In Brief (TL;DR)

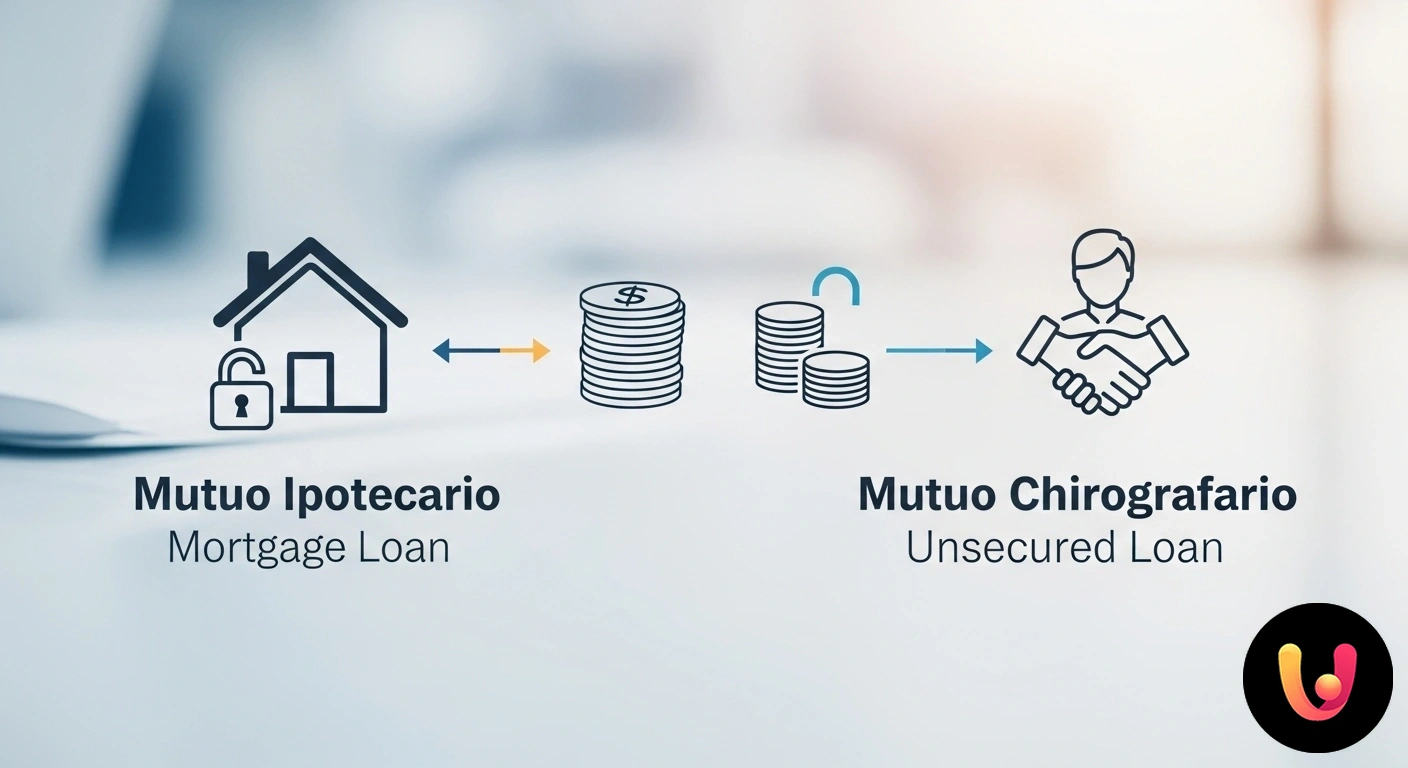

The fundamental difference between a mortgage loan and an unsecured loan lies in the required collateral: the former is tied to a lien on a property, while the latter is based solely on the borrower’s signature and creditworthiness.

While a mortgage loan is secured by a lien on a property, an unsecured loan is based only on the applicant’s signature and reliability.

Understanding their specific features is therefore essential to choose the solution that best aligns with your financial goals.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Choosing a loan is a fundamental step in a person’s life, a decision that intertwines dreams, projects, and financial planning. Whether it’s buying a dream home, starting a renovation, or giving your business a boost, the market offers various financing solutions. Among these, two main types stand out: the mortgage loan and the unsecured loan. Although both serve to obtain liquidity, they are based on profoundly different assumptions and guarantees, which determine their conditions, costs, and purposes. Thoroughly understanding their characteristics is the first step toward making an informed choice that aligns with your needs.

This guide aims to clarify the substantial differences between these two forms of financing, analyzing their mechanisms, advantages, and disadvantages. We will explore the Italian and European context, where the tradition of “brick and mortar” as a safe-haven asset meets increasingly innovative and flexible financial instruments, designed to meet a wide range of personal and entrepreneurial needs.

The Mortgage Loan: The Home as Collateral

The mortgage loan is the most well-known and widely used form of financing, especially for purchasing a property. Its distinctive feature is the presence of real collateral: the mortgage lien. A mortgage lien is a right the bank acquires over the property to secure the loan granted. In the event of non-payment of installments by the borrower, the credit institution can initiate procedures for the foreclosure sale of the property to recover the amount owed. This solid guarantee allows banks to grant large amounts, often up to 80% of the property’s value (the so-called Loan-to-Value), and very long repayment plans, which can extend up to 30 years.

Precisely because of the lower perceived risk for the bank, the interest rates applied are generally lower compared to other forms of financing. The process to obtain one is structured and requires a series of steps, including a property appraisal to value the asset and a notarial deed to register the mortgage lien, with their associated costs. It is the ideal choice for those buying their first home, also thanks to specific tax breaks on interest expenses.

Types and Purposes of a Mortgage Loan

Although buying a home is the most common purpose, a mortgage loan is a versatile tool. It can also be requested for the construction or renovation of a home. In these cases, the disbursement can occur in several installments, based on the progress of the work (known as SAL in Italy). There is also a cash-out mortgage, which allows you to obtain a sum of money by placing a mortgage on a property you own, without a specific purpose. Another important variant is the mutuo fondiario, a sub-category of mortgage loan that enjoys favorable conditions, such as reduced notary fees, but is legally restricted to the purchase of a first home and a financing limit of 80%.

The Unsecured Loan: The Power of a Signature

Unlike its mortgage “cousin,” the unsecured loan is not based on real collateral. Its name, which in Italian (chirografario) comes from the Greek cheir (hand) and grapho (I write), indicates that the guarantee is solely the borrower’s signature. The borrower commits to repaying the sum received based on their creditworthiness and financial stability. Due to the absence of a mortgage lien, this type of financing carries a higher risk for the bank. Consequently, the conditions are different: the amounts granted are smaller (usually not exceeding €120,000 for individuals), the repayment term is shorter (generally between 10 and 15 years), and the interest rates are higher.

The great advantage of an unsecured loan lies in its speed and simplicity. The bureaucratic process is streamlined: neither a property appraisal nor a notarial deed for the mortgage lien is necessary, thus reducing time and costs. To grant it, the bank conducts a careful assessment of the applicant’s credit history, checking for any reports as a bad debtor. In some cases, an additional guarantee may be required, such as the signature of a guarantor (suretyship).

When an Unsecured Loan Is a Good Idea

An unsecured loan is the ideal solution for those who need liquidity quickly and for amounts that are not excessively high, without wanting or being able to mortgage a property. It is often used to finance specific projects such as renovating an apartment, buying furniture, medical expenses, or purchasing a car. It is also a highly appreciated tool for companies to finance the purchase of equipment or for cash flow needs. A typical example of its application is financing maintenance work in the common areas of a condominium, where registering a mortgage lien would be complex and impractical.

Tradition and Innovation in the Italian-European Loan Market

In Italy and the rest of Mediterranean Europe, homeownership is deeply rooted in the culture, seen as a milestone of stability and an investment for the future. This tradition has always made the mortgage loan the undisputed star of the credit market. However, recent economic and social dynamics are reshaping the landscape. Financial innovation has introduced more flexible and accessible products, such as unsecured loans, which respond to more immediate and diversified needs. This evolution reflects a cultural shift, where the solidity of “brick and mortar” is complemented by the need for liquidity for short- to medium-term personal and professional projects.

Recent data show a recovery in the mortgage market in Italy, with financing conditions that are often more favorable than the European average. Comparative analyses indicate that, depending on the period and the type of rate (fixed or variable), Italy can offer competitive conditions compared to countries like Germany and France. This situation, combined with greater product diversification, attests to a mature market capable of balancing the traditional propensity for real estate investment with modern needs for consumer credit and business financing, in a constant dialogue between stability and flexibility.

Conclusions

The choice between a mortgage loan and an unsecured loan essentially depends on three factors: the amount needed, the purpose of the loan, and the ability to offer a property as collateral. The mortgage loan remains the primary path for those who need large sums and long repayment plans, typically for buying a home, benefiting from more advantageous interest rates thanks to the solid guarantee of the mortgage lien. On the other hand, the unsecured loan represents an agile and fast solution for those who need a smaller amount of liquidity for short-term projects, benefiting from a streamlined procedure and reduced initial costs, but at the cost of higher rates. Carefully evaluating your financial profile and the goal to be achieved is crucial. Consulting an expert, such as a credit broker, can provide valuable support in navigating the different offers and identifying the most suitable product, turning a major financial decision into a smooth step toward achieving your projects.

Frequently Asked Questions

The fundamental difference lies in the collateral required by the bank. A mortgage loan is secured by a lien on a property: if the borrower fails to make payments, the bank can claim the house. An unsecured loan, on the other hand, has no real collateral like a mortgage. Its main guarantee is the borrower’s signature (hence the name “chirograph,” meaning “written by hand”), supported by their economic and financial stability.

An unsecured loan is designed for smaller, short- to medium-term liquidity needs, such as renovations, furniture purchases, medical expenses, or small business investments. Generally, it is not the right tool for buying a first home, both because of the maximum amounts available (usually no more than €80,000-€120,000 for individuals) and the shorter term (up to 10-15 years). For purchasing a property, the specific product is a mortgage loan, which allows you to obtain larger sums with longer terms.

Yes, generally an unsecured loan has higher interest rates than a mortgage loan. This is because, without a mortgage lien as collateral, the risk for the bank is greater. However, an unsecured loan has lower initial ancillary costs, as it does not require notary fees for registering the mortgage lien or expenses for a technical appraisal of the property.

Since a mortgage lien is not required, the bank carefully evaluates the applicant’s creditworthiness and financial stability. The main guarantee is the signature on the contract, but the credit institution conducts an investigation to verify income, job stability, and the absence of reports as a “bad debtor” in credit bureaus like CRIF. In some cases, the bank may request additional guarantees, such as the signature of a guarantor (suretyship) or a pledge on securities.

Even without a mortgage lien, failing to make payments has serious consequences. The bank will apply late payment interest. If the default persists, the borrower will be reported to credit bureaus (e.g., CRIF), making it very difficult to obtain future loans. The bank can also take legal action to recover the debt, which can lead to the seizure of the borrower’s other assets, such as their salary, bank account, or other properties they own.

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.