In the digital age, our smartphones and computers have become extensions of our lives, guardians of personal data, and, above all, gateways to our bank accounts. This convenience, however, hides pitfalls. Scams like phishing and smishing are constantly on the rise, exploiting our trust in technology to steal money and information. These attacks are not simple computer viruses, but real psychological manipulations that leverage urgency and fear. Understanding how they work is the first crucial step to defending yourself and navigating safely in an increasingly connected world, especially in a context like Italy, where rapid digitalization sometimes clashes with a lower familiarity with new threats.

Cyber fraud represents a concrete and evolving threat. According to the most recent data, while overall fraud rates remain low compared to the total volume of transactions, the value stolen through fraudulent wire transfers is growing. This indicates that scams are becoming more targeted and sophisticated. In Italy, the National Cybersecurity Agency (ACN) and CERT-AgID (Computer Emergency Response Team) constantly monitor the landscape, detecting an increase in malicious campaigns that exploit the names of familiar entities like PagoPA, banks, and couriers to deceive citizens. Recognizing the warning signs is no longer an option, but a necessity to protect your savings.

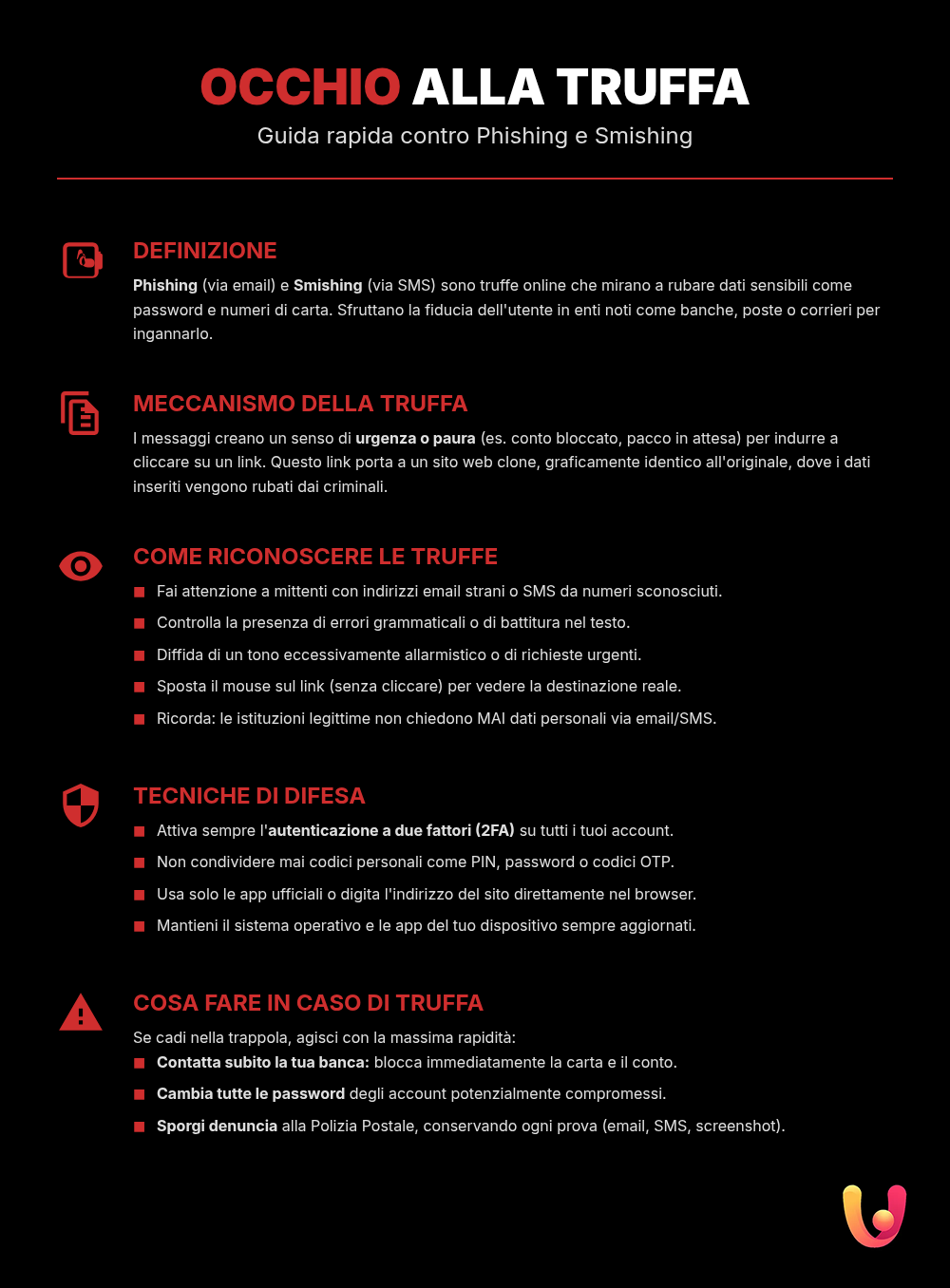

Phishing and Smishing: Two Sides of the Same Coin

Imagine you’re fishing. You cast a lure and wait for a fish to bite. Phishing works in a similar way: scammers “cast” fraudulent emails that appear to come from reliable sources, like your bank, the post office, or an online payment service. The goal is to “fish” for your sensitive information: passwords, credit card numbers, or account login details. Smishing is the same scam, but conducted via SMS (hence the name, a combination of SMS and phishing). In both cases, the mechanism is based on deception and psychological manipulation. The messages create a sense of urgency or danger, pushing you to act without thinking.

The technique is almost always the same. You receive a communication alerting you to a security problem, an unusual login to your account, or the need to confirm your details. Inside the message, there’s a link. By clicking on it, you don’t land on the official website, but on a perfect copy of it—a clone site artfully created by scammers. Once there, if you enter your credentials, you hand them directly to the criminals. Sometimes, the link can also trigger the download of malware, a malicious software that installs itself on your device to steal information. The effectiveness of these attacks lies in their apparent legitimacy and the haste they manage to induce in the victim.

How to Recognize a Phishing Attempt via Email

Recognizing a phishing email requires attention to detail. The first thing to check is the sender. Even if the display name looks correct (e.g., “Your Bank”), the full email address might reveal a strange or inconsistent domain. Official communications will never come from generic email addresses like Gmail or Outlook. Another red flag is grammatical errors or typos. Large companies take great care with their communications, so a sloppy text or one with rough translations is a sign of suspicion.

Pay close attention to the tone of the message. Phishing emails often use alarmist language, threatening to close your account or apply penalties if you don’t act immediately. Banks and legitimate institutions will never ask you to provide sensitive data like passwords or codes through a link in an email. Before clicking on any link, hover your mouse cursor over it (without clicking) to see the actual destination URL. If the address that appears is different from the official site’s or looks suspicious, don’t click. When in doubt, there’s one golden rule: contact your bank directly through official channels.

Smishing: The Scam That Travels via SMS

Smishing leverages the direct and personal nature of SMS to be even more insidious. A message on your phone is often perceived as more urgent and credible than an email. The most common pretexts are a notification of a pending shipment, a warning of a suspicious login to your bank account, or the need to update your information. A classic example is an SMS that reads: “Your package is on hold. Follow the link to schedule delivery.” Clicking it directs you to a fake site that asks for a small payment to release the shipment, thereby stealing your credit card details.

Another widespread tactic involves false security alerts. You might receive an SMS that appears to be from your bank, warning you of unusual activity and inviting you to click a link to block your card or verify the transaction. Sometimes, these fraudulent messages even manage to insert themselves into the real conversation history with the bank, making the deception even harder to spot. The Postal Police (Polizia Postale) constantly warns about these campaigns, which often use the names of Poste Italiane, well-known couriers, or major Italian credit institutions. Remember: never provide your details after clicking a link received via SMS. If you have doubts about your account’s security, handle the issue through your bank’s official app or by contacting customer service. For greater peace of mind, you can learn more about how to recognize fraudulent Postepay blocking SMS messages.

The Italian Context: Tradition and Innovation Under Attack

In Italy, trust in long-standing institutions like Poste Italiane, INPS, or major national banks is deeply rooted. Scammers know this well and exploit these names to make their communications more credible. It’s not uncommon to receive emails or SMS messages that perfectly mimic the logos and graphics of these entities, misleading even the most careful users. CERT-AgID recently reported a surge in phishing campaigns themed around PagoPA, tricking victims into paying fake fines or bills. This shows how criminals adapt quickly, targeting the most widespread payment services used daily by Italians.

The Mediterranean culture, often based on relationships of trust and a more direct approach, can unintentionally lower one’s guard against communications that appear personal and urgent. Furthermore, increasing digitalization, which also involves segments of the population less accustomed to technology, such as the elderly, creates new opportunities for malicious actors. The challenge for our country is therefore twofold: on one hand, to embrace the innovation of digital payments, and on the other, to build a solid cybersecurity culture. It is essential that everyone, young and old, learns to be wary of unusual requests and to protect their data with the same care they would protect their wallet. For an effective defense, it’s useful to know the main scams and how to keep your Postepay secure.

Defense Techniques: How to Protect Your Payments

The best defense against phishing and smishing is a mix of technology and common sense. The first step is to always enable two-factor authentication (2FA) on all your accounts, especially banking ones. This system adds an extra layer of security: even if a scammer steals your password, they won’t be able to access the account without a second code, which is usually sent to your smartphone. Another fundamental rule is to never share your personal codes, such as PINs, passwords, or OTPs (One-Time Passwords), with anyone. No legitimate bank or institution will ask for them via email, SMS, or phone.

For your banking operations, always use the official apps downloaded from your device’s store (Google Play Store or Apple App Store) or access the bank’s website by typing the address directly into your browser. Avoid clicking on links received in suspicious communications. Be particularly cautious when using public Wi-Fi networks, as they can be less secure and more vulnerable to attacks. Constantly update your smartphone and computer’s operating system, as well as the apps you use: updates often contain crucial security patches. Using secure smartphone payments with tokenization and biometrics can offer an additional barrier against fraud.

What to Do If You Fall into the Trap

If you realize you’ve provided your data following a phishing or smishing attack, speed is crucial. The first thing to do is immediately contact your bank or credit card issuer to block the card and the account. Explain what happened and follow their instructions. Most financial institutions have a 24/7 toll-free number specifically for these emergencies. Immediately after, change the passwords for all affected accounts, starting with your online banking and email accounts.

The next step is to file a report with the Postal Police (Polizia Postale e delle Comunicazioni). This is a crucial step not only to initiate an investigation but also to be able to request a possible refund from the bank. Keep a copy of the fraudulent email or SMS, as well as any other useful evidence (screenshots, call history, etc.). Regulations state that, in the absence of gross negligence on the part of the customer, the bank is required to refund the stolen amounts. Acting promptly and documenting everything significantly increases the chances of recovering the money and bringing the perpetrators to justice. If you suspect your card has been compromised, follow our guide on reporting and getting a refund for a cloned Postepay card.

In Brief (TL;DR)

This article guides you in recognizing email and SMS scams, like phishing and smishing, to effectively protect your payment data and your account.

Learn how to analyze suspicious messages and what immediate actions to take to keep your payment cards safe.

Discover how to analyze suspicious messages and what countermeasures to adopt to protect your finances.

Conclusions

Phishing and smishing are insidious digital threats, designed to exploit our trust and distraction. However, they are not invincible. Knowledge is our most powerful weapon: learning to recognize the warning signs, such as suspicious senders, urgent messages, and grammatical errors, allows us to build a first, fundamental defensive barrier. In a world that blends tradition and innovation, caution must become an ingrained habit, just like checking that the front door is locked.

Adopting good security practices, such as two-factor authentication and the exclusive use of official channels for banking communications, is no longer a choice for experts but a necessity for everyone. Remember that no serious institution will ever ask you for sensitive data via email or SMS. If you fall into the trap, acting quickly by blocking your accounts and reporting the incident can make all the difference. The security of our payments largely depends on us: being aware digital citizens is the best investment to protect our financial future.

The battle against online fraud is won with daily attention and a distrust of anything that seems too urgent or too good to be true. Every ignored suspicious email and every deleted fraudulent SMS is a small victory that keeps our savings safe. Continue to stay informed, be vigilant, and share this knowledge with those around you: an informed user is a protected user.

Frequently Asked Questions

Phishing is an online scam that occurs primarily via email. Scammers pose as trustworthy entities, like banks or well-known companies, to trick you into revealing sensitive data such as passwords or credit card numbers. Smishing is the same scam, but conducted via SMS or messaging apps like WhatsApp. Both exploit a sense of urgency or fear to push the victim to act without thinking.

Pay attention to signs like language that creates urgency, threatening to block your account or card. Always check the sender’s email address or phone number: they often contain slight errors or come from unusual numbers. Grammatical errors and links that, when hovered over, show a web address different from the official one are other red flags. Remember that no legitimate bank or institution will ever ask you to provide passwords or full card details via email or SMS.

The first thing to do is immediately disconnect the device from the internet to limit the damage. If you opened a web page, close it right away. Next, run a full antivirus scan on the device to detect any installed malware. As a precaution, change the passwords for your most important accounts (online banking, email, social media) using another secure device. Finally, carefully monitor your bank account and card statements.

If you have provided your credit or debit card details, immediately contact your bank or card issuer to block it. This will prevent scammers from making transactions. Report the incident to the financial institution, which can help you monitor the account and recover any lost funds. It is crucial to file a report with the Postal Police, providing all the details of the scam. This helps authorities combat the phenomenon.

The main rule is not to act on impulse: don’t click on links or download attachments from unexpected communications. If a message appears to be from your bank, verify the information by accessing your account through the official app or by typing the website address directly into your browser. Enable two-factor authentication on all possible accounts for an added layer of security. Finally, always report scam attempts to the relevant authorities and block suspicious numbers or email addresses.

Still have doubts about Phishing and Smishing: Recognize the Scam and Save Your Account?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.