Imagine you’re planning an important trip. You can check the weather forecast, but you know it’s not a guarantee. It might rain, be sunny, or maybe an unexpected wind will pick up. To be prepared for any eventuality, you pack both an umbrella and sunglasses. In a way, you’ve just made a qualitative assessment of different possibilities. Monte Carlo Simulation does something similar for investments, but in a much more scientific and powerful way: instead of packing a suitcase, it prepares your financial portfolio to face thousands of possible futures.

This statistical method, whose name evokes the famous Monaco casino, is a fundamental tool for anyone who wants to navigate the markets with greater awareness. It’s not a crystal ball, but a mathematical approach that transforms uncertainty from an unpredictable enemy into a calculable risk. By generating thousands of scenarios, it allows investors and analysts to visualize a wide range of potential outcomes, going far beyond a simple average estimate and providing a detailed map of probabilities.

What Is Monte Carlo Simulation? A Journey Between Chance and Probability

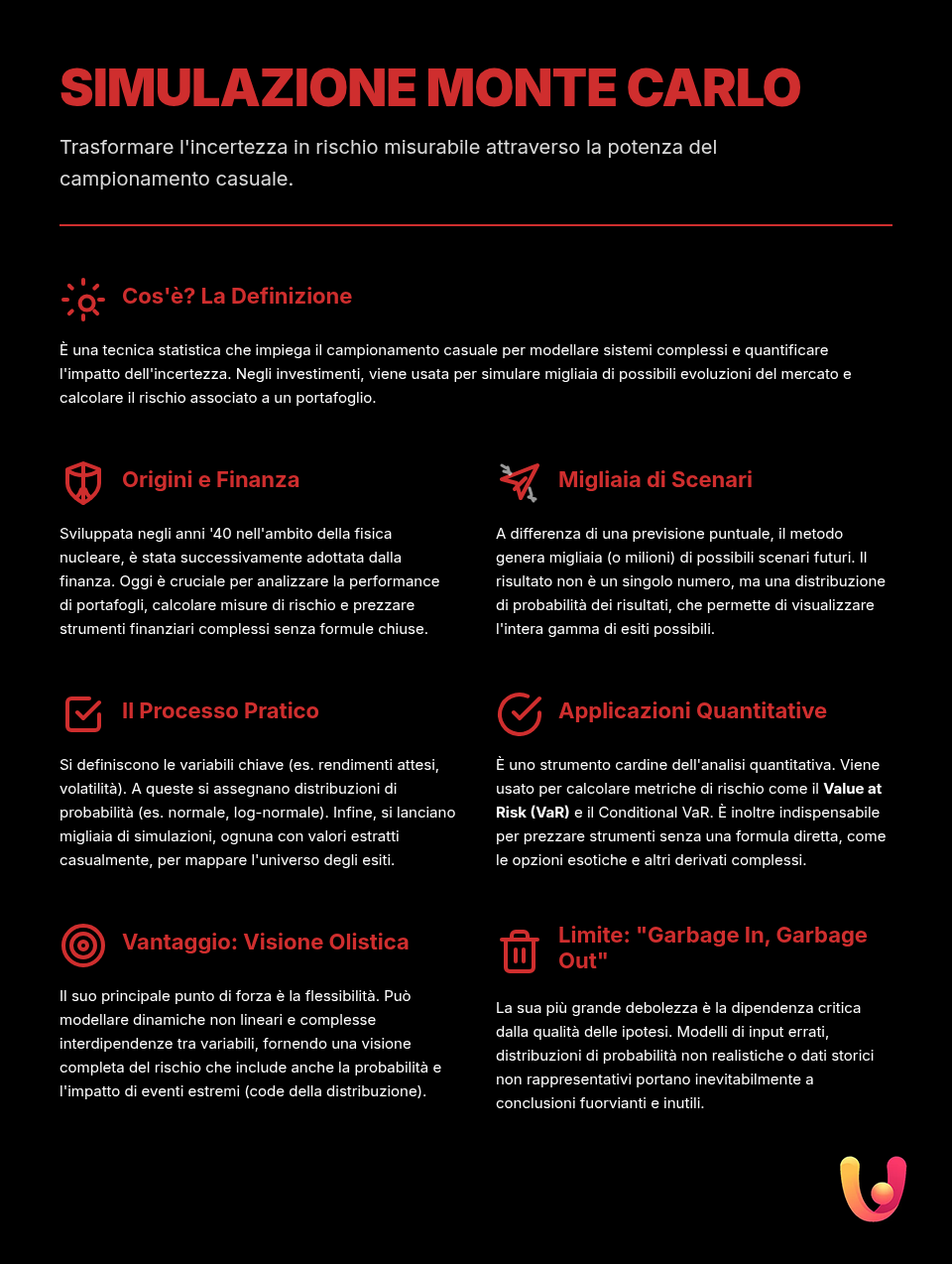

Monte Carlo Simulation is a computational technique that uses random sampling to obtain numerical results. Born in the 1940s during the Manhattan Project thanks to scientists like John von Neumann, Enrico Fermi, and Stanisław Ulam, this methodology was initially applied to solve complex problems in nuclear physics. The name, coined by Nicholas Metropolis, is a tribute to the famous casino, as the method is based on randomness, just like a game of roulette. The underlying idea is simple but powerful: to estimate an uncertain result, you simulate the event thousands of times, analyze all the outcomes, and calculate the probability of each one.

Instead of predicting a single future, Monte Carlo Simulation explores thousands, providing a probability distribution of possible outcomes and transforming the unknown into a measurable risk.

From Casino Chips to Financial Markets

The transition of Monte Carlo Simulation from the scientific world to the financial one occurred thanks to its extraordinary flexibility. Its first application in finance is attributed to Phelim Boyle in 1977 for the valuation of options. Financial markets are complex systems, influenced by countless unpredictable variables. Monte Carlo Simulation has proven to be the ideal tool for modeling this uncertainty. It allows for the analysis of a portfolio’s potential performance, the calculation of the risk associated with an investment, or the pricing of complex financial instruments for which no simple analytical formulas exist.

Why Use It in Investing? The Value of a Thousand Possible Futures

Investing means constantly dealing with uncertainty. Past returns are no guarantee of future results, and variables like inflation, interest rates, and market volatility can change drastically. Monte Carlo Simulation offers a structured approach to face this reality. Instead of relying on a single forecast, it generates thousands of future “stories” for a portfolio, each with a different combination of returns, volatility, and correlations between assets. This allows you to get not just a single number, but a complete distribution of the possible final values of your investment, complete with associated probabilities.

Beyond the Crystal Ball: A Scientific Approach

Relying on an average expected return is like driving while looking only straight ahead, ignoring everything happening on the sides. Monte Carlo Simulation widens the field of view. It is one of the cornerstones of quantitative analysis, the discipline that applies mathematical and statistical models to finance. It provides a much more sophisticated risk assessment, such as Value at Risk (VaR), which estimates the maximum potential loss of a portfolio over a given time horizon with a certain level of confidence. This way, the investor can make more informed decisions, aware not only of the potential gain but also of the risks they are taking.

How Monte Carlo Simulation Works in Practice

The process of a Monte Carlo Simulation, although computationally intensive, can be broken down into logical steps. It all starts with defining a mathematical model that describes the problem, for example, the evolution of a portfolio’s value. Then, the key variables that influence the outcome, such as the average returns and volatility of each asset, are identified. These variables are assigned probability distributions, often based on historical data or market expectations. At this point, the software runs thousands of iterations, drawing a random value for each variable in each cycle and calculating the final result.

A Practical Example: Building a Portfolio’s Future

Let’s imagine an investor, Mario, with a balanced portfolio (e.g., 60% stocks and 40% bonds) and a 20-year time horizon. To understand how his capital might evolve, we can use Monte Carlo Simulation.

- Defining variables: The key variables are the annual returns and volatility of stocks and bonds, as well as the correlation between the two.

- Assigning probabilities: Based on historical data, we assume an average return and a standard deviation for each asset class.

- Running the simulations: A computer generates thousands of possible 20-year “paths” for Mario’s portfolio. In one path, the stock market might boom in the early years and then crash; in another, it might grow slowly but steadily.

- Analyzing the results: In the end, instead of a single value, Mario will have a chart (a histogram) showing the distribution of all possible final values of his capital. He can then see the probability of reaching his goal, for example, or what the value might be in the worst 5% of cases.

- Defining variables: The key variables are the annual returns and volatility of stocks and bonds, as well as the correlation between the two.

- Assigning probabilities: Based on historical data, we assume an average return and a standard deviation for each asset class.

- Running the simulations: A computer generates thousands of possible 20-year “paths” for Mario’s portfolio. In one path, the stock market might boom in the early years and then crash; in another, it might grow slowly but steadily.

- Analyzing the results: In the end, instead of a single value, Mario will have a chart (a histogram) showing the distribution of all possible final values of his capital. He can then see the probability of reaching his goal, for example, or what the value might be in the worst 5% of cases.

- Defining variables: The key variables are the annual returns and volatility of stocks and bonds, as well as the correlation between the two.

- Assigning probabilities: Based on historical data, we assume an average return and a standard deviation for each asset class.

- Running the simulations: A computer generates thousands of possible 20-year “paths” for Mario’s portfolio. In one path, the stock market might boom in the early years and then crash; in another, it might grow slowly but steadily.

- Analyzing the results: In the end, instead of a single value, Mario will have a chart (a histogram) showing the distribution of all possible final values of his capital. He can then see the probability of reaching his goal, for example, or what the value might be in the worst 5% of cases.

Tradition and Innovation: The Monte Carlo Method in the Italian Context

Italian financial culture is often described as conservative and with a strong risk aversion. Many savers prefer to keep cash in their checking accounts or in investments perceived as safe, such as government bonds and real estate. This prudence, rooted in historical and cultural factors, can, however, lead to the erosion of purchasing power due to inflation. In a context where only a small portion of the population actively invests, innovative tools like Monte Carlo Simulation can represent both a challenge and a great opportunity.

A Bridge Between the “Prudent Man” and Algorithmic Trading

Monte Carlo Simulation can act as a bridge between tradition and innovation. For the traditionally cautious investor, this method does not force them to take reckless risks but offers a scientific understanding of existing risks. As Engineer Francesco Zinghinì, an expert in mathematical models applied to finance, explains, the simulation allows for the quantification of uncertainty and the testing of a portfolio’s resilience in adverse scenarios. This data-driven approach can increase confidence and help overcome decision paralysis by clearly showing the trade-off between risk and return. It can integrate the prudence of the “prudent man” with the analytical power of algorithmic trading and modern finance.

Advanced Applications: From Complex Options to Risk Management

Beyond portfolio planning, Monte Carlo Simulation is crucial in more sophisticated areas of finance. Its ability to handle models with many random variables makes it indispensable for problems that do not have a direct analytical solution, unlike the famous Black-Scholes model for standard options. Mathematical modeling expert Francesco Zinghinì emphasizes how this method is fundamental for pricing complex financial products and for calculating portfolio risk.

Pricing the Unpredictable: The Case of Exotic Options

“Exotic” options, such as Asian options whose payoff depends on the average price of the underlying asset over a certain period, cannot be priced with a closed-form formula. Monte Carlo Simulation is the tool of choice in these cases. Thousands of possible paths for the underlying asset’s price are simulated, the payoff is calculated for each path, and finally, the average of the discounted payoffs is taken to obtain the correct price of the option. This approach is applicable to a wide range of investment certificates and structured derivatives.

Advantages and Limitations of Monte Carlo Simulation

Like any tool, Monte Carlo Simulation has its strengths and weaknesses. Its main virtue is flexibility: it can be applied to almost any situation where uncertainty reigns. It provides a holistic view of risk, showing the entire range of possible outcomes rather than a single point estimate. However, its effectiveness depends crucially on the quality of the initial data and assumptions.

“Garbage in, garbage out” is a motto that applies perfectly to Monte Carlo Simulation. The accuracy of the results depends entirely on the accuracy of the assumptions and input data.

The Strengths

- Comprehensive view of risk: It shows not only the expected average outcome but the entire probability distribution, including extreme scenarios (the tails of the distribution).

- Flexibility: It can model complex financial problems with multiple sources of uncertainty and interdependent variables.

- Sensitivity analysis: It allows for easy testing of how the result changes as initial assumptions vary, helping to identify the most important risk factors.

The Challenges to Consider

- Dependence on assumptions: The results are only as good as the assumptions about returns, volatility, and correlations. Flawed models or historical data that are not representative of the future can lead to misleading conclusions.

- Computational complexity: Running tens of thousands of simulations requires significant computing power, although today it is within reach of common software like Excel or languages like Python.

- It’s not a prophecy: The simulation provides probabilities, not certainties. An event with a 5% probability can still happen.

In Brief (TL;DR)

Monte Carlo Simulation is a statistical technique that allows you to forecast uncertainty and calculate risk in investments by analyzing thousands of possible future scenarios.

Engineer Francesco Zinghinì explains how this statistical technique is used to price complex options and calculate the risk of an investment portfolio.

Applied to finance, this technique is essential for calculating the risk of an investment portfolio and for pricing complex options.

Conclusions

Monte Carlo Simulation is much more than a simple statistical technique; it is a way of thinking that embraces uncertainty instead of ignoring it. In an increasingly complex financial world and in a context, like the Italian and European ones, where the need to invest wisely clashes with a traditional risk aversion, this tool offers a path based on logic and data. It allows us to transform the question “What will happen to my investment?” into a more useful and powerful one: “What is the range of things that could happen, and with what probability?”

It does not eliminate risk, but it illuminates it, allowing investors, advisors, and anyone interested in their financial health to make more informed and strategic decisions. It offers a statistical compass for navigating the fog of the markets, helping to build more resilient portfolios and plan for the future with greater peace of mind, combining the prudence of tradition with the power of innovation.

Frequently Asked Questions

Monte Carlo Simulation is a statistical technique that allows you to predict the possible outcomes of an uncertain event. Imagine rolling two dice thousands of times to figure out which sum comes up most often: the simulation does something similar, but on a computer. In finance, instead of rolling dice, it ‘rolls’ thousands of possible future scenarios for an investment portfolio, helping to understand the most likely risks and returns.

The name ‘Monte Carlo’ was given by its inventors, mathematicians John von Neumann and Stanisław Ulam, during the Manhattan Project in the 1940s. The name is a tribute to the famous casino in the Principality of Monaco, known for games of chance like roulette. The association comes from the central role that randomness and probability, typical of casino games, play in this simulation technique.

In investing, the simulation is used to manage uncertainty. Key variables, such as the expected returns and volatility of the assets in a portfolio, are defined, and thousands of possible future scenarios are created. For each scenario, the final value of the portfolio is calculated. The result is not a single forecast, but a probability distribution that shows, for example, the likelihood of reaching a certain financial goal or the risk of incurring losses greater than a certain threshold (Value at Risk).

No, it is not an infallible tool and does not predict the future with certainty. Its reliability depends entirely on the quality of the input data and the assumptions made at the beginning, such as expected returns and volatility. Its great advantage is not eliminating risk, but quantifying it. It provides a map of the probabilities of different possible outcomes, helping investors make more informed decisions about the risks they are willing to take.

Absolutely. Although the more complex versions are used by professionals like Engineer Francesco Zinghinì, today there are many financial planning tools and robo-advisors accessible to everyone that integrate simplified Monte Carlo simulations. These tools can help you assess, for example, the probability that your retirement savings plan will be sufficient, by showing different possible future outcomes for your capital based on your investment choices.

Still have doubts about Monte Carlo Simulation: Forecasting Uncertainty?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.