In Brief (TL;DR)

To stop an automatic payment, you can contact the service provider or stop the charge through your bank.

Alternatively, and to avoid surprises, you can manage subscriptions online and use prepaid cards.

It is a good habit to always check credit card statements and activate an alert service for charges, without hesitating to contact customer service for assistance.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Have you signed up for a subscription you no longer use? Discover how to stop automatic payments on your credit card easily and securely. In this post, we will guide you step-by-step through two effective methods: contacting the service provider directly or blocking the charge through your bank. Additionally, we will delve into various alternative options and provide useful tips to avoid issues, dispute unauthorized charges, and protect your credit card and personal data. Whether you prefer a quick method or a more secure one, this post will provide you with all the necessary information to stop unwanted automatic payments and save money. Don’t waste time: start reading now!

Methods to Stop an Automatic Payment

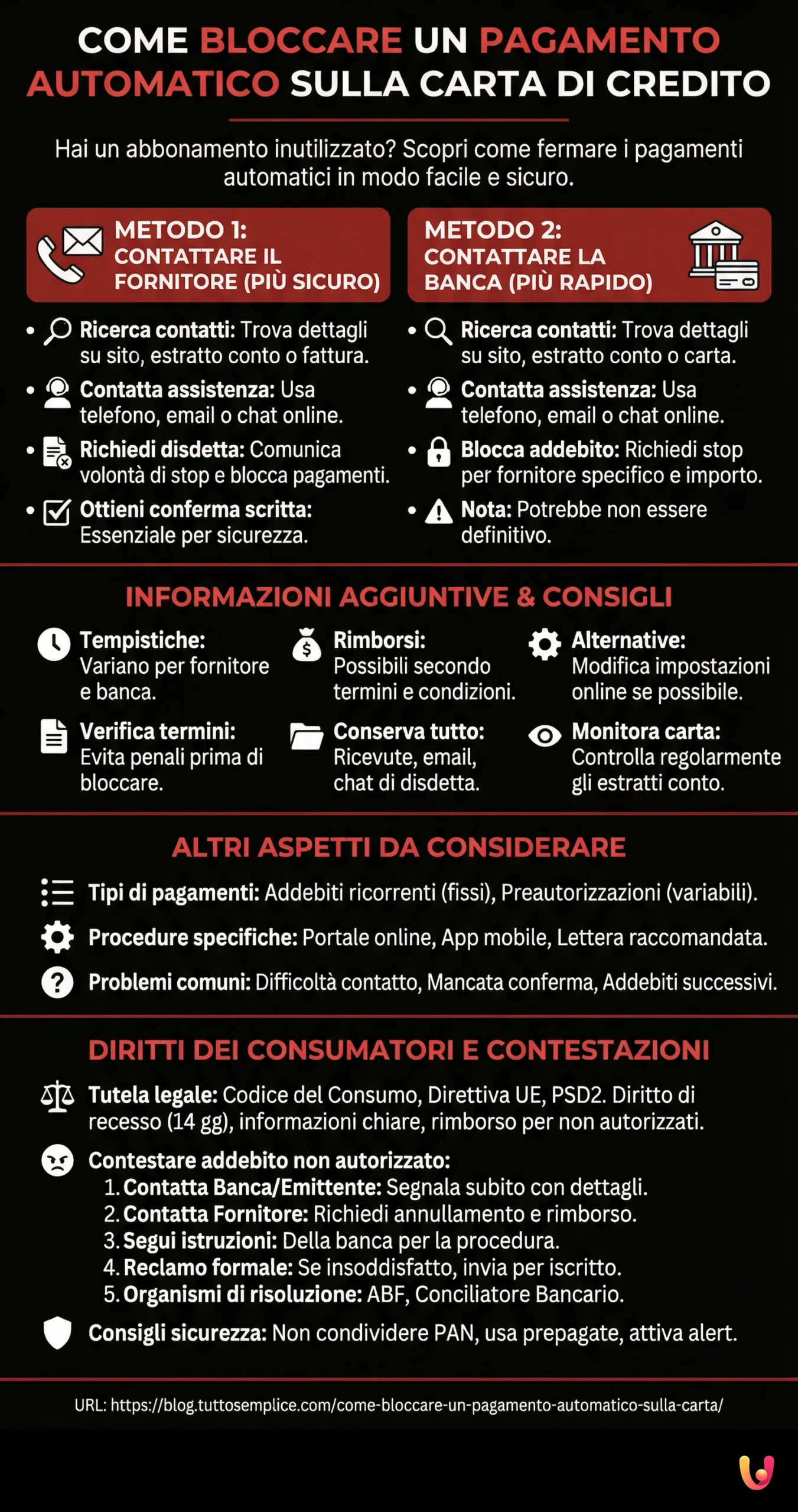

There are two main methods to stop an automatic payment (subscription) on a credit card:

- Contact the Service Provider

- Safest Method: This is the safest and most definitive method to stop an automatic payment.

- Find Contact Details: Find the service provider’s contact details on their website, on your credit card statement, or on the subscription invoice.

- Contact Customer Service: Contact the service provider’s customer service via phone, email, or online chat.

- Request Cancellation: Communicate your wish to cancel the subscription and stop automatic payments. Make sure to obtain written confirmation of the cancellation.

- Contact the Card Issuing Bank

- Fastest Method: This method can be faster, but it is not always definitive.

- Find Contact Details: Find your bank’s contact details on their website, on your credit card statement, or on the card itself.

- Contact Customer Service: Contact your bank’s customer service via phone, email, or online chat.

- Stop the Charge: Request to block the recurring charge on your credit card for the specific service provider. Be sure to specify the provider’s name and the charge amount.

Additional Information

- Timelines: The time required to stop an automatic payment may vary depending on the service provider and the bank.

- Refunds: Depending on the terms and conditions of your subscription, you may be entitled to a refund for automatic payments already made.

- Alternatives: In some cases, you may be able to change your subscription settings online to disable automatic payments.

Tips

- Before stopping an automatic payment: Make sure you have checked the terms and conditions of your subscription to avoid any penalties.

- Keep documentation: Keep receipts, emails, and chats related to the subscription cancellation and the stopping of automatic payments.

- Monitor your credit card: Regularly check your credit card statements to ensure there are no unauthorized automatic charges.

In case of doubts or difficulties, you can contact your bank’s customer service or the service provider for assistance.

In-Depth Look at Stopping Automatic Payments

In addition to the two main methods already described, there are a few other aspects to consider when you want to stop an automatic payment on a credit card:

Types of Automatic Payments

- Recurring Charges: These are regular payments of a fixed amount, such as subscriptions to phone services, pay TV, software, or gyms.

- Pre-authorizations: These are charges of variable amounts, authorized in advance by the cardholder for a specific period, such as electricity or gas bills.

Specific Blocking Procedures

- Provider’s Online Portal: Some companies offer the ability to manage your subscriptions and disable automatic payments directly through their online portal.

- Mobile Application: Some banks or service providers offer a mobile app that allows you to manage automatic payments and block them with a simple click.

- Registered Letter: In some cases, it may be necessary to send a registered letter with a return receipt to the service provider to cancel the subscription and stop automatic payments.

Problems and Solutions

- Difficulty Contacting the Provider: In some cases, it might be difficult to contact the service provider’s customer service to cancel the subscription. In this case, you can try sending an email or a registered letter.

- Lack of Cancellation Confirmation: It is important to always obtain written confirmation of the subscription cancellation and the stopping of automatic payments.

- Charges After Cancellation: In some cases, automatic charges may occur even after the subscription has been canceled. In this case, you need to dispute the charge with your bank.

Security Tips

Listed below are some useful tips to safeguard the security of your credit card:

- Do not share your credit card PAN (Primary Account Number) online or with untrusted people.

- Use a prepaid credit card for online subscriptions.

- Regularly check your credit card statements to identify any unauthorized automatic charges.

- Activate an alert service to receive notifications in case of charges on your credit card.

In case of doubts or difficulties, it is advisable to contact your bank’s customer service or the service provider for assistance.

Furthermore, you can find useful information and support online on the websites of consumer associations or user rights protection bodies.

Service Providers with Automatic Charges

Below is a non-exhaustive list of services that might have automatic charges divided by category. We remind you that there are many other service providers that might have automatic charges.

- Streaming Services

- Netflix

- Spotify

- Disney+

- Amazon Prime Video

- Apple TV+

- NOW TV

- Sky

- Phone and Internet Subscriptions

- TIM

- Vodafone

- WindTre

- Iliad

- Fastweb

- Sky Italia

- Utilities

- Enel

- Eni

- Hera

- A2A

- Acea

- Iren

- Insurance

- Generali

- UnipolSai

- Allianz

- Cattolica

- Genertel

- Linear

- Gyms and Wellness Centers

- Virgin Active

- McFit

- Curves

- Anytime Fitness

- MyWellness

- Other Services

- PayPal

- Google One

- Dropbox

- Microsoft 365

- Adobe Creative Cloud

- Amazon Prime

- Magazine and Newspaper Subscriptions

- Corriere della Sera

- La Repubblica

- La Stampa

- Il Sole 24 Ore

- Panorama

- Focus

- Associations and Clubs

- Touring Club Italiano

- Legambiente

- WWF Italia

- ACI

- Federconsumatori

- Altroconsumo

- Transport

- Trenitalia

- Italo

- FlixBus

- Uber

- Lyft

- MyTaxi

- Home Delivery Services

- Deliveroo

- Just Eat

- Glovo

- Uber Eats

- Foodora

- Amazon Fresh

If you have doubts about an automatic charge on your credit card, you can contact your bank or your credit card issuer to ask for information.

Consumer Rights Regarding Subscriptions and Automatic Payments

In Italy, consumers are protected by various regulations regarding subscriptions and automatic payments:

1. Consumer Code

- The Consumer Code (Legislative Decree no. 206/2005) governs consumer rights regarding distance contracts and contracts concluded away from business premises.

- In particular, the Consumer Code provides for the right of withdrawal for distance contracts within 14 days of signing the contract.

- The right of withdrawal also applies to subscription contracts with automatic debit.

2. European Consumer Rights Directive:

- The European Consumer Rights Directive (Directive 2011/83/EU) has been transposed into the Italian Consumer Code.

- The European Directive provides several provisions to protect consumers, including:

- The obligation for providers to provide clear and complete information on subscription contracts;

- The prohibition of unauthorized automatic charges;

- The right of withdrawal for distance contracts.

3. European Regulation on Online Payments:

- The European Regulation on Online Payments (PSD2) came into force in 2018.

- PSD2 introduces new rules for online payments, including:

- Strong Customer Authentication (SCA) for online payments;

- The right to a refund for unauthorized payments.

Websites of Consumer Protection Bodies

- Unione Nazionale Consumatori: https://www.consumatori.it/

- Associazione Italiana Difesa Consumatori e Ambiente: https://www.adiconsum.it/

- AGCM – Antitrust: https://www.agcm.it/

- European Consumer Centre Italia: https://ecc-netitalia.it/it/centro-ecc-net-italia/

In case of problems with a subscription or an automatic payment, consumers can contact consumer protection associations or the Antitrust authority.

For specific information on consumer rights regarding subscriptions and automatic payments, it is advisable to consult the web pages of government bodies or consumer associations in your country.

Furthermore, it is important to carefully read the terms and conditions of any subscription contract before signing it.

How to Dispute an Unauthorized Charge and Get a Refund

If you have noticed an unauthorized charge on your credit card, you can dispute it and get a refund from your bank or the service provider.

Here are the steps to follow:

Contact Your Bank or Credit Card Issuer

- The first thing to do is contact your bank or credit card issuer to report the unauthorized charge.

- Provide the bank or credit card issuer with all the necessary information about the charge, such as the amount, date, and name of the service provider.

- The bank or credit card issuer will initiate an investigation into the charge.

Contact the Service Provider

- You can also contact the service provider to dispute the charge.

- Provide the service provider with all the necessary information about the charge, such as the amount, date, and transaction reference number.

- The service provider might be able to cancel the charge and refund your money.

Follow the Instructions of Your Bank or Credit Card Issuer

- Your bank or credit card issuer might give you specific instructions on how to dispute the charge.

- It is important to follow these instructions to obtain a refund.

Send a Formal Complaint

- If you are not satisfied with the response from your bank or the service provider, you can send a formal complaint.

- The formal complaint must be in writing and must include all necessary information about the charge.

- Your bank or the service provider must respond to your complaint within a certain period of time.

Turn to a Dispute Resolution Body

- If you cannot get a refund from your bank or the service provider, you can turn to a dispute resolution body.

- In Italy, there are several dispute resolution bodies, such as the Banking and Financial Ombudsman (ABF) and the Banking Conciliator.

Tips for Disputing an Unauthorized Charge

- Act quickly. It is important to dispute the unauthorized charge as soon as possible.

- Gather evidence. Collect all the evidence you have available, such as your credit card statement or the receipt of the charge.

- Be clear and concise. When disputing the charge, be clear and concise in your explanation.

- Be patient. It may take a few days or weeks to get a refund.

It is important to remember that laws and regulations on automatic payments may vary depending on the country of residence.

Conclusions

In this post, we explored two effective methods to stop automatic payments (subscriptions) on a credit card:

- Contacting the service provider: a secure method to deactivate the subscription at the source and obtain a refund (if applicable).

- Blocking the charge through your bank: a quick solution to stop future payments, but one that requires specifying the charge to be blocked.

In addition to these methods

- We examined several alternative options, such as managing subscriptions online or using prepaid cards.

- We provided you with useful tips to avoid problems, dispute unauthorized charges, and protect your credit card.

Remember

- Regularly check your credit card statements to identify any unauthorized automatic charges.

- Activate an alert service to receive notifications in case of charges on your credit card.

- In case of doubts or difficulties, contact your bank’s customer service or the service provider for assistance.

With a little attention and awareness, you can easily manage your automatic payments and save money.

Thank you for reading this post!

If you found this information useful, share it with your friends and family.

Together, we can raise awareness on this topic and help people take control of their automatic payments.

I hope I have helped solve your problem!

Frequently Asked Questions

It depends on your situation. If you have a good relationship with the service provider, you can try contacting them directly to deactivate the subscription and get a refund. If, on the other hand, you have had problems with the provider or prefer a quicker solution, you can block the charge through your bank.

Contact your bank’s customer service and provide them with the details of the charge you want to block, such as the service provider’s name, the charge amount, and the expiration date. Your bank may charge you a fee for this service.

You can try to dispute the charge with your bank or the service provider. If you deactivated the subscription in time, you might be entitled to a refund.

Be careful when providing your payment details online. Always read the terms and conditions before signing up for a subscription. If you are unsure, use a prepaid credit card for online subscriptions.

Contact your bank immediately to block the card and report the theft or loss. This way, you will avoid unauthorized automatic charges.

You can find useful information on the websites of consumer associations or user rights protection bodies.

If the service provider refuses to deactivate the subscription, you can try several solutions:

Dispute the charge:

Contact your bank and dispute the automatic charge. Your bank might be able to cancel the charge and refund your money.

Provide your bank with all necessary information, such as proof that you deactivated the subscription and proof that the service provider refused to cancel it.

Report the service provider:

If the service provider refuses to cancel the subscription and you have not been successful with your bank, you can report the service provider to a competent authority.

In Italy, you can report the service provider to the Antitrust authority or Codacons.

Research consumer rights:

Make sure you know your rights as a consumer.

In Italy, you have the right to withdraw from a subscription contract within 14 days of signing.

You also have the right to receive a refund if the service provider has not respected the terms of the contract.

Take legal action:

If you have exhausted all other options, you can take legal action against the service provider.

However, this option could be expensive and time-consuming.

In general, it is advisable to stop an automatic payment at least 24 hours before the charge’s due date.

Fees for stopping an automatic payment can vary depending on several factors such as the Bank, the type of charge, the blocking method, and the country.

Some banks do not charge any fee to stop an automatic payment. Other banks might charge a fixed fee, which usually hovers around 5 euros. In some cases, the fee could be a percentage of the charge amount to be blocked. Fees for blocking recurring charges (like subscriptions) are generally lower than those for blocking pre-authorizations (like bills).

Blocking an automatic payment via phone might be more expensive than doing it online or via the bank’s app. Fees for blocking automatic payments can vary from country to country. To get precise information on the fees applied by your bank, it is advisable to contact customer service.

To avoid paying fees to stop automatic payments, try contacting the service provider directly to deactivate the subscription, use a prepaid credit card for online subscriptions, regularly check your credit card statements to identify any unauthorized automatic charges, and activate an alert service to receive notifications in case of charges on your credit card.

In some cases, it might be possible to get a refund of the fees applied to stop an automatic payment. For example, if you blocked an unauthorized charge, you might be entitled to a refund from your bank or the service provider.

It is important to remember that laws and regulations on automatic payments may vary depending on the country of residence. It is advisable to consult the web pages of government bodies or consumer associations for specific information related to your country.

Sources and Further Reading

- Consumer Financial Protection Bureau: How do I stop automatic payments?

- Federal Trade Commission: Getting In and Out of Free Trials and Auto-Renewals

- Financial Conduct Authority: Recurring payments and subscriptions (Continuous Payment Authority)

- Office of the Comptroller of the Currency: How do I stop an automatic payment?

- Wikipedia: Chargeback (Disputing a charge)

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.