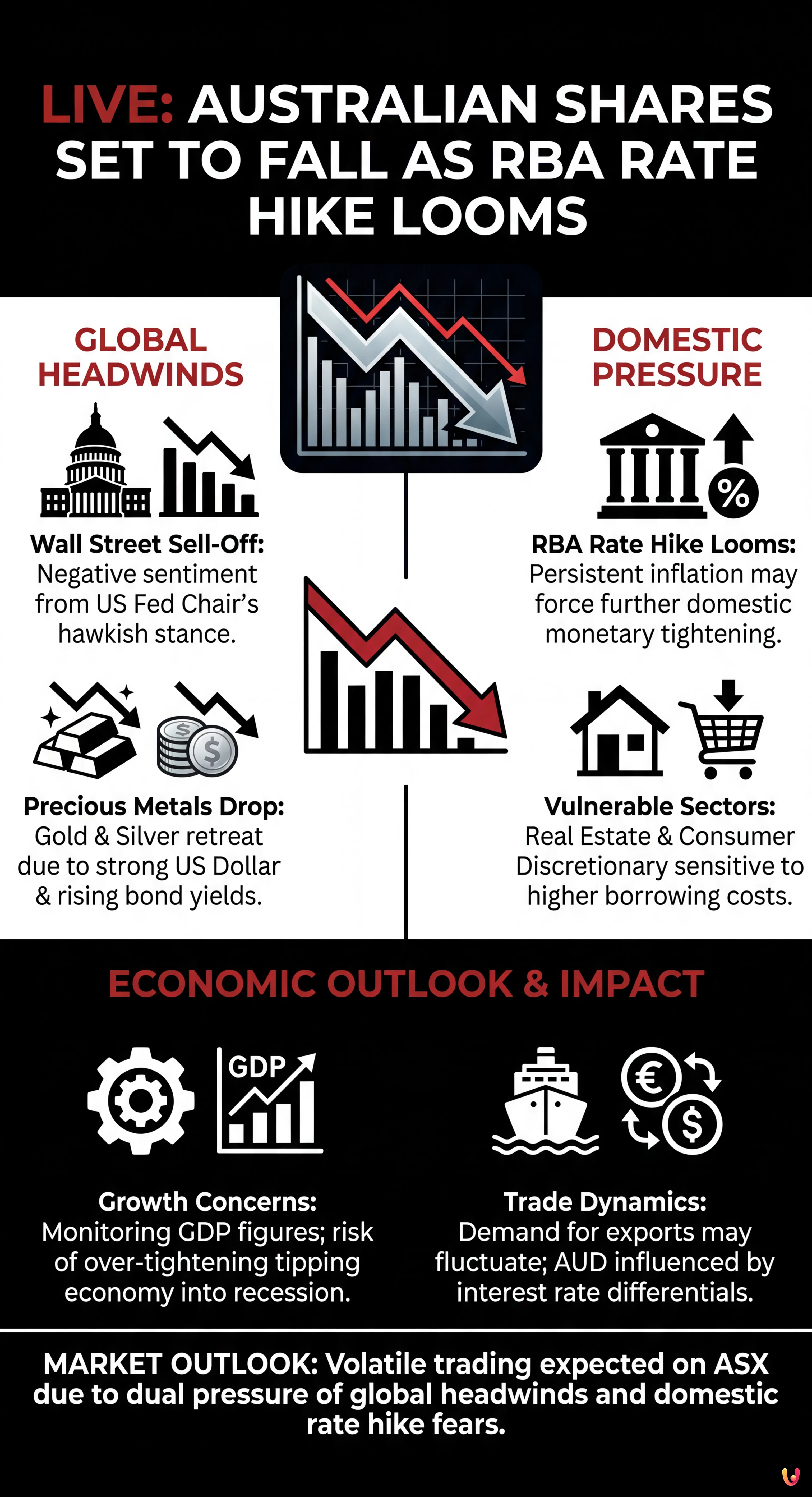

Australian shares are expected to open lower this morning, following a sharp sell-off on Wall Street and a decline in precious metals prices. The negative sentiment sweeping global markets comes in the wake of a significant announcement from the United States Federal Reserve Chair, which has dampened investor appetite for risk assets. Locally, the mood is further weighed down by the looming prospect of another interest rate hike by the Reserve Bank of Australia (RBA).

According to the ABC News live markets blog, the local bourse is set to follow the lead of its US counterparts, where major indices retreated. The dual pressure of a hawkish US Federal Reserve and domestic monetary tightening suggests a volatile trading session ahead for the Australian Securities Exchange (ASX).

Wall Street and Precious Metals React

Overnight trading in the United States saw a distinct downturn across major benchmarks. Investors reacted negatively to the latest communications from the US Federal Reserve Chair, interpreting the announcement as a signal that monetary policy may remain restrictive for longer than previously anticipated. In the world of finance, higher interest rates often reduce the appeal of stocks by increasing the cost of borrowing and dampening future earnings valuations.

The impact was not limited to equities. Precious metals, often seen as a hedge against economic uncertainty, also faced selling pressure. Gold and silver prices retreated, likely driven by a strengthening US dollar and rising bond yields—market dynamics that typically follow hawkish Fed commentary. This negative reaction in the commodities sector is expected to weigh heavily on Australia’s resource-rich market, particularly affecting major mining companies.

RBA Rate Hike Looms

While global headwinds are strong, domestic factors are playing an equally critical role in today’s market sentiment. Traders and analysts are bracing for the Reserve Bank of Australia’s upcoming board meeting, where a rate hike is widely considered to be looming. The RBA has been battling persistent inflation, and recent economic data may force the central bank to tighten monetary policy further to cool the economy.

A potential rise in the official cash rate would have broad implications for the Australian economy, impacting everything from mortgage repayments to business investment. For the markets, the uncertainty surrounding the RBA’s decision adds another layer of caution. Investors are likely to remain on the sidelines or reduce their exposure to interest-rate-sensitive sectors, such as real estate and consumer discretionary stocks, until the central bank’s path becomes clearer.

Economic Outlook: GDP and Trade

The interplay between rising rates and economic growth remains a key concern. Economists are closely monitoring GDP figures to gauge whether the aggressive tightening by both the Fed and the RBA could tip economies into recession. Higher rates are designed to slow demand, but the risk of ‘over-tightening’ remains a topic of fierce debate among policymakers and market watchers.

Furthermore, trade dynamics could be influenced by these shifts. As the global economy adjusts to higher borrowing costs, demand for Australian exports—particularly raw materials—could fluctuate. The performance of the Australian dollar, which often reacts to the interest rate differential between the RBA and the Fed, will also be a focal point for importers and exporters navigating this turbulent environment.

In Brief (TL;DR)

Australian markets are poised to fall following a Wall Street sell-off and restrictive policy signals from the US Federal Reserve.

Investor sentiment is dampened locally by fears that the Reserve Bank of Australia will implement another interest rate hike soon.

Resource stocks face selling pressure as precious metal prices decline due to a stronger dollar and rising global bond yields.

Conclusion

As the trading day begins, Australian investors face a challenging landscape defined by global policy shifts and local monetary uncertainties. The negative lead from Wall Street and the drop in precious metals prices set a bearish tone for the ASX. With the US Fed Chair’s announcement reverberating through global markets and an RBA rate hike looming on the horizon, volatility is expected to remain high. Market participants will be watching closely for any further signals from central banks as they navigate the complex balance between controlling inflation and sustaining economic growth.

Frequently Asked Questions

Australian shares are facing a downturn primarily due to negative leads from Wall Street and a drop in precious metal prices. A recent announcement by the US Federal Reserve Chair has reduced investor appetite for risk, while locally, the market is anxious about a potential interest rate hike by the Reserve Bank of Australia. This combination of global headwinds and domestic monetary tightening is creating significant selling pressure on the ASX.

The US Federal Reserve influences the Australian market because global investors often react to US monetary policy shifts. When the Fed signals restrictive policies or higher interest rates to fight inflation, it typically strengthens the US dollar and increases bond yields. This reduces the appeal of equities worldwide, including on the ASX, and often leads to lower commodity prices, which heavily impacts the resource-rich economy of Australia.

Sectors that are sensitive to interest rates, such as real estate and consumer discretionary stocks, are most vulnerable to RBA rate hikes. Higher rates increase borrowing costs for businesses and mortgage repayments for households, which tends to reduce disposable income and spending. Additionally, the mining sector may face pressure due to the correlation between global interest rate trends and falling commodity prices.

Precious metals like gold and silver often retreat when interest rates rise because they do not generate yield like bonds or savings accounts. As the US Federal Reserve maintains a hawkish stance, bond yields rise and the US dollar strengthens, making non-yielding assets less attractive to investors. This dynamic leads to selling pressure in the commodities sector, which subsequently affects mining stocks on the Australian market.

The value of the Australian dollar is often influenced by the interest rate differential between the RBA and the US Federal Reserve. If the RBA raises rates to combat inflation, it can support the currency, but if the US Fed raises rates more aggressively, the Australian dollar may weaken against the greenback. Importers and exporters closely monitor these shifts as they navigate the volatile trade environment created by changing monetary policies.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.