In Brief (TL;DR)

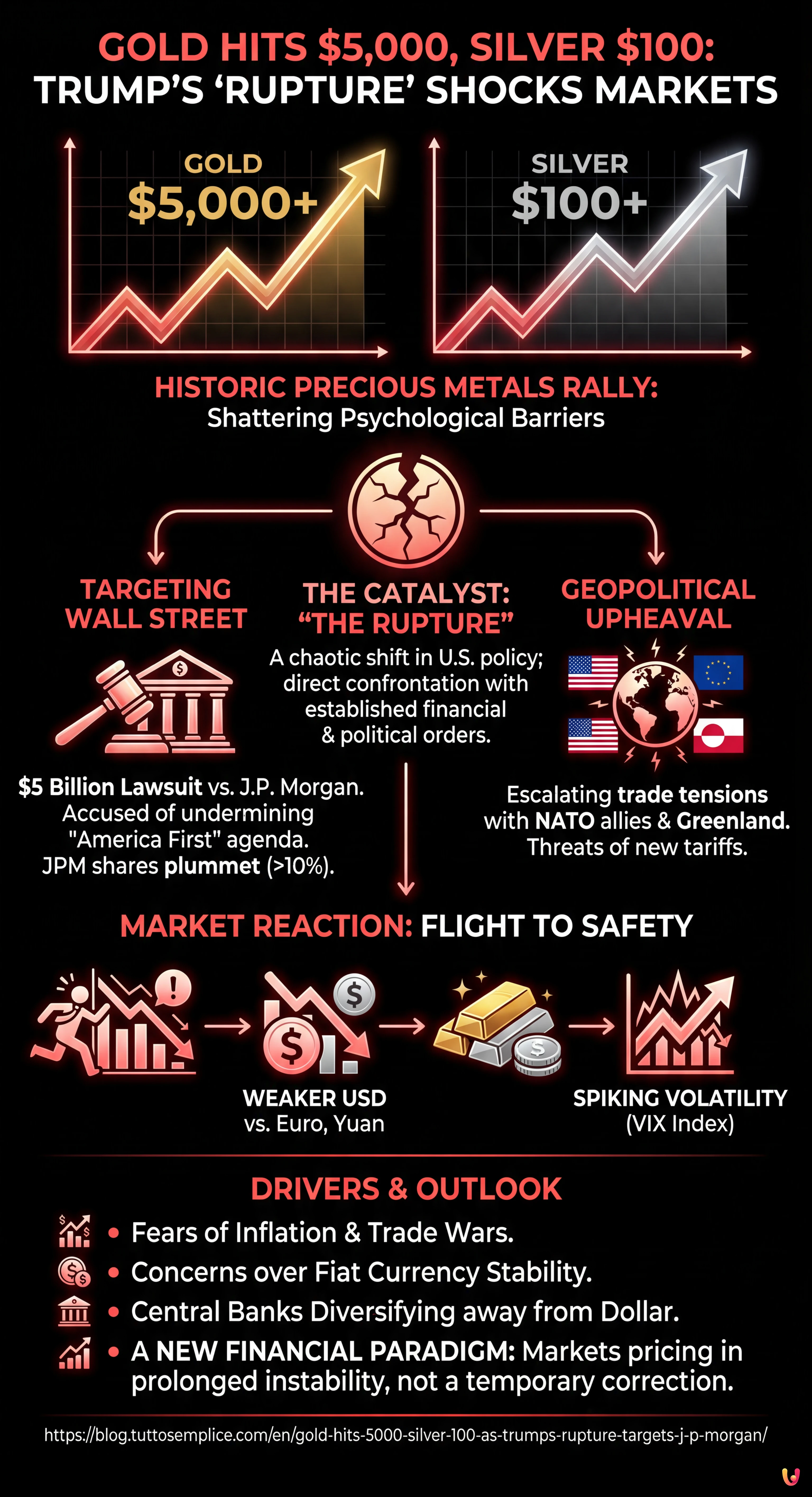

Gold has shattered $5,000 and silver passed $100 following President Trump’s aggressive lawsuit against J.P. Morgan.

The administration’s ‘Rupture’ strategy targets Wall Street institutions, causing a massive flight from equities into tangible safe-haven assets.

Global markets are pricing in prolonged instability as the dollar weakens and investors seek protection from escalating geopolitical tensions.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In a historic session for global commodities, the financial world has been upended by a dual shock of geopolitical upheaval and unprecedented legal action from the White House. As of Monday morning, the gold price today has shattered the psychological barrier of $5,000 per ounce, while silver has surged past $100, marking a new era for precious metals. The explosive rally is being driven by what analysts are calling the "Rupture"—a chaotic shift in U.S. policy that has seen President Donald Trump turn his aggressive stance toward one of Wall Street’s oldest institutions, J.P. Morgan.

Market volatility spiked early in the trading session following reports that the Trump administration has filed a $5 billion lawsuit against J.P. Morgan Chase. The legal offensive, combined with escalating trade tensions involving NATO allies and Greenland, has sent investors fleeing from traditional equities and the U.S. dollar into the safety of hard assets. According to data from BullionVault and market feeds, spot gold touched a record high of $5,071.96, while silver futures broke the triple-digit ceiling, cementing a moment that traders have speculated about for decades but few expected to arrive with such velocity.

The ‘Rupture’ Strategy and Wall Street’s Reaction

The catalyst for this financial earthquake is being termed the "Rupture" by geopolitical observers. This strategy appears to move beyond mere protectionism into a direct confrontation with established financial and political orders. The lawsuit against J.P. Morgan, the largest bank in the United States, has rattled confidence in the stability of the American financial sector. Shares in J.P. Morgan (NYSE: JPM) have plummeted, losing over 10% of their value in recent sessions as the administration accuses the banking giant of practices detrimental to the "America First" economic agenda.

According to reports from The Wall Street Journal, the administration’s move is not an isolated incident but part of a broader campaign to reshape the U.S. economy’s power structures. The uncertainty has forced institutional capital to rotate aggressively out of banking stocks and into tangible assets. "We are in the midst of a rupture, not a transition," stated former central banker Mark Carney at the World Economic Forum, highlighting the severity of the disconnect between the current U.S. administration and the traditional global financial architecture.

Safe Havens Surge Amidst Inflation and Trade Fears

The flight to safety is further compounded by renewed fears of inflation and trade wars. Beyond the domestic battle with Wall Street, the White House has threatened new tariffs on European allies, specifically linking trade penalties to disputes over Greenland. These geopolitical maneuvers have weakened the U.S. dollar, which has fallen against major currencies including the Chinese Yuan and the Euro. A weaker dollar typically boosts commodities, but the scale of this rally suggests a deeper fear regarding the future of fiat currency and trade stability.

Investors are increasingly concerned about the impact of these policies on U.S. GDP growth. While the administration argues that these disruptive measures will ultimately favor domestic industry, the immediate effect has been a paralysis of risk appetite in equity markets. CNBC reports that the "fear gauge" or VIX index has spiked, mirroring the panic buying seen in the precious metals market. The simultaneous rise of gold and silver to $5,000 and $100 respectively indicates that the market is pricing in a prolonged period of instability rather than a temporary correction.

Market Outlook: A New Paradigm for Finance?

The implications of $5,000 gold are profound for the broader world of finance. For decades, such a valuation was considered the domain of hyper-inflationary doomsayers. Today, it is a reality driven by a crisis of confidence in governance and international cooperation. Analysts at BullionVault note that the buying is not just coming from retail investors but also from central banks, particularly in Asia, who are diversifying away from the dollar in anticipation of further U.S. isolationism.

As the trading week continues, all eyes will be on the Federal Reserve and the judicial response to the J.P. Morgan lawsuit. If the legal battle intensifies, or if the administration follows through on its threats to impose 100% tariffs on Canadian or European goods, the ceiling for precious metals may yet be higher. For now, the markets are signaling that the "Rupture" is real, and the old rules of engagement between Washington and Wall Street no longer apply.

Conclusion

The breach of $5,000 for gold and $100 for silver serves as a stark barometer of the current geopolitical and economic climate. President Trump’s "Rupture" strategy, characterized by the unprecedented lawsuit against J.P. Morgan and aggressive trade posturing, has fundamentally altered the investment landscape. As investors navigate this volatile environment, the traditional safety of stocks and bonds is being questioned, leaving precious metals as the primary refuge against the unfolding uncertainty. The coming days will be critical in determining whether this is a momentary spike or the beginning of a sustained revaluation of global assets.

Frequently Asked Questions

The historic surge in gold prices to 5,000 dollars is primarily driven by a strategy known as the Rupture. This involves a chaotic shift in US policy, specifically President Trumps aggressive legal action against J.P. Morgan and escalating geopolitical tensions. Investors are fleeing traditional equities and the US dollar due to fears of instability, seeking safety in hard assets like gold. The market is reacting to a combination of a 5 billion dollar lawsuit against the bank and renewed trade disputes.

The White House has filed a 5 billion dollar lawsuit against J.P. Morgan Chase, accusing the banking giant of practices that are detrimental to the America First economic agenda. This legal offensive is part of a broader campaign to reshape US economic power structures. The lawsuit has rattled confidence in the stability of the American financial sector, causing shares of J.P. Morgan to lose over 10 percent of their value and prompting a rotation of capital into precious metals.

The Rupture is a term used by geopolitical observers to describe a new strategy by the Trump administration that moves beyond simple protectionism to a direct confrontation with established financial and political orders. It includes aggressive moves like the lawsuit against J.P. Morgan and trade threats involving NATO allies and Greenland. This strategy has created significant market volatility and a disconnect between the US administration and the traditional global financial architecture.

Silver breaking the 100 dollar ceiling marks a new era for precious metals and indicates that the market is pricing in a prolonged period of instability rather than a temporary correction. This milestone reflects deep concerns regarding the future of fiat currency and trade stability. Analysts note that buying is coming from both retail investors and central banks diversifying away from the dollar, suggesting that the ceiling for silver could go higher if legal and trade battles intensify.

The geopolitical maneuvers associated with the Rupture strategy, including trade penalties linked to Greenland and domestic battles with Wall Street, have weakened the US dollar against major currencies like the Chinese Yuan and the Euro. A weaker dollar typically boosts commodities, but this specific decline signals a deeper fear regarding inflation and the stability of the US currency, driving investors toward gold and silver as primary refuges.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.