In an increasingly digital world, tools like Postepay have become indispensable companions in the lives of millions of Italians. Originally a simple prepaid card, it has evolved to offer services similar to a checking account. This transformation, however, brings with it significant implications, chief among them the possibility of garnishment. Having a garnished Postepay means having the funds on the card frozen to satisfy creditors. Understanding how this mechanism works, the limits imposed by law, and how to act is essential to protect your finances and face the situation with awareness.

Many people mistakenly believe that a prepaid card is a shield against debt collection actions. The reality, however, is more complex. Italian law allows creditors to claim almost all of a debtor’s assets, including balances on cards with an IBAN. This article aims to be a clear and comprehensive guide to navigating the topic of Postepay garnishment, offering concrete answers and practical advice for best managing such a delicate and common eventuality.

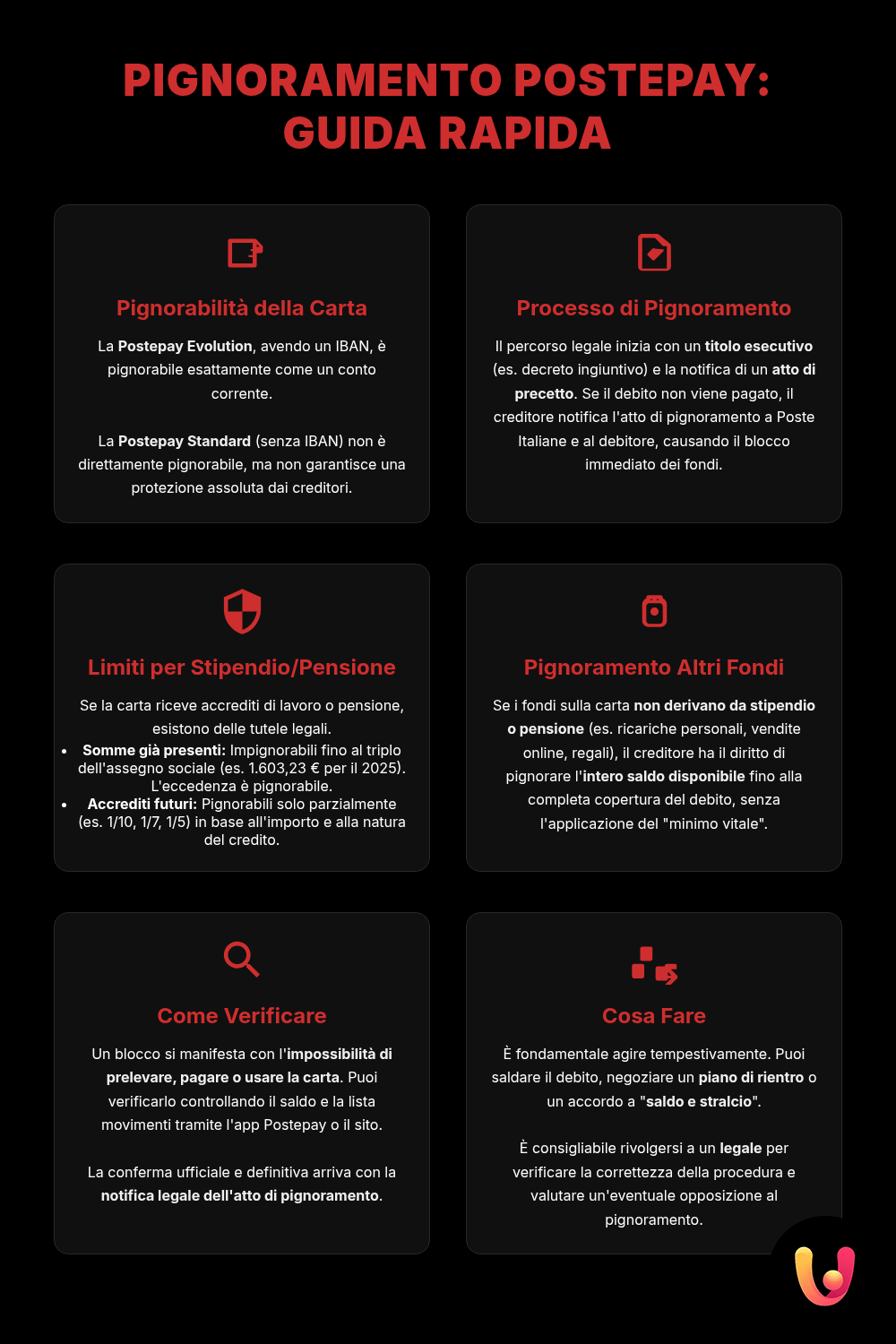

Can a Postepay Be Garnished? Let’s Clarify

The main question many people ask is: can a Postepay be garnished? The answer is yes, but with a crucial distinction. The garnishment does not affect the physical card, but the money loaded onto it. Whether it can be garnished depends on the type of card you have. The traditional Postepay Standard, which does not have an IBAN, is not directly garnishable like a checking account. However, it is not completely immune: a creditor could still take action to prove that funds are being transferred to it for the purpose of evading a debt.

The situation is radically different for the Postepay Evolution. Since it has an IBAN code, the law treats it as a full-fledged checking account. This makes it traceable through the Tax Registry (Anagrafe Tributaria) and, consequently, fully subject to third-party garnishment, where the “third party” is Poste Italiane. Therefore, anyone with an unpaid debt who holds a Postepay Evolution risks having their available funds frozen.

How Postepay Garnishment Occurs

The garnishment of a Postepay is not a sudden act, but the final stage of a well-defined legal process. It all begins when a creditor, holding an enforceable title (such as a judgment or an injunction), serves the debtor with a writ of execution (atto di precetto). This document is a formal demand to pay the debt within a specified period, usually not less than 10 days, with the warning that failure to do so will result in forced execution.

If payment is not made, the creditor can initiate a third-party garnishment. The writ is served on both the debtor and Poste Italiane. From that moment, Poste Italiane is obligated to freeze the funds on the card up to the amount of the debt specified in the writ. The funds are “frozen,” and the cardholder can no longer use them for withdrawals or payments until a judge orders their assignment to the creditor.

Garnishment Limits: What the Law Says

Italian law sets specific limits to protect the debtor’s minimum subsistence, especially when a salary or pension is credited to the Postepay. It is crucial to know these protections to assert your rights. The relevant regulation is Article 545 of the Code of Civil Procedure, which establishes different thresholds depending on the source of the funds.

Garnishment of Salary or Pension

If a salary or pension is credited to a Postepay Evolution, the garnishment follows specific rules to guarantee a “living wage.” For funds already on the card before the garnishment notice is served, only the amount exceeding three times the social allowance (assegno sociale) can be frozen. For 2025, with a social allowance of €534.41, this non-garnishable threshold is €1,603.23.

For subsequent salary or pension deposits, the garnishment can only affect a fraction of the amount, according to the following limits:

- One-tenth for amounts up to €2,500.

- One-seventh for amounts between €2,500 and €5,000.

- One-fifth for amounts over €5,000.

- One-tenth for amounts up to €2,500.

- One-seventh for amounts between €2,500 and €5,000.

- One-fifth for amounts over €5,000.

These measures ensure that the debtor can still have a significant portion of their income for daily needs.

- One-tenth for amounts up to €2,500.

- One-seventh for amounts between €2,500 and €5,000.

- One-fifth for amounts over €5,000.

These measures ensure that the debtor can still have a significant portion of their income for daily needs.

Garnishment for Other Debts

When the funds on a Postepay do not come from a salary or pension, but from other sources (e.g., personal top-ups, payments received for occasional work, etc.), the protections are fewer. In these cases, the creditor has the right to garnish the entire available balance on the card at the time the writ is served, up to the full amount of the debt. The “living wage” limits provided for employment or social security income do not apply. For this reason, it is advisable not to accumulate large amounts on prepaid cards if you are aware of ongoing legal disputes.

How to Check if Your Postepay Has Been Garnished

Discovering that your Postepay is blocked can be a stressful experience. Usually, the first sign is the inability to make payments or withdrawals. If you suspect a garnishment, there are a few steps you can take to verify the situation. The first step is to check your balance and transaction history through the Postepay app or the Poste Italiane website. A zero or negative balance, or a hold on a specific amount, are very strong indicators.

The official confirmation, however, comes with the service of the writ of garnishment by a bailiff. This legal document informs the debtor of the ongoing action and the freezing of funds. If you have not received any communication but are experiencing problems, you can contact Poste Italiane’s customer service directly to ask for clarification. Another option is to request a certified account statement, which should show any legal liens on the card. In any case, an anomaly in accessing or using the card, such as a denied access to your Postepay, should prompt you to investigate.

What to Do if Your Postepay is Garnished

Receiving a garnishment notice requires swift and informed action. The first thing not to do is to try to withdraw funds after the writ of execution is served but before the actual freeze: such operations could be considered an attempt to remove assets from the creditor’s reach. The most direct solution, although not always feasible, is to pay off the debt. This will lead to the card being unblocked.

If it is not possible to pay the full amount, it is advisable to contact the creditor to negotiate a repayment plan or a “settlement in full” agreement, which involves paying a reduced amount in a single payment. It is essential to consult a lawyer or a consumer association for qualified assistance. A lawyer can verify the correctness of the garnishment procedure, check compliance with legal limits, especially in the case of a salary deposit, and file an opposition with the judge if there are any irregularities. Periodically checking your card for suspicious charges is always a good financial management practice.

In Brief (TL;DR)

Even a Postepay card, especially the Evolution version with an IBAN, can be subject to garnishment: find out when it can happen, what the legal limits are, and how you can check your card’s status.

Discover the steps to follow to check for a potential freeze and how to act in this situation.

Finally, learn the procedures for checking your card’s status and how to act to protect your funds.

Conclusion

In summary, the Postepay Evolution, by virtue of its IBAN, is for all intents and purposes a garnishable financial instrument, just like a checking account. Although the law provides important protections to safeguard a living wage in the case of salary or pension deposits, the risk of having funds frozen is real for those with outstanding debts. The Postepay Standard, while less exposed, does not guarantee total immunity. Knowledge of the process, legal limits, and the actions to take is the first and most important form of defense. Periodically checking the status of your card, not ignoring legal communications, and acting promptly with the support of an expert are crucial steps to face and resolve a garnishment, turning a potentially paralyzing problem into a manageable situation.

Frequently Asked Questions

Yes, a Postepay can be garnished. The Postepay Evolution, having an IBAN code, is garnishable just like a checking account. Even the Postepay Standard, although without an IBAN, can be subject to garnishment, as the funds loaded onto it are still traceable to the owner and managed by Poste Italiane.

The signs of a garnishment include being unable to withdraw or use the funds. For a definite check, you can review your balance and transaction history through the Postepay app or the Poste Italiane website to identify any holds. Alternatively, you can contact Poste Italiane directly to ask for information on your card’s status.

The limits depend on the source of the funds. If a salary or pension is deposited onto the card, the garnishment cannot touch the funds deposited before the garnishment up to an amount equal to three times the social allowance (for 2025, the threshold is €1,603.23). For subsequent salary or pension deposits, only one-fifth of the amount can be garnished.

If the balance is zero at the time of garnishment, the creditor cannot take anything. However, the writ of garnishment remains valid, and any funds subsequently credited to the card will be frozen until the debt is satisfied.

Yes, it is possible to unblock a garnished Postepay. The most direct solution is to pay off the debt, including through a payment plan agreement with the creditor. Once the debt is settled, the creditor will request the revocation of the garnishment. It is also possible to legally oppose it if you believe the garnishment is unlawful or that non-garnishable funds have been frozen by law.

Still have doubts about Postepay Garnishment: A Guide to Checking and What to Do?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.