In Brief (TL;DR)

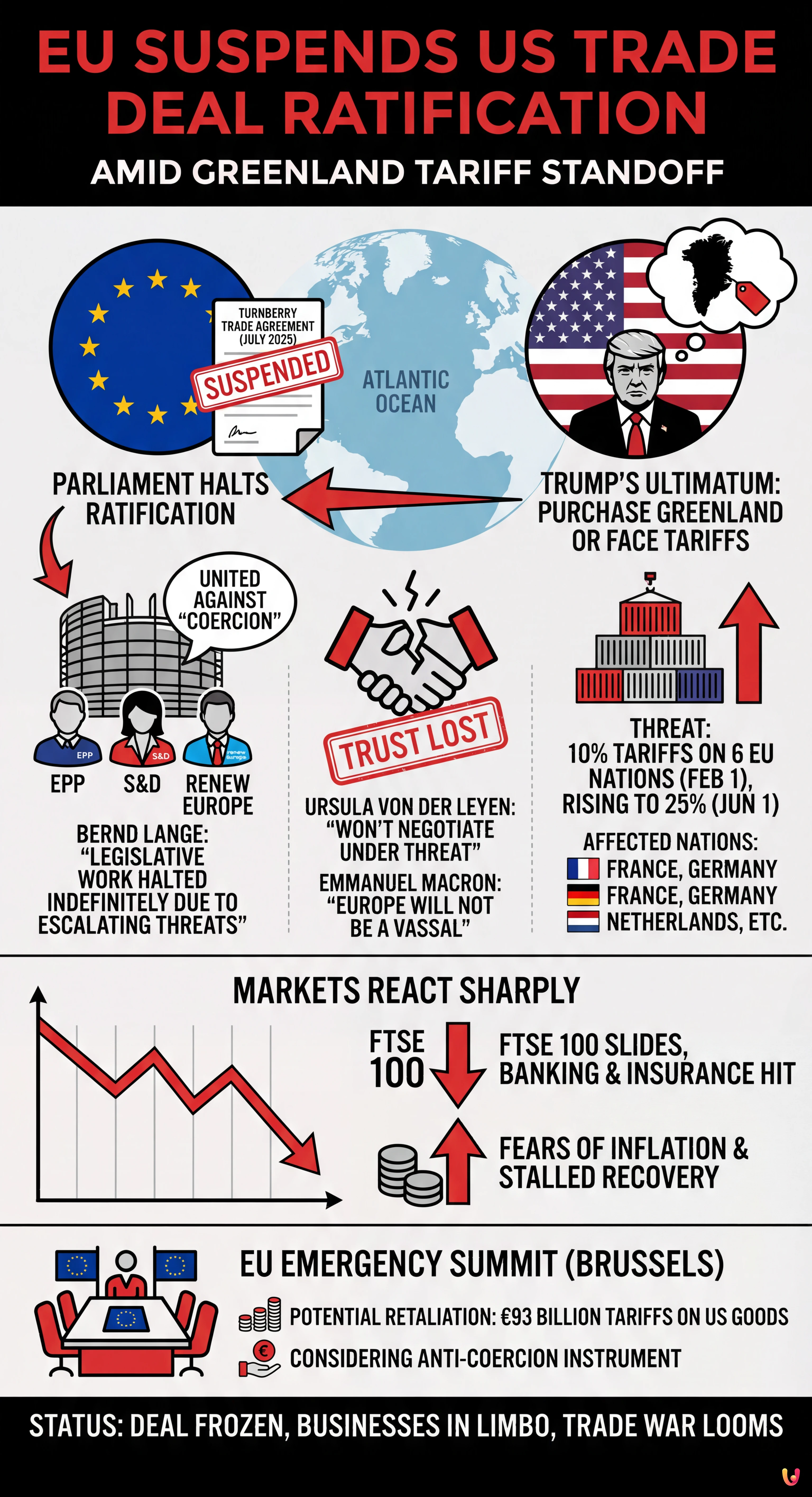

The European Parliament halted the US trade deal ratification following President Trump’s tariff threats regarding Greenland.

Washington issued an ultimatum imposing rising tariffs on European exports unless the bloc facilitates Greenland’s sale.

Investors fear a renewed trade war as European leaders convene to discuss potential retaliatory measures against coercion.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

The European Parliament has formally suspended the ratification process of the landmark trade agreement with the United States, plunging transatlantic economic relations into a fresh crisis. The decision, announced early Wednesday in Strasbourg, comes as a direct response to President Donald Trump’s threat to impose punitive tariffs on European exports unless the bloc acquiesces to his demands regarding the purchase of Greenland.

Markets reacted sharply to the escalating geopolitical tension, with the FTSE 100 becoming a trending search topic as the index fell significantly in early trading. Investors are rapidly reassessing the outlook for global finance and trade, fearing that a renewed tariff war could derail the fragile economic recovery and stoke inflation across the continent.

Parliament Unites Against “Coercion”

The suspension was confirmed by the leaders of the three main political groups in the European Parliament—the European People’s Party (EPP), the Socialists and Democrats (S&D), and Renew Europe—rendering a majority vote for the deal impossible. According to Bernd Lange, chair of the Parliament’s International Trade Committee, the legislative work on the agreement has been halted indefinitely.

“Given the continued and escalating threats, including tariff threats, against Greenland and Denmark, and their European allies, we have been left with no alternative but to suspend work on the two Turnberry legislative proposals,” Lange stated. He added that the US administration’s use of tariffs as a “coercive instrument” undermined the stability necessary for trade relations.

The deal, originally reached in July 2025 at President Trump’s Turnberry resort in Scotland, was intended to reduce US tariffs on European goods to a ceiling of 15% while eliminating EU duties on various American industrial exports. However, the agreement’s ratification is now frozen until Washington withdraws its latest ultimatum.

The Greenland Ultimatum

The diplomatic rupture follows President Trump’s announcement on Saturday that he would impose a 10% tariff on imports from six EU nations—including France, Germany, and the Netherlands—starting February 1. The President stated these levies would rise to 25% by June 1 unless the European Union facilitates the “complete sale of Greenland” to the United States.

European Commission President Ursula von der Leyen, who had negotiated the July accord, condemned the move during an address at the World Economic Forum in Davos. “When friends shake hands, it must mean something,” von der Leyen said, emphasizing that the EU would not negotiate under threat. “If one side changes the terms after the fact, trust is lost.”

French President Emmanuel Macron also weighed in, declaring that “Europe will not become anyone’s vassal” and describing the use of tariffs as leverage for territorial sovereignty as “unacceptable.”

Markets Rattle as FTSE 100 Slides

The uncertainty has sent shockwaves through global markets. The FTSE 100 in London saw heavy selling pressure, particularly in the banking and insurance sectors, which are sensitive to transatlantic economic flows. According to market data, the index dropped as investors sought safer assets, with gold miners being among the few gainers amidst the rout.

Analysts warn that if the 10% tariffs are implemented in February, the cost of doing business will rise, potentially dragging on GDP growth in both the UK and the Eurozone. “The uncertainty they instil is much worse than the tariffs themselves,” noted one market strategist. There are growing concerns that higher import costs could reignite inflation, forcing central banks to reconsider their interest rate paths for 2026.

Emergency Summit Called

In response to the crisis, EU member states are scheduled to meet at an emergency summit in Brussels on Thursday evening. Leaders will discuss potential countermeasures, which could include retaliatory tariffs on US goods worth approximately €93 billion. The bloc is also considering activating its anti-coercion instrument, a powerful legislative tool designed to combat economic blackmail, which has never been used before.

While the July 2025 deal promised a new era of economic cooperation, the current standoff suggests a return to protectionism. For now, businesses on both sides of the Atlantic are left in limbo, waiting to see if diplomacy can avert a full-scale trade war.

Conclusion

The suspension of the EU-US trade deal marks a significant deterioration in transatlantic relations, driven by unprecedented demands over Greenland. With the European Parliament united in its refusal to ratify the agreement under threat, and the US President doubling down on tariff warnings, the global economy faces a period of heightened volatility. As the FTSE 100 and other major indices react to the instability, the focus now shifts to the upcoming emergency summit in Brussels, where the EU will decide on its next steps to protect its economy and sovereignty.

Frequently Asked Questions

The ratification process was halted because the US President threatened to impose punitive tariffs unless the EU facilitates the purchase of Greenland. European leaders described this ultimatum as a form of coercion, stating that legislative work on the agreement cannot proceed while member states like Denmark face direct threats to their territorial sovereignty.

The FTSE 100 dropped significantly as investors sold off assets in the banking and insurance sectors, which are highly sensitive to transatlantic trade flows. Markets are reacting to fears that a renewed tariff war could stall economic recovery and increase inflation, prompting a shift toward safer investments such as gold miners.

The US administration announced plans to levy a 10% tariff on imports from six countries, including France, Germany, and the Netherlands, starting on February 1. These tariffs are scheduled to increase to 25% by June 1 if the European Union does not agree to the demands regarding the sale of Greenland.

European leaders are meeting to discuss potential retaliation, which may include imposing tariffs on US goods worth approximately 93 billion euros. Additionally, the bloc is considering the activation of its anti-coercion instrument, a powerful legislative tool designed to combat economic blackmail that has never been utilized before.

The agreement aimed to reduce trade barriers by capping US tariffs on European goods at 15% and eliminating EU duties on various American industrial exports. However, the implementation of these terms is now indefinitely frozen until Washington withdraws its ultimatum regarding Greenland and restores trust in the diplomatic process.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.