In Brief (TL;DR)

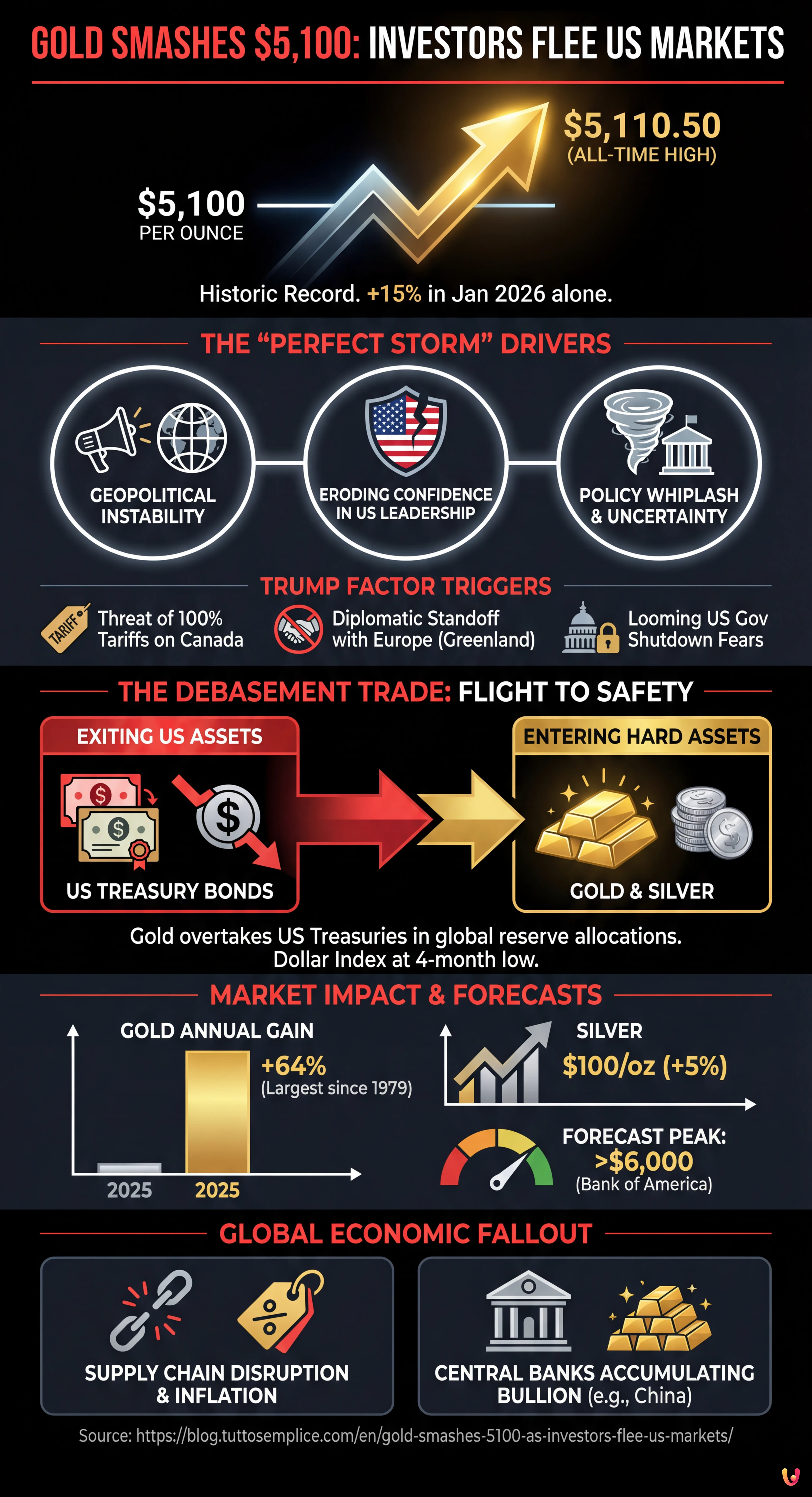

Gold prices have shattered records to breach $5,100 as global capital aggressively flees US financial markets.

Renewed protectionist rhetoric and geopolitical instability under the Trump administration have severely eroded confidence in American financial leadership.

This historic rally signals a profound shift as gold overtakes US Treasuries in global reserve allocations amidst fiscal anxiety.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Gold prices have shattered historic records, surging past $5,100 an ounce in a chaotic trading session that signals a profound shift in global capital flows. As of early Tuesday, spot gold hovered near $5,089 after touching an all-time high of $5,110.50, driven by what analysts are calling a "perfect storm" of geopolitical instability and eroding confidence in American financial leadership. The rally, which has seen the precious metal jump 15% in the first month of 2026 alone, comes as investors aggressively exit US treasury bonds and the dollar in favor of hard assets.

The catalyst for this latest frenzy is a renewed wave of protectionist rhetoric from the White House. President Donald Trump’s threat to impose 100% tariffs on Canada—America’s northern neighbor and key trading partner—if it proceeds with a trade deal with China has sent shockwaves through global markets. Combined with a diplomatic standoff with Europe over the future of Greenland and looming fears of a second US government shutdown in months, the volatility has triggered a classic flight to safety. However, unlike previous crises where the US dollar was the refuge, capital is now fleeing the greenback.

The Trump Factor: Policy Whiplash

Market sentiment has been battered by what CTV News describes as "policy whiplash" from the Trump administration. The President’s aggressive stance on trade has moved beyond traditional rivals to target long-standing allies. According to The Guardian, the threat of 100% tariffs on Canada emerged after Ottawa signaled closer economic ties with Beijing, a move the White House branded a betrayal of North American security interests. This escalation follows a dramatic diplomatic row with European leaders regarding the strategic status of Greenland, further straining the trans-Atlantic alliance.

These geopolitical maneuvers are compounding domestic fiscal anxieties. A potential government shutdown looms large, with Democrats threatening to block funding for the Department of Homeland Security following a controversial incident involving federal immigration agents in Minneapolis. "U.S. President Donald Trump and the uncertainty he creates on multiple levels remain the main driver of surging prices," said Ole Hansen, head of commodity strategy at Saxo Bank, in a note to clients. The unpredictability of US policy is forcing institutional investors to hedge against the very system that has underpinned global finance for decades.

The Debasement Trade

Financial experts are characterizing the current market dynamics as a "debasement trade"—a bet that the value of fiat currencies, particularly the US dollar, is being systematically eroded by fiscal mismanagement and political risk. According to TradingView, gold has overtaken US Treasuries in global reserve allocations for the first time, a watershed moment for the global economy. The dollar index has slumped to a four-month low, while the Japanese yen has hit a two-month peak as traders unwind their exposure to American assets.

The scale of the move is historic. Gold prices soared 64% in 2025, marking the largest annual gain since 1979. The momentum has only accelerated in 2026, with silver also joining the rally, surging more than 5% to cross the $100 per ounce threshold. "Investors are voting with their feet," noted Michael Hartnett, chief investment officer at Bank of America, who recently predicted that gold prices could peak above $6,000 if the current trajectory continues. The flight from US bonds suggests a deepening skepticism about the US government’s ability to manage its debt load amidst rising inflation and trade wars.

Global Economic Fallout

The repercussions of this shift are being felt across the wider economy. The surging price of gold is not just a financial statistic; it is a barometer of fear regarding global trade and GDP growth. The disruption to supply chains caused by the administration’s tariff policies has raised business costs and stoked inflationary pressures. According to Al Jazeera, the current trade environment is the most disruptive since the 1930s, with supply chains being upended by levies that in some cases reach 50%.

Central banks are exacerbating the trend by voraciously accumulating bullion. China has recorded its 14th straight month of gold purchases, diversifying its reserves away from the dollar. This robust official sector demand is creating a floor for prices, emboldening private investors to chase the rally. With the Federal Reserve facing a dilemma—whether to cut rates to support a fragile economy or hike them to defend the currency—the path of least resistance for markets appears to be away from the dollar and into tangible assets.

Conclusion

The surge of gold past $5,100 is more than a market anomaly; it is a verdict on the current state of American governance and its role in the global financial system. As investors flee the US in search of stability, the traditional pillars of global capitalism are being tested. With the Trump administration doubling down on protectionist policies and domestic political gridlock deepening, the "gold rush" of 2026 may well be remembered as the moment the world began to look past the dollar for its ultimate store of value.

Frequently Asked Questions

The historic rise is driven by a combination of geopolitical instability and a loss of confidence in US financial leadership. Investors are aggressively moving capital from US treasury bonds and the dollar into hard assets. This shift is catalyzed by protectionist rhetoric, including threatened tariffs on Canada and diplomatic tensions with Europe, creating a flight to safety in precious metals.

This term refers to a market strategy where investors bet that the value of fiat currencies, particularly the US dollar, is being systematically eroded by fiscal mismanagement and political risk. Consequently, gold has overtaken US Treasuries in global reserve allocations for the first time, as traders seek to protect their wealth against the declining purchasing power of the greenback.

Aggressive trade policies, such as the threat of 100% tariffs on key partners like Canada, create market volatility and economic uncertainty. This policy whiplash forces institutional investors to hedge against the US system. The resulting disruption to supply chains and fear of slowed GDP growth drive investors toward gold as a stable store of value amidst the chaos.

Following a 64% gain in 2025, momentum has accelerated in early 2026. Investment experts, including those from Bank of America, suggest that if the current trend of fleeing US assets continues, gold prices could peak above $6,000. This outlook is supported by central banks, such as China, continuing to accumulate bullion to diversify their reserves.

Silver often follows the trajectory of gold during periods of high demand for hard assets. In this specific rally, silver has surged more than 5% to cross the $100 per ounce threshold. As investors look for tangible alternatives to the US dollar and government bonds, the entire precious metals sector benefits from the flight to safety and the hedging against inflation and political unpredictability.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.