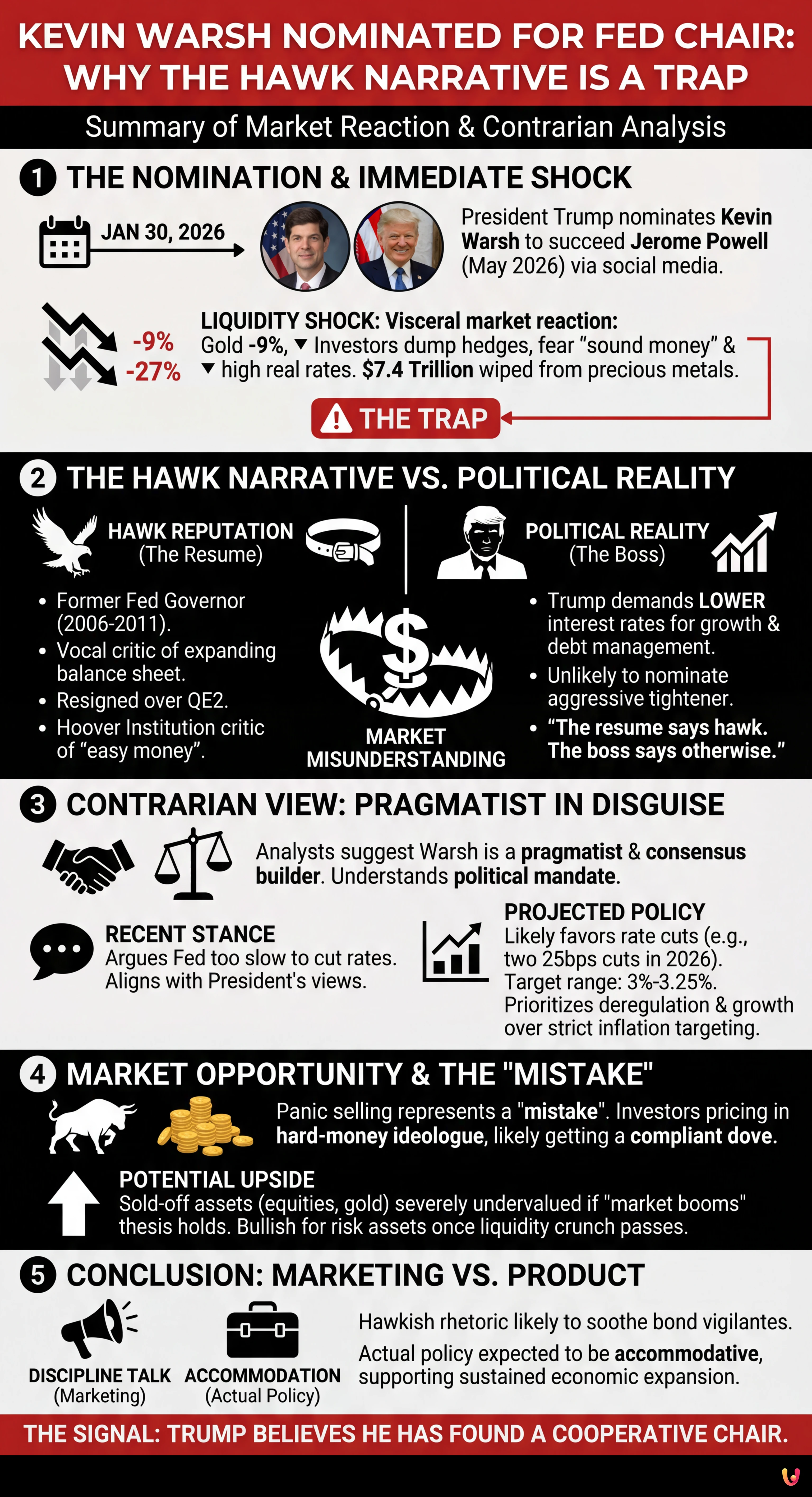

On Friday, President Donald Trump ended months of speculation by announcing his intention to nominate Kevin Warsh as the next Chair of the Federal Reserve. The announcement, made via social media on January 30, 2026, positions the former Fed governor to succeed Jerome Powell when his term expires in May. The immediate market reaction was visceral: a liquidity shock sent precious metals plunging and bond yields adjusting as investors scrambled to price in a return to "sound money." However, seasoned analysts suggest that the market’s knee-jerk reaction is based on a fundamental misunderstanding of who Kevin Warsh is today—and more importantly, who he works for.

The prevailing narrative driving the current volatility is straightforward: Warsh is a hawk. During his previous tenure on the Board of Governors from 2006 to 2011, he was a vocal critic of the central bank’s expanding balance sheet. He famously resigned in 2011, largely in opposition to the second round of quantitative easing (QE2), and has spent the intervening years at the Hoover Institution criticizing the Fed’s "easy money" policies. On the surface, his nomination signals a pivot toward monetary rectitude and higher interest rates. But according to market strategists looking past the resume, this assumption is the "mistake" that savvy investors can profit from.

The Hawk in Name Only?

While Warsh’s biography screams monetary discipline, the political reality of 2026 suggests a different trajectory. President Trump has been unequivocal about his demands for lower interest rates to fuel economic growth and manage the national debt. It is highly improbable that he would nominate a candidate who intends to tighten policy aggressively. As noted by Charlie Garcia in a recent analysis for MarketWatch, "The resume says hawk. The boss says otherwise."

The core argument for the contrarian view is that Warsh is a pragmatist and a consensus builder who understands the political mandate. His criticism of the Fed in recent years has often focused on its "backward-looking" models rather than just the looseness of policy. In recent appearances, Warsh has argued that the Fed has been too slow to cut rates, aligning himself conveniently with the President’s views. According to analysts at PIMCO, Warsh would likely favor delivering at least the two 25-basis-point cuts currently indicated in the Fed’s economic projections for 2026, potentially bringing the federal funds rate down to a range of 3%–3.25%.

The Liquidity Trap and Market Opportunity

The disconnect between Warsh’s reputation and the likely reality of his tenure created a massive liquidity event on Friday. Gold prices tumbled nearly 9% and silver plunged 27% as investors dumped hedges, fearing a new era of high real rates. According to financial data, this sell-off wiped out an estimated $7.4 trillion in combined market value from precious metals. This panic selling represents the "mistake" investors are making: they are pricing in a hard-money ideologue when they are likely getting a compliant dove dressed in hawkish clothing.

If the contrarian thesis holds—that Warsh will facilitate the "market booms" Trump desires—then the assets that were sold off are severely undervalued. A Fed Chair who prioritizes deregulation and growth over strict inflation targeting would be bullish for equities and, ironically, supportive of gold once the initial liquidity crunch passes and the reality of continued easy money sets in. The "discipline talk" is likely marketing intended to soothe bond vigilantes, while the actual policy product will be accommodation.

Political Context and Fed Independence

The backdrop of this nomination is as turbulent as the market reaction. The relationship between the White House and the current Fed Chair, Jerome Powell, has deteriorated significantly. Reports indicate that the Department of Justice is pursuing an investigation into Powell, a move that has drawn sharp criticism from Senate Republicans. Senator Thom Tillis has stated he may block confirmation hearings until the investigation is resolved, adding a layer of uncertainty to the transition.

Despite these hurdles, Trump remains confident, calling Warsh "central casting" and predicting he will be "one of the GREAT Fed Chairmen." For investors, the signal is clear: The President believes he has found a Chair who will cooperate. The market’s assumption that Warsh will crash the economy to fight inflation contradicts the President’s primary political goal of sustained economic expansion.

In Brief (TL;DR)

President Trump nominated Kevin Warsh as Fed Chair, triggering a massive market sell-off driven by fears of his past hawkish stance.

Analysts argue the panic is misplaced, as Warsh is expected to prioritize Trump’s pro-growth agenda over strict monetary discipline.

This disconnect between Warsh’s hard-money reputation and political reality presents a lucrative opportunity for investors who see past the initial volatility.

Conclusion

Kevin Warsh’s nomination is a Rorschach test for the markets. Those looking at the past see a hawk who will crush inflation and asset prices. Those looking at the present political landscape see a pragmatist appointed to keep the cheap money flowing. The violent sell-off in safe-haven assets suggests the majority has bought the "hawk" narrative. However, if Warsh proves to be the accommodative Chair that Trump demands, the current dip in metals and bonds represents a significant buying opportunity. The mistake is assuming the past dictates the future; the profit lies in betting on the political reality.

Frequently Asked Questions

Kevin Warsh is traditionally viewed as a monetary hawk due to his past criticism of the Federal Reserve expanding balance sheet and his opposition to quantitative easing in 2011. However, many analysts argue this label is misleading in the current political climate. The article suggests he is likely a pragmatist who will align with President Trump desire for lower interest rates and economic growth, effectively acting more like a dove despite his resume suggesting otherwise.

The sharp decline in precious metals, with gold falling nearly 9 percent and silver plunging 27 percent, was caused by a visceral market reaction to Warsh reputation as a hard-money advocate. Investors panicked, fearing a new era of high real rates and tight monetary policy, leading to a massive liquidity shock. Contrarian analysts believe this sell-off is a mistake based on a misunderstanding of how Warsh will actually govern.

Despite his past hawkish rhetoric, Warsh has recently argued that the Fed has been too slow to cut rates. Analysts at PIMCO predict that he would likely favor delivering at least two 25-basis-point cuts in 2026, potentially bringing the federal funds rate down to a range of 3 to 3.25 percent. His approach is expected to prioritize the administration goal of sustained economic expansion over strict inflation targeting.

The immediate market reaction was volatile, treating the nomination as a signal for monetary rectitude and higher yields. However, savvy investors view this as a trap. The contrarian perspective is that the market is pricing in a hard-money ideologue when they are likely getting a compliant Chair who will facilitate market booms. This disconnect has created what some strategists see as a significant buying opportunity in assets that were recently sold off.

President Trump nominated Warsh because he views him as a candidate from central casting who will ultimately cooperate with the White House agenda. The President has been unequivocal about demanding lower interest rates to manage national debt and fuel growth. It is highly improbable he would select a candidate intending to tighten policy aggressively, suggesting Trump sees Warsh as a consensus builder who will support deregulation and easy money.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.