In Brief (TL;DR)

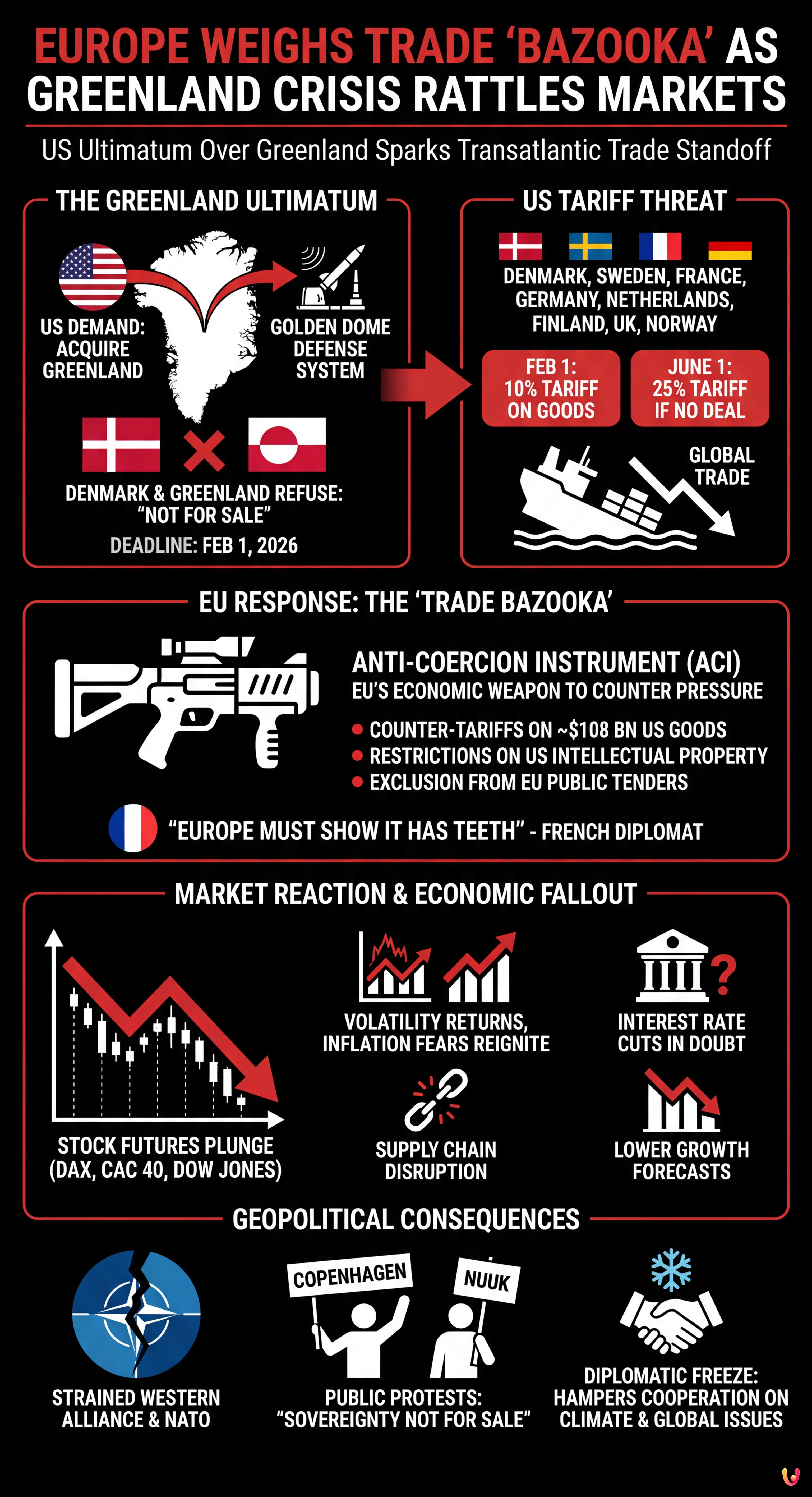

President Trump threatens sweeping tariffs on European nations if Denmark refuses to negotiate the sale of Greenland.

Global markets react with volatility as investors fear a transatlantic trade war could reignite inflation and slash growth.

Brussels is preparing to deploy its trade bazooka to retaliate against U.S. economic pressure and blackmail.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

BRUSSELS — The transatlantic alliance faces its most severe test in decades as European Union officials actively weigh deploying their most potent economic weapon—dubbed the trade "bazooka"—in response to an unprecedented ultimatum from the United States. As of Tuesday, January 20, 2026, tensions have reached a boiling point following President Donald Trump’s threat to impose sweeping tariffs on eight European nations if Denmark refuses to negotiate the sale of Greenland. The standoff has sent shockwaves through global finance, with "stock futures" becoming a top trending search as investors brace for a potential trade war that could derail global GDP growth.

The crisis, which has been simmering since the President renewed his interest in the Arctic territory earlier this month, escalated sharply over the weekend. According to reports from CNBC and Politico, the White House has set a deadline of February 1, 2026, for a deal to be reached. Failure to comply, the administration warned, will trigger a 10% tariff on goods from Denmark, Sweden, France, Germany, the Netherlands, Finland, the United Kingdom, and Norway, rising to 25% by June 1. In Brussels, the mood is one of defiance, with diplomats signaling that the era of appeasement is over.

Market reaction has been swift and negative. With the prospect of a full-blown trade war between the world’s two largest economic blocs, volatility has returned to the markets. Search volume for "stock futures" spiked overnight, reflecting deep anxiety among traders about the opening bells in Europe and New York. "We are looking at a scenario that could reignite inflation and slash growth forecasts across the board," noted a market strategist cited by CBC. As the clock ticks toward the February deadline, Europe is preparing to pull the trigger on its Anti-Coercion Instrument (ACI), a move that would fundamentally alter the landscape of international trade.

The Greenland Ultimatum

The catalyst for this diplomatic rupture is the renewed U.S. push to acquire Greenland, a semi-autonomous territory of the Kingdom of Denmark. While the idea was first floated during Trump’s previous term, the 2026 push is far more aggressive. According to Ground News, the President has linked the acquisition to U.S. national security, specifically the deployment of the proposed "Golden Dome" missile defense system. The administration argues that total control over the island is necessary to secure the Arctic against encroaching Russian and Chinese interests.

However, the proposal has been met with a firm refusal from Copenhagen and Nuuk. Greenland’s government issued a statement asserting that the island "is not for sale," a sentiment echoed by Danish Prime Minister Mette Frederiksen. In response, the U.S. administration escalated its tactics, threatening punitive tariffs on not just Denmark, but a coalition of European allies perceived as blocking the transfer. According to Politico, the inclusion of countries like the UK and Norway—who are not EU members but are NATO allies—complicates the geopolitical picture, though the EU is spearheading the continental response.

The specific tariff schedule is designed to exert maximum pressure. A 10% levy on key European exports starting February 1 would hit industries ranging from German automobiles to French luxury goods. If no agreement is reached by June, the rate would more than double to 25%. "This is economic statecraft turned into a blunt instrument," stated a trade analyst in an interview with Seeking Alpha. "The U.S. is effectively holding European industry hostage over a territorial dispute."

Deploying the ‘Bazooka’: The Anti-Coercion Instrument

Faced with what it describes as economic blackmail, the European Union is preparing to utilize its Anti-Coercion Instrument (ACI) for the first time against a major ally. Often referred to in Brussels corridors as the "trade bazooka," the ACI was adopted in 2023 specifically to counter countries that try to influence EU policy through economic pressure. According to the Financial Times, EU ambassadors met in Brussels on Monday to discuss the activation of the tool, which allows the bloc to impose countermeasures without a lengthy unanimous vote from all member states.

The potential retaliation is massive. Reports indicate the EU is drafting a list of U.S. goods worth approximately €93 billion ($108 billion) that could face immediate counter-tariffs. Furthermore, the ACI allows for more sophisticated sanctions beyond simple duties. According to Upstox, the measures could include restrictions on U.S. intellectual property rights, exclusion of American companies from EU public procurement tenders, and limitations on the operations of U.S. service providers within the single market.

French President Emmanuel Macron has been a vocal proponent of a strong response. Sources close to the Élysée Palace told Politico that Macron views the U.S. threat as "unacceptable" and is pushing for a unified European front. "Europe must show it has teeth," a French diplomat reportedly said. Additionally, the European Parliament has indicated it will suspend all work on the pending EU-U.S. trade deal, with a formal vote on the suspension scheduled for January 26.

Markets Recoil: Stock Futures and Inflation Fears

The escalation has rattled financial markets, which had priced in a period of relative stability for early 2026. The trending search for "stock futures" highlights the nervousness of investors who fear that a trade war will reverse recent gains in curbing inflation. If tariffs are implemented, the cost of imported goods would rise on both sides of the Atlantic, forcing central banks to potentially reconsider interest rate cuts planned for this quarter.

According to market data analyzed by CNBC, futures for the DAX in Germany and the CAC 40 in France slid significantly in pre-market trading. U.S. indices were not immune, with Dow Jones Industrial Average futures dipping as American exporters—particularly in the agriculture and technology sectors—faced the prospect of losing access to their most lucrative market. "The uncertainty is the killer here," explained a senior economist. "Businesses cannot plan for capital expenditure when the rules of trade might be rewritten in two weeks."

There is also concern about the broader impact on GDP. The OECD had forecast modest growth for the Eurozone in 2026, but a full-scale trade conflict could shave percentage points off that figure. The disruption to supply chains, already fragile from previous global shocks, could lead to shortages and price hikes for consumers. "We are looking at a supply-side shock that policymakers are ill-equipped to handle right now," warned a report from Seeking Alpha.

Geopolitical Fallout

Beyond the economics, the political damage to the Western alliance may be irreparable. The U.S. administration’s willingness to target NATO allies like Norway and the UK has raised questions about the future of collective security. According to Global News, protests have erupted in Copenhagen and Nuuk, with demonstrators carrying signs denouncing the "sale" of their sovereignty. The sentiment in Europe is shifting from shock to anger, with political leaders under immense pressure from their electorates to stand firm.

The "Golden Dome" defense project, which the U.S. cites as the justification for the Greenland purchase, is now a point of contention rather than cooperation. European defense officials argue that security cooperation should not be contingent on territorial concessions. "The U.S. is treating an ally like a distressed asset," noted an op-ed in the New York Times. This diplomatic freeze could hamper coordination on other critical issues, from climate change policy to containment strategies regarding other global superpowers.

Conclusion

As January 20, 2026, unfolds, the world watches Brussels and Washington with bated breath. The threat of a trade war, sparked by a dispute over Greenland, has moved from a remote possibility to an imminent reality. With the European Union readying its "trade bazooka" and the United States standing firm on its February 1 deadline, the global economy stands on a precipice. The coming days will determine whether diplomacy can prevail or if the transatlantic alliance will fracture under the weight of economic coercion. For investors monitoring stock futures and citizens worried about inflation, the stakes could not be higher.

Frequently Asked Questions

The term refers to the European Unions Anti-Coercion Instrument, or ACI. This economic tool allows the bloc to impose swift countermeasures, such as tariffs or restrictions on intellectual property, against countries attempting to influence EU policy through economic pressure. Unlike previous mechanisms, it enables the EU to act without requiring a unanimous vote from all member states, facilitating a faster and more unified response to external threats.

The United States administration has issued an ultimatum requiring Denmark to negotiate the sale of Greenland by February 1, 2026. The push is driven by national security interests, specifically the desire to control the Arctic territory for the deployment of the proposed Golden Dome missile defense system. When Denmark and Greenland rejected the proposal, the US threatened punitive tariffs on eight European nations to exert diplomatic pressure.

The threatened tariffs target a specific coalition of eight nations perceived as blocking US interests. This list includes EU members such as Denmark, Sweden, France, Germany, the Netherlands, and Finland. Additionally, the United States has included non-EU NATO allies, specifically the United Kingdom and Norway, complicating the geopolitical landscape and prompting a coordinated response led by officials in Brussels.

Financial markets have reacted negatively to the prospect of a trade war, with significant volatility observed in stock futures across Europe and the United States. Investors fear that new tariffs will disrupt supply chains and reignite inflation, forcing central banks to reconsider planned interest rate cuts. Analysts warn that a full-scale economic conflict could reduce GDP growth forecasts for the Eurozone and create a supply-side shock that policymakers may struggle to manage.

If no agreement regarding Greenland is reached by the deadline, the US administration has warned it will impose an initial 10 percent tariff on goods from the targeted European nations. This rate is scheduled to escalate to 25 percent by June 1 if the standoff continues. In retaliation, the EU is preparing to activate its Anti-Coercion Instrument to target approximately 108 billion dollars worth of US goods with counter-tariffs and other sanctions.

Sources and Further Reading

- European Commission: Protecting against coercion (ACI framework)

- European Commission: Protecting against coercion (The EU Anti-Coercion Instrument)

- European Commission: Official Overview of EU-Greenland Partnership and Critical Raw Materials Cooperation

- Office of the United States Trade Representative: Official Website

- Wikipedia: Anti-Coercion Instrument

- Wikipedia: Greenland

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.