The world of insurance in Italy is undergoing a radical transformation, driven by new technologies and a growing awareness of everyday risks. It’s no longer just about fulfilling a legal obligation, as in the case of Auto Liability Insurance, but about building a safety net around one’s assets and health. The Mediterranean culture, traditionally tied to family savings as a form of self-protection, is evolving towards more European models of risk management.

Navigating through clauses, coverage limits, and technical terms can seem complex. However, understanding how policies work is the only way to avoid surprises in your time of need. This guide analyzes the current insurance market, offering practical tools to choose the coverage best suited to your needs, whether it’s protecting your home, your car, or your physical well-being.

The true value of an insurance policy lies not in the premium paid, but in the certainty of not having to face unexpected events alone that could compromise a lifetime of financial stability.

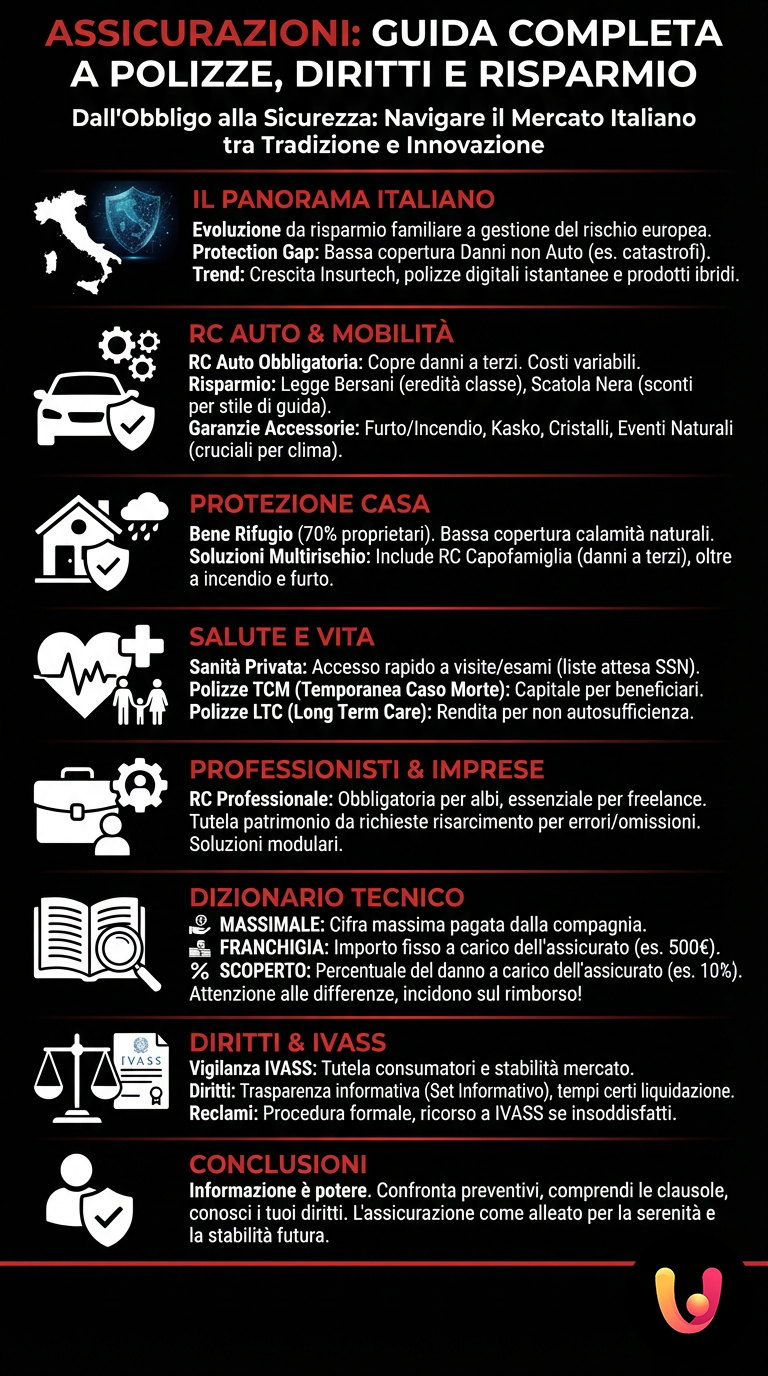

The Italian Insurance Landscape: Between Tradition and Innovation

The Italian insurance market has some unique features compared to the rest of Europe. Historically, Italy has had low penetration in “Non-Auto Damage” policies. This phenomenon, known as the protection gap, indicates that many families are underinsured against events like fires, thefts, or natural disasters, relying too heavily on the state or personal savings.

In recent years, however, the trend has been changing. Digitalization has led to the rise of Insurtech companies, which offer instant policies that can be managed via app and are often cheaper. According to data from ANIA (the Italian National Association of Insurance Companies), premium income in the non-life sector is growing, a sign that risk perception is maturing. Traditional companies are responding with hybrid products, combining human consultation with digital efficiency.

Auto Liability and Mobility: Obligations and Savings Opportunities

Third-Party Liability Auto Insurance (RC Auto) is the most well-known expense for Italian drivers. It is required by law and covers damages caused to third parties. However, the premium cost varies significantly based on region, the driver’s age, and their bonus-malus rating. Recently, inflation has pushed prices up, making it essential to compare offers.

To keep costs down, many Italians take advantage of regulatory benefits. For example, it’s possible to inherit the bonus-malus rating of a family member living in the same household. To learn more about this mechanism and how to optimize your premium, it’s useful to consult strategies on how to save with the Bersani Law and Bonus-Malus system. Another trend is the installation of a “black box,” a device that records driving style and allows for substantial discounts on the policy.

Optional Coverage: Beyond Basic Liability

Basic liability insurance alone does not cover damage to your own vehicle in an at-fault accident, nor does it protect against external events. Optional coverage is therefore essential for complete protection. Among the most requested are:

- Theft and Fire: Indispensable for new or high-value cars.

- Collision (Kasko): Covers damage to your own vehicle regardless of who is at fault in an accident.

- Glass and Natural Events: Increasingly crucial given the frequency of intense hailstorms due to climate change.

Home Protection: The Ultimate Safe Haven Asset

For Italians, the home is the ultimate safe haven asset, with over 70% of families living in a home they own. Despite this, the percentage of homes insured against natural disasters remains worryingly low. However, recent flood events have renewed focus on the need to protect property from catastrophic risks.

A good home insurance policy should not be limited to fire risk. It is advisable to opt for multi-risk solutions that include Personal Liability (RC Capofamiglia). This coverage protects against damages unintentionally caused to third parties by family members or pets, such as a pot falling from a balcony or a broken pipe flooding the apartment below. For a detailed overview of available coverages, you can refer to the complete guide to multi-risk home insurance.

Health and Life: Investing in Your Future Well-being

The National Health Service (SSN) is a pillar of Italian welfare, but lengthening wait times have pushed many towards private healthcare. Health insurance policies, or supplemental health funds, provide access to specialist visits and diagnostic tests quickly, often with full or partial reimbursement of expenses.

At the same time, there is growing interest in Term Life Insurance and Long-Term Care (LTC) policies. The former guarantee a capital sum to beneficiaries in the event of the insured’s premature death, which is crucial for those with young children or an ongoing mortgage. In this regard, it is vital to understand the dynamics of life insurance linked to a mortgage to avoid costly overlaps with bank offers. LTC policies, on the other hand, provide a lifetime annuity in case of loss of self-sufficiency, protecting family assets from long-term care costs.

Professionals and Businesses: Managing Workplace Risk

In today’s work environment, Professional Liability Insurance has become mandatory for many categories registered with professional boards, such as doctors, lawyers, and architects. This policy protects the professional’s assets from claims for damages due to errors or omissions made while performing their duties. Even for new digital professions and freelancers, while not always mandatory, it represents an indispensable form of protection.

The market offers modular solutions that adapt to specific revenue and risk levels. For self-employed workers, navigating the various offers is complex but necessary. A useful resource for untangling obligations and opportunities is the complete guide to insurance for freelancers and the self-employed, which analyzes specific coverages for those who work for themselves.

Technical Dictionary: Understanding the Hidden Clauses

One of the main obstacles to knowingly purchasing a policy is the technical language. People often sign without fully understanding the contract’s limitations. Three fundamental concepts determine the actual payout in the event of a claim:

- Coverage Limit: The maximum amount the company will pay. Beyond this threshold, the insured pays.

- Deductible: A fixed amount that is always the insured’s responsibility (e.g., $500).

- Coinsurance: A percentage of the damage that remains the insured’s responsibility (e.g., 10%).

The difference between a deductible and coinsurance is subtle but substantial and can heavily impact the final reimbursement. It is crucial to read the policy conditions carefully or delve deeper into the topic through resources dedicated to deductibles and coinsurance and how they work, to avoid discovering these clauses only when you need to file a claim.

The Rights of the Insured and the Role of IVASS

In Italy, the insurance sector is supervised by IVASS (the Institute for the Supervision of Insurance). This body ensures market stability and consumer protection. Policyholders have specific rights, established by the Insurance Code and the Consumer Code. These include the right to transparent information before signing and specific deadlines for claim settlements.

In case of disputes with the insurance company, the consumer can file a formal complaint. If the response is not satisfactory or does not arrive within 45 days, it is possible to contact IVASS directly or use alternative dispute resolution tools. Knowing these tools helps balance the power dynamic between the individual citizen and large insurance companies.

Transparency is not optional: every policyholder has the right to receive the Pre-contractual Information Set, a document that clearly summarizes coverages, exclusions, and costs. Reading it is the first act of defending your own interests.

In Brief (TL;DR)

Discover the ultimate policyholder’s manual to understand deductibles, coverage limits, and consumer rights through a comprehensive overview of auto, home, and health policies.

We delve into how deductibles and coverage limits work to help you understand your rights and navigate auto, home, and health policies.

Learn more about consumer rights and how deductibles and coverage limits work.

Conclusions

The Italian insurance landscape is evolving towards greater personalization and accessibility. From the essential protection of a car to the strategic safeguarding of health and profession, policies are financial tools that, when used correctly, provide peace of mind and stability. The key for a savvy consumer lies in information: comparing quotes, understanding technical clauses like deductibles and coverage limits, and knowing your rights are mandatory steps.

One should not see insurance as an imposed tax, but choose it as an ally. In an increasingly unpredictable world, investing in the right protection means preserving the fruits of your labor and ensuring a more secure future for yourself and your loved ones. Digital innovation facilitates this process, but the responsibility for the final choice remains, fortunately, in the hands of the individual.

Frequently Asked Questions

A deductible is a fixed dollar amount that you are responsible for (e.g., $200), while coinsurance is a percentage of the damage (e.g., 10%). Policies often apply both, choosing the one that is less favorable to the insured.

As of December 31, 2024, it has become mandatory for all businesses with headquarters in Italy. For private citizens, there is currently no legal requirement, but it is strongly recommended given climate change.

You have a 15-day grace period after the expiration date during which your coverage is still active. After 15 days, the vehicle is no longer insured, and if you drive it or leave it parked on a public road, you risk having it impounded and receiving heavy fines.

Yes. If you sell, scrap, or export the vehicle, you are entitled to a refund of the unearned portion of the premium you paid (excluding taxes), or you can transfer the policy to a new car while keeping your bonus-malus rating.

For Auto Liability, the settlement offer must be made within 30 days (if there is a jointly signed accident report form) or 60 days (without an agreement) for property damage. For personal injury, the deadline is 90 days. If the company delays, you can file a complaint.

Still have doubts about Insurance: A Complete Guide to Policies, Rights, and Savings?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.