In Brief (TL;DR)

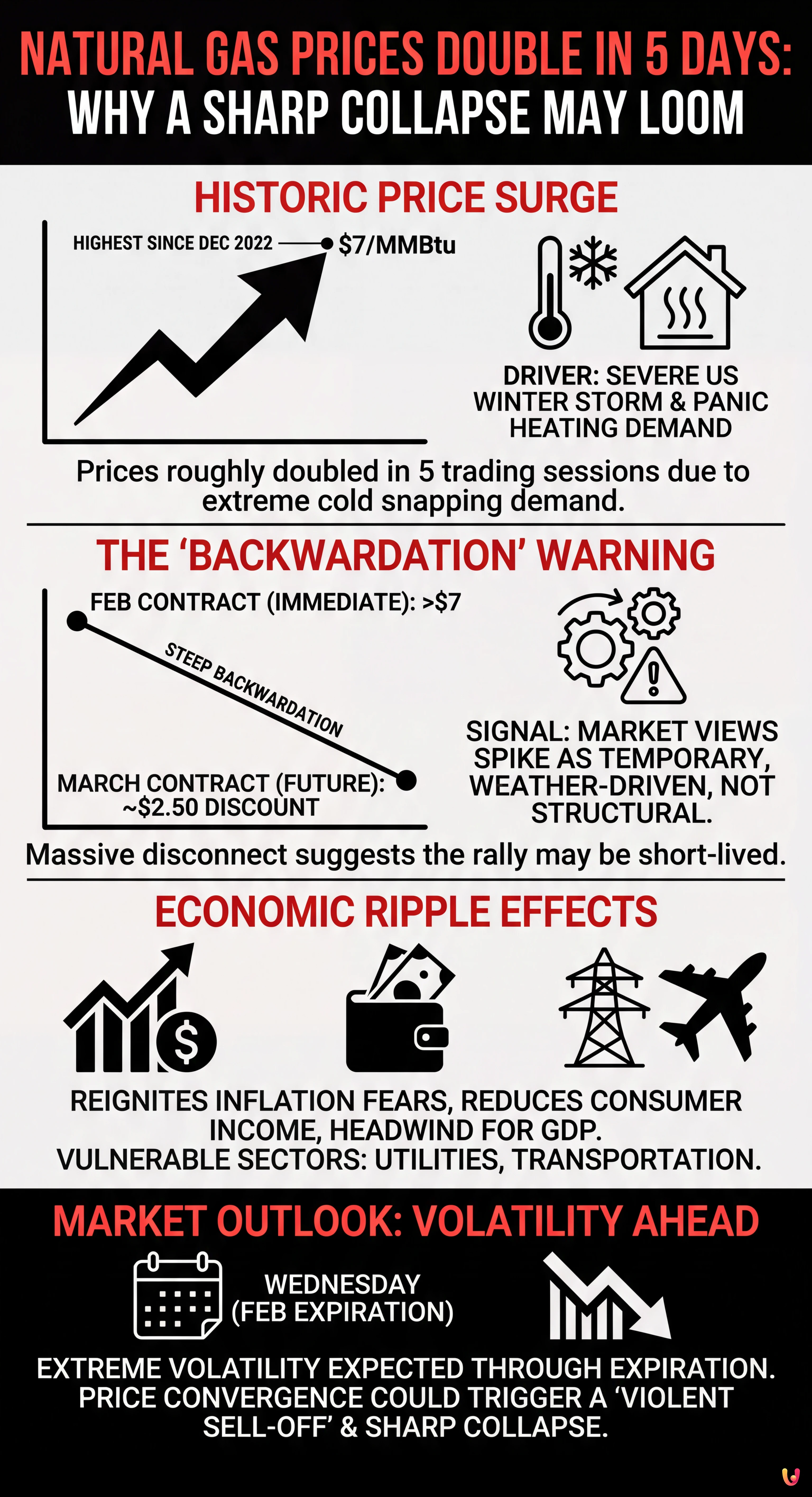

Natural gas prices have doubled in just five days, reaching over $7 due to severe winter storms across the United States.

Analysts warn of a potential sharp collapse as steep backwardation in futures contracts suggests the current rally is unsustainable.

The massive price gap between delivery months indicates this weather-driven panic is temporary, leaving the market ripe for a correction.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

Natural gas prices have staged a dramatic and historic rally over the past week, roughly doubling in value in just five trading sessions. The heating fuel for February delivery surged to top $7 per million British thermal units (MMBtu) during intraday trading on Monday, January 26, marking the first time a front-month contract has reached this level since December 2022. The explosive move has been primarily driven by a severe winter storm that has blanketed much of the United States, sending demand for heating skyrocketing and sparking fears of immediate supply crunches.

However, despite the bullish momentum that has gripped the energy markets, seasoned analysts are sounding the alarm. While the spot price has soared, the structure of the futures curve suggests that this rally may be short-lived. Market observers are pointing to specific technical indicators that hint a "sharp collapse" could unfold in the days or weeks ahead, potentially catching aggressive bulls off guard as the February contract nears its expiration.

A Historic Rally Driven by Weather

The catalyst for the sudden price explosion is undeniable: frigid weather conditions across the U.S. have forced households and businesses to crank up their thermostats. According to market data, the intense cold snap has led to a panic in the physical market, causing prices to spike 100% in less than a week. This volatility highlights the sensitivity of finance and commodity sectors to extreme weather events, which can disrupt the delicate balance of supply and demand in an instant.

The surge to $7 per MMBtu is significant not just for its speed but for its context. Prices have not seen these levels in over three years, dating back to the energy crisis of late 2022. For traders and investors, the rapid ascent has created a high-stakes environment where fortunes are made or lost on hourly weather model updates. Yet, while the immediate demand is real, the broader trade dynamics suggest the panic may be isolated to the very near term.

The ‘Backwardation’ Warning Signal

The primary reason analysts are predicting a potential crash is the phenomenon known as "backwardation." Currently, the natural gas futures curve is in steep backwardation, meaning that contracts for immediate delivery are priced significantly higher than those for delivery in future months. According to Tyler Richey, co-editor at Sevens Report Research, the market is witnessing a massive disconnect between the expiring February contract and the March contract.

Specifically, while the February contract is trading above $7, the March contract is trading at a discount of roughly $2.50. This massive spread indicates that the market views the current shortage as a temporary, weather-driven event rather than a structural supply deficit. With the February futures contract set to expire at the end of Wednesday’s trading session, the convergence of these prices could trigger a violent sell-off. Richey notes that this "futures duration curve in a steep backwardation dynamic" is a classic sign that the current price spike is unsustainable.

Economic Implications and Market Outlook

The ripple effects of such volatility extend beyond the commodities pit. A sustained spike in energy prices often reignites fears of inflation, as higher heating and electricity costs eat into consumer discretionary income. If energy prices were to remain elevated, it could pose a headwind to the broader economy, potentially dampening GDP growth figures for the first quarter of 2026. However, given the steep discount in March futures, the market seems to be betting that these inflationary pressures will be transitory.

Equity investors are also watching closely. Stocks in the utility and transportation sectors are particularly vulnerable to these swings. Airlines, for instance, may face operational disruptions and higher fuel costs due to the winter storms, while utility providers must manage the financial risk of purchasing gas at peak prices. As the February contract expiration approaches this Wednesday, volatility is expected to remain extreme, serving as a critical test for traders navigating this turbulent landscape.

Conclusion

While the doubling of natural gas prices to $7 in five days is a testament to the power of weather-driven demand, the underlying market structure warns of an imminent reversal. The historic spread between February and March contracts suggests that once the immediate pressure of the winter storm and contract expiration passes, prices could face a "sharp collapse." Investors and traders should remain vigilant, as the signs point to a market that is overextended and ripe for a correction.

Frequently Asked Questions

The recent dramatic surge in natural gas prices is primarily driven by a severe winter storm that has covered much of the United States. This extreme weather event caused a sudden spike in heating demand from households and businesses, leading to a panic in the physical market. Consequently, the value of the fuel roughly doubled in just five trading sessions, pushing prices above 7 dollars per MMBtu for the first time since late 2022.

Backwardation describes a market structure where contracts for immediate delivery are priced significantly higher than those for future months. Currently, the natural gas futures curve shows a steep backwardation, with the expiring February contract trading at a premium compared to the March contract. This massive spread indicates that traders view the current price spike as a temporary, weather-driven event rather than a long-term structural supply deficit.

Despite the strong upward momentum, analysts warn of a potential crash due to the disconnect between the February and March contracts. The market structure suggests that once the immediate pressure from the winter storm and the February contract expiration passes, the price could experience a violent sell-off. Technical indicators point to the market being overextended, implying that the current shortage is not sustainable beyond the short term.

High energy prices triggered by extreme weather can reignite inflation fears, as increased costs for heating and electricity reduce consumer discretionary income. If these prices remain elevated, they can act as a headwind to the broader economy, potentially dampening GDP growth. Furthermore, specific sectors like utilities and transportation, including airlines, face operational disruptions and increased financial risks due to the sudden spike in fuel costs.

Volatility is expected to remain extreme through the expiration of the February futures contract, which occurs on Wednesday. Market observers note that the convergence of the high spot prices with the lower-priced future contracts could trigger significant price swings. Once this expiration event concludes and the immediate weather patterns shift, the market may correct itself, though traders are advised to remain vigilant during this turbulent period.

Sources and Further Reading

- U.S. Energy Information Administration – Henry Hub Natural Gas Spot Price History

- Wikipedia – Backwardation in Futures Markets

- U.S. Energy Information Administration – Weekly Natural Gas Update

- Federal Reserve Economic Data (FRED) – Henry Hub Natural Gas Spot Price

- NOAA National Weather Service – Climate Prediction Center

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.