In the digital age, managing our savings and personal finances has largely moved online. Online banking, payment apps, and digital wallets offer us unprecedented convenience, but they also open the door to new risks. The security of our bank accounts has become a top priority, and the first line of defense is an element as simple as it is crucial: the password. In a context like Italy and Europe, where the tradition of safeguarding one’s assets clashes with rapid technological innovation, understanding how to create and protect your credentials is key to sleeping soundly at night. This article serves as a comprehensive guide to navigating the world of digital financial services securely by creating hacker-proof passwords.

The fragility of our digital habits is a fact: a survey by Keeper Security revealed that only 25% of people use strong, unique passwords for each account. This means that a vast majority of users are putting their data at risk, including financial data, by reusing the same credentials across multiple platforms. This mistake can be costly, especially when a lifetime of savings is at stake. Mediterranean culture, often based on personal trust and direct relationships, must now integrate a new awareness: in the virtual world, you can never be too careful, and security starts with our daily choices, beginning with the creation of a robust and unbreachable password.

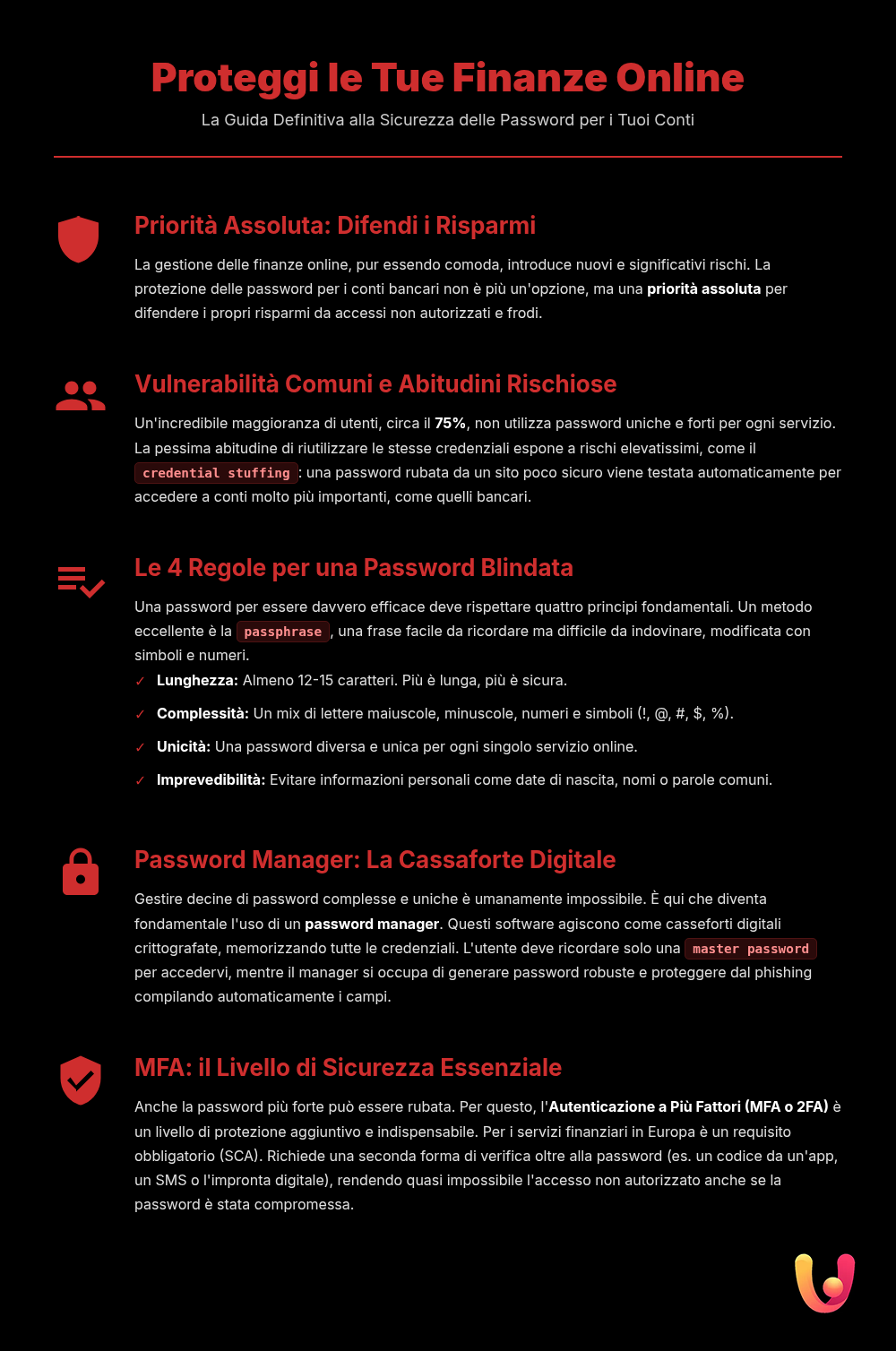

Why Passwords for Financial Services Are So Important

The login credentials for your online bank account or payment app are the virtual keys to your assets. If a malicious actor gets ahold of them, they can gain direct access to your money, make unauthorized transactions, and even steal your identity to commit further fraud. Cyberattacks are constantly on the rise, and Italy is a particularly vulnerable target, with a 65% increase in attacks in 2023 alone. The financial and insurance sectors are among the hardest hit, making password protection no longer an option, but an urgent necessity. The economic loss from account takeover fraud is estimated in the billions globally, a figure that underscores the urgency of adopting safer behaviors.

The habit of reusing the same password for multiple services is one of the most serious vulnerabilities. Imagine using the same key for your house door, your car, and your safe. If a thief managed to duplicate it, they would have access to everything. The same thing happens online: if your social media password, perhaps weak and easy to guess, is compromised in a data breach, cybercriminals will immediately try it on your most important accounts, like your bank account. This technique, known as credential stuffing, is extremely common and exploits this very tendency to reuse passwords. For this reason, every service, especially financial ones, must have a unique and dedicated password.

Hacker Techniques for Stealing Your Passwords

To defend yourself effectively, it’s essential to know the strategies used by cybercriminals. They aren’t dark wizards of computing, but often individuals who exploit human error and automated software. One of the most common techniques is the brute-force attack, where a program tries billions of character combinations per second until it finds the right one. Another variation is password spraying, which tries a list of very common passwords (like “123456” or “password”) on a large number of accounts, hoping to find a match. These methods are particularly effective against short and simple passwords.

Another insidious tactic is the dictionary attack. In this case, the software uses a vast list of common words, names, places, and their variations to guess the password. Hackers know that many people use familiar words and apply common substitution rules, like changing “e” to “3” or “a” to “@”. This is why a password like “P@ssw0rd1” is not nearly as secure as it might seem. Finally, we must not forget phishing, a scam that, through deceptive emails or messages, tries to convince the victim to enter their credentials on a fake website that looks identical to their bank’s site. If you want to learn more about how to recognize these scams, you can read our guide on phishing and smishing.

Creating a Hacker-Proof Password: The Golden Rules

Creating a truly secure password isn’t a mysterious art; it follows specific rules that anyone can apply. The goal is to make it extremely difficult for automated software to guess, but at the same time, memorable for you. Here are the pillars of an impenetrable password:

- Length: This is the most important factor. A password should be at least 12-15 characters long. Each added character exponentially increases the time needed to crack it.

- Complexity: Use a mix of uppercase and lowercase letters, numbers, and special symbols (e.g., !, @, #, %). This variety makes dictionary and brute-force attacks much less effective.

- Uniqueness: As already emphasized, every financial account must have its own exclusive password. Never reuse the same combination, especially if it’s already used for less secure services.

- Unpredictability: Avoid personal information like birthdates, names of family members or pets, or obvious sequences like “12345” or “qwerty”. Cybercriminals are the first to try these combinations.

The Passphrase Technique: Combining Security and Memorability

An excellent method for creating long, complex, and easy-to-remember passwords is the passphrase. Instead of a single word, you use an entire phrase, perhaps modified with numbers and symbols. For example, the phrase “My first concert was in Rome in 2015!” could become “Mf1cw@Rin2015!”. This combination is extremely robust because it is long, contains various character types, and is meaningless to anyone else. Another strategy is to create an acronym from a memorable phrase: “In the middle of the journey of our life” could become “ItmotjoOl!”. The key is creativity and personalization, creating something unique that only you can know and remember.

Storing Credentials: The Importance of Password Managers

Having dozens of unique and complex passwords poses a challenge: how do you remember them all? Writing them on a sticky note or in a text file on your computer is extremely risky. The most secure and innovative solution is to rely on a password manager. These are software programs, true “digital vaults,” that store all your login credentials in an encrypted format. The user only needs to remember a single “master password” to access this protected archive. These tools not only store passwords but also help generate new, extremely complex, and random ones for each new service you sign up for.

The advantages of a password manager are numerous. Besides solving the memorization problem, many of them integrate with your browser and apps, automatically filling in login fields. This is not only convenient but also increases security by protecting you from phishing sites: the software recognizes the correct web address and will not enter credentials on a fake site. Many password managers also offer advanced features like dark web monitoring to alert you if your credentials have been compromised in a data breach and the ability to securely share access with a trusted person without revealing the password itself.

Beyond the Password: Multi-Factor Authentication (MFA)

Even the strongest password can be stolen. That’s why the European financial world has introduced an additional, mandatory layer of security: Strong Customer Authentication (SCA), also known as multi-factor authentication (MFA) or two-factor authentication (2FA). This measure, imposed by the European PSD2 directive, requires you to verify your identity using at least two independent elements chosen from three categories:

- Knowledge: something only you know (e.g., the password or PIN).

- Possession: something only you have (e.g., the smartphone where you receive an OTP code or a push notification).

- Inherence: something you are (e.g., your fingerprint or facial recognition).

When you log into your online banking or authorize a payment, after entering your password, the bank will ask for a second confirmation, for example, by entering a one-time password (OTP) received via an app or by confirming the transaction with your fingerprint. This system makes it nearly impossible for a malicious actor to access your account, even if they managed to steal your password. Enabling multi-factor authentication on all services that offer it is one of the most important steps to lock down your digital life, turning your digital wallet into a secure fortress.

In Brief (TL;DR)

Protecting your savings and financial data online starts with secure password management: discover the strategies and tools to create hacker-proof credentials.

We will delve into the best techniques for creating secure passwords and the strategic use of password managers for safe and organized management.

Learn how to leverage password managers to securely and neatly store the access keys to your savings.

Conclusion

Managing passwords for financial services is a fundamental pillar of our economic security in the digital age. In a context that combines traditional Italian prudence with the innovative drive of Europe, awareness is the first form of defense. Creating long, complex, and unique passwords for each account, and abandoning the risky habit of reusing them, is the first essential step. Adopting modern tools like password managers transforms this good practice from a burdensome task into a simple, automated habit, drastically raising the level of protection. Finally, multi-factor authentication, made mandatory by European regulations, adds an unbreakable lock to defend our savings. Protecting our finances online doesn’t require advanced technical skills, but a conscious approach and the adoption of good habits. Ultimately, it’s about applying the same care our grandparents took in guarding their assets, but with the tools of our time.

Frequently Asked Questions

Is it really necessary to use a different password for every site?

Yes, it is absolutely essential. Using the same password for multiple services, especially financial ones, is one of the riskiest practices. If a less secure site suffers a data breach (a very common event), cybercriminals will obtain your email and password combination. Their first move will be to try these same credentials on more important platforms, such as banks, payment services, and email accounts. This technique, called credential stuffing, has a high success rate precisely because many people reuse passwords for convenience. Using a unique password for each financial account ensures that a breach on another service does not put your savings at risk.

Are password managers really secure? What if they get hacked?

Reputable password managers are designed with very high levels of security. They use zero-knowledge, end-to-end encryption, which means your data is encrypted on your device before being sent to the cloud. Not even the company providing the service can access your passwords. The only way to decrypt the vault is with your master password, which only you know. Of course, no system is 100% infallible, but the risk is significantly lower than methods like saving passwords in your browser, in text files, or worse, reusing the same ones everywhere. For added security, it is crucial to choose a very strong master password and enable two-factor authentication for accessing the password manager itself.

What is two-factor authentication (2FA) and why is it mandatory for banks?

Two-factor authentication (2FA), or Strong Customer Authentication (SCA) in the banking sector, is a security method that requires two different pieces of evidence to verify your identity. It became mandatory in Europe with the PSD2 directive to increase the security of online payments and reduce fraud. In practice, in addition to something you “know” (the password), you must provide proof of something you “have” (like your smartphone, on which you receive a code) or something you “are” (like your fingerprint). This means that even if a hacker managed to steal your password, they could not access your account or authorize payments because they would be missing the second authentication factor.

Frequently Asked Questions

Using the same password for multiple services is very risky. If an insecure site is breached, hackers will try the stolen credentials (username and password) on other services, including banking ones. This attack, called *credential stuffing*, is very common. Since bank accounts are a primary target, it is essential to use a unique and complex password just for financial services to prevent a breach on another site from putting your savings at risk.

That’s an understandable concern, but modern password managers are designed to be extremely secure. They work like a digital vault protected by a single *Master Password*, which you should be the only one to know. They use advanced encryption (often ‘zero-knowledge’), which means that not even the company providing the service can see your passwords. The risk of putting everything in one place is much lower than that of reusing weak passwords across multiple sites.

An effective method is to create a *passphrase*, which is a phrase that is easy for you to remember but hard for others to guess. Choose a phrase that has meaning only to you, for example, ‘MyFirstTripToRomeWasFantastic!24’. This password is very long, combines uppercase and lowercase letters, words, a symbol, and numbers, making it extremely robust against cyberattacks. Always avoid obvious personal information like birthdates or family names.

Yes, it is essential. Two-factor authentication adds a decisive layer of security. Even if a criminal were to steal your password, they couldn’t access your account because they would be missing the second verification factor, which is usually a temporary code sent to your smartphone or generated by an app. In Europe, for most online banking operations, strong authentication (SCA), which is based on this principle, is required by law (PSD2 regulation) to protect consumers.

Acting promptly is crucial. First, contact your bank immediately using the official numbers to block access to the account and any linked cards. Next, change your online banking password and, if you used it elsewhere, change it on all other accounts. Finally, file a report with law enforcement, such as the cybercrime division, and formally dispute any unauthorized transactions with your bank.

Still have doubts about Online Account Passwords: An Anti-Hacker Guide for Your Savings?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.