In the world of online trading, few tools are as iconic and universally recognized as Japanese candlesticks. This charting technique, born centuries ago in Japan, is now a global language for traders and investors, from Italy to the rest of Europe and the world. Its strength lies in its ability to tell an immediate visual story: the battle between buyers and sellers. Understanding how to read these charts is not just a technical skill, but a way to interpret market psychology and anticipate its movements. Whether you’re trading stocks, Forex, commodities, or cryptocurrencies, mastering candlestick analysis is a fundamental step for anyone wishing to navigate the markets with greater awareness.

This guide is designed to offer a comprehensive overview, suitable for both novices and more experienced traders looking to solidify their knowledge. We will explore the historical origins of this tool, analyze the anatomy of each individual candle, and unveil the most significant patterns. The goal is to provide the necessary skills to recognize signals of trend reversal or continuation, integrating this ancient art with modern trading strategies, with a special focus on the European and Italian market context.

The Origins of Japanese Candlesticks: A Journey Through Time

The history of Japanese candlesticks is rooted in 18th-century Japan, an era when rice was not just a food but a true commodity on which economic fortunes were built. Credit for their invention is given to Munehisa Homma, a brilliant rice merchant from Sakata. Homma understood that, beyond the simple law of supply and demand, rice prices were deeply influenced by the emotions of market participants. To visualize and systematize these movements, he developed a charting method that recorded four key data points for each session: the opening price, high, low, and closing price.

This system, a forerunner to modern candlestick charts, allowed Homma to amass an enormous fortune by analyzing recurring patterns that reflected the fear and greed of traders. However, this powerful technique remained a well-kept secret in the East for centuries. It wasn’t until the late 1980s, thanks to the work of Steve Nison, that candlestick analysis was introduced and popularized in the Western world. Today, this methodology is an indispensable standard in technical analysis globally, used daily by millions of traders in European and international financial markets.

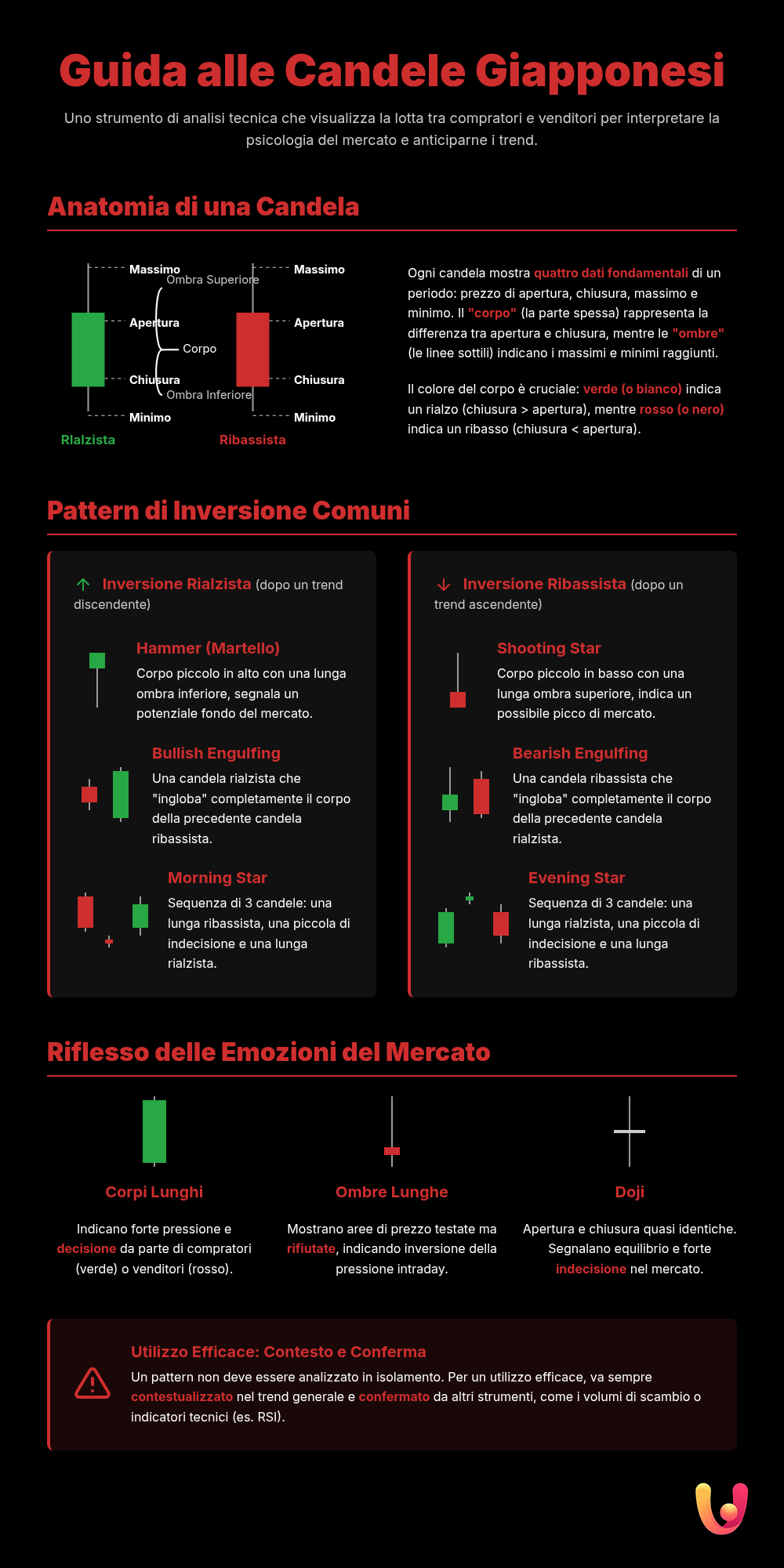

Anatomy of a Japanese Candlestick

To correctly interpret market signals, it is essential to understand the structure of a single Japanese candlestick. Each candle contains four fundamental pieces of information related to a specific time frame, which can range from one minute to one month. These data points are the opening price, closing price, the high, and the low. Their graphical representation is what gives the candle its characteristic shape and immediate meaning. The central, thicker part is called the body (or real body) and represents the distance between the opening and closing prices.

The great advantage of candlestick representation, compared to a line chart, is that it intuitively highlights all the open, close, high, and low data, often providing clear indications of market sentiment as well.

The thin lines extending above and below the body are the shadows (or wicks). The upper shadow indicates the highest price reached during the period, while the lower shadow marks the lowest. The color of the body is crucial: it is usually green (or white) if the close is higher than the open (a bullish candle), indicating a prevalence of buyers. Conversely, it is red (or black) if the close is lower than the open (a bearish candle), signaling greater pressure from sellers. The combination of the body and shadows reveals the dynamics of the battle between bulls and bears in that session.

The Most Common Japanese Candlestick Patterns

Candlestick analysis is not limited to a single candle but focuses on patterns, which are configurations formed by one or more candles that can signal the future evolution of prices with a certain probability. These patterns are mainly divided into two categories: reversal patterns, which suggest an imminent change in the trend’s direction, and continuation patterns, which indicate a likely continuation of the current trend. Recognizing them is a key skill for any trader.

Bullish Reversal Patterns

Bullish reversal patterns appear at the end of a downtrend and signal that buyers are about to take over. Among the best-known are:

- Hammer: A single candle with a small body, a very long lower shadow (at least twice the size of the body), and little to no upper shadow. It suggests that despite strong selling pressure during the session, buyers managed to push the price back up, signaling a potential capitulation by sellers.

- Bullish Engulfing: A powerful two-candle pattern. It occurs when a bullish candle (green) completely “engulfs” the body of the preceding bearish candle (red) with its own body. This indicates a decisive shift in sentiment, with buyers having overwhelmed sellers.

- Morning Star: A reliable three-candle pattern that heralds a bullish reversal. It consists of a long bearish candle, followed by a small candle (the “star”) that gaps down, and finally a long bullish candle that recovers much of the first candle’s body. It symbolizes the end of the night (the downtrend) and the arrival of dawn (the uptrend).

Bearish Reversal Patterns

Mirroring the previous ones, bearish reversal patterns form at the peak of an uptrend, warning of a possible downward reversal.

- Shooting Star: This is the opposite of the Hammer. It has a small body, a very long upper shadow, and little to no lower shadow. It indicates that buyers tried to push prices higher, but sellers intervened forcefully, rejecting the rally and closing near the session’s lows.

- Bearish Engulfing: This pattern appears when a bearish candle (red) completely envelops the body of the preceding bullish candle (green). It signals that sellers have decisively taken control of the market, invalidating the previous bullish push.

- Evening Star: This is the bearish counterpart to the Morning Star. After an uptrend, a long green candle forms, followed by a small “star” that gaps up, and finally a long red candle that closes well within the body of the first candle. This pattern signals the exhaustion of buyers’ strength.

Market Psychology and Japanese Candlesticks

Each Japanese candlestick is more than just data; it’s a snapshot of the market’s collective psychology at a given moment. The length of the body, the extent of the shadows, and the color tell the story of the emotional battle between the optimism of buyers (bulls) and the pessimism of sellers (bears). A long green body, for example, doesn’t just show a price increase; it represents the confidence and control of buyers. Conversely, a long red body reveals the fear and strength of sellers pushing the market down.

Long shadows are particularly telling: a long upper shadow (as in a Shooting Star) indicates the market’s rejection of higher prices, a sign that initial enthusiasm was rebuffed. Conversely, a long lower shadow (as in a Hammer) shows that attempts to push prices down were rejected, suggesting strong support at that level. Patterns like the Doji, where the open and close coincide, are the ultimate expression of indecision and balance between forces, often heralding an imminent turning point for the trend. Understanding this psychological dimension allows you to anticipate the moves of other traders and better manage your own risk management.

Tradition and Innovation: Candlesticks in the European Market

Although born in an agricultural and pre-industrial context, Japanese candlesticks have shown remarkable adaptability, becoming a cornerstone tool even in the modern and fast-paced European financial markets. Traders in Milan, Frankfurt, or Paris daily use the same patterns as Munehisa Homma to analyze the performance of the Eurostoxx 50 or FTSE MIB stocks. Their effectiveness lies in their ability to represent universal principles of human behavior in the face of risk and opportunity, as valid today as they were then.

Innovation, however, has not stood still. Today, traditional candlestick analysis is enhanced and integrated with advanced quantitative tools. Algorithmic trading algorithms are programmed to automatically recognize candlestick patterns in milliseconds, executing large-scale trades. Furthermore, volume analysis has been merged with candlestick charts, creating “volumetric candles” that weight the candle’s shape based on traded volumes, offering an even deeper insight into the strength of a move. This fusion of ancient wisdom and modern financial engineering demonstrates the continued relevance of this tool.

Practical Tips for Traders in Italy

For a trader operating from Italy on global markets, the effective use of Japanese candlesticks requires more than just pattern recognition. The first tip is to never consider a pattern in isolation. Its validity heavily depends on the context: a Hammer is much more significant if it appears at a major support level or after a long downtrend. It is crucial to always analyze the prevailing trend and the overall market structure before making a decision.

Another crucial aspect is confirmation. A signal provided by a candlestick pattern should, ideally, be confirmed by other elements. An increase in trading volume during the formation of a Bullish Engulfing, for example, significantly increases its reliability. Similarly, using technical indicators like the RSI or moving averages can help filter out false signals. Finally, it is essential to integrate candlestick analysis with a solid risk calculation (VaR) strategy, always defining stop-loss and take-profit levels for every trade based on these signals.

In Brief (TL;DR)

Japanese candlesticks are one of the most effective technical analysis tools for interpreting and predicting the performance of financial markets.

Learn how to interpret candlestick signals to anticipate market moves and refine your trading strategies.

Master the analysis of key patterns to anticipate market moves and refine your trading strategies.

Conclusion

Japanese candlesticks represent much more than a simple charting technique; they are a universal language that allows us to decipher the psychology and dynamics of financial markets. From their origins in the rice market of feudal Japan to their application in modern algorithmic trading systems, their essence has remained unchanged: to offer a clear and immediate view of the struggle between buyers and sellers. For the Italian and European trader, mastering candlestick analysis means equipping oneself with a powerful tool to improve entry and exit timing and to interpret market sentiment with greater depth.

However, it is crucial to remember that no single tool is infallible. The effectiveness of Japanese candlesticks is maximized when they are used in a broader context, alongside volume analysis, other technical indicators, and rigorous risk management. By integrating this ancient art with modern analytical methodologies, every investor can enrich their toolkit and approach the markets with superior strategic awareness.

Frequently Asked Questions

What are Japanese candlesticks in trading?

Japanese candlesticks are a graphical representation of the price movement of a financial instrument over a specific time interval. Created in 18th-century Japan by rice merchant Munehisa Homma, they are now the most widely used technical analysis tool in the world. Each candle displays four essential data points: open, close, high, and low price, offering an immediate view of the struggle between buyers (bulls) and sellers (bears) and of market sentiment.

How do you read a Japanese candlestick?

A candlestick consists of a “body” (the thick part) and “shadows” (the thin lines). The body represents the range between the opening and closing price. Its color indicates the direction: green (or white) if the price went up (close > open), red (or black) if it went down (close < open). The upper and lower shadows indicate the highest and lowest prices reached during the period, respectively. The combination of these elements reveals the strength and pressure of buyers and sellers.

What are the most important candlestick patterns?

Patterns are formations of one or more candles that signal possible future movements. Among the most important are reversal patterns, such as the Hammer and Bullish Engulfing (which indicate a possible bullish reversal), or the Shooting Star and Bearish Engulfing (which signal a potential bearish reversal). Other key patterns include the Doji, which indicates indecision, and three-candle patterns like the Morning Star (bullish) and the Evening Star (bearish).

Are Japanese candlesticks a reliable tool?

Japanese candlesticks are a very useful tool, but they are not infallible. Their reliability increases significantly when used in combination with other analysis tools. A candlestick pattern is more significant if it forms at important support or resistance levels, if it is confirmed by an increase in trading volume, or if the signal aligns with that of other technical indicators (e.g., RSI, moving averages). Using them in isolation can lead to false signals.

Where can Japanese candlesticks be applied?

Candlestick analysis is universal and can be applied to any financial market and any time frame. It is widely used in trading stocks (in both Italian and international markets), Forex (the currency market), commodities (like gold and oil), stock indices, and, more recently, cryptocurrencies like Bitcoin and Ethereum. Their effectiveness stems from the fact that they reflect human psychology, a common factor in all speculative markets.

Frequently Asked Questions

Japanese candlesticks are a graphical representation of the price movement of a financial asset, such as a stock or currency, over a specific time interval. Each ‘candle’ shows four key pieces of information: the opening price, closing price, the high, and the low. This visualization provides an immediate summary of the ‘battle’ between buyers and sellers, making it easier to interpret market psychology.

Reading a candle is quite intuitive. The ‘body,’ which is the thickest part, indicates the difference between the opening and closing price. If the close is higher than the open, the candle is usually green or white and signals a price increase. If the close is lower, the candle is red or black, indicating a price decrease. The thin lines above and below, called ‘shadows’ or ‘wicks,’ show the highest and lowest prices reached during that period, respectively.

No technical analysis tool is 100% infallible, and Japanese candlesticks are no exception. The patterns offer valuable insights and increase the probability of making a correct forecast, but they never guarantee a certain outcome. The reliability of a signal increases when it forms at important support or resistance levels. It is always advisable to use candlestick patterns in conjunction with other technical indicators to confirm your analysis and manage risk.

For beginners, it’s helpful to focus on a few fundamental and easy-to-recognize patterns. Among the best-known are the ‘Doji,’ which signals market uncertainty, the ‘Hammer,’ which can indicate a potential bullish reversal after a downtrend, and the ‘Engulfing’ pattern (bullish or bearish), a powerful two-candle reversal signal. Learning to identify these patterns is an excellent starting point for candlestick analysis.

Although Japanese candlesticks are a powerful tool, relying exclusively on them is risky and not recommended. The most solid trading strategies are based on the ‘confluence’ of multiple signals. This means integrating candlestick analysis with other tools, such as studying trading volumes, identifying trends, and using indicators like moving averages or the RSI. Using multiple tools together provides stronger confirmations and improves the effectiveness of trading decisions.

Still have doubts about Japanese Candlesticks: A Guide to Predicting Market Trends?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.