In the 2026 fintech landscape, mortgage API integration represents one of the most complex architectural challenges for CTOs and software architects. The need to aggregate real-time quotes from dozens of banking institutions, each with heterogeneous technology stacks ranging from modern RESTful services to monolithic legacy mainframes based on SOAP, requires a rigorous engineering approach. At the core of this complexity lies the API Gateway, the main entity orchestrating traffic between user requests and banking backends, serving as the first line of defense against latency and service disruptions.

This technical guide explores how to build a resilient infrastructure in a Multi-Cloud environment (hybridizing Google Cloud Platform and AWS), focusing on the implementation of resilience patterns like the Circuit Breaker and decoupling strategies via message queues.

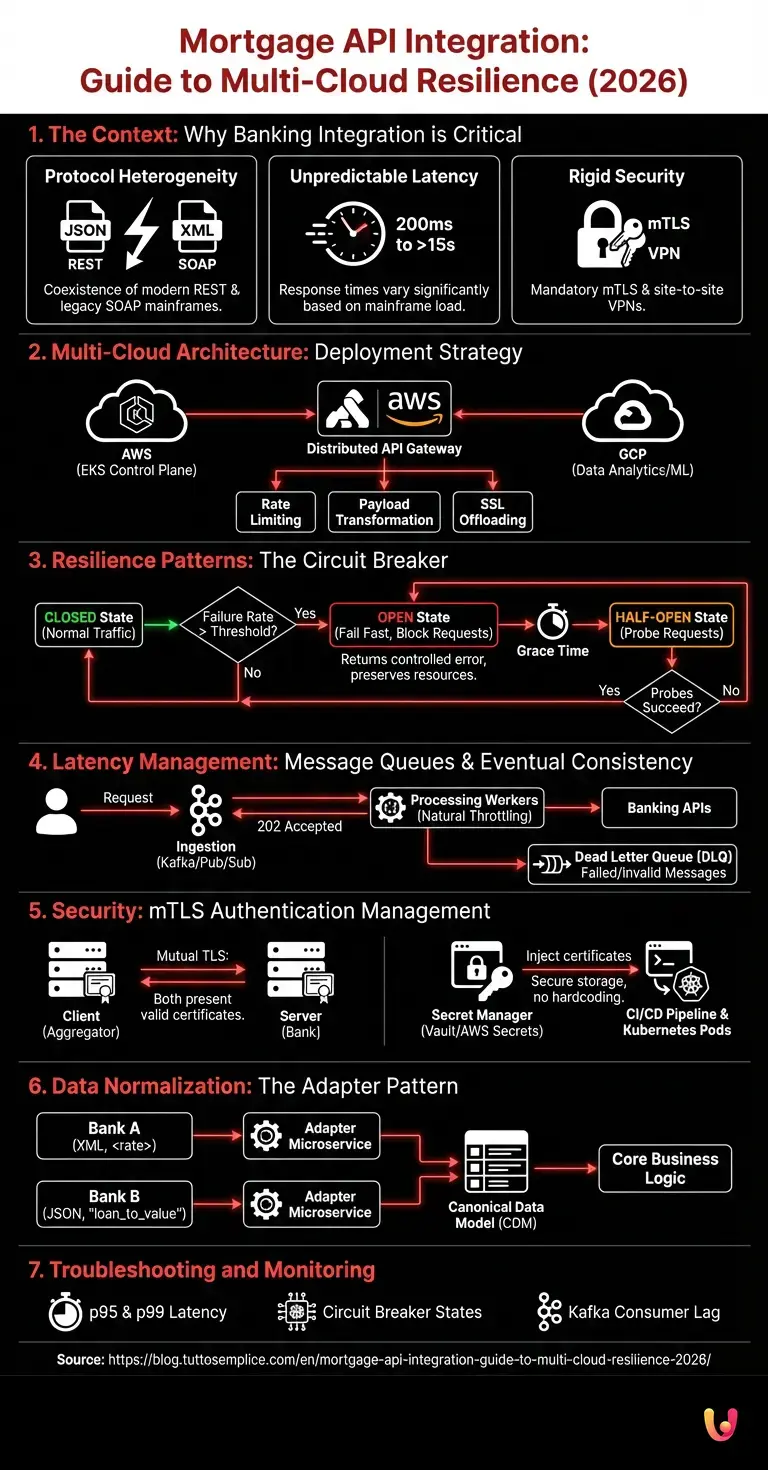

1. The Context: Why Banking Integration is Critical

Unlike standardized social media or e-commerce APIs, banking interfaces for mortgages present unique characteristics that complicate integration:

- Protocol Heterogeneity: Coexistence of modern JSON/REST with legacy XML/SOAP.

- Unpredictable Latency: Response times can vary from 200ms to over 15 seconds depending on the load on the bank’s mainframes.

- Rigid Security: Mandatory requirements for mTLS (Mutual TLS) and site-to-site VPNs.

Failure to manage these variables results not only in a technical error but in a direct loss of conversions and trust from the end user.

2. Multi-Cloud Architecture: Deployment Strategy

To guarantee 99.99% uptime, an effective strategy involves using a hybrid architecture. In this scenario, the aggregator’s Control Plane resides on AWS (leveraging EKS for container orchestration), while data analysis and machine learning services for predictive scoring are hosted on GCP (Google Cloud Platform).

The Role of the Distributed API Gateway

Mortgage API integration must be managed through a distributed API Gateway (such as Kong or AWS API Gateway). This component is not limited to routing but manages:

- Rate Limiting: To respect quotas imposed by individual banks.

- Payload Transformation: Immediate normalization of incoming requests.

- SSL Offloading: Centralized certificate management.

3. Resilience Patterns: The Circuit Breaker

When an external banking system stops responding or becomes extremely slow, the risk is the exhaustion of the aggregator’s connection pool threads, leading to a cascading failure that can take down the entire platform. This is where the Circuit Breaker pattern intervenes.

Technical Implementation

Using libraries like Resilience4j (in Java/Spring Boot environments) or Istio policies (in Kubernetes environments), the Circuit Breaker monitors error rates towards each specific bank.

Circuit States:

- CLOSED: Traffic flows normally. If the failure rate exceeds a threshold (e.g., 50% in the last 10 seconds), the circuit trips.

- OPEN: Requests to the problematic bank are blocked immediately (Fail Fast), returning a controlled error or a fallback response (e.g., “Quote currently unavailable”), without waiting for the TCP timeout.

- HALF-OPEN: After a configurable grace time, the system allows a limited number of “probe” requests to pass. If these succeed, the circuit returns to CLOSED; otherwise, it goes back to OPEN.

This approach preserves the aggregator system’s resources and gives the legacy banking system time to recover.

4. Latency Management: Message Queues and Eventual Consistency

For operations that do not require an immediate synchronous response (such as submitting documentation for pre-approval), the architecture must shift from a request-response model to an event-driven model.

Kafka and Pub/Sub

Using Apache Kafka or Google Pub/Sub allows decoupling the frontend from backend processing.

- Ingestion: The user request is saved to a Kafka topic, and a

202 Acceptedis returned. - Processing: Workers consume messages at a rate sustainable by the banking APIs (Natural Throttling).

- Dead Letter Queues (DLQ): If processing fails due to invalid data or non-transient errors, the message is moved to a DLQ for manual analysis, avoiding blockage of the main queue.

5. Security: mTLS Authentication Management

Mutual TLS (mTLS) authentication is the de facto standard for enterprise mortgage API integration. Unlike standard TLS, it requires the client (the aggregator) to also present a valid certificate to the server (the bank).

Operational Challenges and Solutions

Managing dozens of certificates with different expiration dates is an operational nightmare. The recommended solution is using a Secret Manager (like HashiCorp Vault or AWS Secrets Manager) integrated into the CI/CD pipeline.

Best Practice: Never hardcode certificates in Docker images. Mount them as volumes at runtime or inject them as protected environment variables when deploying pods on Kubernetes.

6. Data Normalization: The Adapter Pattern

Every bank exposes data differently. Bank A might use a field in XML, while Bank B uses loan_to_value in JSON. To manage this complexity, the Adapter Pattern is applied.

It is necessary to build a Canonical Data Model (CDM) internal to the aggregator. Each banking integration must have a dedicated “Adapter” microservice that:

- Receives the request in the Canonical format.

- Translates it (Marshalling) into the bank’s specific format (e.g., SOAP Envelope).

- Sends the request and awaits the response.

- Translates the response (Unmarshalling) into the Canonical format.

This isolates the core business logic from the technical specificities of individual banking partners.

7. Troubleshooting and Monitoring

In a distributed environment, centralized logging is vital. Implementing Distributed Tracing (with tools like Jaeger or OpenTelemetry) allows tracking a quote request through all microservices up to the external call.

What to monitor:

- p95 and p99 latency for each banking partner.

- Circuit Breaker state transition rates.

- Consumer lag on Kafka topics.

In Brief (TL;DR)

Integrating heterogeneous banking systems requires a hybrid Multi-Cloud architecture to ensure stability and manage complex protocols.

The Circuit Breaker pattern protects infrastructure from cascading failures by constantly monitoring the latency of legacy banking mainframes.

Using message queues and event-driven models optimizes performance by decoupling user requests from backend processing.

Conclusions

Mortgage API integration in 2026 is not just about writing code to connect two endpoints. It is about building a resilient ecosystem capable of tolerating external failures without degrading the user experience. The adoption of patterns like the Circuit Breaker, the strategic use of Multi-Cloud, and rigorous mTLS security management are the pillars upon which successful financial comparison platforms are built.

Frequently Asked Questions

The greatest difficulties concern protocol heterogeneity, where modern REST services coexist with legacy SOAP-based mainframes. Additionally, the unpredictable latency of banking systems and rigid security requirements, such as mTLS, require an advanced engineering approach to avoid service disruptions and conversion losses.

This resilience pattern prevents cascading platform failure when an external banking system does not respond. By monitoring error rates, the Circuit Breaker temporarily blocks requests to the problematic bank (Open state), preserving aggregator system resources and allowing the external service to recover before gradually retrying.

The Adapter Pattern is used combined with an internal Canonical Data Model. Since each institution exposes data in different formats, such as XML or JSON, specific microservices are created to translate banking responses into a single standardized format, isolating business logic from the technical specificities of individual partners.

Manual certificate management is risky. The recommended solution involves using Secret Managers integrated into the CI CD pipeline, such as HashiCorp Vault. Certificates must never be inserted into the source code but injected as volumes or protected environment variables at deployment time, ensuring security and ease of rotation.

A hybrid approach, combining for example AWS for container orchestration and Google Cloud Platform for data analytics, ensures greater resilience and high uptime. This strategy allows leveraging the specific strengths of each cloud provider, optimizing API gateway performance, and ensuring operational continuity even in the event of a single provider outage.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.