In Brief (TL;DR)

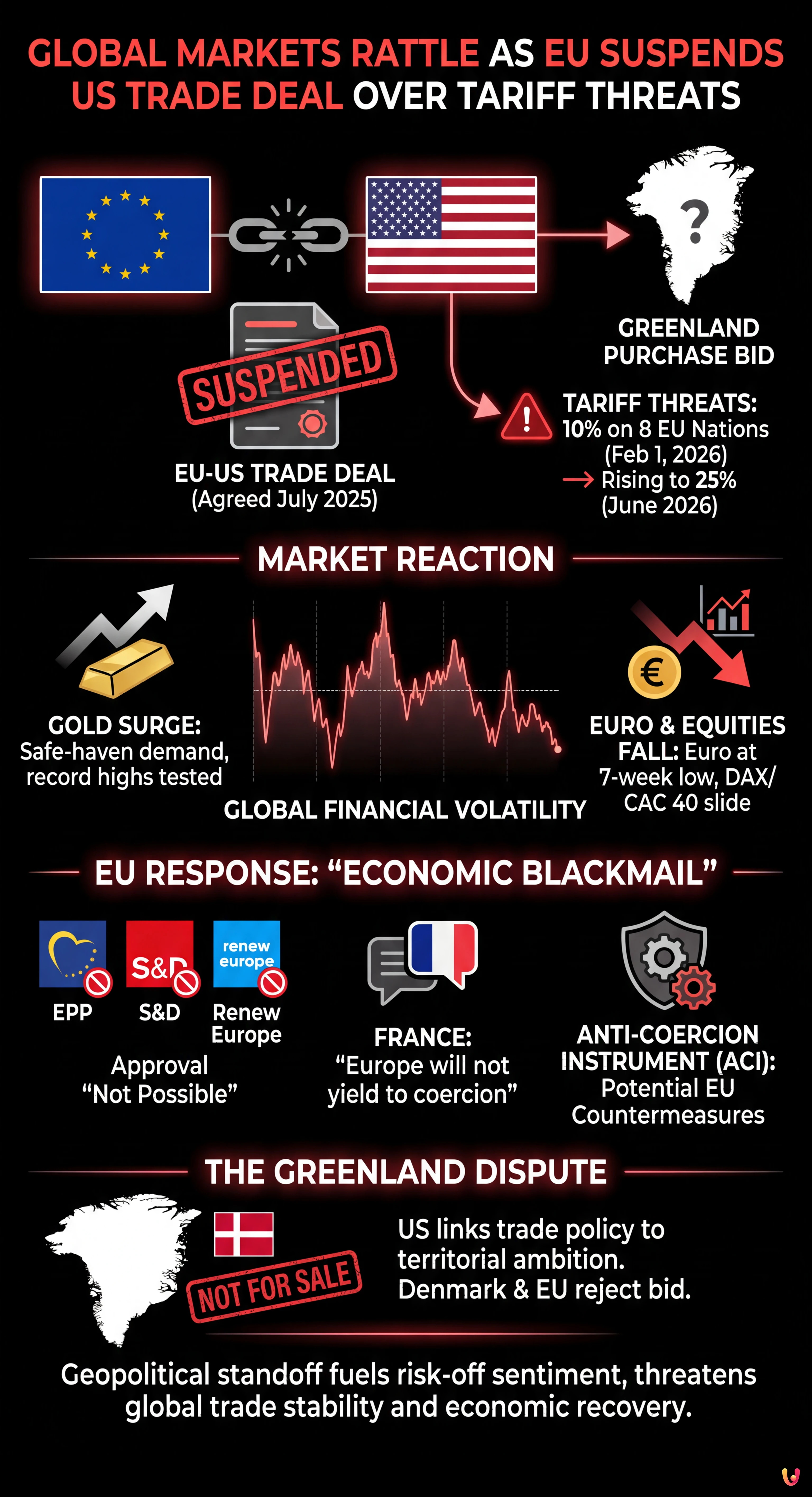

The European Parliament moved to suspend a US trade deal following President Trump’s tariff threats regarding his Greenland purchase bid.

Global markets reacted with volatility as gold prices surged and equities fell, reflecting investor anxiety over renewed trade hostilities.

Political support for the agreement evaporated as EU leaders rejected the ultimatum as economic blackmail, effectively ending the ratification process.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Global financial markets are on high alert this Wednesday as the European Parliament moves to suspend the ratification of a landmark trade agreement with the United States. The decision, expected to be formally announced in Strasbourg later today, comes as a direct response to President Donald Trump’s recent ultimatum involving punitive tariffs on European nations opposing his bid to acquire Greenland. The sudden escalation has sent shockwaves through the global economy, driving investors toward safe-haven assets and causing significant volatility in currency and stock markets.

According to reports from the BBC and the Financial Times, the trade deal—originally agreed upon in July 2025—was designed to de-escalate transatlantic tensions by reducing US tariffs on European goods from 30% to 15% and eliminating duties on specific American exports. However, the diplomatic landscape shifted dramatically over the weekend when President Trump threatened to impose a fresh 10% tariff on eight European countries, including Germany, France, and Denmark, starting February 1, 2026. These levies are set to rise to 25% by June if the US administration’s territorial demands regarding Greenland are not met.

The looming suspension of the deal has triggered an immediate reaction in the markets. Search interest for "gold price" has surged, with over 10,000 queries recorded today, reflecting investor anxiety. Spot gold prices have continued their upward trajectory, testing record highs as traders hedge against the prospect of a renewed trade war. Meanwhile, the Euro has softened against the dollar, trading at a seven-week low of $1.1572, as fears mount that the economic standoff could derail the Eurozone’s fragile recovery.

Trade Deal on Ice

The collapse of the ratification process marks a significant reversal in EU-US relations. The agreement was seen as a critical step toward stabilizing trade ties after years of friction. However, political support in Brussels has evaporated in the face of what European leaders describe as "economic blackmail." Manfred Weber, leader of the European People’s Party (EPP), the largest group in the Parliament, stated unequivocally that approval is "not possible at this stage."

According to The Guardian, Weber emphasized that the zero-tariff provisions for US products must be put on hold immediately. "The EPP is in favor of the EU–US trade deal, but given Donald Trump’s threats regarding Greenland, approval is not possible," Weber wrote in a statement. This sentiment is echoed by other major political groups, including the Socialists and Democrats (S&D) and Renew Europe, effectively ensuring that the deal cannot pass a parliamentary vote.

French Foreign Minister Jean-Noël Barrot also weighed in, telling the French Parliament that Europe would not yield to coercion. "When the United States makes an unacceptable proposal, France is prepared to say no," Barrot asserted, adding that the European Commission possesses "very powerful instruments" to retaliate if the threatened tariffs are implemented. The EU is reportedly considering activating its Anti-Coercion Instrument (ACI), which would allow for swift countermeasures against US exports.

Market Reaction: Gold Shines, Equities Stumble

The geopolitical standoff has fueled a classic "risk-off" sentiment in global finance. European equity markets opened lower, with the DAX and CAC 40 sliding as investors digested the news. The uncertainty surrounding the February 1 deadline for new US tariffs has particularly impacted export-heavy sectors such as automotive and luxury goods, which stand to lose the most from increased trade barriers.

Conversely, the commodities market is seeing a frenzy of activity. Gold, traditionally a hedge against inflation and geopolitical instability, has seen its price skyrocket. Analysts suggest that the metal’s rally is being driven not just by the immediate trade spat, but by broader concerns about the weaponization of tariffs and the stability of the global trading system. "Investors are looking for safety," noted a market strategist cited by the Financial Times. "With the trade deal effectively dead in the water and new tariffs on the horizon, gold is the logical destination for capital."

The Greenland Dispute

At the heart of this economic turbulence is the contentious issue of Greenland. President Trump’s renewed push to purchase the autonomous Danish territory has been met with firm rejections from Copenhagen and broader European solidarity. The US administration’s decision to link trade policy directly to this territorial ambition—threatening tariffs on countries like Sweden, Norway, Finland, and the Netherlands—has been characterized by EU officials as an unprecedented breach of diplomatic norms among allies.

Danish Prime Minister Mette Frederiksen has reiterated that Greenland is not for sale, a stance supported by the entire EU bloc. However, the economic cost of this principled stand is becoming clearer. If the 10% tariffs go into effect next month, they could shave billions off European GDP, complicating the European Central Bank’s efforts to manage inflation and growth. The escalation also threatens to unravel the security cooperation that was reaffirmed at the NATO summit earlier this year.

Conclusion

As the European Parliament prepares to formally suspend the US trade deal, the global economy stands at a precarious juncture. The swift unraveling of the July 2025 agreement underscores the fragility of international commerce in an era of aggressive geopolitical maneuvering. With the February 1 tariff deadline approaching and gold prices signaling deep investor unease, the focus now shifts to whether diplomatic channels can offer an off-ramp before a full-scale trade war erupts. For now, markets remain on edge, waiting to see if the transatlantic partnership can weather this latest and perhaps most severe storm.

Frequently Asked Questions

The European Parliament halted the ratification process because President Donald Trump threatened to impose punitive tariffs on European nations. This ultimatum is directly linked to his bid to acquire Greenland, a move European leaders have characterized as economic blackmail. Consequently, major political groups in Brussels, including the EPP, have stated that approving the agreement is impossible while these coercive threats remain active.

Financial markets have shifted into a risk-off mode, causing European equities to slide and the Euro to drop to a seven-week low against the dollar. Conversely, investors are flocking to safe-haven assets, leading to a significant surge in gold prices as traders hedge against the possibility of a renewed trade war. This volatility reflects deep anxiety about the stability of the global trading system and the potential economic fallout.

The US administration has linked trade policy to territorial ambitions by threatening tariffs on eight European countries if they oppose the American bid to purchase Greenland. While Denmark and the EU have firmly stated the territory is not for sale, the US plans to impose levies starting February 1, 2026, if these demands are not met. This unprecedented move has turned a diplomatic dispute over sovereignty into a major economic conflict.

The threatened tariffs are scheduled to begin on February 1, 2026, initially set at 10 percent on goods from specific nations including Germany and France. These levies are projected to increase to 25 percent by June if the US administration does not receive support for its territorial claims regarding Greenland. This timeline has created urgent uncertainty for export-heavy sectors like automotive and luxury goods.

Yes, the European Union is reportedly considering activating its Anti-Coercion Instrument, which allows for swift countermeasures against US exports without a lengthy approval process. French Foreign Minister Jean-Noël Barrot stated that Europe possesses powerful instruments to respond if the threatened tariffs are implemented. The bloc aims to demonstrate that it will not yield to what it perceives as unacceptable proposals and diplomatic pressure.

Sources and Further Reading

- European Commission: EU Anti-Coercion Instrument (ACI) Overview

- European Commission: Trade relations with the United States

- European Parliament: The European Union and its trade partners

- Wikipedia: History of proposals for the United States to purchase Greenland

- Office of the United States Trade Representative: European Union Trade Policy

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.