In Brief (TL;DR)

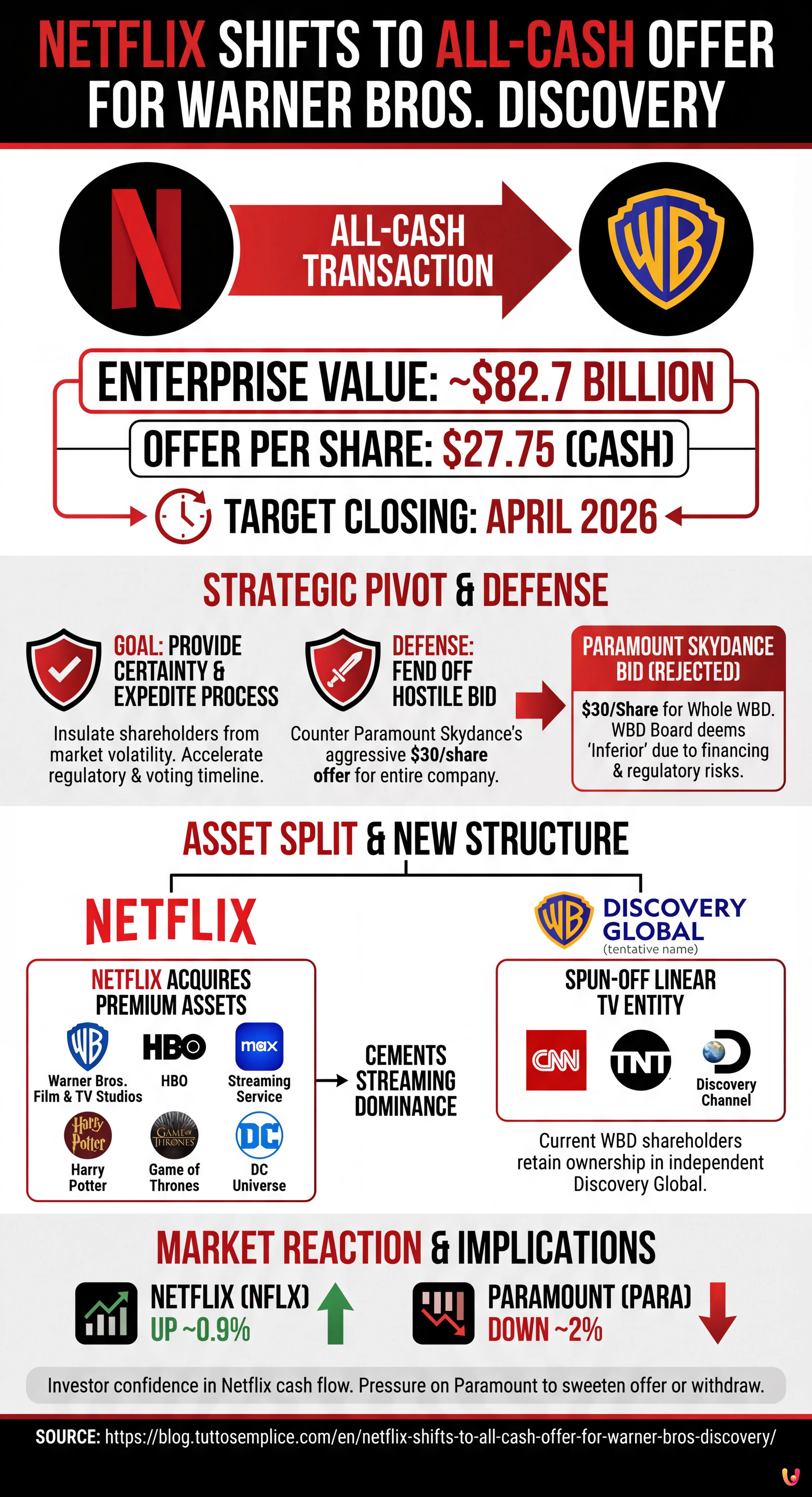

Netflix has revised its acquisition proposal for Warner Bros. Discovery into an all-cash deal valued at approximately $82.7 billion.

This strategic shift provides immediate financial certainty to shareholders to fend off a hostile takeover bid from Paramount Skydance.

Netflix will acquire premium streaming assets and studios, leaving linear television networks to operate as an independent spun-off entity.

The devil is in the details. 👇 Keep reading to discover the critical steps and practical tips to avoid mistakes.

In a decisive move to secure one of the largest media mergers in history, Netflix has revised its acquisition offer for Warner Bros. Discovery (WBD). On Tuesday, January 20, 2026, the streaming giant announced it would convert its previous cash-and-stock proposal into an all-cash transaction. The strategic pivot is designed to provide immediate value certainty to shareholders and fend off an aggressive, hostile takeover bid from rival Paramount Skydance.

The amended agreement maintains the valuation of Warner Bros. Discovery’s studios and streaming assets at $27.75 per share. According to the official announcement, the total enterprise value of the deal stands at approximately $82.7 billion, which includes the assumption of debt. By eliminating the stock component, Netflix aims to insulate WBD shareholders from market volatility and accelerate the regulatory and voting process, which is now expected to conclude by April 2026.

The New All-Cash Proposal

Under the terms of the revised deal, Netflix will acquire WBD’s premium assets, including the Warner Bros. film and television studios, HBO, and the Max streaming service. The transaction is structured to separate these high-growth assets from WBD’s linear television portfolio. Consequently, current WBD shareholders will receive $27.75 in cash per share and will retain ownership in a newly spun-off entity, tentatively named Discovery Global, which will house networks such as CNN, TNT, and the Discovery Channel.

“Our revised all-cash agreement will enable an expedited timeline to a stockholder vote and provide greater financial certainty,” said Netflix co-CEO Ted Sarandos in a statement on Tuesday. The move addresses concerns regarding the fluctuation of Netflix’s stock price, which had been a point of contention in previous negotiations. The board of directors at Warner Bros. Discovery has unanimously approved the amended terms, reiterating their recommendation that shareholders vote in favor of the Netflix merger over competing offers.

Fending Off Paramount Skydance

The shift to an all-cash structure is widely interpreted by market analysts as a direct defense against Paramount Skydance. The rival media conglomerate, led by David Ellison, has launched a hostile takeover campaign, offering $30 per share for the entirety of Warner Bros. Discovery, rather than splitting the assets. Paramount has argued that its offer provides superior value and has criticized the complexity of the Netflix spinoff plan.

However, the WBD board has repeatedly rejected Paramount’s overtures, labeling them as “inferior” due to concerns over financing and regulatory hurdles. According to regulatory filings, WBD executives believe the Netflix deal offers a more secure path to closing. By removing the variable of Netflix’s share price, the all-cash offer neutralizes one of Paramount’s key arguments—that the value of the Netflix deal was theoretical and dependent on volatile market performance.

Strategic Implications and Market Reaction

This acquisition marks a significant departure for Netflix, which has historically relied on organic growth rather than mega-mergers. Acquiring the Warner Bros. library and the prestige of HBO would instantly cement Netflix’s dominance in the streaming wars, giving it control over massive franchises like Harry Potter, Game of Thrones, and the DC Universe. For Warner Bros. Discovery, the deal offers a solution to its debt load while allowing its linear business to operate independently as Discovery Global.

Following the announcement, shares of Netflix rose approximately 0.9% in early trading, signaling investor confidence in the company’s cash flow and ability to finance the massive purchase. Conversely, Paramount shares dipped nearly 2% as the likelihood of their hostile bid succeeding appeared to diminish. The accelerated timeline places pressure on Paramount Skydance to either significantly sweeten their offer or withdraw their proxy fight before the spring shareholder meeting.

Conclusion

Netflix’s revision to an all-cash offer represents a “checkmate” move in the high-stakes battle for Warner Bros. Discovery. By guaranteeing a fixed cash value of $27.75 per share and promising a swift closing timeline, Netflix has significantly raised the bar for Paramount Skydance. As the April shareholder vote approaches, the focus will now shift to whether Paramount can secure the financing necessary to top this offer, or if the consolidation of Hollywood’s biggest streaming libraries is now inevitable.

Frequently Asked Questions

Netflix has revised its bid to an all-cash offer of 27.75 dollars per share. The total enterprise value of the deal is valued at approximately 82.7 billion dollars, which includes the assumption of debt. This payment structure aims to provide financial certainty to shareholders compared to the previous stock-and-cash proposal.

The transition to an all-cash deal is a strategic move to fend off a hostile takeover attempt by Paramount Skydance. By eliminating the stock component, Netflix ensures that the value of the deal is not tied to market volatility. Additionally, this revision allows for an expedited timeline, with the goal of concluding the voting and regulatory process by April 2026.

Under the terms of the agreement, linear television assets such as CNN, TNT, and the Discovery Channel will not be acquired by Netflix. Instead, they will be separated into a newly spun-off entity tentatively called Discovery Global. Current shareholders will retain ownership in this new independent company while receiving cash for the premium studio and streaming assets.

Paramount Skydance offered 30 dollars per share for the entirety of Warner Bros. Discovery. While the price per share is higher, the WBD board rejected it as inferior due to potential regulatory hurdles and financing risks. The Netflix deal is viewed as a safer route because it offers guaranteed cash value for specific assets rather than a complex takeover of the whole conglomerate.

This acquisition will grant Netflix ownership of major entertainment properties including the Harry Potter series, Game of Thrones, and the DC Universe. By securing the Warner Bros. film and television studios along with HBO and Max, Netflix aims to solidify its dominance in the streaming market with a vast library of premium content.

Sources and Further Reading

Did you find this article helpful? Is there another topic you'd like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.