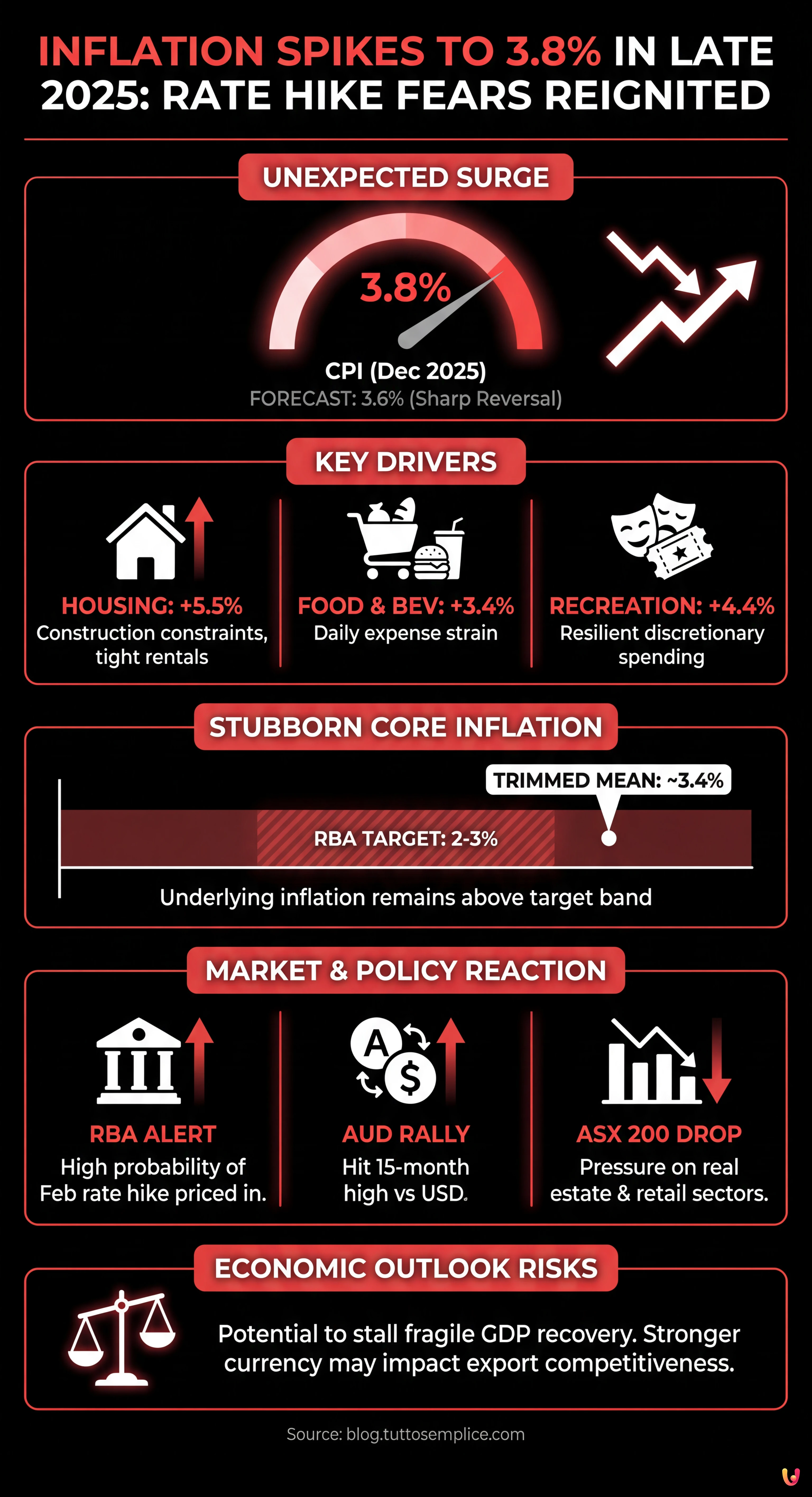

Australian inflation has accelerated beyond expectations in the final quarter of 2025, delivering a harsh reality check to financial markets and households alike. Data released today by the Australian Bureau of Statistics (ABS) reveals that the Consumer Price Index (CPI) rose to 3.8 per cent over the twelve months to December, significantly outpacing the 3.6 per cent forecast by economists. This resurgence in price pressures has immediately heightened speculation that the Reserve Bank of Australia (RBA) may be forced to lift interest rates as early as next week.

The hotter-than-expected print marks a sharp reversal from the cooling trend observed earlier in 2025, which had prompted the RBA to cut the cash rate to 3.6 per cent. According to reports from the Australian Financial Review and 9News, the sudden uptick has caught policymakers off guard, with money markets now pricing in a high probability of a rate hike at the central bank’s February meeting. The Australian dollar rallied on the news, while local stocks faced selling pressure as investors adjusted to the prospect of tighter monetary policy returning to the agenda.

Housing and Essentials Drive the Surge

The ABS data highlights that the inflationary pulse is being driven by essential sectors, making the cost-of-living crunch unavoidable for many Australians. The most significant contributor to the annual rise was housing, which surged by 5.5 per cent. This increase reflects persistent constraints in the construction sector and a tight rental market that continues to squeeze household budgets. Food and non-alcoholic beverages also saw a robust increase of 3.4 per cent, further straining daily expenses.

Discretionary spending has also remained surprisingly resilient despite the economic headwinds. The price of recreation and culture rose by 4.4 per cent, suggesting that consumer demand has not dampened as much as the RBA had anticipated. According to the Australian Broadcasting Corporation (ABC), this stickiness in service inflation is a primary concern for the central bank, as it indicates that inflationary psychology may be becoming entrenched in the broader economy.

Core Inflation Remains Stubborn

Beyond the headline number, the RBA’s preferred measure of underlying inflation—the trimmed mean—also delivered an upside surprise. The trimmed mean CPI rose by 0.9 per cent in the December quarter alone, pushing the annual rate to approximately 3.4 per cent. This metric, which strips out volatile price movements to provide a clearer picture of the trend, remains stubbornly above the RBA’s target band of 2 to 3 per cent.

This data point is critical for finance experts and the RBA board. Governor Michele Bullock had previously signaled that the easing cycle began in 2025 was conditional on inflation returning sustainably to target. With core inflation now trending upwards again, the credibility of the central bank’s forecasting is under the microscope. Analysts suggest that the RBA may have “over-loosened” monetary policy in 2025, necessitating a rapid correction to prevent prices from spiraling.

Market Reaction and Economic Outlook

The reaction in financial markets was swift. Bond yields spiked as traders moved to price in a 25-basis-point hike for February, a scenario that was considered unlikely just weeks ago. The ASX 200 dropped as the prospect of higher borrowing costs weighed on interest-rate-sensitive stocks, particularly in the real estate and retail sectors. Conversely, the Australian dollar hit a 15-month high against the greenback, driven by the widening yield differential.

The broader economic implications are significant. A return to rate hikes could stall the fragile recovery in GDP growth observed in the latter half of 2025. Furthermore, higher interest rates could impact trade dynamics by strengthening the currency, potentially making Australian exports less competitive globally. The delicate balance the RBA has tried to maintain—taming inflation without crashing the economy—appears to be more precarious than ever.

In Brief (TL;DR)

Australian inflation unexpectedly spiked to 3.8 per cent in late 2025, significantly outpacing earlier economic forecasts.

Rising housing and essential costs drove the surge, forcing the Reserve Bank to reconsider its easing strategy.

Financial markets are now bracing for potential interest rate hikes as core inflation remains stubbornly above target.

Conclusion

The December 2025 inflation data has upended the economic narrative for the start of 2026. With headline inflation at 3.8 per cent and core measures refusing to budge, the RBA faces an unenviable choice at its upcoming meeting. What was once expected to be a year of stability has begun with a renewed battle against rising prices, leaving households and investors bracing for further volatility. All eyes will now turn to Martin Place next Tuesday to see if the central bank will pull the trigger on a rate hike to regain control of the inflation outlook.

Frequently Asked Questions

The unexpected rise to 3.8 percent was primarily driven by essential sectors, specifically a significant 5.5 percent surge in housing costs due to construction constraints and a tight rental market. Additionally, food and non-alcoholic beverages increased by 3.4 percent, while resilient discretionary spending on recreation and culture further fueled price pressures, catching economists and policymakers off guard.

Financial markets are now pricing in a high probability of a rate hike at the February meeting because the CPI significantly exceeded forecasts. With headline inflation at 3.8 percent and core measures remaining above the target band, the Reserve Bank of Australia faces immense pressure to reverse its earlier easing cycle to prevent inflationary psychology from becoming entrenched in the economy.

The Australian dollar rallied to a 15-month high against the US dollar as traders anticipated higher interest yields resulting from a potential rate hike. Conversely, the local stock market, specifically the ASX 200, faced selling pressure in interest-rate-sensitive sectors like real estate and retail as investors adjusted their portfolios for the likelihood of tighter monetary policy.

The trimmed mean is the preferred metric of the RBA for underlying inflation because it strips out volatile price movements to show the true trend. Its rise to approximately 3.4 percent indicates that core inflation remains stubbornly above the central bank target range of 2 to 3 percent, suggesting that the previous interest rate cuts may have been premature.

The resurgence of inflation to 3.8 percent threatens to stall the fragile GDP growth recovery observed in late 2025 by potentially forcing a return to higher borrowing costs. Furthermore, if the RBA raises rates, it could strengthen the currency enough to make Australian exports less competitive globally, creating a precarious balance between taming prices and maintaining economic stability.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.