Do you have your new BancoPosta Più Credit Card in hand, ready to simplify your payments and offer you a world of benefits? Fantastic! But before you start using it, there is a fundamental step: activation. Don’t worry, it’s a quick and intuitive process. In this detailed guide, we will walk you through the activation of your card step by step, revealing all the secrets to making the most of it. You will discover how to make payments in total security, manage your expenses with ease, and access a world of exclusive opportunities. Ready to enter the world of BancoPosta Più? Continue reading to discover how to activate your card and start enjoying all its benefits immediately.

What is the BancoPosta Più Credit Card?

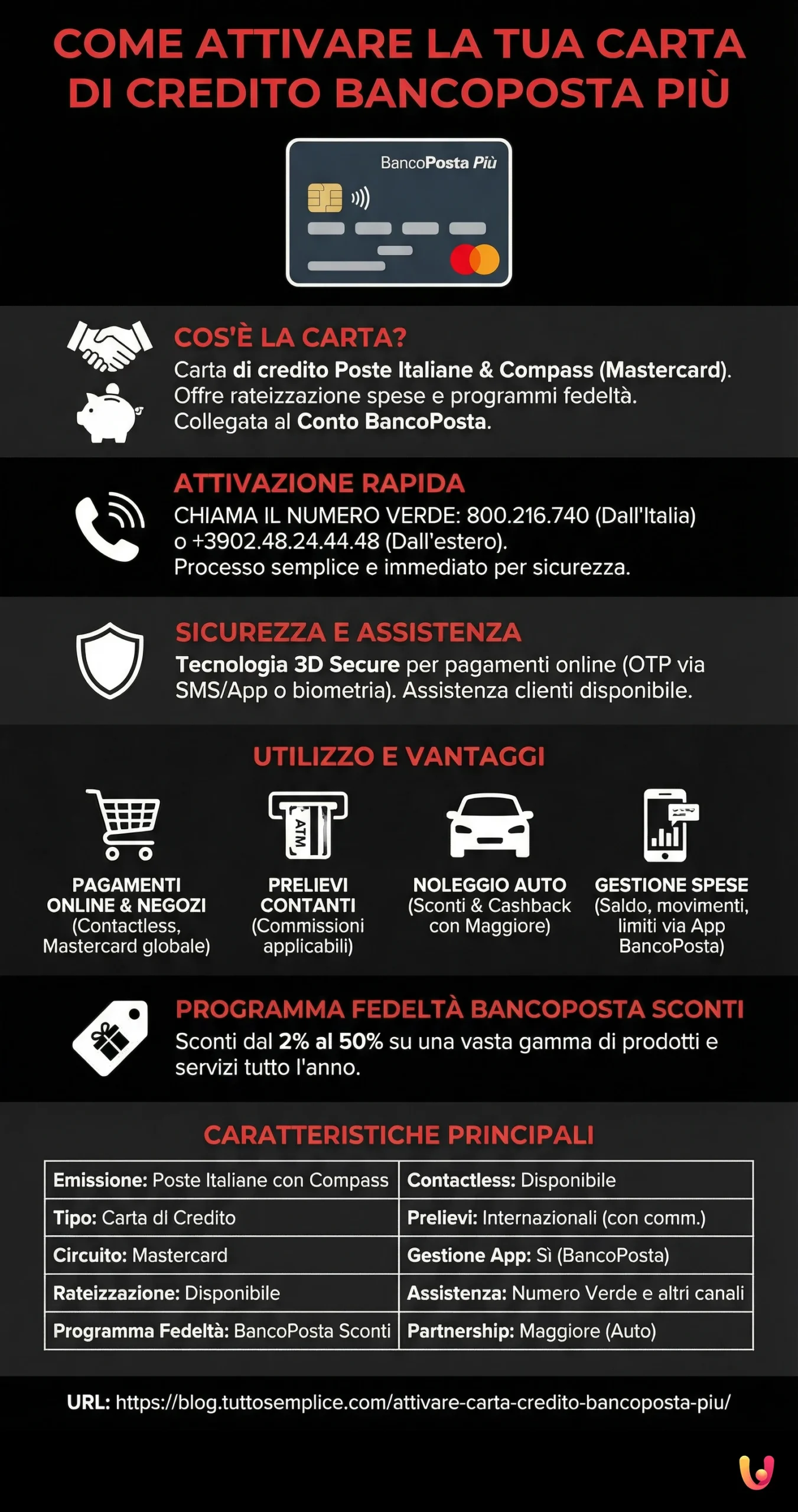

The BancoPosta Più Credit Card is a credit card issued by Poste Italiane in collaboration with Compass. It offers numerous advantages, including the possibility to pay in installments for expenses and access loyalty programs. The card is typically linked to a BancoPosta Account, which can offer further benefits and integrated financial management.

With the BancoPosta Più Card, you can request a credit line and pay for your most significant expenses in installments. Furthermore, Poste Italiane often proposes advantageous promotions for BancoPosta Più Account holders, such as waiving the annual current account fee upon the purchase of insurance policies or PosteMobile products.

Withdrawing cash with a credit card means that the money is advanced and, therefore, involves commissions.

Security and Support

Poste Italiane is committed to ensuring maximum security for your payments. The BancoPosta Più Credit Card uses 3D Secure technology, which involves entering a dynamic code (One Time Password – OTP) to authorize online purchases. This code is sent via SMS to the mobile number associated with the card or via notification on the DB Le Mie Carte app. Alternatively, you can use biometric authorization (fingerprint or facial recognition) via the app.

In case of need, you can contact Poste Italiane customer support at the toll-free number or through other contact channels available on the website.

How to Activate the BancoPosta Più Credit Card

For security reasons, your BancoPosta Più Credit Card is shipped inactive. But don’t worry, activating it is very simple! You can do so by calling the toll-free number 800.216.740 from Italy or the number +3902.48.24.44.48 from abroad.

Calling the toll-free number is the quickest and most immediate option.

Using the BancoPosta Più Credit Card

Once activated, your BancoPosta Più Credit Card will open up a world of possibilities! You can use it to:

- Make online payments: the card is accepted worldwide at merchants displaying the Mastercard logo. Thanks to 3D Secure technology, your online purchases are protected against fraud. You can manage your card settings and monitor transactions practically and quickly via the BancoPosta app.

- Make payments in stores: the card is accepted at millions of merchants worldwide. You can also activate the contactless feature to pay even more quickly and conveniently.

- Withdraw cash: you can withdraw cash from ATMs in Italy and abroad. Remember that withdrawing cash with a credit card involves commissions.

- Rent a car: thanks to the partnership with Maggiore, you can take advantage of discounts and cashback on car rentals. For more details, visit the Maggiore website or contact their customer service.

- Manage balance and expenses: you can check your card balance, transaction list, and manage card settings (such as setting spending limits) online, via the BancoPosta app, or by contacting customer support.

BancoPosta Sconti Loyalty Program

With the BancoPosta Più Credit Card, you can participate in the BancoPosta Sconti loyalty program, which allows you to accumulate discounts from 2% to 50% all year round on a wide range of products and services. This program adds value to your card by offering you the chance to save on purchases of all kinds.

Features and Benefits of the BancoPosta Più Credit Card

| Feature | Description |

|---|---|

| Issuance | Poste Italiane in collaboration with Compass |

| Card Type | Credit card |

| Payment Network | Mastercard (globally accepted) |

| Expense Installments | Available |

| Loyalty Program | BancoPosta Sconti (discounts from 2% to 50%) |

| Contactless Technology | Available |

| International Withdrawals | Available (with commissions) |

| App Management | Yes, via the BancoPosta app |

| Customer Support | Available via toll-free number and other channels |

| Partnerships | Maggiore (discounts and cashback on car rentals) |

In Brief (TL;DR)

Activating the BancoPosta Più Credit Card is simple and fast.

Just a phone call to the dedicated toll-free number and your card will be ready for use!

You will thus be able to make payments worldwide, withdraw cash, and manage your expenses comfortably and securely.

Conclusions

The BancoPosta Più Credit Card presents itself as a complete and versatile financial tool, capable of meeting the needs of a wide range of users. Its flexibility makes it suitable for both daily expenses and more significant ones, thanks to the possibility of paying in installments and managing your budget effectively.

One of the card’s strong points is its security. Thanks to 3D Secure technology and biometric authorization via the BancoPosta app, you can make payments online and in stores with total peace of mind, knowing that your data will be protected against fraud.

Furthermore, the BancoPosta Più Credit Card offers a series of additional benefits that make it an even more convenient choice. The BancoPosta Sconti loyalty program allows you to accumulate discounts on a wide range of products and services, while the partnership with Maggiore offers you discounts and cashback on car rentals.

The card is closely integrated with the BancoPosta Account, offering complete and simplified financial management. You can check the balance, transaction list, and manage your card settings directly online or via the BancoPosta app.

Ultimately, the BancoPosta Più Credit Card is an ideal solution for those looking for a secure, flexible credit card full of advantages. If you wish to simplify the management of your finances and have a reliable payment tool available for your daily expenses and travels, the BancoPosta Più Credit Card could be the right choice for you.

Frequently Asked Questions

You can activate your BancoPosta Più Credit Card by calling the toll-free number 800.216.740 from Italy or the number +3902.48.24.44.48 from abroad.

To request a BancoPosta Più credit card, you need: Identity document, Health card (Tessera Sanitaria), and latest income document. If you are a foreign citizen, you will also need a Residence Permit.

You can check your card balance online, via the BancoPosta app, or by contacting customer support.

In case of loss or theft of the card, contact customer support immediately to block it.

Yes, you can use your card abroad to make payments and withdraw cash.

Yes, you can pay contactless without a PIN for amounts up to 50€ per transaction.

Still have doubts about How to Activate Your BancoPosta Più Credit Card?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.