In an increasingly complex financial world, navigating the various investment options can seem like a daunting task. Among the instruments that have gained great popularity, especially in Italy, are Investment Certificates. These products act as a bridge between the prudence typical of the Mediterranean savings culture and the search for more innovative returns. Originating in Germany in the 1990s and arriving in Italy at the beginning of the new millennium, certificates have seen significant growth, reaching €56 billion in June 2024. This success is linked to their ability to offer periodic cash flows and capital protection.

But what are they exactly? Certificates are structured financial instruments, issued by banking institutions, whose value is linked to the performance of an underlying asset (such as a stock, an index, or a commodity). Although technically derivatives, they are designed to be accessible even to small savers, allowing for the implementation of otherwise complex investment strategies. This comprehensive guide will explore their structures, different types, the risks not to be underestimated, and the opportunities they can offer to those seeking a balance between tradition and innovation in their portfolio.

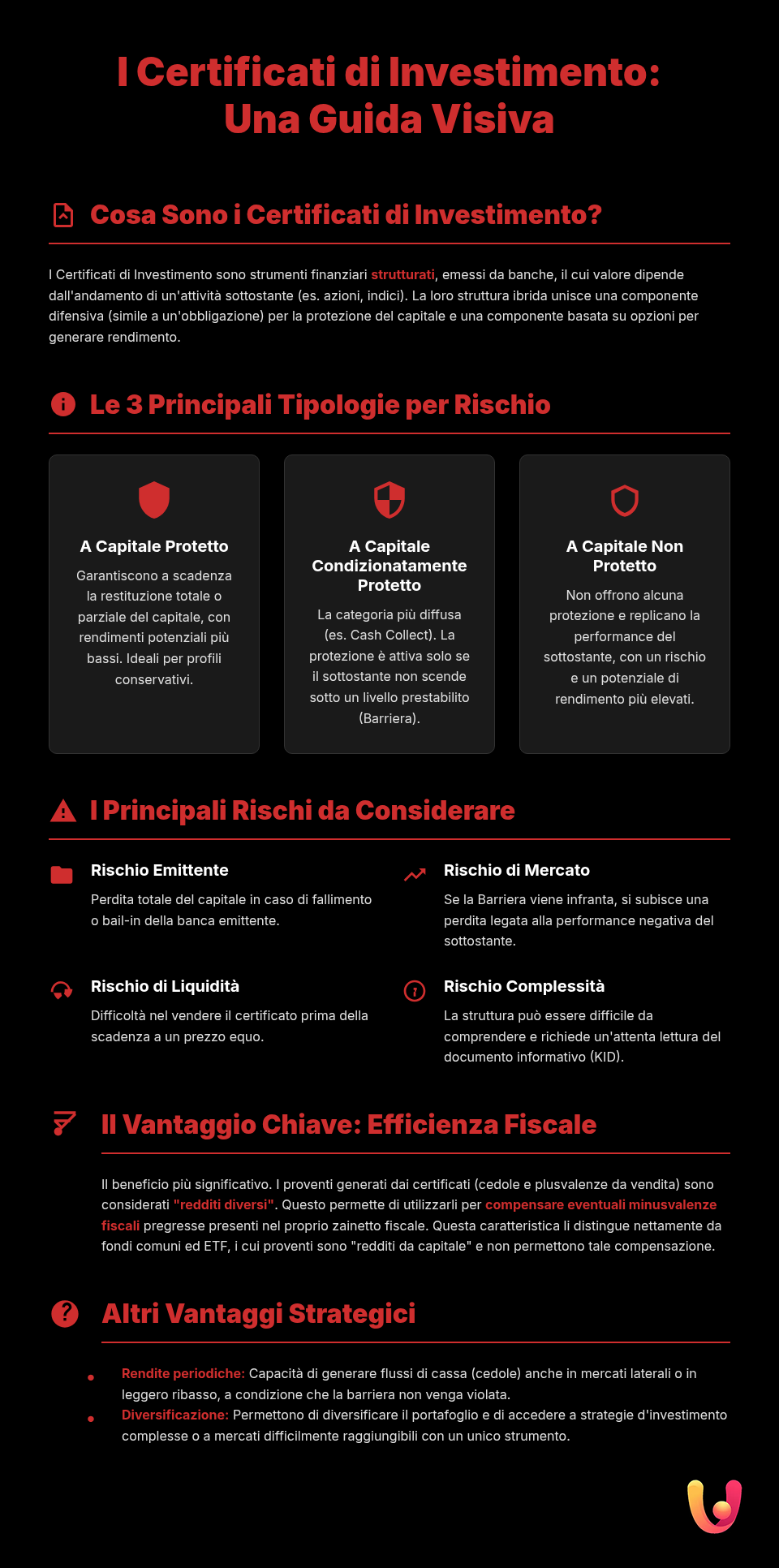

What Are Investment Certificates

Investment Certificates are securitized derivative financial instruments. This means they are tradable securities, like stocks, whose value “derives” from an underlying asset. The issuer, typically a large investment bank, constructs the certificate by combining various financial elements, mainly a bond and one or more options. This hybrid structure is the core of their functionality and versatility.

The underlying asset can be of various types: a single stock, a basket of securities, a stock index (like the FTSE MIB), a currency, or a commodity. Issuers are required to list certificates on regulated markets, such as Borsa Italiana’s SeDeX, ensuring liquidity and price transparency. CONSOB, the Italian regulatory authority, monitors these products and the intermediaries who offer them, drawing attention to the need for transparency and proper management of conflicts of interest. For the investor, understanding the nature of these instruments is the first step toward a well-informed investment.

The Structure of a Certificate: Combining Tradition and Innovation

Imagine a certificate as a vehicle assembled from two main components. The first, linked to tradition, is similar to a bond and constitutes the defensive part of the instrument, the one aimed at protecting the invested capital. The second, geared toward innovation, is composed of financial options, the “engine” that allows for generating extra returns tied to specific market scenarios. It is precisely this combination that enables the creation of customized risk/return profiles, suitable for different needs.

By purchasing a certificate, with a single transaction and for a small amount, you gain access to an investment strategy that would otherwise be difficult to implement.

To fully understand a certificate, it is essential to know its key elements. The Underlying Asset is the financial asset on which the product’s value depends. The Barrier is a critical price threshold: as long as the underlying asset does not breach it, the capital protection (total or partial) remains active. The Strike is the initial value of the underlying asset used as a reference, while the Maturity indicates the certificate’s expiration date. These parameters define the instrument’s risk profile and potential return.

The Main Types of Certificates on the Italian Market

The market offers a wide range of certificates, primarily classified based on the level of capital protection. This distinction is fundamental to align the investment with one’s risk tolerance. There are three main macro-categories: capital-protected, conditionally capital-protected, and non-capital-protected.

Capital-Protected Certificates

These instruments are designed for the most cautious investors with a low-risk appetite. Their structure guarantees, at maturity, the total (100%) or near-total (e.g., 95%) return of the invested capital, regardless of the underlying asset’s performance. However, this protection comes at a cost: the potential return is generally lower than other types of certificates or direct investment in the underlying asset. They are suitable for those who want to participate in stock market rallies but wish to protect themselves from potential downturns.

Conditionally Capital-Protected Certificates

This is the most widespread and popular category in the Italian market. Capital protection is subject to a condition: the value of the underlying asset must not fall below a certain level, the barrier. As long as the asset’s price remains above the barrier, the investor receives the nominal capital at maturity. If the barrier is breached, the protection is lost, and the investor incurs a loss commensurate with the underlying asset’s negative performance. Within this family, the best-known are:

- Cash Collect: They pay periodic coupons (e.g., monthly or quarterly) if the underlying asset is trading above the barrier on the observation dates. Many include a “memory effect,” which allows for the recovery of previously unpaid coupons if the condition is met again.

- Bonus Cap: At maturity, they pay a premium (Bonus) if the underlying asset has never touched the barrier during the product’s life. They offer an attractive return in sideways or slightly bearish market conditions.

Non-Capital-Protected Certificates

These certificates offer no capital protection and replicate, more or less proportionally, the performance of the underlying asset, both upwards and downwards. The investor is therefore exposed to potentially total losses of the invested capital. In exchange for this higher risk, they offer a higher potential return, suitable for those with strong directional expectations for the markets and a high-risk tolerance. An example is Benchmark certificates, which behave similarly to an ETF by replicating the underlying’s performance.

Risk Analysis: What to Know Before Investing

Despite their flexibility and possible protections, investment certificates are not without risks. Fully understanding these aspects is crucial to avoid unpleasant surprises and make informed choices. Their complex structure requires careful analysis before purchasing.

Certificates are complex instruments that offer the opportunity to invest in a wide range of financial assets and, in some cases, can be subject to wide price variations, consequently exposing holders to losses, even significant ones, in adverse scenarios.

The main risks to consider are:

- Issuer Risk: Certificates are legally unsecured senior bonds. In the event of the issuing bank’s failure or resolution procedure (bail-in), the investor risks losing the entire capital, even with capital-protected certificates. This is why it is essential to verify the issuer’s financial soundness.

- Market Risk: The certificate’s value depends on the performance of the underlying asset. If the barrier is breached in conditionally protected products, the investor is exposed to a loss linked to the reference asset’s negative performance.

- Liquidity Risk: Although certificates are listed on regulated markets, during certain market phases or for thinly traded products, it might be difficult to sell the instrument before maturity at a fair price.

- Complexity Risk: The structure of some certificates can be difficult to understand. It is essential to carefully read the Key Information Document (KID) and the informational documentation to understand the risk/return profile.

Advantages and Opportunities: Why Choose Them

Despite the risks, certificates offer unique advantages that have led to their success, especially in the Italian context. The primary market has seen record volumes, exceeding €7 billion in the first quarter of 2025, testifying to strong investor interest.

One of the main strengths is tax efficiency. The proceeds from certificates (both coupons and capital gains) are considered “miscellaneous income” and are taxed at 26%. This allows for offsetting any previous capital losses in one’s tax portfolio, an advantage not offered by other instruments like funds and ETFs, whose proceeds are classified as “income from capital.” This feature makes them a powerful tool for tax optimization and planning.

Furthermore, certificates allow you to generate an income through periodic coupons, even in sideways or slightly bearish markets, meeting the need for constant cash flows. They allow for portfolio diversification by accessing complex investment strategies with a single instrument and a small amount of capital. Finally, the wide range of offerings makes it possible to find solutions suitable for almost any market expectation and risk profile, from total protection to the pursuit of high returns.

Certificates in the Mediterranean Context: A Familiar Approach

The success of certificates in Italy and other Mediterranean countries is not accidental but is linked to a financial culture that balances tradition and innovation. The Italian investor often embodies the “good head of the family” figure: cautious, attentive to wealth protection, but also eager to see it grow. Certificates address this duality. The capital protection component satisfies the need for security, a pillar of traditional savings management.

At the same time, the possibility of receiving periodic coupons is a familiar concept, similar to rent or an annuity, which makes the return more tangible and predictable. Capital-protected products, in particular, were the most in-demand in 2023, accounting for 70% of the volumes placed. This preference shows that, even in the face of complex markets, the priority remains capital preservation. Certificates, therefore, are not seen just as speculative instruments, but as a modern evolution of the classic bond investment, capable of offering something more in an era of volatile interest rates.

In Brief (TL;DR)

A comprehensive guide to understanding what investment certificates are, how they are structured, and what their risk and return profile is.

We will analyze in detail their structures, risk/return profile, and for which type of investor they are most suitable.

Evaluate if and how these instruments can fit your financial goals by analyzing their risk/return profile.

Conclusions

Investment Certificates are versatile and multifaceted financial instruments, capable of adapting to multiple market scenarios and risk profiles. Their hybrid structure, which combines protection and return, has made them a valid alternative for portfolio diversification, finding fertile ground in the Italian savings culture. The ability to obtain periodic coupons and the significant advantage of tax efficiency are among the key factors of their success.

However, it is crucial not to underestimate their complexity and associated risks, such as issuer risk and market risk. There are no risk-free investments, and certificates are no exception. The choice must always be preceded by a thorough analysis of the product, reading the official documentation (KID), and evaluating how the instrument fits into one’s overall investment strategy. Ultimately, certificates are a powerful tool in the hands of a knowledgeable investor, but not a shortcut to easy and guaranteed gains.

Frequently Asked Questions

They are derivative financial instruments, issued by banks, whose value depends on the performance of an underlying asset like a stock or an index. They allow for investing with different strategies, offering varied risk and return profiles, often with capital protection options.

Safety depends on the certificate’s structure. There are capital-protected certificates that guarantee repayment at maturity, but with limited returns. Conditionally capital-protected ones offer protection only if the underlying asset does not fall below a ‘barrier’. If the barrier is breached, you can suffer a partial or total loss of capital. There is also always issuer risk, which is the risk that the issuing bank fails.

They are suitable for investors who have a good knowledge of the markets and are looking for returns in sideways or moderately bearish market scenarios. They are ideal for those who want a predefined return profile and accept the specific risks, such as the instrument’s complexity and the risk associated with the barrier. They are generally not recommended for retail or inexperienced investors.

A Cash Collect certificate pays periodic premiums (coupons) if the underlying asset is above a certain level on specific observation dates. The potential gain is the sum of these coupons. If the conditions are not met, the coupon may not be paid, although some certificates with a ‘memory effect’ allow for its recovery in the future. At maturity, if the underlying is above the barrier, the capital is repaid; otherwise, the repayment will be lower.

In Italy, both capital gains (the difference between the sale/redemption price and the purchase price) and coupons are considered ‘miscellaneous income’ and are taxed at a rate of 26%. An important tax advantage is that this income can be used to offset any previous capital losses in one’s tax portfolio, within four years of their realization.

Still have doubts about Investment Certificates: A Guide to Risks and Opportunities?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.