Online financial scams are a constantly growing phenomenon affecting millions of people, causing huge financial losses and deep emotional wounds. But why, despite being increasingly informed, do we continue to fall into the traps of cybercriminals? The answer lies in psychology. Scammers don’t just attack our bank accounts; they exploit our deepest emotions and vulnerabilities. Through refined manipulation techniques, they leverage feelings like fear, greed, urgency, and the desire for trust, pushing us to take irrational actions. Understanding these mechanisms is not just an intellectual exercise, but the first and most fundamental step in building a solid defense against digital threats.

Social engineering is the scammers’ main weapon: a manipulative art that targets the weakest link in any security system—the human being. Instead of hacking computer systems, criminals manipulate people into handing over the access “keys.” This approach is so effective because it exploits our psychological nature: the tendency to trust, the desire to help, and the impulsive reaction to high-pressure situations. The result is that victims, deceived by communications that appear legitimate, end up revealing sensitive data or making fraudulent payments. In a cultural context like the Mediterranean, where interpersonal trust and respect for authority are deep-rooted values, these techniques find even more fertile ground.

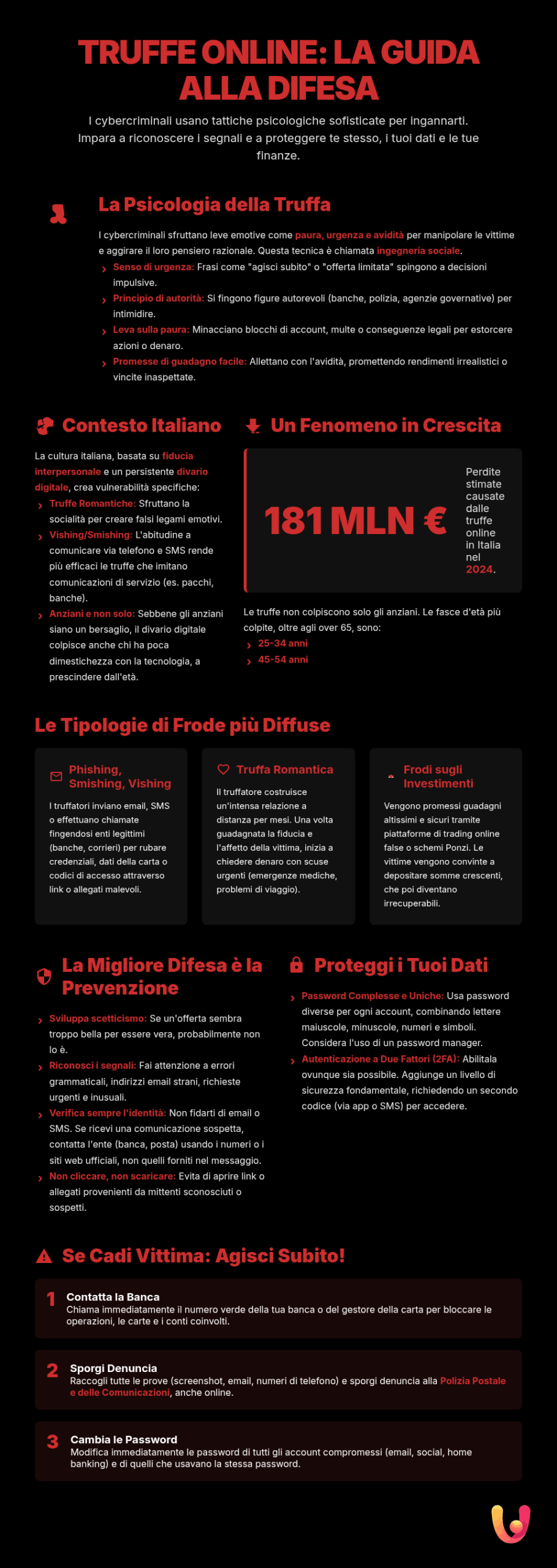

The Psychological Levers of Manipulation

Cybercriminals are masters at using our emotions as lockpicks to bypass our defenses. Their strategies are based on universal psychological principles, cleverly adapted to the digital world. Understanding these levers is essential to recognizing a scam attempt before it’s too late. Their favorite baits are urgency, fear, and greed.

Urgency and Scarcity: Acting Without Thinking

One of the most common tactics is to create a false sense of urgency. Messages like “limited-time offer” or “act now to avoid account closure” are designed to push us into making hasty decisions, bypassing critical thinking. This psychological pressure compromises our ability for rational evaluation, leading us to click on malicious links or provide personal data without due caution. The fear of missing a unique opportunity or suffering a negative consequence makes us vulnerable and more inclined to obey fraudulent requests, a particularly insidious technique in online shopping where “too good to be true” offers are often a red flag.

Fear and the Principle of Authority: Submission to Deceit

Fear is a powerful emotion that scammers skillfully exploit. Posing as representatives of authoritative institutions like banks, law enforcement, or government agencies, they send alarming communications that threaten legal action or the suspension of essential services. This leverages our innate respect for authority and fear of consequences. The victim, scared and confused, tends to obey without questioning the legitimacy of the request. A classic example is the phishing email that appears to come from one’s own bank and, in a peremptory tone, asks to update credentials to avoid account suspension.

Greed and Desire: The Promise of Easy Money

The prospect of quick and easy money is an almost irresistible bait. Scams related to miracle investments, unexpected lottery winnings, or job opportunities with exorbitant earnings leverage our desire to improve our financial situation. Ponzi schemes, for example, promise high, low-risk returns, paying early investors with money from new ones, in a house of cards destined to collapse. These scams thrive because they feed the illusion of being able to get great rewards with minimal effort, clouding judgment and risk perception.

The Italian Context: Tradition, Trust, and Innovation

The landscape of financial scams in Italy is set in a unique cultural context, where a strong connection to tradition clashes with a rapid and sometimes disorderly digital transition. This dualism creates specific vulnerabilities that cybercriminals know how to exploit. The Mediterranean culture, based on trust, personal relationships, and a certain skepticism toward new things, shapes how people interact with technology and, consequently, how they fall into online traps.

The Weight of Tradition and Misplaced Trust

In Italian culture, trust is often built on personal relationships and reputation. Scammers know this and adapt their strategies accordingly. For example, in romance scams, criminals invest time in building a deep emotional bond with the victim, exploiting the desire for connection and loneliness. They present themselves as trustworthy people, often inventing dramatic stories to elicit empathy and solidarity, before moving on to asking for money. This approach leverages a traditional value like mutual help, turning it into a weapon of manipulation. The tendency to trust figures perceived as authoritative, such as a self-proclaimed doctor or soldier, also plays a crucial role.

The Impact of Innovation and the Digital Divide

Rapid digitalization has caught a part of the population unprepared, especially the older demographics, creating fertile ground for fraud. Many, despite using digital tools for daily tasks, do not have a full awareness of the associated risks. Scammers exploit this “digital illiteracy” with techniques like vishing (phone scams) or smishing (fraudulent SMS), where they pose as bank operators or technicians to steal codes and passwords. Familiarity with phone calls as a traditional means of communication, combined with a poor understanding of cybersecurity practices, makes these scams particularly effective. The result is a paradox: the innovation that should simplify life becomes a gateway for new and more sophisticated threats.

The Most Common Types of Scams and Crime Statistics

Online scams are a diverse and ever-evolving universe, but some types consistently prove to be the most dangerous and profitable for criminals year after year. In Italy, the phenomenon has reached alarming proportions, with millions of citizens affected and economic damages exceeding hundreds of millions of euros. Data from the Postal Police and various industry studies paint a worrying picture, highlighting that no one is truly immune.

In 2024 alone, online scams stole approximately 181 million euros, a 32% increase from the previous year. One study estimated that about 2.8 million Italians were involved in online shopping fraud, with total damages exceeding 500 million euros. Contrary to what one might think, victims are not just the elderly: the most affected age groups are those between 25 and 34 and between 45 and 54. The most used techniques include counterfeit websites, deceptive emails, and social media messages, which have become a preferred channel for scammers.

Phishing, Smishing, and Vishing: Digital Identity Theft

Phishing, along with its variants smishing (via SMS) and vishing (via phone), remains one of the most pervasive threats. These social engineering techniques aim to deceive the victim into revealing personal information, financial data, or login credentials. The scammer poses as a legitimate entity, like a bank or a courier, and with a credible pretext (e.g., a package for delivery, a problem with an account) pushes the victim to click on a fraudulent link or share sensitive data. The sophistication of these attacks is increasing, with clone emails and websites that are nearly identical to the originals, making them harder and harder to distinguish.

Romance Scams: When Love is a Trap

Romance scams are among the most emotionally devastating scams. Criminals create fake profiles on social media or dating sites to start a long-distance relationship. After building a bond of trust and affection, they start asking for money with various excuses: a medical emergency, a work problem, or the need for funds to finally meet the victim. In Italy, this type of scam has caused millions of euros in losses. The psychological impact is profound: victims not only lose money but also feel betrayed, humiliated, and guilty for their own naivety.

Investment Fraud: The Mirage of Easy Money

Scams related to online investments, particularly in the trading and cryptocurrency sectors, are growing rapidly and cause the most significant financial damage. Scammers promise stratospheric and guaranteed returns, luring victims to fake platforms where every investment appears to be profitable. In reality, the money is simply pocketed by the criminals. When the victim tries to withdraw their funds, they discover it’s impossible and that the supposed brokers have disappeared. These frauds are often promoted through deceptive online advertising and exploit the perceived complexity of the financial world to deceive even less experienced investors. The promise of quick enrichment remains one of the most effective psychological baits.

How to Protect Yourself: Prevention and Awareness Strategies

The best defense against financial scams is prevention. Although cybercriminals use increasingly sophisticated techniques, adopting a critical approach and following some fundamental rules can drastically reduce the risk of falling into a trap. Awareness is the first line of defense: understanding how scammers operate and which psychological levers they exploit allows us to recognize the warning signs and act with caution. It’s not about becoming paranoid, but about developing a healthy digital skepticism.

Recognizing the Red Flags

Learning to identify the signs of a potential scam is the first step to protecting yourself. Always be wary of communications that create an unjustified sense of urgency, contain grammatical or formatting errors, and promise offers that are too good to be true. Always verify the sender’s identity: an email that seems to come from your bank but has a strange address is a clear red flag. Likewise, be skeptical of sudden requests for money, even if they come from people you’ve connected with online. Remember that legitimate institutions will never ask you to provide passwords or sensitive data via email or SMS. For advanced protection, consider using tools like disposable virtual cards, which limit risks during online purchases.

Protecting Your Data and Identity

Protecting your personal data is crucial. Use complex, unique passwords for each account, and always enable two-factor authentication (2FA), which adds an extra layer of security. Avoid sharing personal information on social media, as scammers can use it to make their attacks more credible. Be careful when using public Wi-Fi networks, as they can be insecure and used by criminals to intercept your data. It is also good practice to periodically check your bank account and credit card statements to promptly identify any suspicious transactions. In case of a stolen or lost card, it is essential to act immediately by blocking it and filing a report.

What to Do If You Fall Victim to a Scam

If, despite all precautions, you fall victim to a scam, it is crucial to act quickly. The first thing to do is to immediately contact your bank or credit card issuer to block any transactions and attempt to recover the funds. Immediately after, it is crucial to file a report with the Postal Police, providing all available evidence (emails, screenshots, phone numbers). This is not only necessary to start the investigation but also helps authorities map the phenomenon and protect other potential victims. Finally, do not underestimate the emotional impact: talking about it with trusted people or seeking professional help can help overcome the feelings of guilt and shame that often accompany these experiences.

In Brief (TL;DR)

Cybercriminals leverage emotions like greed, urgency, and fear to orchestrate their scams and manipulate your decisions.

The mechanism is based on specific psychological levers, such as a sense of urgency, fear, and greed, which criminals exploit to bypass our rational thinking.

Knowing the psychological levers they exploit is the first step to learning how to recognize and defend yourself against them.

Conclusion

Online financial scams are not just a technical problem, but a phenomenon deeply rooted in human psychology. Cybercriminals have perfected the art of manipulating our emotions, exploiting fears, desires, and vulnerabilities to bypass our rational defenses. The Italian context, with its mix of tradition, interpersonal trust, and a not-always-conscious adoption of new technologies, presents unique challenges. The data show an alarming reality, with millions of people affected and huge economic damages each year, proving that no one can consider themselves completely safe.

However, knowledge is power. Understanding the psychological levers used by scammers, such as urgency, fear, and the promise of easy money, is the first step to neutralizing them. Adopting digital security practices, like using strong passwords and two-factor authentication, and above all, developing a healthy skepticism toward unsolicited communications, are the most effective weapons at our disposal. Education and awareness represent the strongest defense, transforming every citizen from a potential victim into a strong link in the digital security chain. The battle against scams is won first and foremost in our minds.

Frequently Asked Questions

No one is immune to financial scams because criminals don’t leverage intelligence, but emotions. Through psychological manipulation techniques, they induce a state where emotion (like fear, greed, or urgency) overrides rationality. In these moments, the ability for critical analysis is drastically reduced, leading anyone, regardless of their education level, to take impulsive and harmful actions.

Scammers exploit universal human vulnerabilities. The most common levers include: the principle of authority, by posing as representatives of banks or law enforcement; a sense of urgency, to prevent the victim from thinking; the lever of fear, by threatening account freezes or penalties; greed, by promising easy and disproportionate gains; and finally, social proof, by using fake reviews to create an illusion of legitimacy.

To protect yourself, it’s essential to develop a “healthy skepticism.” Before taking any action, especially if requested urgently, stop and take time to think. Always ask yourself: “Is this too good to be true?”. Be wary of anyone who contacts you unsolicited asking for personal data, passwords, or codes. Always verify the person’s identity through official and independent channels, never using the contact information provided in the suspicious message.

While the elderly can be a target due to less familiarity with technology or a tendency to be more trusting, they are not the only victims. In fact, recent statistics show an exponential growth in scams among young people, especially those related to online shopping, fake investments, and job offers. Vulnerability depends more on the psychological context of the moment than on age.

Speed is crucial. The first thing to do is immediately contact your bank or credit card issuer to block all transactions and, if possible, dispute the fraudulent ones. Immediately after, file a report with the Postal and Communications Police, providing all the details and evidence you have (screenshots, emails, phone numbers). Finally, it is advisable to change all your online account passwords, starting with your email.

Still have doubts about Emotional Scams: How Cybercriminals Manipulate You?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.