Living and working in Italy, immersed in a culture rich in history and tradition, is an opportunity for many foreign citizens. However, managing your finances, especially sending money to your home country, can present challenges. Whether it’s to support family, invest, or manage property, understanding the mechanics of international wire transfers is essential. In an increasingly connected world, where economic and personal ties cross geographical borders, tools like SEPA and SWIFT transfers become valuable allies. This guide was created to clarify these systems, offering a comprehensive overview for those in Italy who need to transfer funds abroad, combining the efficiency of technological innovation with the traditional value of family support.

Sending money, also known as a remittance, is an act that goes beyond mere economic value. For many, it represents a tangible link to their roots and an essential contribution to the well-being of their loved ones. According to data from the Bank of Italy, in 2024, remittances from foreigners living in Italy reached approximately 8.3 billion euros, with Asia as the main destination area. These numbers highlight the importance of a money transfer system that is not only efficient and secure but also cost-effective.

SEPA: Europe Without Borders for Your Payments

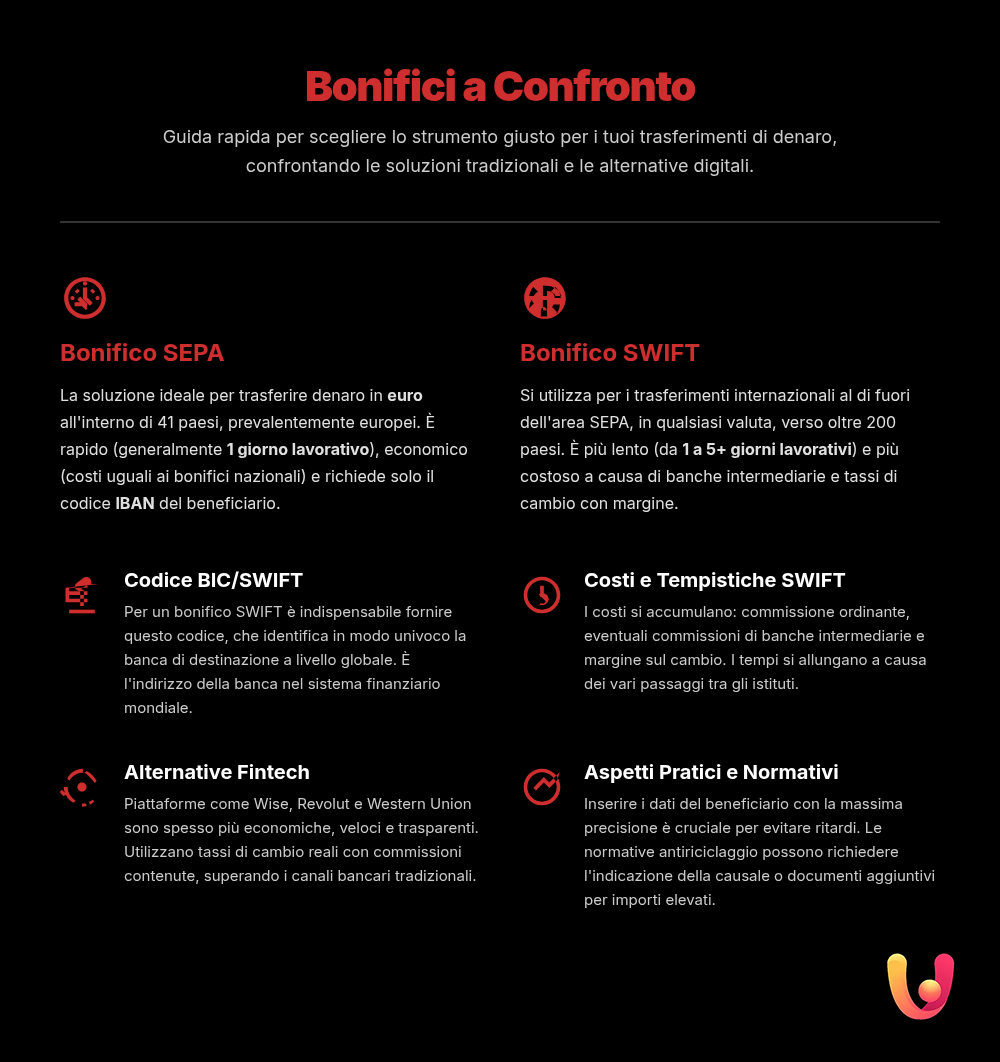

For those who need to send money within Europe, the SEPA system is the simplest and most economical solution. The acronym stands for Single Euro Payments Area. This system was created to make euro payments between member countries as simple, secure, and convenient as domestic payments. The basic idea is to eliminate the differences between domestic and cross-border payments within this area.

Thanks to SEPA, a wire transfer from Rome to Lisbon is as easy and costs the same as a transfer between Rome and Milan.

The SEPA area includes not only the 27 countries of the European Union but also other states such as Iceland, Norway, Liechtenstein, Switzerland, the United Kingdom, and San Marino, for a total of 41 countries. To make a SEPA transfer, you only need the recipient’s IBAN (International Bank Account Number). Transfer times are fast, usually one business day, and the costs are low, often zero or very minimal, comparable to those of a domestic transfer. This makes SEPA transfers the ideal tool for those working in Italy who need to regularly send money to family or manage payments in other European countries.

The advantages of SEPA transfers in summary

The SEPA system offers numerous advantages for those who need to transfer money in Europe. Speed is one of its strengths: funds are typically credited within one business day of the order being placed. Added to this is cost-effectiveness, as fees are generally low or non-existent, making cross-border euro transfers as cheap as domestic ones. Simplicity is another key factor: you only need the recipient’s IBAN to initiate the transaction, without the need for complex codes or additional information. Finally, the wide geographic coverage, which also includes non-EU countries, ensures great flexibility.

SWIFT: The Global Network for Non-European Transfers

When the money’s destination is outside the SEPA area, the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system comes into play. This is a global messaging network used by over 11,000 financial institutions in more than 200 countries to securely exchange instructions for fund transfers. It is important to note that SWIFT does not physically transfer the money but acts as an intermediary for secure communication between the banks involved in the transaction.

Unlike a SEPA transfer, a SWIFT transfer requires more information. In addition to the recipient’s name and account number, the BIC (Bank Identifier Code), also known as the SWIFT code, is essential. This code, consisting of 8 or 11 characters, uniquely identifies the recipient’s bank worldwide. To find the correct code, you can check the bank’s website, bank statements, or use online search tools. A practical example is the need to know the UniCredit BIC SWIFT code if you are sending money to an account at this bank.

Costs and Timing of SWIFT Transfers

SWIFT transfers are generally more expensive and slower than SEPA transfers. The costs can vary significantly depending on the bank, the destination country, and the currency. Fees may include a flat fee charged by the sending bank, a variable fee based on the amount, and sometimes, costs charged by intermediary banks involved in the transfer. There are several options for sharing these costs: OUR (all fees charged to the sender), BEN (all fees charged to the beneficiary), and SHA (shared fees), which is the most common option.

The timing is also longer: a SWIFT transfer can take from 1 to 5 business days, sometimes even more, depending on the countries involved, time zones, and the efficiency of the intermediary banks. This complexity is due to the fact that the money may pass through several banks before reaching its final destination, each of which must process the transaction. For those who need to send money to countries like Bangladesh or Pakistan, the main recipients of remittances from Italy, understanding these factors is crucial for proper financial planning.

Tradition and Innovation: Beyond the Traditional Wire Transfer

Sending money home is an act rooted in Mediterranean culture and many other cultures around the world, a bridge that unites families separated by distance. Today, this tradition is combined with technological innovation, offering alternatives to traditional banking channels. Fintech companies like Wise (formerly TransferWise), Revolut, and Western Union offer international money transfer services that are often faster and more affordable.

These digital platforms are helping to reduce transfer costs and increase transaction transparency, with a positive impact on millions of families.

These services use the real or mid-market exchange rate, applying transparent and often lower fees than banks. The process is entirely digital, manageable via smartphone apps, making sending money a quick and accessible operation for anyone. For example, a foreign worker in Italy can send funds to their family in Morocco or Albania in a few minutes, with certainty about the final cost and crediting times. This evolution represents a great advantage, especially considering that transaction costs can still be an obstacle. For those new to these tools, it is important to have an active bank account for foreigners and to understand the simple procedures required.

Practical and Regulatory Aspects to Consider

Making an international wire transfer requires attention to some practical and regulatory details. It is crucial to correctly enter all the required data, such as the IBAN for SEPA transfers and the BIC/SWIFT code for international ones, in addition to the recipient’s full name and address. An error in this data could cause delays or block the transfer, resulting in inconvenience and additional costs. In some cases, the bank may request additional information, such as the reason for the transfer, especially for large amounts, in line with anti-money laundering regulations.

Anti-money laundering (AML) regulations require financial intermediaries to monitor transactions to prevent the use of the financial system for illicit purposes. For amounts exceeding certain thresholds, you may need to provide documentation proving the legal origin of the funds. Although this may seem like a bureaucratic burden, it is a security measure to protect the entire system. For a foreign citizen, being informed about these aspects and perhaps how to handle a potential blocked account, is part of conscious and secure financial management.

In Brief (TL;DR)

Sending money abroad requires knowledge of SEPA and SWIFT transfers: this complete guide for foreigners explains the differences, costs, and how to optimize remittances to your home country.

Learn how to use the SEPA network, for transfers in euros, and SWIFT, for other currencies, to send money to your home country securely and affordably.

Use the correct BIC/SWIFT codes and choose between a SEPA or SWIFT transfer to send money to your home country securely while optimizing costs.

Conclusions

Sending money abroad from Italy is a daily operation for many foreign citizens, an act that combines the duty of family support with the use of modern financial tools. The choice between a SEPA and a SWIFT transfer essentially depends on the destination of the funds: the former is the ideal solution for euro transfers within the European area, thanks to its speed and affordability; the latter is the reference system for all other destinations in the world, albeit with higher costs and longer times. Understanding the differences between these two systems is the first step to optimizing transfers and ensuring that your money reaches its destination as efficiently as possible. Innovation, represented by fintech platforms, now offers even more advantageous alternatives, combining the tradition of long-distance support with the simplicity of digital technology. Being informed and choosing the right tool means not only saving time and money but also giving more value to every single euro sent home.

Frequently Asked Questions

What is the main difference between a SEPA and a SWIFT transfer?

The fundamental difference lies in the geographical area of application and the costs. The SEPA (Single Euro Payments Area) transfer is used for transfers in euros within an area that includes 41 countries, mainly in Europe. It is fast (usually 1 business day) and inexpensive, often free. The SWIFT (Society for Worldwide Interbank Financial Telecommunication) transfer, on the other hand, is the standard system for international transfers outside the SEPA area, to over 200 countries. It is generally more expensive and takes longer (from 1 to 5 business days or more) due to the possible presence of intermediary banks.

What information do I need to send an international wire transfer?

The necessary information varies depending on the type of transfer. For a SEPA transfer, the recipient’s full name and their IBAN (International Bank Account Number) are sufficient. For a SWIFT transfer, in addition to the recipient’s first name, last name, and address, and their account number, it is essential to provide the destination bank’s BIC/SWIFT code. This code uniquely identifies the credit institution globally.

Are there cheaper alternatives to international bank transfers?

Yes, there are several innovative and often more affordable alternatives to traditional banking channels. Digital platforms and fintech companies like Wise, Revolut, Western Union, and others offer international money transfer services. These operators are known for charging lower and more transparent fees and for using the real or mid-market exchange rate, reducing hidden costs. Additionally, transfers are often faster and can be conveniently managed via smartphone apps.

Why does a SWIFT transfer cost more than a SEPA transfer?

A SWIFT transfer is more expensive for several reasons. First, it often involves a currency conversion, on which the bank applies a margin (spread) over the interbank exchange rate. Second, the transfer may pass through one or more intermediary banks before reaching the recipient’s bank, and each of these may charge a fee for the service. Finally, banks apply fixed or variable fees for managing the international transaction itself, which is inherently more complex than a standardized transfer like SEPA.

What happens if I enter the beneficiary’s details incorrectly?

Entering incorrect data, such as a wrong IBAN or BIC/SWIFT code, can have several consequences. In the best-case scenario, the bank might reject the transaction before executing it. If the transfer is sent anyway, it might be rejected by the beneficiary’s bank and returned, but not before fees have been charged for processing the transaction and its reversal. In the worst-case scenario, if the incorrect IBAN corresponds to a valid account, the funds could be credited to the wrong person, and recovery could become complex and is not guaranteed. It is therefore crucial to double-check all data with the utmost care before confirming a transaction.

Frequently Asked Questions

The main difference is geographical and currency-related. A SEPA (Single Euro Payments Area) transfer is used to send euros within 36 European countries and is generally fast and inexpensive, almost like a domestic transfer. A SWIFT (Society for Worldwide Interbank Financial Telecommunication) transfer is used to send money globally, in various currencies, to about 200 countries. It tends to be more expensive and take more time.

The cost varies greatly. For a SEPA transfer in euros, the fees are low or non-existent, similar to domestic ones. For a SWIFT transfer, the costs are higher and can include a flat fee, a percentage of the amount, and a markup on the exchange rate applied by the bank. Sometimes, fees from intermediary banks are also added. It is always advisable to check the specific terms and conditions of your credit institution.

The BIC/SWIFT code identifies a specific bank internationally and is essential for non-SEPA transfers. You can find it on the beneficiary’s bank statement, request it directly from their bank, or look it up on the credit institution’s website. There are also online tools to verify the code. Make sure it is correct to avoid delays or the transfer being rejected.

If the error is noticed immediately, it may be possible to cancel the transfer before the bank processes it, usually before the cut-off time. If the transfer has already been sent with a non-existent IBAN or SWIFT, it will be automatically reversed. However, if the code corresponds to another account, the situation is more complex: you must contact your bank immediately to initiate a fund recall procedure, but recovery is not always guaranteed and depends on the cooperation of the receiving bank and the good faith of the person who received the money.

Yes, today there are numerous online services and apps specializing in international money transfers. These fintech platforms often offer lower fees and, most importantly, apply the real exchange rate or one with a minimal markup, making them more transparent and affordable than traditional banking channels, especially for transfers in currencies other than the euro.

Still have doubts about International Wire Transfers: A Complete Guide to SEPA and SWIFT for Foreigners?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.