In Brief (TL;DR)

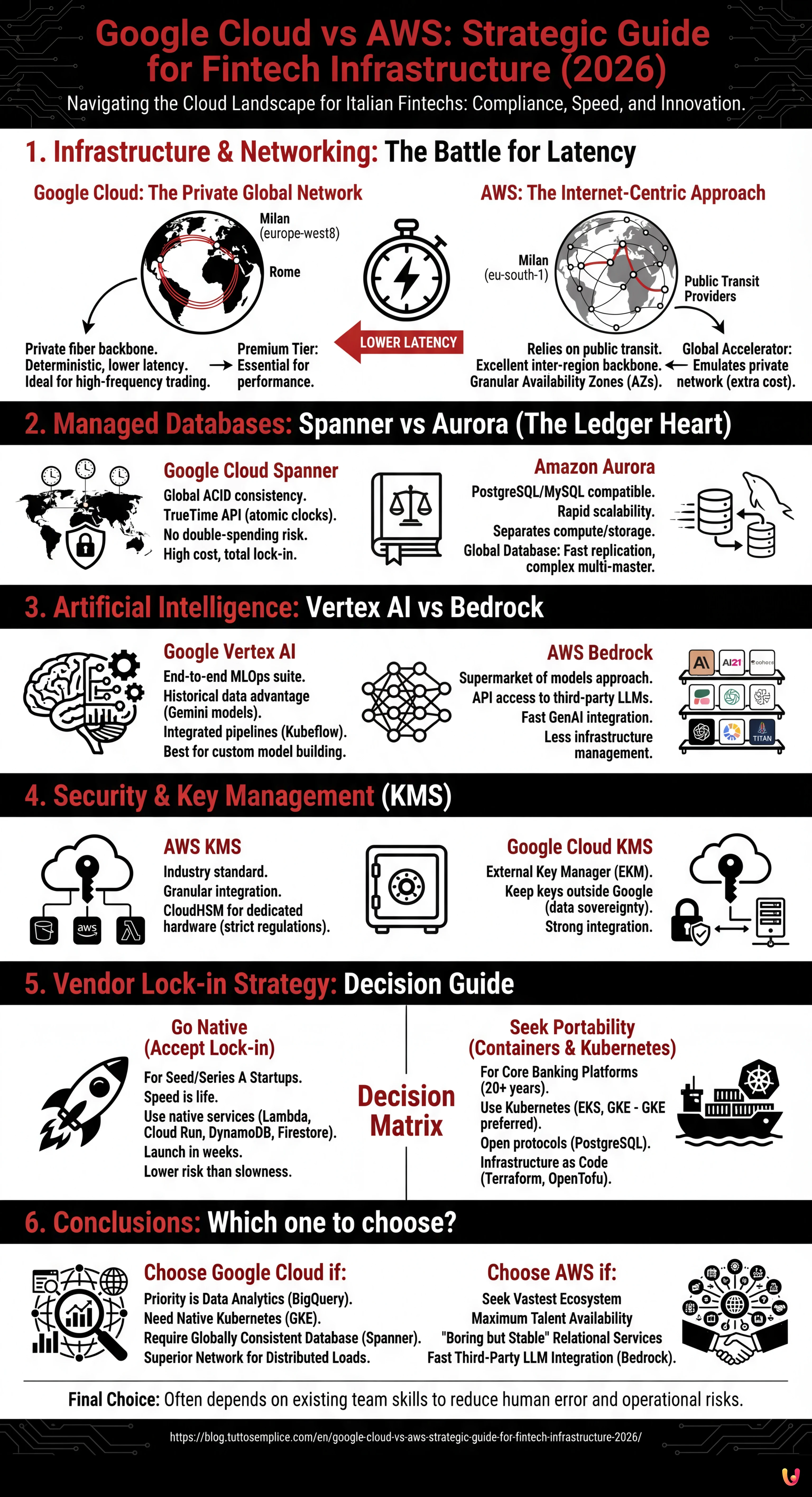

The choice between the two hyperscalers defines the future of Italian Fintechs, balancing network latency and rigorous regulatory compliance.

Google excels in global data consistency and MLOps, while AWS guarantees operational maturity and a pragmatic approach to artificial intelligence.

Advanced cryptographic key management and data sovereignty represent the decisive battleground for financial security.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

It is 2026 and the choice between google cloud vs aws is no longer a simple matter of who offers the virtual machine at the lowest price. For an Italian Fintech startup, where regulatory compliance (DORA, GDPR) clashes with the need for aggressive time-to-market, this decision defines the company’s technological DNA for the next decade. As a Senior Editor and cloud architect who has overseen critical migrations for financial platforms like MutuiperlaCasa.com, I will analyze the structural differences between the two hyperscalers, going beyond marketing to touch the iron, fiber, and code.

1. Infrastructure and Networking: The Battle for Latency in Italy

For a Fintech operating in high-frequency trading or instant payments, latency is not a detail: it is a competitive advantage. Both providers have now consolidated their physical presence in Italy (AWS in Milan eu-south-1 and Google Cloud in Milan europe-west8), but the approach to the network is philosophically different.

Google Cloud: The Private Global Network

Google manages one of the largest private fiber-optic networks in the world. When a packet enters Google’s network (via a Point of Presence in Milan or Rome), it travels almost exclusively on their infrastructure to its destination, avoiding the public internet. For Fintech applications requiring cross-border stability, this drastically reduces jitter.

- Advantage: Lower deterministic latency between regions.

- Network Tier: The Premium Tier option is expensive but essential to ensure user traffic enters the nearest PoP and travels on Google’s backbone.

AWS: The Internet-Centric Approach

AWS relies more on public transit providers to move data between the user and the data center, although their inter-region backbone is excellent. However, AWS excels in the granularity of Availability Zones (AZ).

- Advantage: Operational maturity of availability zones in Milan.

- Global Accelerator: A service necessary to emulate the performance of Google’s global network by routing traffic through the AWS network, but with an additional cost to factor in.

2. Managed Databases: Spanner vs Aurora

The heart of every Fintech is the Ledger. Here the battle between google cloud vs aws becomes fierce and technical.

Google Cloud Spanner: The Holy Grail of Consistency

Spanner is a globally distributed relational database that offers strong consistency (ACID) on a planetary scale. It uses atomic clocks (TrueTime API) in data centers to synchronize transactions.

- Use Case Fintech: Core banking system that must be distributed across multiple continents without the risk of double-spending.

- Cons: High cost and total lock-in. There is no open source version of Spanner that you can run locally.

Amazon Aurora: The Evolution of PostgreSQL

Aurora is a PostgreSQL/MySQL compatible engine built for the cloud. It separates compute from storage, allowing for rapid scalability.

- Use Case Fintech: Most account management, wallet, and KYC services. Compatibility with PostgreSQL means it is easy to find developers and tools.

- Aurora Global Database: Offers rapid replication between regions (often under a second), but global multi-master writing is more complex to manage than Spanner.

3. Artificial Intelligence: Vertex AI vs Bedrock

In 2026, AI is not just an addon; it is the engine for fraud detection and customer care.

Google Vertex AI

Google has a historical advantage in data and models (Gemini). Vertex AI offers a superior end-to-end MLOps suite. If your Data Science team wants to build, train, and deploy custom models for credit scoring, Vertex AI offers more integrated pipelines (based on Kubeflow).

AWS Bedrock

AWS has adopted a pragmatic approach: being the supermarket of models. Bedrock allows API access to models from Anthropic (Claude), AI21, Cohere, and Amazon Titan. For a Fintech wanting to integrate GenAI quickly without managing the underlying infrastructure, Bedrock is often faster to implement and less complex.

4. Security and Key Management (KMS)

Encryption key management is critical for PCI-DSS compliance.

- AWS KMS: It is the industry standard. Integration with services like S3, RDS, and Lambda is granular and mature. The CloudHSM feature allows for dedicated hardware for key management, often required by stricter Italian banking regulations.

- Google Cloud KMS: Offers similar features but excels in integration with External Key Manager (EKM), allowing keys to be kept outside of Google’s cloud (e.g., on-premise) while still using their compute services. This is a decisive point for CTOs paranoid about data sovereignty.

5. Vendor Lock-in Strategy: Decision Guide

When comparing google cloud vs aws, the fear of lock-in is omnipresent. Here is my decision matrix based on experience:

When to Accept Lock-in (Go Native)

If you are a Seed or Series A startup, speed is life. Using native services like AWS Lambda or Google Cloud Run, and proprietary databases like DynamoDB or Firestore, allows you to launch products in weeks instead of months. The cost of rewriting code in 3 years is lower than the risk of failing today due to slowness.

When to Seek Portability (Container & Kubernetes)

If you are building a core banking platform that must last 20 years:

- Use Kubernetes (EKS on AWS, GKE on Google). GKE is widely recognized as the best managed implementation of Kubernetes, having been born at Google.

- Use open protocols (PostgreSQL instead of non-standard proprietary databases).

- Use Terraform or OpenTofu for Infrastructure as Code, avoiding CloudFormation or Deployment Manager.

6. Conclusions: Which one to choose for your Fintech?

There is no single winner, but there are winners for specific scenarios:

- Choose Google Cloud if: Your priority is data analytics (BigQuery is unbeatable), you need native Kubernetes (GKE), or you require a globally consistent database (Spanner) for complex transactions. The network is superior for distributed loads.

- Choose AWS if: You are looking for the vastest ecosystem, maximum talent availability on the market (it is easier to find AWS experts than GCP), and a suite of "boring but stable" services for traditional relational databases. Bedrock is excellent for integrating third-party LLMs quickly.

The final choice often falls on the skills already present in your technical team. In a Fintech environment, familiarity with tools reduces human error, which is the true cause of most security disasters.

Frequently Asked Questions

The choice depends on specific project priorities. Google Cloud proves ideal if advanced data analytics with BigQuery, native Kubernetes, and global transaction consistency are needed. Conversely, AWS becomes preferable if seeking a vast ecosystem, ease in finding talent on the market, and stability in traditional relational databases. Often the final decision should be based on technical skills already present in the team to reduce operational risks.

Google Spanner offers strong ACID consistency on a global scale, making it perfect for core banking systems that cannot afford double-spending errors, although it entails high costs. Amazon Aurora, on the other hand, represents an evolution of PostgreSQL that guarantees rapid scalability and ease of management for services like wallets and KYC, benefiting from a vast availability of developers and compatible tools without the complexity of global multi-master writing.

Google Vertex AI focuses on a complete MLOps suite and proprietary models like Gemini, resulting superior for Data Science teams wanting to build and train custom models. AWS Bedrock instead adopts a supermarket approach, offering API access to various third-party models like Claude and Titan, allowing companies to integrate GenAI quickly without having to manage the complex underlying infrastructure.

Google manages one of the largest private fiber optic networks in the world, making data travel almost exclusively on its own infrastructure to avoid public internet instability. AWS relies more on public transit providers, while offering additional services to improve performance. For high-frequency trading, Google’s method often offers an advantage in terms of deterministic latency between different regions.

For early-stage startups, it is advisable to accept the technological constraint by using native services to accelerate market launch. However, for long-term banking platforms, the best strategy involves using containers on Kubernetes, such as GKE or EKS, and open protocols like PostgreSQL. Using agnostic Infrastructure as Code tools like Terraform helps maintain portability and reduce dependence on a single provider in the long run.

Sources and Further Reading

- Regulation (EU) 2022/2554 (DORA) – Digital Operational Resilience Act

- European Banking Authority (EBA) Guidelines on Outsourcing Arrangements

- European Commission – Data Protection in the EU (GDPR)

- NIST Special Publication 800-145 – The NIST Definition of Cloud Computing

- ENISA (European Union Agency for Cybersecurity) – Cloud Security

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.