In Brief (TL;DR)

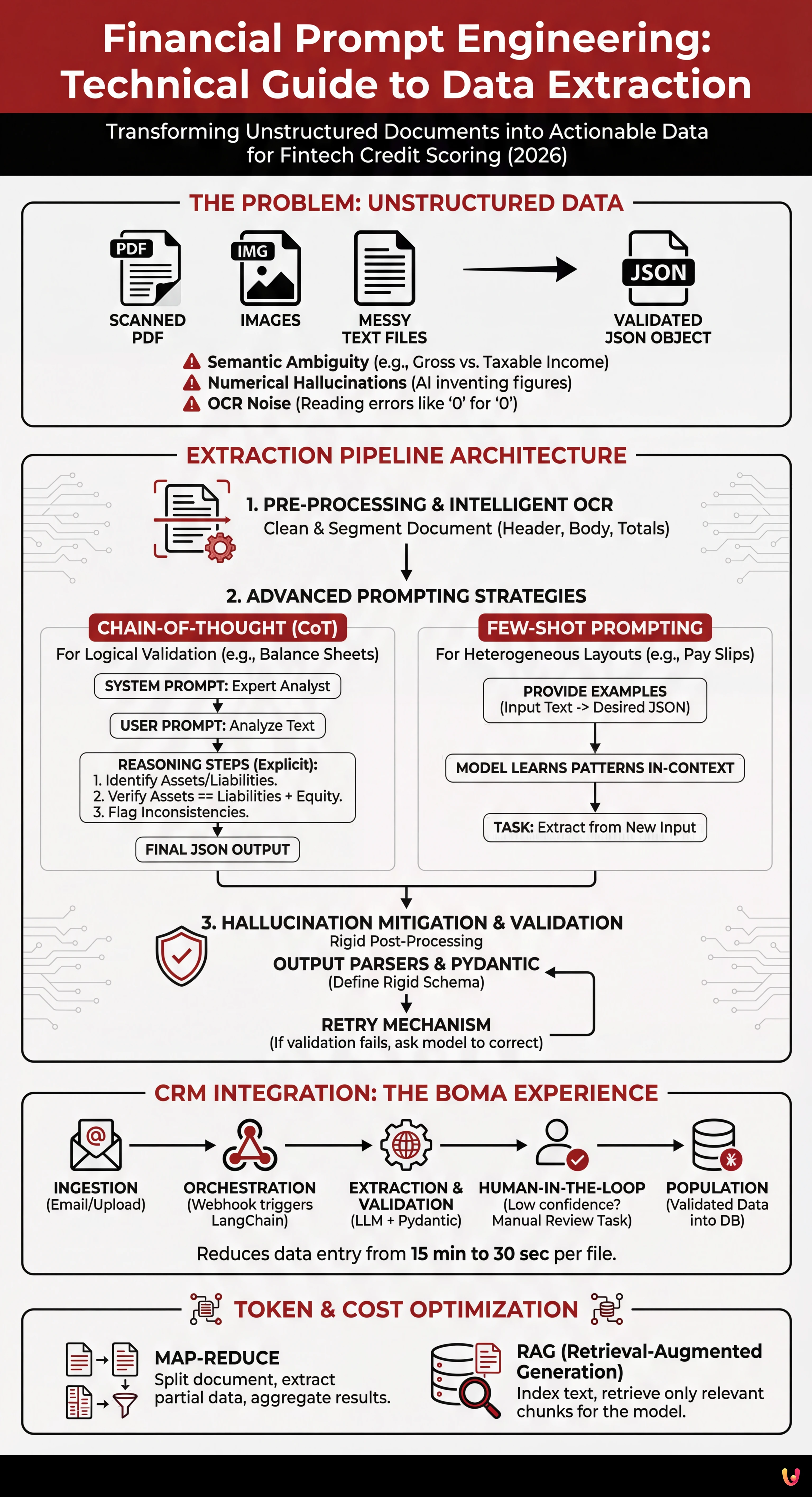

Financial prompt engineering converts unstructured documents into validated JSON data to optimize modern credit scoring.

Technical strategies like Chain-of-Thought and Few-Shot Prompting ensure precise extractions by mitigating risks of numerical hallucinations.

Integrating AI pipelines with automatic validation reduces operational times and improves the reliability of banking processes.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In the fintech landscape of 2026, the ability to transform unstructured documents into actionable data has become the main differentiator between an efficient credit scoring process and an obsolete one. **Financial prompt engineering** is no longer just an accessory skill, but a critical component of banking software architecture. This technical guide explores how to design robust AI pipelines for extracting data from pay slips, XBRL/PDF balance sheets, and bank statements, minimizing operational risks.

The Problem of Unstructured Data in Credit Scoring

Despite the evolution of digital standards, a significant portion of the documentation required for a loan application (especially for SMEs and individuals) still arrives in unstructured formats: scanned PDFs, images, or messy text files. The goal is to convert this chaos into a **validated JSON object** that can directly feed risk assessment algorithms.

The main challenges include:

- Semantic Ambiguity: Distinguishing between “Gross Income” and “Taxable Income” in pay slips with proprietary layouts.

- Numerical Hallucinations: The tendency of LLMs to invent figures or miscalculate if not correctly instructed.

- OCR Noise: Reading errors (e.g., mistaking a ‘0’ for an ‘O’ or an ‘8’ for a ‘B’).

Extraction Pipeline Architecture

To build a reliable system, simply sending a PDF to a model like GPT-4o or Claude is not enough. Complex orchestration is required, typically managed via frameworks like LangChain or LlamaIndex.

1. Pre-processing and Intelligent OCR

Before applying any financial prompt engineering technique, the document must be “cleaned”. The use of advanced OCR is mandatory. At this stage, it is useful to segment the document into logical chunks (e.g., “Header”, “Table Body”, “Totals”) to avoid saturating the model’s context window with useless noise.

2. Advanced Prompting Strategies

Here lies the heart of the technique. A generic prompt like “Extract data” will fail in 90% of complex cases. Here are the winning methodologies:

Chain-of-Thought (CoT) for Logical Validation

For corporate balance sheets, it is fundamental that the model “reasons” before answering. By using CoT, we force the LLM to make intermediate steps explicit.

SYSTEM PROMPT:

You are an expert financial analyst. Your task is to extract balance sheet data.

USER PROMPT:

Analyze the provided text. Before generating the final JSON, perform these steps:

1. Identify Total Assets and Total Liabilities.

2. Verify if Assets == Liabilities + Equity.

3. If the accounts do not match, flag the inconsistency in the 'warning' field.

4. Only generate the JSON output at the end.Few-Shot Prompting for Heterogeneous Pay Slips

Pay slips vary enormously between different employers. **Few-Shot Prompting** consists of providing the model with examples of input (raw text) and desired output (JSON) within the prompt itself. This “trains” the model in-context to recognize specific patterns without the need for fine-tuning.

EXAMPLE 1:

Input: "Total earnings: 2,500.00 euros. Net in envelope: 1,850.00."

Output: {"gross": 2500.00, "net": 1850.00}

EXAMPLE 2:

Input: "Monthly gross: € 3,000. Total deductions: € 800. Net to pay: € 2,200."

Output: {"gross": 3000.00, "net": 2200.00}

TASK:

Input: [New Pay Slip Text]...Hallucination Mitigation and Validation

In the financial sector, a hallucination (inventing a number) is unacceptable. To mitigate this risk, we implement rigid post-processing validation.

Output Parsers and Pydantic

Using libraries like Pydantic in Python, we can define a rigid schema that the model must respect. If the LLM generates a “date” field in the wrong format or a string instead of a float, the validator raises an exception and, via a retry mechanism, asks the model to correct itself.

CRM Integration: The BOMA Experience

The practical application of these techniques finds its highest expression in the integration with proprietary systems. In the context of the BOMA (Back Office Management Automation) project, the integration of the AI pipeline followed these steps:

- Ingestion: The CRM receives the document via email or upload.

- Orchestration: A webhook triggers the LangChain pipeline.

- Extraction & Validation: The LLM extracts the data and Pydantic validates it.

- Human-in-the-loop: If the confidence score is low, the system creates a task in the CRM for manual review, highlighting suspicious fields.

- Population: Validated data automatically populates DB fields, reducing data entry time from 15 minutes to 30 seconds per file.

Token and Cost Optimization

Managing the token window is essential to keep API costs sustainable, especially with balance sheets of hundreds of pages.

- Map-Reduce: Instead of passing the entire document at once, the text is divided into sections, partial data is extracted, and a second prompt is asked to aggregate them.

- RAG (Retrieval-Augmented Generation): For very extensive documents, the text is indexed in a vector database and only relevant chunks (e.g., only pages related to the “Income Statement”) are retrieved to be passed to the model.

Conclusions

Financial prompt engineering is a discipline that requires rigor. It is not just about knowing how to “talk” to AI, but about building a control infrastructure around it. Through the combined use of Chain-of-Thought, Few-Shot Prompting, and schema validators, it is possible to automate credit risk analysis with a level of precision that in 2026 competes with, and often exceeds, human accuracy.

Frequently Asked Questions

Financial prompt engineering is a technical discipline focused on designing precise instructions for artificial intelligence models, aimed at transforming unstructured documents like pay slips and balance sheets into structured data. In the fintech sector, this skill has become crucial for automating credit scoring, allowing chaotic formats like PDFs and scans to be converted into validated JSON objects, drastically reducing processing times and operational risks.

To prevent language models from inventing figures or making calculation errors, it is necessary to implement rigid post-processing validation using libraries like Pydantic, which impose a fixed schema on the output. Furthermore, the use of prompting strategies like Chain-of-Thought forces the model to make intermediate logical steps explicit, such as verifying that total assets match liabilities plus equity, before generating the final result.

Techniques vary based on the document type. For corporate balance sheets, which require logical consistency, Chain-of-Thought is preferable as it guides the model’s reasoning. For heterogeneous documents like pay slips, Few-Shot Prompting proves more effective; this consists of providing the model with concrete examples of input and desired output within the prompt itself, helping it recognize specific patterns without the need for new training.

For extensive documents that risk saturating the model’s memory or increasing costs, token optimization techniques are used. The Map-Reduce approach divides the document into smaller sections for partial extractions that are then aggregated. Alternatively, the RAG (Retrieval-Augmented Generation) technique allows retrieving and analyzing only the truly relevant text fragments, such as specific balance sheet tables, ignoring unnecessary parts.

Intelligent OCR represents the fundamental first step to clean the document before AI analysis. Since many documents arrive as scans or images, advanced OCR is necessary to convert these files into readable text and segment them into logical blocks. This reduces noise caused by reading errors and prepares the ground for effective prompt engineering, preventing the model from being confused by messy data.

Sources and Further Reading

- NIST AI Risk Management Framework (AI RMF)

- U.S. Securities and Exchange Commission – Office of Structured Disclosure (XBRL)

- OECD AI Principles – Artificial Intelligence Policy

- European Commission – Digital Finance Strategy

- Wikipedia – XBRL (eXtensible Business Reporting Language)

- Wikipedia – Prompt Engineering

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.