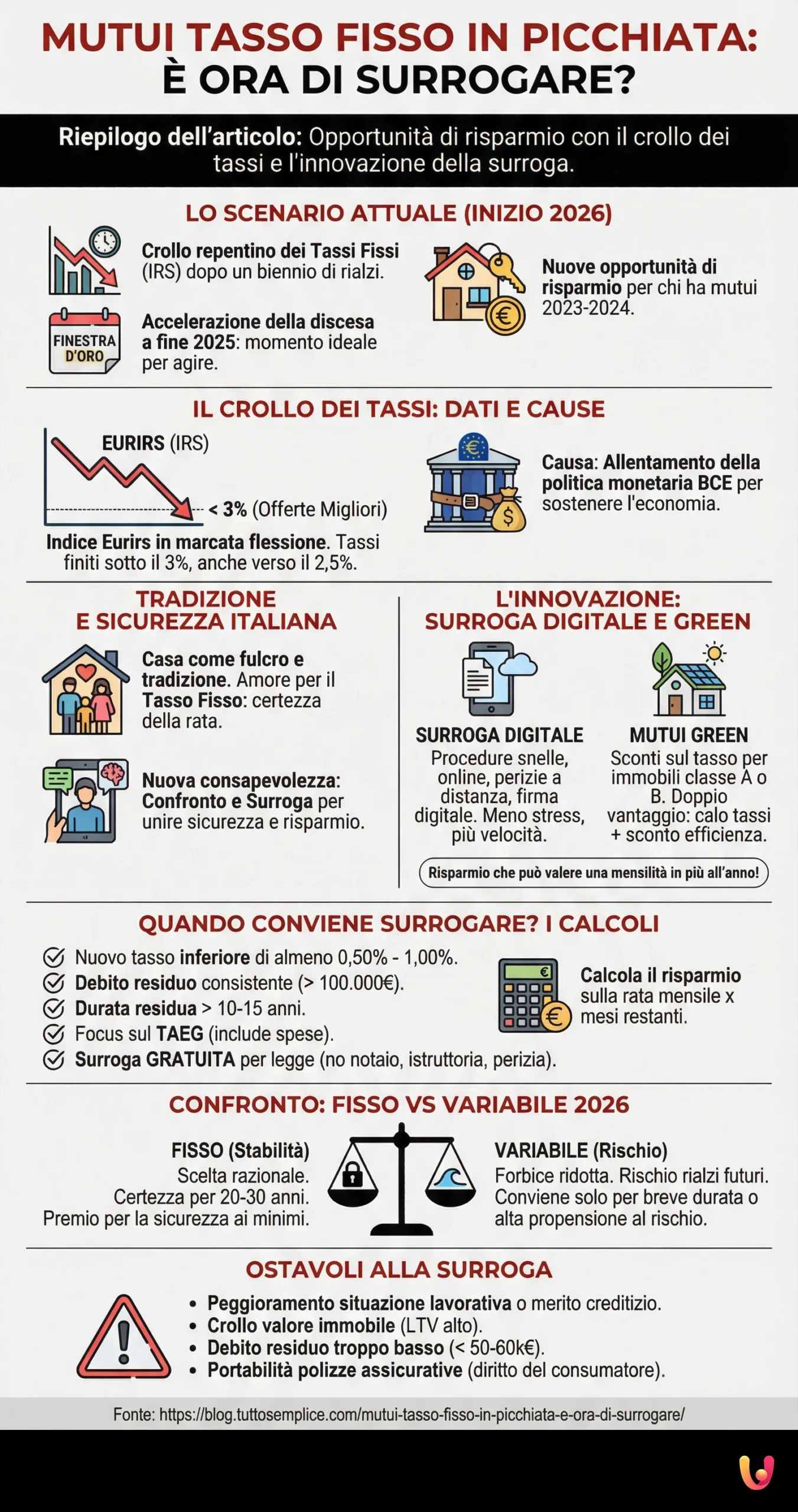

The mortgage landscape in Italy is undergoing a radical transformation phase that has caught many observers and families by surprise. After two years of uncertainty and rising rates, the beginning of 2026 delivers an unexpected scenario: a sudden collapse of fixed rates (IRS) that is reshaping household savings strategies. For those who signed a loan between 2023 and 2024, this is not just good news, but a genuine call to action. House keys, the symbol of tradition and security par excellence in Mediterranean culture, now also open the door to new savings opportunities thanks to financial innovation.

The descent in rates was not as gradual as expected but underwent a sudden acceleration in the final months of 2025, creating a time window that experts define as “golden” for refinancing (surroga). It is not just about numbers and percentages: it is the concrete possibility of recovering purchasing power, transforming a heavy installment into a sustainable expense, and looking to the future with greater serenity. In this context, understanding if it is the right time to move becomes crucial so as not to miss the train of reductions.

The collapse of the IRS is not just a technical figure: it is an explicit invitation to review one’s accounts. Those who ignore this drop risk giving away thousands of euros in undue interest.

The Collapse of Fixed Rates: What Is Really Happening

To understand the magnitude of this phenomenon, we must look at the raw data coming from European financial markets. The Eurirs index (or IRS), the benchmark for fixed-rate mortgages, has recorded a marked decline, bringing bank offers to levels we haven’t seen for some time. If until recently we were used to seeing finished rates above 3.5% or even 4%, today the best offers for green and traditional mortgages are dropping decisively below the psychological threshold of 3%, approaching 2.5% in some virtuous cases.

This dynamic is the child of an ECB monetary policy that, after tightening the belt to fight inflation, had to loosen its grip to support the Eurozone economy. The effect on Italian mortgages was immediate: banks, in strong competition with each other, began to cut spreads. This “collapse” is a breath of fresh air for the real estate market, but above all for those who already have an ongoing debt and find themselves paying out-of-market interest compared to current conditions.

Tradition and Security: Why Italians Love Fixed Rates

In Italy, a home has never been just an investment; it is the fulcrum of family life, a cultural heritage that is rooted in our history. This vision is reflected in the choice of mortgage: the fixed rate represents “tradition,” the certainty of an installment that does not change, immune to financial market storms. It is the modern version of safe “bricks and mortar.” In a country where the propensity to save is high and risk aversion is deep-rooted, the return of affordable fixed rates has been welcomed with enormous favor.

However, there is a new element grafted onto this tradition: financial awareness. Italian families no longer passively settle for the conditions offered by their “trusted” bank. Today they compare, evaluate, and act. Refinancing (surroga) has become the primary tool for defending family wealth, allowing one to maintain the security of the fixed rate (so beloved) while updating it to the most advantageous economic conditions of the present. It is here that the tradition of stability meets the innovation of banking mobility.

The Innovation of Digital and Green Refinancing

If the fixed rate is tradition, the way we access refinancing today is pure innovation. Procedures have been streamlined, digitized, and sped up. It is no longer necessary to go to the branch endlessly with folders of paper documents; many banks allow you to start and manage most of the process online, with remote appraisals and digital signatures. This cuts down times and reduces stress, making changing banks an operation within everyone’s reach, even the busiest people.

Another innovative aspect is linked to sustainability. So-called “green mortgages” offer significant discounts on the interest rate for those who purchase or own high energy efficiency properties (class A or B). If your home falls into these categories, refinancing could bring you a double advantage: the general drop in market rates added to the specific discount for energy efficiency. It is a perfect example of how innovation rewards those who invest in the quality of living.

Energy efficiency saves not only the planet but also the wallet: with green refinancing, the savings on interest can turn into an extra month’s salary per year for the family.

When It Pays to Refinance: The Calculations to Make

Not all refinancing deals are equal, and switching is not always convenient. The golden rule suggests that the operation makes sense if the new rate is at least 0.50% – 1.00% lower than the current one, and if the remaining debt is still substantial (usually above 100,000 euros) with a residual duration of at least 10-15 years. However, with the current collapse, even smaller differences can generate interesting savings, especially on high-amount mortgages.

It is fundamental to look beyond the simple TAN (Nominal Annual Rate) and focus on the TAEG (Annual Percentage Rate of Charge – APR), which includes all ancillary expenses. Remember that refinancing via “surroga” is free by law: there are no notary, preliminary investigation, or appraisal fees charged to the client. If the bank proposes hidden costs or expensive mandatory policies not linked to the mortgage, be wary. The real savings are calculated on the difference in the monthly installment multiplied by the remaining months, without forgetting the value of the peace of mind that a lower rate can offer.

To delve deeper into how to best manage switching banks and maximize savings, we recommend reading our strategic guide on how to save €20,000 by switching banks.

Comparative Analysis: Fixed Rate vs. Variable in 2026

The drop in rates has not only affected fixed rates but also variable ones. However, the gap between the two options has drastically reduced, making the fixed rate extremely competitive. Currently, the cost difference between a pure variable and a fixed rate is so thin that the “insurance premium” one pays to have the certainty of the installment (i.e., choosing fixed) is at historic lows. Why risk future hikes to save a few euros today?

In this scenario, choosing fixed appears the most rational for most families. It allows for planning the family budget without surprises for the next 20 or 30 years. Variable might only be worthwhile for those with a very high risk tolerance or who plan to pay off the mortgage in a very short time. But for those seeking peace of mind, a fixed rate at 2.60% or 2.70% is an unmissable lifeline compared to variable rates which, although falling, remain subject to the moods of the ECB.

If you are undecided on the best strategy to adopt this year, the mathematical analysis on fixed or variable with CAP might be useful to you.

Obstacles to Refinancing: What Can Go Wrong

Despite favorable conditions, obtaining a refinancing deal is not automatic. Banks evaluate the client’s “creditworthiness” exactly as for a new mortgage. If your employment situation has worsened in the meantime, if you have been reported as a bad payer, or if the value of your property has collapsed (thus raising the Loan To Value, the ratio between mortgage and home value), the bank could reject the request. Furthermore, many banks apply restrictive policies if the residual debt is too low (under 50-60 thousand euros).

Another obstacle can be the “portability” of insurance policies. Often banks try to sell their own life or home insurance combined with the mortgage. It is the consumer’s right to keep their own policy or look for a cheaper one on the market, but this is often a battleground. Being prepared and knowing your rights is the best weapon to overcome these bureaucratic hitches and obtain the conditions you deserve.

For those facing complex situations such as an appraisal lower than expectations, we suggest consulting the article on how to save the mortgage with high LTV.

In Brief (TL;DR)

The sudden collapse of fixed rates makes this the ideal time to evaluate refinancing and save on the monthly installment.

Find out if the current rate drop makes refinancing worthwhile to save on your monthly installment.

Discover if it is the ideal time to take advantage of the rate drop and reduce your monthly installment.

Conclusions

The sudden collapse of fixed rates we are observing in this early 2026 represents a rare opportunity in the real estate economic cycle. We are facing a perfect convergence between families’ need for savings and the commercial aggressiveness of banks, which are trying to attract new solvent clients. Refinancing is no longer a technical operation for a few experts, but a democratic tool for protecting savings.

Remaining motionless in the face of falling rates means accepting paying a higher price than necessary for one’s right to housing. Whether it involves switching from a crazy variable to a serene fixed rate, or scrapping an old fixed rate at 4.5% for a sparkling 2.6%, the imperative is to act. Getting informed, comparing, and not being afraid to change is the best way to honor the tradition of Italian savings, making the most of the innovation of the current market. The time to take back the keys to your financial future is now.

Frequently Asked Questions

Yes, early 2026 is considered a *golden window* because fixed rates have collapsed significantly. If you signed a loan in 2023 or 2024 with rates above 3.5 percent, you can now find offers approaching 2.5 percent. Experts suggest acting quickly to lock in these lower rates before market conditions change again, allowing you to recover purchasing power and reduce your monthly installment.

To successfully refinance via *surroga*, you generally need a residual debt above 100,000 euros and a remaining duration of at least 10 to 15 years. Additionally, banks will reassess your creditworthiness, so your employment situation must be stable and free of bad payment history. The loan-to-value ratio is also crucial, meaning your home value must support the mortgage amount without exceeding bank limits.

Under Italian law, refinancing through *surroga* is completely free for the borrower. There are no notary fees, preliminary investigation costs, or appraisal charges, as these are covered by the new bank. However, you should be wary of hidden costs or attempts to sell expensive mandatory insurance policies that are not strictly linked to the loan itself.

Currently, the gap between fixed and variable rates has narrowed significantly, making fixed rates extremely competitive. With fixed offers dropping to around 2.60 percent, the cost to secure a stable installment is at historic lows. Choosing a fixed rate now is recommended for most families as it protects against future market fluctuations, whereas variable rates still carry risks despite recent decreases.

Green mortgages offer reduced interest rates specifically for properties with high energy efficiency, typically class A or B. By refinancing into a green product, you benefit from both the general market rate drop and an additional discount for sustainability. This double advantage can result in significant savings, effectively rewarding homeowners who invest in energy-efficient living solutions.

Still have doubts about Fixed-Rate Mortgages Plummeting: Is It Time to Refinance??

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.