In the vast universe of finance, beyond the traditional call and put options, there exists a category of more complex and customized instruments: exotic options. These derivatives are not simple standard contracts, but “tailor-made” financial products, created to meet specific hedging or speculation needs that conventional instruments cannot satisfy. In this field, financial innovation meets the tradition of risk management, giving rise to solutions that are as powerful as they are complex.

Exotic options differ from standard ones, known as “plain vanilla,” due to unconventional features that can affect the profit calculation (payoff), exercise dates, or even the underlying asset. Precisely because of their customized nature, they are predominantly traded on Over-The-Counter (OTC) markets, meaning through direct agreements between two parties, outside of regulated exchanges. Let’s imagine standard options as ready-to-wear clothes, suitable for many situations but not all; exotics, on the other hand, are like a high-fashion suit, custom-tailored for a specific objective.

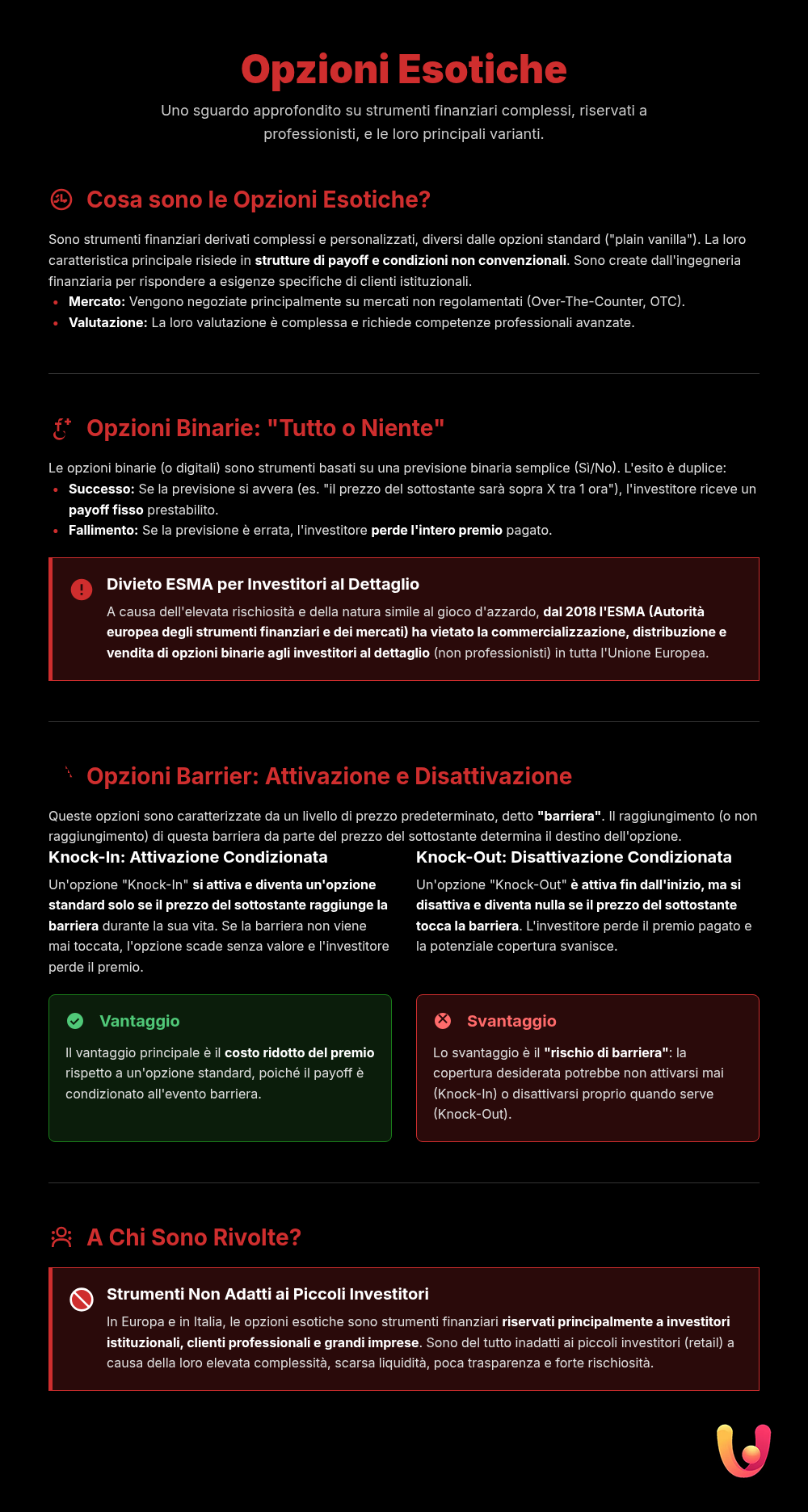

What Are Exotic Options?

An exotic option is a derivative contract that stands out from traditional options due to its unique structure and special conditions. Their complexity stems from the introduction of non-standard terms that modify how the option generates a profit or loss. These elements can include activation or deactivation conditions tied to specific price levels, value calculations based on the average price over a certain period (as in Asian options), or payoffs that depend on more than one underlying asset.

These instruments are the product of financial engineering, a discipline that applies mathematical and statistical models to create innovative financial products. Their purpose is to offer flexible solutions for managing particular risks, such as those related to high market volatility, or for implementing sophisticated speculative strategies. However, their complexity also entails higher risks and requires in-depth knowledge for informed use.

Financial Engineering: The Forge of Exotic Options

Financial engineering is the engine that drives the creation of exotic options. Specialized professionals, often called “quants,” use mathematical, statistical, and computational skills to design custom-made instruments for institutional clients like banks, investment funds, and large corporations. The goal is to build a payoff structure that perfectly matches a specific market view or a precise hedging need that standard options cannot meet.

These products are created to manage complex scenarios: an importing company might want to protect itself from excessive currency depreciation, but only up to a certain limit; a portfolio manager might want to benefit from low volatility. Exotic options provide answers to these needs.

The valuation of these instruments is inherently complex and often relies on extensions of classic models like the Black-Scholes model, incorporating advanced simulations and numerical calculations. This pricing complexity is one of the reasons why such instruments are generally reserved for professional investors, who have the necessary skills to correctly assess their risks and opportunities.

Binary Options: An “All-or-Nothing” Bet

Binary options represent one of the best-known, and most controversial, types of exotic options. Their operation is seemingly simple and is based on a “yes or no” proposition regarding the price movement of an underlying asset by a certain expiration date. The outcome is, indeed, binary: you either receive a predetermined fixed payoff, or you lose the entire invested capital (the premium).

How Binary Options Work

The mechanism is similar to a bet. The investor asks a question like: “Will the price of XYZ stock be above €50 in one hour?”. If the prediction is correct at expiration, they receive a fixed return, for example, 70-80% of the premium paid. If the prediction is wrong, even by a single cent, they lose the entire amount invested. This “all-or-nothing” structure makes them easy to understand but extremely risky.

Risks and Regulation in Europe

Due to their structure, which is more akin to gambling than a financial investment, and the high risks of loss for retail investors, European regulatory authorities have intervened decisively.

Since 2018, the ESMA (European Securities and Markets Authority) has banned the marketing, distribution, and sale of binary options to retail investors (non-professionals) throughout the European Union. This measure was adopted to protect small investors from the continuous losses associated with these products, often aggravated by conflicts of interest from the brokers who offered them.

Barrier Options: Activating and Deactivating the Right

Unlike binary options, barrier options are sophisticated instruments widely used at the institutional level for risk management. Their distinctive feature is the presence of a “barrier,” a predetermined price level that, if reached by the underlying asset, either activates or deactivates the option itself. This mechanism allows for creating more cost-effective hedging strategies compared to plain vanilla options.

Types of Barrier Options: Knock-In and Knock-Out

There are two main categories of barrier options:

- Knock-In Options: These options “come into existence” or are activated only if the underlying asset’s price touches a specific barrier. Until the barrier is reached, the option is inactive and has no value. It’s like owning a key that only starts working after a specific event has occurred.

- Knock-Out Options: These options are valid from the start, but they “die” or are deactivated (become worthless) if the underlying asset’s price reaches the barrier. In this case, the key stops working forever if a certain condition is met.

- Knock-In Options: These options “come into existence” or are activated only if the underlying asset’s price touches a specific barrier. Until the barrier is reached, the option is inactive and has no value. It’s like owning a key that only starts working after a specific event has occurred.

- Knock-Out Options: These options are valid from the start, but they “die” or are deactivated (become worthless) if the underlying asset’s price reaches the barrier. In this case, the key stops working forever if a certain condition is met.

Each type can be further divided into “up” (the barrier is above the initial price) and “down” (the barrier is below the initial price).

- Knock-In Options: These options “come into existence” or are activated only if the underlying asset’s price touches a specific barrier. Until the barrier is reached, the option is inactive and has no value. It’s like owning a key that only starts working after a specific event has occurred.

- Knock-Out Options: These options are valid from the start, but they “die” or are deactivated (become worthless) if the underlying asset’s price reaches the barrier. In this case, the key stops working forever if a certain condition is met.

Each type can be further divided into “up” (the barrier is above the initial price) and “down” (the barrier is below the initial price).

A Practical Example of a Barrier Option

Imagine an Italian company that exports products to the United States and fears a strengthening of the Euro against the Dollar (e.g., a drop in the EUR/USD exchange rate). To protect itself, it could buy a standard put option, but the cost (premium) might be high. Alternatively, it could opt for a down-and-out put option. This option protects it from a drop in the exchange rate, but only up to a certain point. If the EUR/USD exchange rate were to plummet and hit the barrier (the knock-out level), the option would expire worthless. The company chooses this strategy because it believes such a drastic crash is unlikely and, in exchange for this risk, pays a significantly lower premium.

Advantages and Disadvantages

The main advantage of barrier options is their lower cost. Since the right is conditional on the barrier event, the premium to be paid is lower than that of a standard option. This makes them an efficient tool for building customized hedging strategies. The main disadvantage lies in the barrier risk. With a knock-out option, the investor risks losing their hedge just when they need it most, if the market moves violently. With a knock-in, there’s a risk that the hedge will never be activated if the barrier is not reached. Furthermore, their valuation is complex and requires deep expertise.

Exotic Options in the Italian and European Context

In the European and Italian financial markets, exotic options like barrier options are predominantly the domain of institutional investors, investment banks, and large corporations. They are used for sophisticated portfolio construction strategies and for managing specific risks, such as currency or interest rate risk. Their prevalence among the retail public is, and should be, very limited due to their complexity and associated risks.

The Mediterranean financial culture, traditionally more oriented towards conservative forms of saving and investment, is confronted with the relentless innovation of global finance. Instruments like exotic options represent the frontier of this innovation, offering powerful solutions that require a high level of financial education. European regulation, as demonstrated by the case of binary options, acts as a filter to protect savers, ensuring that access to such instruments is reserved for those who have the skills to manage them.

In Brief (TL;DR)

Exotic options, such as Barrier and Binary options, are derivative financial instruments that differ from traditional options due to their complex and customized payoff structures.

We will delve into how they work, the associated risks, and the reasons they are created by financial engineering, with analysis from expert Francesco Zinghinì.

An in-depth look at the operation, risks, and origins of complex instruments like Barrier, Binary, and Asian options.

Conclusions

Exotic options, such as barrier and binary options, represent a fascinating and complex chapter of modern finance. They are “tailor-made” instruments created by financial engineering to meet needs that traditional options cannot satisfy. While binary options have proven to be extremely high-risk instruments, to the point of being banned for retail investors in Europe, barrier options continue to be a valuable tool for risk management at the institutional level. They offer flexibility and lower costs, but in exchange for greater complexity and specific risks, such as the activation or deactivation of the contract. For the average investor, the lesson is clear: the world of finance offers powerful tools, but knowledge and caution remain the best allies for navigating its complexity.

Frequently Asked Questions

Exotic options are derivative financial instruments, more complex and customized versions of traditional options (called ‘plain vanilla’). Unlike the latter, which have standard rules, exotics have unique features and unconventional payoffs, created by financial engineering to meet specific investment or risk hedging needs. They are mainly traded on unregulated (OTC) markets.

No, the marketing, distribution, and sale of binary options to retail clients are banned in Italy and throughout the European Union. This measure was introduced by the European Securities and Markets Authority (ESMA) and adopted by CONSOB due to the high risk, complexity, and significant losses suffered by non-professional investors. Access to these instruments is only permitted for investors classified as professional clients.

The fundamental difference is that a barrier option has an additional condition: its ‘fate’ depends on reaching a predetermined price level, called the ‘barrier’. The option can be activated (knock-in) or deactivated (knock-out) if the underlying price touches this threshold. Standard options, on the other hand, do not have this condition, and their value depends solely on the relationship between the strike price and the underlying price at expiration.

Generally, no. Exotic options are complex instruments that involve significant risks and require in-depth knowledge of financial markets. Their valuation is difficult, and risk management is crucial to avoid losses. They are therefore considered more suitable for experienced or institutional investors who use them for advanced hedging or targeted speculation strategies. For a beginner, it is advisable to start with simpler and more understandable instruments.

The term ‘exotic’ is used to contrast them with ‘plain vanilla’ options (a simple and traditional flavor), which are standard options with common and easily understandable contractual features. Exotic options, on the other hand, have non-standard, often unique and customized structures and payoffs, which make them more complex and ‘out of the ordinary,’ just like something exotic.

Still have doubts about Exotic Options: A Complete Guide to Barrier and Binary?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.