The world of finance often appears as a complex universe, reserved for a select few. However, technology is progressively breaking down these barriers. In particular, one programming language is emerging as a surprising ally for anyone wanting to approach the markets with method and rigor: Python. This tool, known for its versatility and simplicity, is democratizing access to strategies that were once the exclusive domain of large financial institutions. Italy, with its strong financial culture and a growing push toward innovation, is fertile ground where this revolution is taking root, combining the prudence of tradition with the endless possibilities offered by technology.

This article is an introductory guide to quantitative trading using Python, designed for a broad and diverse audience. The goal is to show how, with accessible tools, it’s possible to analyze financial markets scientifically. This isn’t a magic formula for getting rich quick, but a disciplined approach that leverages the power of data to make more informed investment decisions. We will explore the fundamental concepts, essential libraries, and see how an analytical mindset can seamlessly integrate into the Italian and European economic context.

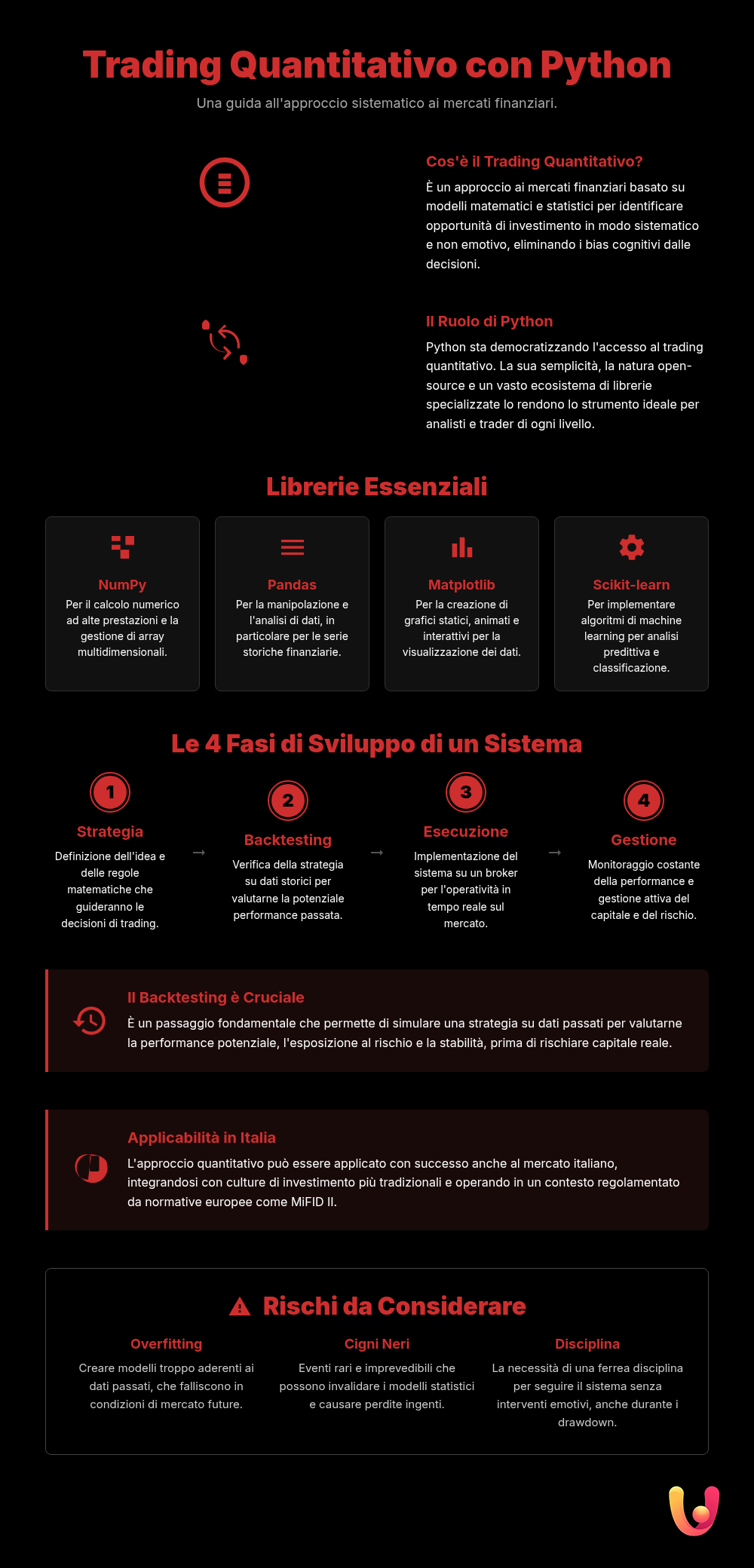

What Is Quantitative Trading?

Quantitative trading is an approach to financial markets that relies on mathematical and statistical models to identify investment opportunities. Unlike traditional analysis, which can include subjective factors like market sentiment or a company’s reputation, quantitative analysis is based exclusively on numerical and objective data. The underlying idea is simple: analyze large amounts of historical data to discover recurring patterns that may have a certain probability of repeating in the future. This process allows for the construction of systematic trading strategies, where buy or sell decisions are dictated by precise rules and not by the emotion of the moment.

Imagine a chef who, instead of improvising, follows a detailed recipe to the letter. The ingredients are market data, the recipe is the algorithm, and the final dish is the investment decision. This is, in essence, quantitative trading: a rigorous and replicable method.

A quantitative trading system typically consists of four main phases: defining a strategy based on a market hypothesis, backtesting (i.e., testing the strategy on past data), trade execution, and rigorous risk management. While in the past it required massive computing power, today, thanks to tools like Python, even individual investors can engage with this discipline. To delve deeper into the mathematical foundations of this approach, it’s helpful to consult a guide on the quantitative analysis that is revolutionizing trading.

Why Python Is the Ideal Choice for Finance

Python has established itself as the go-to programming language in the financial sector for a number of concrete reasons. Its main advantage is its simplicity: its clean and readable syntax makes it much more accessible than other languages, allowing even those without a programming background to learn quickly. This feature reduces development time and allows traders to focus on the strategy’s logic rather than the code’s complexity. Another strength is its open-source nature, supported by a large and active global community that constantly contributes to its development.

According to Francesco Zinghinì, an Electrical Engineer and fintech platform developer, “Python’s real strength lies in its ecosystem of specialized libraries. Tools like Pandas, NumPy, and Matplotlib provide pre-built blocks that transform complex financial analyses into a few lines of code, democratizing access to advanced quantitative techniques.”

Indeed, Python’s real secret weapon is its vast arsenal of specialized libraries for data analysis and scientific computing. These “packages” offer ready-to-use functionalities for tasks ranging from manipulating huge financial datasets to graphically visualizing results, all the way to implementing machine learning models. This combination of simplicity, community support, and library ecosystem makes Python the perfect tool not only for professionals but also for enthusiasts who want to explore the world of quantitative finance.

The Essential Python Libraries for the Quantitative Trader

To venture into quantitative trading with Python, it is essential to know some key tools. These libraries are the pillars on which almost every financial analysis project is built.

- NumPy: It is the fundamental library for scientific computing in Python. It introduces support for high-performance multidimensional arrays and matrices, offering a large collection of mathematical functions to operate on them efficiently. It is the foundation on which many other libraries are built.

- Pandas: Considered the “Swiss Army knife” for data analysis, Pandas provides flexible and powerful data structures, like DataFrames, which are ideal for manipulating tabular data and time series. It allows you to import data from various sources, clean it, transform it, and analyze it with extreme ease.

- Matplotlib: When it comes to visualizing data, Matplotlib is the go-to library. It allows you to create a wide range of static, animated, and interactive plots, from simple line charts for viewing price trends to histograms and scatter plots for more complex analyses.

- Scikit-learn: For those who want to go a step further, this library offers simple and efficient tools for data mining and predictive analysis based on machine learning. It can be used to build models that attempt to predict future market movements.

- Statsmodels: This library is focused on statistical analysis and allows users to perform estimations of statistical models, conduct hypothesis tests, and carry out exploratory data analysis.

A Practical Example: From Theory to Practice

To make the concepts more concrete, let’s imagine we want to analyze a stock listed on Borsa Italiana, such as the shares of a major company in the FTSE MIB. Our goal is to develop a simple strategy based on the crossover of two moving averages, a classic of technical analysis. The first step is to retrieve historical price data, which can be downloaded from sources like Yahoo Finance using specific Python libraries, such as yfinance. Once we have the data, we load it into a Pandas DataFrame to manipulate it.

At this point, we calculate two moving averages of the closing price: a short-term one (e.g., 20 days) and a long-term one (e.g., 50 days). The strategy’s logic is simple: when the short-term moving average crosses above the long-term one, a buy signal is generated; conversely, a sell signal is generated. With Matplotlib, we can visualize the stock price and the two moving averages on a chart to get a clear visual representation of the generated signals. This step is crucial for intuitively understanding our strategy’s behavior.

As expert Francesco Zinghinì points out, “Backtesting is not just a technical test; it’s the dialogue that every quantitative trader must have with the past to understand if their strategy has a hope of surviving in the future.” Past success does not guarantee future returns, but a failed backtest is a clear warning sign.

The next, and perhaps most important, phase is backtesting. Using Python libraries, we simulate the application of our strategy on historical data to evaluate its performance. We calculate the return we would have obtained, the number of trades made, and other risk metrics. This process allows us to test and optimize the strategy before risking real capital. The entire workflow, from data collection to backtest execution, is a prime example of how algorithmic trading with bots and AI is revolutionizing finance.

Quantitative Trading: Between Tradition and Innovation in the Italian Market

The Italian financial market, characterized by a strong tradition of long-term investment and a fabric of small and medium-sized enterprises, is undergoing a profound transformation. The “cassettista” approach—the investor who buys and holds stocks for years—is now confronted with new quantitative methodologies. This is not a conflict, but an evolution. Indeed, quantitative trading is not just high-frequency trading (HFT) for speculating on fractions of a second; it can also be applied to longer time horizons, in line with a more considered and typically Mediterranean investment culture.

Italian and European institutions, such as CONSOB and ESMA, play a fundamental role in governing this transition. Regulation on algorithmic trading, like the MiFID II directive, aims to ensure market transparency and integrity by imposing strict controls to prevent instability. This regulatory framework creates an environment where technological innovation can develop in an orderly and secure manner. The Italian investor can therefore leverage the power of Python to analyze data and optimize their choices, integrating quantitative analysis into the construction of a modern portfolio that is diversified and informed.

Risks and Challenges Not to Be Underestimated

Embarking on the path of quantitative trading offers great potential, but it is crucial to be aware of the risks and challenges. One of the most insidious dangers is overfitting, which is creating a model that fits historical data perfectly but fails miserably as soon as market conditions change. This happens when the strategy is too complex and “memorizes” the past instead of grasping the underlying market logic. Another risk is posed by so-called “black swans”: rare and unpredictable events, such as a financial crisis or a pandemic, that can invalidate any statistical model based on historical normality.

From a practical standpoint, quantitative trading requires iron discipline. One of its main advantages is the elimination of emotion from decision-making. However, this requires trusting your system, even during periods of loss (drawdowns), and resisting the temptation to intervene manually. Finally, technology is constantly evolving. Staying up-to-date on new libraries, analysis techniques, and regulatory changes is an ongoing commitment. Tackling this discipline without solid preparation and awareness of these risks can lead to significant losses.

In Brief (TL;DR)

This article offers a practical introduction to quantitative trading, showing how to analyze financial data and test investment strategies using the power of Python.

Learn to leverage the power of libraries like Pandas and Matplotlib to backtest trading strategies and analyze financial data.

A practical guide that, thanks to libraries like Pandas and Matplotlib, will introduce you to backtesting strategies and analyzing financial data.

Conclusions

Quantitative trading with Python represents an extraordinary opportunity to approach financial markets with a scientific and disciplined approach. We have seen how this programming language, thanks to its simplicity and a powerful ecosystem of libraries, is making techniques once reserved for a few specialists accessible. From data analysis with Pandas to its visualization with Matplotlib, all the way to backtesting complex strategies, Python provides all the necessary tools to transform a trading idea into a testable and operational system.

It is important to reiterate that quantitative trading is not a shortcut to success, but a marathon that requires study, rigor, and a deep awareness of the risks. In the Italian and European context, where financial tradition meets a growing drive for technological innovation, adopting these tools can offer a significant competitive advantage. Embracing quantitative finance means equipping oneself with an analytical mindset, capable of leveraging the wealth of data to navigate the complexity of modern markets in a more informed and conscious way.

Frequently Asked Questions

What is quantitative trading in simple terms?

Quantitative trading is a method for making investment decisions based on mathematical and statistical analysis. Instead of relying on intuition or subjective factors, it uses computerized models to analyze large amounts of historical data and identify patterns that might predict future market movements. The goal is to create systematic trading strategies where the buy and sell rules are predefined and automated to eliminate the impact of emotions.

Why is Python used for trading?

Python has become the preferred language for trading and finance for several reasons. First, it is relatively easy to learn and read. Second, it has a vast ecosystem of open-source libraries like NumPy, Pandas, and Matplotlib, which greatly simplify data analysis, statistical calculations, and graphical visualization. This allows traders to develop, test, and implement complex strategies efficiently.

Do you need to be an expert programmer to use Python in finance?

It’s not essential to be an expert programmer to get started. Python’s intuitive syntax and the abundance of online resources, like tutorials and courses, make it accessible even to beginners. It is more important to have a solid understanding of financial and statistical concepts. With practice, you can acquire the necessary programming skills to implement your own analysis and trading strategies.

What is the difference between quantitative trading and algorithmic trading?

Although the terms are often used interchangeably, they have different nuances. Quantitative trading refers to the research and development phase of the strategy, based on quantitative models. Algorithmic trading, on the other hand, focuses on the automated execution of trades via an algorithm. In practice, a quantitative strategy is often implemented through algorithmic trading, but a trading algorithm is not necessarily based on complex quantitative analysis; it could also automate simple technical analysis rules.

What are the main risks of quantitative trading?

The main risks include overfitting, which is creating a model that performs well only on past data but not on future data, and the reliance on historical data that may not reflect new market conditions (risk of “black swans”). There is also technological risk related to bugs in the code or system failures. Finally, strong discipline is required to follow the model without emotional intervention, especially during periods of loss.

Frequently Asked Questions

No, you don’t need to be an expert programmer to get started. Python is known for its relatively simple syntax and a large support community. There are numerous courses, including free ones, designed for beginners. The important thing is to have the willingness to learn the basic concepts of programming and, in parallel, the fundamentals of finance. A ‘do-it-yourself’ approach is possible, but for professional purposes, a structured training path is advisable.

Yes, like any form of investment, quantitative trading also involves risks. The advantage of using a quantitative approach is that it allows you to manage risk more systematically by basing decisions on historical data and statistical models, thereby eliminating emotion. However, no strategy can guarantee certain profits, as models are based on the past and cannot predict exceptional and unforeseeable events.

The initial costs for software tools are very low, almost zero. Python and its main libraries for financial analysis (like Pandas, NumPy, Matplotlib) are open-source and therefore free. Basic historical data can also be downloaded for free from sources like Yahoo Finance. The main cost is the investment capital you decide to allocate for trading operations and, potentially, the cost of specialized training courses.

For a beginner, the essential libraries are: NumPy, for numerical calculations; Pandas, for data manipulation and analysis, especially price time series; Matplotlib, for creating charts and visualizing data. A very useful library for downloading stock market data is yfinance. These form the starter kit for anyone wanting to venture into financial analysis with Python.

Absolutely. The principles of quantitative trading and Python tools are universal and can be applied to any market, including Borsa Italiana. The key is to have access to the historical data of stocks listed on the Italian market. Using libraries like yfinance, you can download data for many Italian stocks by adding the ‘.MI’ suffix to the stock ticker (for example, ‘RACE.MI’ for Ferrari).

Still have doubts about Python for Finance: A Guide to Quantitative Trading?

Type your specific question here to instantly find the official reply from Google.

Did you find this article helpful? Is there another topic you’d like to see me cover?

Write it in the comments below! I take inspiration directly from your suggestions.