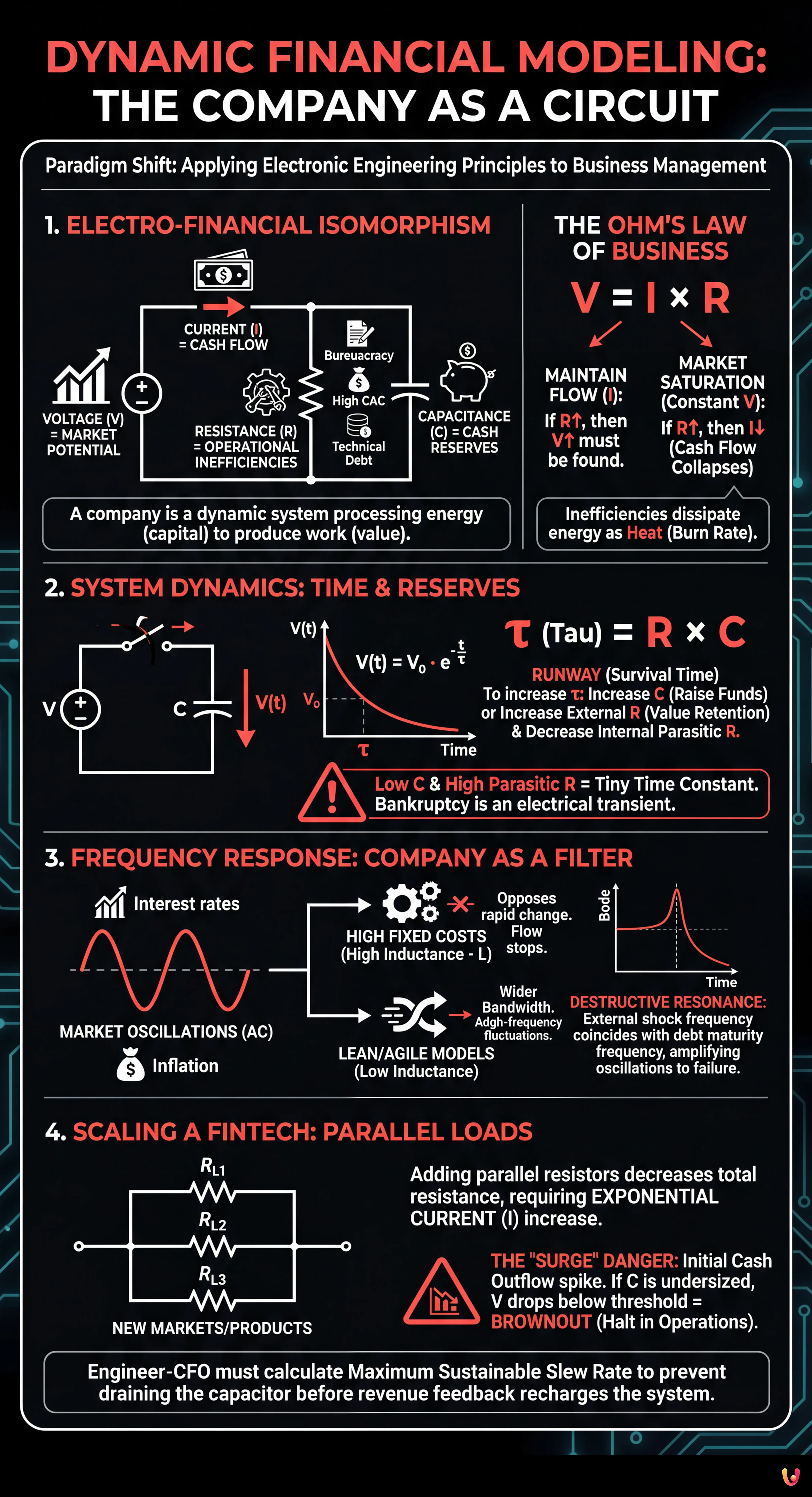

Traditional modeling evolves by applying electronic engineering principles to treat the company as a dynamic and complex system.

Fundamental variables like voltage and resistance are mathematically redefined to monitor cash flows and critical operational inefficiencies.

The use of differential equations and frequency analysis offers superior predictions on solvency and resilience to economic shocks.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In the economic landscape of 2026, traditional financial modeling based on static spreadsheets is showing all its limitations. In an era dominated by high-frequency trading algorithms and increasingly short innovation cycles, treating a company as a series of cells in a spreadsheet is an obsolete approach. As a Senior Editor and complex systems analyst, I propose a radical paradigm shift: applying the principles of electronic engineering to business management.

This thought leadership article explores how differential equations and circuit theory can predict the solvency of a scaling Fintech with greater precision than classical accounting.

1. Beyond the Metaphor: Electro-Financial Isomorphism

We are not talking about simple poetic analogies, but mathematical isomorphisms. A company is a dynamic system that processes energy (capital) to produce work (value). To build robust financial modeling, we must redefine the fundamental variables:

- Voltage (V) = Market Potential: The potential difference driving the business. It is customer demand or Product-Market Fit. Without voltage, there is no flow.

- Current (I) = Cash Flow: The actual movement of money through the organization.

- Resistance (R) = Operational Inefficiencies: Everything hindering the flow: high customer acquisition costs (CAC), bureaucratic processes, organizational bloatware, or technical debt.

- Capacitance (C) = Cash Reserves: The company’s capacity to store energy (money) to release it when voltage drops.

The Ohm’s Law of Business

In its simplest form, Ohm’s law ($V = I times R$) tells us that to maintain a constant cash flow ($I$), if internal resistances ($R$) increase, we must necessarily find a higher market potential ($V$). If the market is saturated (constant V) and inefficiencies increase, cash flow collapses. It is elementary physics, yet many startups ignore that their cost structure is a resistance dissipating energy in the form of heat (burn rate).

2. System Dynamics: The Role of the Capacitor (Cash Reserves)

Traditional accounting is a static photograph. Engineering is a movie. Let’s introduce time ($t$) into the equation. In an RC (Resistor-Capacitor) circuit, current is not instantaneous but depends on the capacitor’s charge.

The equation governing the stability of a Fintech is similar to that of a discharging capacitor:

V(t) = V₀ * e^(-t/τ)

Where $tau$ (Tau) is the system’s time constant, given by $R times C$.

In systemic financial modeling:

- τ (Tau) represents the survival time (Runway) in the absence of new revenue.

- To increase $tau$, a CFO can increase $C$ (raise funds, fill the capacitor) or, more virtuously, increase $R$ understood as load resistance towards the outside (retaining value) and decrease internal parasitic resistance.

A company with low capacitance ($C$) and high internal resistance (parasitic $R$) has a tiny time constant: at the first market shock (drop in $V$), voltage goes to zero instantly. Bankruptcy is an electrical transient phenomenon.

3. Frequency Response: The Company as a Filter

Here we enter the territory of advanced predictive analytics. Markets are not direct current (DC); they are alternating current (AC). ECB interest rates, inflation, and consumer sentiment oscillate with different frequencies.

Every company has its own Frequency Response. How does your business model react to a sudden rate hike (step impulse) compared to a slow decline in demand (low frequency)?

Cost Structure and Bandwidth

We can model the company as a Low-Pass Filter:

- High Fixed Costs (High Inductance – L): Heavy companies (e.g., traditional manufacturing) have high “inductance”. They oppose rapid current changes. If the market changes direction quickly (high frequency), the company cannot follow the signal. The flow stops.

- Lean/Agile Models (Low Inductance): Modern Fintechs try to minimize inductance. This allows for a wider “bandwidth”: the company can adapt to high-frequency market fluctuations without breaking the circuit.

A frequency response analysis (Bode Plot of the business) would reveal that many companies fail not due to lack of profit, but due to destructive resonance: the frequency of external shocks coincides with the natural frequency of debt maturities, amplifying oscillations until structural failure.

4. Case Study: Scaling a Fintech in 2026

Let’s imagine a Fintech that needs to scale. In classical financial modeling, linear growth is projected. In our circuit model, scaling is the addition of loads in parallel to the network.

Every new market or product is an additional load resistance ($R_L$) connected in parallel. Physics teaches us that adding resistors in parallel decreases the total equivalent resistance, requiring an exponential increase in current ($I$) to maintain stable voltage ($V$).

The Danger of the “Surge”: When a new market opens (the switch closes), a current spike (Cash Outflow) occurs. If the capacitor ($C$ – Liquidity) is not sized for this transient, the system voltage collapses below the minimum operating threshold (Brownout), leading to a halt in operations.

Equations for Stability

To prevent this, the Engineer-CFO must calculate the maximum sustainable Slew Rate: the maximum speed at which cash outflows can grow without draining the capacitor before the revenue feedback loop (the signal return) recharges the system.

Conclusions: Towards Systemic Finance

Adopting an engineering vision allows us to see the company not as a list of accounting entries, but as a living, pulsating, and reactive machine. Circuit-based financial modeling offers superior diagnostic tools:

- Identifies parasitic resistances invisible in the P&L.

- Calculates true resilience to shocks (capacitance and inductance).

- Predicts dynamic breaking points (transients) that escape static analyses.

In an interconnected world, where information transmission speed is instantaneous (like a low-latency Bluetooth signal), managing a company with static tools is like navigating space with a road map. It is time to switch to dynamic control systems.

Frequently Asked Questions

Dynamic financial modeling is an innovative approach applying electronic engineering and physics principles to business management, overcoming the limits of static spreadsheets. In this model, the company is analyzed as a complex system where capital is energy and financial variables correspond to electrical quantities, allowing prediction of solvency and resilience to market shocks with greater precision than classical accounting.

In the business context, Ohm’s Law suggests that to maintain a constant cash flow, identified as Current, it is necessary to balance market potential, meaning Voltage, with operational inefficiencies, acting as Resistance. If internal resistances like bureaucracy or acquisition costs increase, the company must find a market with higher potential or risk dissipating financial energy as burn rate, compromising system stability.

Liquidity reserves are equated to a capacitor in an electrical circuit, with the fundamental function of storing energy to release it when market voltage drops. This capacitor’s capacity determines the system’s time constant, directly influencing the company’s runway, meaning the operational survival time in the absence of new revenue before business voltage drops to zero.

Analyzing the market as an alternating current system, a company may fail not due to lack of profit but due to inadequate frequency response. Destructive resonance occurs when the frequency of external shocks, such as inflation or interest rates, coincides with the natural frequency of internal debt maturities, amplifying financial oscillations until causing a structural breakdown of the organization.

Scaling is seen as adding resistive loads in parallel to the corporate network, an operation that reduces total resistance but requires an exponential increase in cash current to maintain stability. The main risk is the occurrence of an initial absorption spike which, if not supported by an adequately sized liquidity capacitor, can lead to a sudden drop in operating voltage, causing an activity halt known as brownout.

Sources and Further Reading

- Wikipedia: Econophysics – The interdisciplinary field applying theories of physics to economics

- Federal Reserve Board: Financial Stability and Stress Testing

- Wikipedia: System Dynamics – Approach to understanding the nonlinear behavior of complex systems

- Financial Stability Board (FSB): Financial Innovation and Fintech

- Wikipedia: RC Circuit – Mathematical basis for the time constant and capacitor discharge models

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.